Tightwad Gazette Tour | active and passive frugality

I finally had a moment to flip through the Tightwad Gazette again!

We're starting on page 343 in my big blue Tightwad Gazette book, with an article Amy wrote about active and passive tightwaddery (or frugality, if you're part of my crew. Heh.)

Amy tells how TV crews would want to film her and her family doing frugal things, but she sometimes had trouble coming up with such ideas because a lot of her tightwaddery was the passive sort (such as NOT going to McDonald's) vs. the active sort (such as DIY-ing).

She points out that even when we are in a stage of life where we do not have time to do things like, say, can 24 jars of homegrown pears, we can still manage to pull off passive tightwaddery.

So then I started thinking about things I do that are passive moneysavers, but I got a little stuck. Maybe more of my frugality is active?

I came up with:

- I don't dye my hair.

- I don't get my nails done.

- I don't go shopping very often (except for groceries!)

- Ummmm....I don't get cosmetic procedures done? (that might be a reach. Ha.)

- I don't take the money out of my savings account?

I could say, "I don't go out for coffee.", but it feels more accurate to say, "I make my coffee at home."

I could say, "I don't go out to eat very often." but again, it feels more accurate to say, "I cook my food at home." or, "I pack my lunches."

I don't know...maybe I am missing some obvious passive ways I save money!

Dangerous frugality

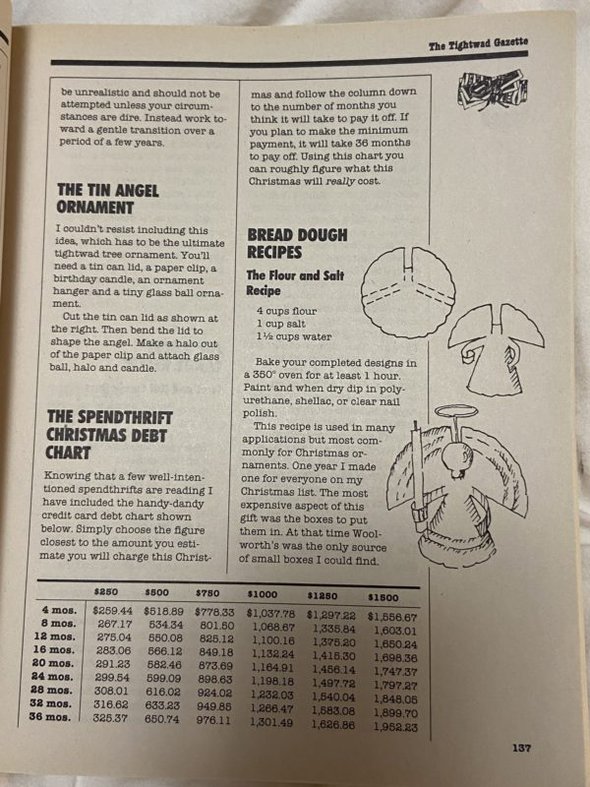

You know that tin can Christmas tree angel we chatted about in a previous edition? I thought it seemed like a slicing hazard!

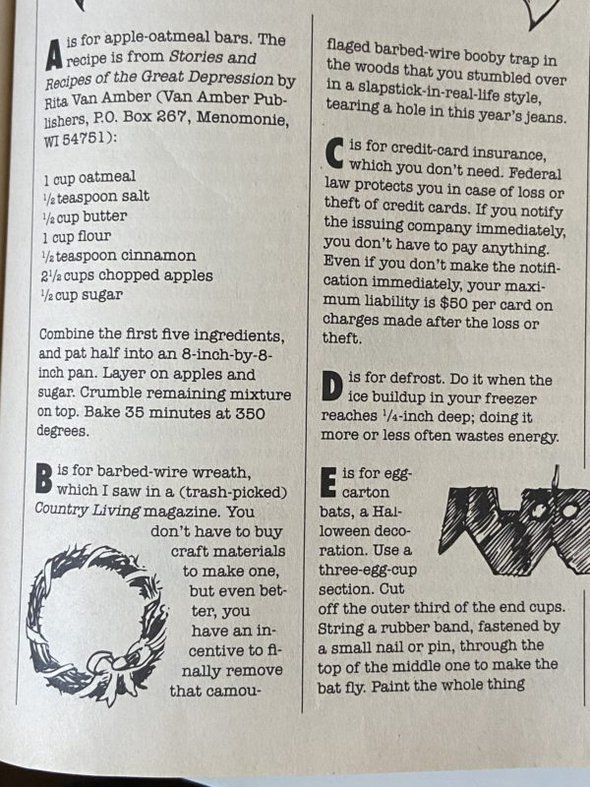

Well, the Tightwad A to Z has a barbed wire wreath suggestion for the letter B.

I don't know if this is tongue-in-cheek or not, but I pity the person with poor spatial perception* who accidentally bumps such a wreath.

*me. That would be me. I routinely stub my toes and bump into things, and I would not trust myself around a sharp wreath!

For G she has "grocery store scale" because those are useful for things like a 5-pound bag of oranges.

Some bags have more than five pounds in them, so if you use the scale to find the heavier bag, you get more bang for your buck. I wrote about this tip back in 2018, but I don't think I remembered reading it first in the Tightwad Gazette!

R is for rubber spatula, which I also wrote about in a Tuesday tip. Ha.

(The bright blue spatulas are by Tovolo.)

S is for stamps, a largely unnecessary household item in this day and age. Amy suggests getting them by mail from the USPS, using their "stamps by mail" envelopes. Who knew this even existed back then? I didn't!

I like her T: a thermos with ice water whenever you leave the house. Then you never need to buy a soda or bottled water. I think when this was written, it was slightly less common practice to always have a water bottle with you.

Interestingly, I kinda think this money-saving thing has morphed into a money-spending thing, where it is common to own a zillion water bottles and to be always upgrading to the newest kind.

The basic idea is still solid. Just don't be forever buying water bottles!

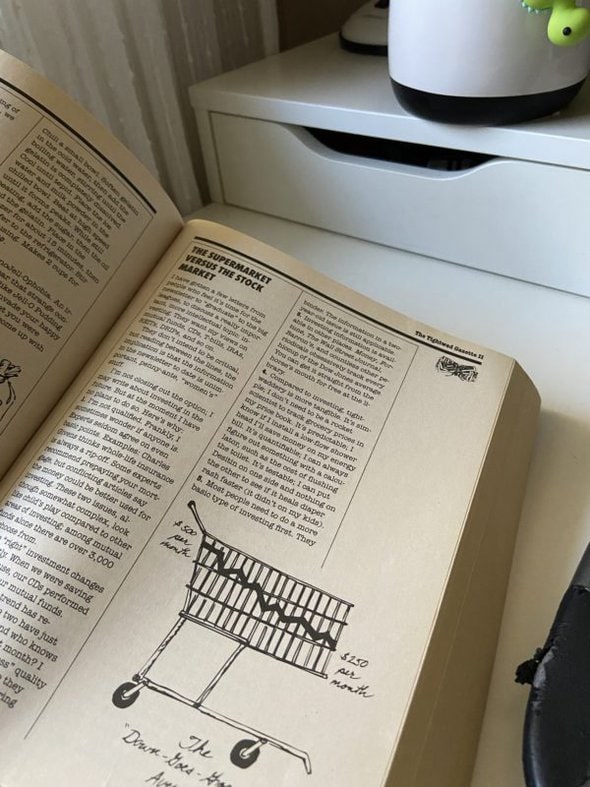

Supermarket vs. Stock Market: I disagree

Amy wrote an article in which she argues that tightwaddery can give you a similar return for your time as compared to investing.

I don't know if this perspective was informed by the time (she said stock market returns were poor), or if all the investment options then were time-consuming, but I cannot imagine how tightwaddery could outperform an automatic investment in an index fund.

I spend zero minutes each month on my investments because they are set up to auto-deposit, and I rarely check on them. They are almost completely passive.

So, I see no reason to choose between investing or being frugal; I can do both because the investing costs me no time at all.

I do understand her argument for why she didn't want to write articles about investing (lots of the same reason I don't do that here!) and I also appreciate her pointing out that if you spend money willy-nilly, your investment returns will do you little good.

But I still solidly support automatically depositing money into a low-cost index fund, and I really, really, really support doing that through your work if your employer does a match (as my hospital does.)

As proof that my investing takes up a minimal amount of headspace: until I typed this post, I'd totally forgotten that I even HAVE an investment account through my hospital job. Ha.

Baked potatoes as a main dish

Amy suggests serving baked potatoes for dinner, topped with homemade cheese sauce (basically a white sauce with cheese added in), broccoli, and some crispy bacon pieces (which does sound good!)

She also suggests topping them with chili. And I've made a buffalo-chicken style baked potato meal, which you can see in this post.

At the end of the article, Amy says that a fast food place called Mr. Potato sold broccoli cheese baked potatoes similar to her homemade ones for the breathtaking price of $3.39 compared to her homemade version which costs $0.20.

(I don't know if this is the same Mr. Potato??)

Anyway, this article popped out at me because I sometimes walk by a little local restaurant that mainly sells baked potatoes, and there a single potato topped only with garlic butter and cheese costs about $10. Amy would REALLY be gobsmacked by that price.

I do like potatoes as a base, but I kinda prefer mashed potatoes.

I often make a meal for myself with either mashed sweet potatoes or mashed yellow potatoes as a base.

Zoe doesn't like mashed potatoes (a texture thing for her), so I'm usually just making them for myself.

For the sweet potato kind, I just roast sweet potatoes in my toaster oven and then store them in my fridge so I have the option of eating them mashed or not mashed.

And for regular potatoes, I cut them into small pieces, boil them, and then mash them with butter, salt, pepper, and half and half. It really doesn't take long; by the time I'm done sauteeing the veggies and protein, the potatoes are ready to be mashed.

Regardless, whether they're baked or mashed, potatoes make a good frugal base for a meal, and the possibilities for topping them are pretty endless.

________________

Boy, I'm at 1100 words and I only made it through a few pages of the Tightwad Gazette this time!

We'll pick up around page 357 next time for those of you following along at home.

We had a baked potato meal to feed 17 of us staying at an Airbnb together. We topped it with chili. It was a good filling meal.

Many things in our lives are passively frugal: wearing clothing from season to season, not having much work done our home as in being content with what we have, etc.

I like baked potatoes (and love sweet potatoes). Just yesterday I learned that the best way to make "baked" potatoes in the mircowave is to cook them at 50% power. I tried it last night and thought it worked well.

@K D, I cook them like this also. Recently, after microwaving them I spritz them in a little olive oil and place them in the air fryer for about 10 minutes. The skin gets crispy and yum!

@Marlena,

That is a great tip about air frying them after microwaving them. I'm going to try that. Thank you, Marlena.

It was absolutely not a thing to carry around a water bottle at the time that book was written. I remember when I went to college in 1998 being surprised by all the hippie hiker types at my university who carried around Nalgene bottles (remember those?). That was the first time I ever saw anyone carry around water. And I lived in the desert. People just used water fountains. And just didn't drink as much water.

@kristin@going country, hey, I have a Nalgene water bottle!

@Sophie in Denmark, Me too. In fact we have two.

@kristin@going country, I don't have many water bottles but one of them is a 1 qt nalgene.

@kristin@going country, I still use my Nalgene bottle from the '80s. It ain't broke, so I ain't fixin' it.

@kristin@going country, I recently wondered why it seems imperative now to always carry a water bottle and it was not that way in the past. It's not like we as humans suddenly have a need for more water. I hope someone can tell me!

@kristin@going country,

My husband STILL has a Nalgene water bottle he takes in his lunch box to work. He's been using it since, I don't know...1910? Ha. (He wasn't born then, just to clarify).

@Kara, In Arizona you are dehydrated all the time whether you know it or not! Carrying a bottle means reminding oneself to drink more water!!!

@Madeline, But why is this a thing now and it wasn't 20 years ago?

@Kara,

Good question! I know the young people I work with (early 20s to 30ish in ages) grew up carrying around water bottles all the time, and are much more interested than I in having whatever the latest "hip" water vessel is (example, they all have Stanleys right now). One work friend has even said, "I feel dehydrated"....no, no you are not dehydrated, because you're always drinking water! Lol.

I have a used Yeti that I was given from someone on my Buy Nothing group (my son borrowed it, lost it, and luckily it was found and returned to me). I had no idea it was a Yeti when I asked for it, but I love it. it definitely encourages me to drink more water....but that still doesn't answer the question, lol .

@Kara, my guess is that someone decided that drinking fountains aren't sanitary around the same time that water bottle companies figured out a way and a marketing plan to look essential and cool AND water bottling plants became The Way One Must Consume Water, in spite of having the cleanest tap water in the world. What baffles me is that this also coincides with the massive worry about "saving the planet". . . doesn't seem very planet-saving to manufacture 9 gazillion plastic disposable bottles. I might just be too dinosaurish to adapt to this fad. (Currently using a pair of old vanilla bottles to keep tap water cold and portable in my fridge when not using my trusty Nalgene bottle from the 1980s.)

@Kara, there is an interesting article on the history of it here:

https://time.com/6548310/new-years-water-bottles/

It doesn't help that public drinking fountains have been so reduced.

@Kara, I believe it is the way that wellness, natural health and fitness became “trends’ and pretty much over 20 years, everyone is paying attention to exercise, fitness habits,meditation, and self improvement in ways they did not, before then! NOW we have fitness and health uppermost in our minds a lot of the time, it seemsIt’s like wearing a fitness tracker.. no one did it 20 years ago.. but now, we do. ! And so we developed habits to support that.. like keeping ourselves hydrated all day. Counting steps, It is a cultural change.

@Kara, My husband and I were discussing this today. Our grand daughter has to take a water bottle to school with her. We never did and nor did our children. We did have a water fountain in the playground and we all drank from that merrily sharing our germs but rarely got ill. We mainly drank tea and soft drinks were a rare luxury.

@kristin@going country,

I still have my nalgene bottle from the 80's, used all thru college and work (field biologist). I also still have my coleman 3 gallon spigot thermos and my larger 5 gallon insulated work spigot that we fill with an electrolyte drink for field work days.

Kristen- I think you could add the investment account to your passive frugality list. While the initial time setting it up was certainly active, the automatic deduction makes it more passive. YOU don’t have to remember to set the funds aside & compounding interest is working for you. Employer matching contributions & automatic contributions make a tremendous difference over time.

Oh, that is true!

@Kristen, but you should periodically check your account. Auto pilot isn't a guarantee of a good return. I myself are more into stocks, I am a huge Warren Buffet fan. Buy a good stock and hold (and for me, dividends did not make a difference). $50K outlay is now worth almost the new target amount people think they need for retirement. I do have other investments that are not individual stocks.

@Selena, i am with you. i have been in the stock market since 1979. and i love warren buffet.

My adult sons are Boy Scouts and love their Nalgene bottles. Each one is emblazoned with stickers from hikes at Philmont Scout Ranch. Beautiful country! They don’t want ice water, but I do. My aging Swell brand bottle for the win! I actually have a backup Swell ready that was a freebie from Cheerios cereal a while back.

One of my friends was a retired executive chef and had a fun idea about starting a food truck that sells loaded baked potatoes. It never got past the planning stage, but it sure made good sense in terms of ingredient cost.

@Ruby,

Similar to pancake restaurants, that are popular in certain parts of the Netherlands! (Including rustic furniture, copper pans etc)

@JNL,

There's a local "chain" here called The Original Pancake House (I think they have, maybe, 2 or 3 restaurants) that does a booming business, for good reason. Their pancakes are yummy, and you have a wide choice of all kinds of toppings and/or add ins. Yes, you can make them at home, but it's a nice option for a breakfast splurge.

You could also count the walking to school as passive - not using gas. I remember her riding her bike to work before she had kids and people would wonder why she was riding a bike. She was saving money on gas. Can you imagine how much money she would save now!

And I do remember reading that she would take snack and water when she would do errands with her kids. When I first tried that with my family, they didn't like it at all and we still stopped at restaurants. Now my husband prefers quick snacks and sandwiches while on the road.

See, I'd file the walking to school under active frugality because I am doing something!

@Maureen, I looked up gas prices per gallon, adjusted for inflation.

1983 was $1.16

adjusted for 2022 is $3.40.

Where I live, we currently pay between $3- 3.39, so not much change.

But as a side note, the cost of operating a car includes much more because of oil, filters and fluids, maintenance, tires, insurance, license, etc., on top of the purchase price, where a bike clearly wins!

I love baked potatoes. I like them baked in the oven for a long time so the skin is crispy. I also sometimes do make them topped with broccoli cheese sauce.

And yes, for most the early 90s, the stock market wasn't so great. Except for tech stocks, woohoo!

And I would be probably literally dead if we had a barbed wire wreath. I have dyspraxia which means I am always tripping, falling, bruising, stubbing my toes, cutting or burning myself when I cook etc. I've always had it as a source of hilarity in my family of origin. But just yesterday my son said, "I worry that you're going to trip, somehow flip yourself into the ocean and drown. It would be just like you."

@Rose, I grew up eating baked potatoes differently than most people, I think. As I said, they're baked a long time (without foil, which is a heat sink) so the skins are crispy and "tough" and the insides soft and fluffy. Then I cut them in the middle vertically, scrape out the insides from both ends, and anoint everything with butter, sour cream, chives, whatever. That way you get delicious potato skins as well as fluffy potatoes. I don't know why I seem to be the only person who does this!

@Rose,

I learned how to do this in my 7th grade home ec rotation! We would then put them back in the over for 5-10 minutes and called them twice baked potatoes 🙂

@Rose, that’s how I do it. I also brush some olive oil and sprinkle sea salt on the skins. They get nice and crispy.

@Rose,

I grew up eating baked potatoes the same way! That's how my mom always made them, and so that's how I make them. Yes to butter, sour cream, and any other yummy toppings we have on hand. I always eat the skins.

@Rose, when I was in college, there was a popular restaurant called TGIF which served potato skins as an appetizer. They were delicious!

@Rose, you're not. Better half has always baked sans foil for the 40+ years we've been married. We've consumed the "fluff", the skins became either a meal (saved them in the freezer) or an appetizer/side dish. Regardless, baked potatoes and/or their skins, are a vessel for whatever topping trips your trigger. I enjoy them with taco meat or chili, with various "fixings". We used to have a chain restaurant called Hungry Hobo. It became a Subway . Stopped at one out of state, the taco stuffed potato just wasn't the same.

@Rose, one of our favorite family dishes was doing exactly that with leftover ham and adding shredded cheese.

Not buying that Ferrari …

Also not “upgrading” to a more expensive house as income increased, buying household items and using them forever (furniture, dishes, silverware, decor), not caring about trends, not having my kids in a bunch of sports, being a homebody.

@JenRR, I consider renting a form of passive tightwaddery. We will never need to worry about upgrading our home so that it can sell in the future. The house flippers have ruined everything when it comes to selling one's home. Unless you've upgraded all the styles to the latest trends, it's harder to sell it. And since I'm a renter, I'm not as worried about whether what I'm renting is trendy--if it's outdated, that's great, it means it's harder for the landlord to rent it out again! "As long as it works" is my motto when it comes to house decor.

@Karen A., Renting will definitely save you in maintenance costs! It’s nice when someone else gets to pay for the new roof or busted water heater. We were lucky enough to buy in 2015 when home prices were much lower. Rental prices in our neighborhood have nearly doubled in that time! Thankfully, our neighborhood is in such high demand, trendiness isn’t that big of an issue when selling. I’m with you on the “as long as it works” motto.

@JenRR,

It would be interesting to see a breakdown of renting vs. buying by city. I wonder if this differs from place to place.

@JenRR, Rental also means you'll never be underwater and that you can easily move for a better job, family, etc. One of the realizations of the Great Recession and one reason why it took so long to recover from, is that people were stuck in their existing homes but suitable jobs were elsewhere.

@Bee, It does--based on many different factors, of course. My daughter is having a very hard time finding a new place in Manhattan. Occupancy rates are very high for some reason (probably Airbnb, now that I think about it).

@JenRR, "not caring about trends" is a HUGE money-saver.

@Central Calif. Artist Jana, YES!!! THIS!!!

@Central Calif. Artist Jana, YES! I still have furniture from my first college apartment that was purchased at garage sales! I still like it well enough, and I've repainted some of it a different color, but overall it works, and it's definitely not so precious that I care if you put your feet on the coffee table or something happens to it! Trends are honestly exhausting, and eventually everything comes back around!

@Jen, I love trends. If it happens to be 1904, of course, in my house. Everything except the sofas is from that era. Ain't nobody got time for 1904 sofas.

Yes. It will vary a lot on location, as well as, personal circumstances. I live in a smaller town with a large university. The population is transient and rentals are in very high demand. We bought a house when the market was much lower, planning to live in it for several years. It’s been nine years already. The mortgage on our new house (plus taxes and insurance) was less than our rent for a crappy, poorly maintained apartment. We already owe less on our house than the first owner paid for it in 2001, and demand for houses in my neighborhood has been steady over the years. My house would currently rent out for double our mortgage.

On the other hand, my first house was a financial bust. I only lived there a year, the housing market crashed, it took seven months to sell, and I lost my down payment. Ouch!

@Rose, A comfortable sofa is a must! I’ve heard 1904 was a good year for trends.

@Central Calif. Artist Jana, As I get older, it is funny to watch some of my stuff come back into style. I guess I will be on trend every 20 years or so.

@JenRR, The recent craze for late 70s clothing styles. Now where did I put those Gunne Sax dresses?

@Rose,

I have a soft spot for mid century flower pots. I have my green fingers from my mum, so I have had to buy several in recent years (covid converted me to house plants). I ve told the kids to flog the flower pots after I'm gone!

@Bee,

It really would be interesting. We bought our home in 2007, and rents in our area now are significantly more than our mortgage payment for apartments/townhouses that are much smaller than our house. (Of course, that doesn't take into account taxes, maintenance costs, etc).

@Rose,

Seriously! My sister wore a Gunne Sax dress to her high school prom. If only I had held onto my bell bottoms....

@Rose, I still love Gunne Sax and Laura Ashley and "prairie style". April Cornell filled that hole in my closet in the late '90s, and I will wear her clothes as long as they fit.

@Rose, my late mother saved a few late 70s items for me. Most still fit though the disco pants might require me to lose five pounds for comfort sake. One kiddo wore the disco outfit for Halloween.

@Rose, same here. I have no interest in what the rest of the world is doing. When I was paying to get a picture framed, the clerk asked me what my style was. I told her the truth, "World War II English country cottage."

Judging by the look on her face she probably went home and told the whole family'

@Central Calif. Artist Jana, I wore a Gunne Sax wedding gown 35 years ago. I love it but it's a little bit '80's style.

A few more passive frugal things, that maybe some of the other commentariat also avoid:

- Not buying expensive travel/vacations.

- Not buying expensive cars/vehicles (LOL the town we moved to is much smaller than our college town, and people use GOLF CARTS to get around, picking their kids up from school or going to restaurants on the square. I think we are going to stick to our new-to-us bikes)

- I haven't heard a lot of folks here talk about their horse riding hobbies, haha. That can get expensive. Though I don't think having hobbies other than frugality is anti-frugality, as hobbies can be very fulfilling.

- Limiting/no alcohol saves so much money.

This isn't me, because I collect mugs LOL, but:

- Collecting drinking ware. There's some extensive collections of Stanley cups and Starbucks cups on social media that are quite expensive. Actually, any "fad" collection would fit into this, like beanie babies!

@Andrea G / Midwest Andrea, My daughter loves to ride and did it competitively as a child. It's sooooo expensive here, of course. If we lived in a rural area, it would be pretty cheap-ish, I guess.

@Rose, While Midwest horse owning might be cheaper than where you live, it's still expensive. There's a reason they're called "hayburners."

@Chrissy, I was thinking more like Kristin Going Country, or someone I know on a homestead in rural Idaho.

Luckily my daughter used to sometimes teach riding, so it helped a bit and she was a pony camp counselor in the summers, teaching riding, horse care and art.

@Andrea G / Midwest Andrea, I get drinking ware from Goodwill and other thrift stores. People donate their discarded water bottles and coffee travel mugs. These items sell for $6 to $8. Not cheap, but a heck of a lot better than paying $25-$30 for them new.

I also find regular ceramic coffee mugs for garage sale prices. The ones with advertising are especially cheap and if I was furnishing a weekend getaway cabin, I'd get some of those. I don't need any more, but if you can find a really new-looking holiday mug, you can fill it up with candy and give as an office gift.

@Andrea G / Midwest Andrea, I live in area where golf carts have become very popular among those in their 30s and 40s. They are buying them in place of a second car — much cheaper than a EV.

@Andrea G / Midwest Andrea, I forgot to put "not drinking alcohol" on my list. Not only am I not spending money on the stuff, I'm not spending money on cleaning up messes that I made while under the influence (like DUIs).

I remember when people thought that Beanie Babies were actually an investment rather than a purchase. Such deception. . .

Ohhhh, this is a good one! Skipping alcohol saves in the moment, and it can also potentially save you in the future because alcohol use is associated with numerous health problems.

@Fru-gal Lisa, I've thrifted many of my mugs, or they are souvenirs or even gifts from others. I got a cute trendy iced coffee cup from GoodWill for $1, just had to peel off the vinyl sticker on it!

I love gifting mugs and other glassware with candy or baked goods. It's my go-to White Elephant gift.

@Rose, Yeah, we have probably the cheapest set-up for horses there can be, but there are still expenses associated with them. Most notably, hay in the winter. And we bought some riding tack, like a new saddle. Like anything, there are infinity things that will drain your money if you're not careful.

@Fru-gal Lisa, I have been know to "upcycle" a thrift store item into a gift!

@kristin @ going country, I figure any animal someone takes on is gonna cost something somewhere, if it's a vet, shots, shoeing, and so on. A friend of mine is a very active rider and her husband refers to her horse as "his 401k."

The local stable where my daughter and I would sometimes ride on the beach (me on the Percheron because I loved him) was affordable but it closed a coupl years ago. The town has changed from families vacationing to singletons who want to party. It's sad--I really adored the owner. I remember once some of the horses came sneaking out of the barn while her back was turned, and she turned around and in a an angry tone said, "All of you, get right back in that barn," and all the horses sheepishly returned. She was great. Now it's a horse sanctuary rather than a riding stable.

Horses are like any animal, I think: you gotta show them who's boss. I remember my daughter was riding a horse called Maple at one point, and Maple threw her twice at a horse show. My daughter ran off crying so it was left to me to take Maple back to the barn and untack her. Her eyes were rolling and I know she was dying to bite me, so I showed her my fist and said, "Look. You bite me, this is going straight in your muzzle." She graciously allowed me to untack her without biting me.

@Andrea G / Midwest Andrea, ooo I just thought of another one. Not buying expensive concert tickets. I'd love to see Taylor Swift when she comes to the nearest big city to me next month, but I was waitlisted when the tickets went on sale last year, and resale STARTS at $1500 per ticket.

@Andrea G / Midwest Andrea,

Oh, I know what you mean! When the Foo Fighters were coming to my area, I really, REALLY wanted to go.....but tickets in the nosebleed sections of our large stadium were hundreds of dollars apiece. My son's marching band director had two tickets that he had to sell at the last minute (better than nosebleed sections), and they were about $450 apiece. Nope.

For $1500, the Rolling Stones had better perform my playlist in my living room.

@Cheryl, Me too!

Once when I was unemployed I found some like-new sweatshirts with embroidery on them. I kept one and gave one to a friend who worked at Dillard's (a very swanky dept. store). She opened it and began yelling at me for spending too much money on an expensive designer item and said she was going to make me return it. I laughed and had to tell her that I'd picked it up at a thrift store bag sale --where everything you could stuff in the bag they gave you was $5.

I credit passive frugality through much of our marriage for allowing us to retire early.

- We didn't buy new cars, only pre-owned, and then kept them and kept them.

- We camped instead of hoteling/moteling for the most part.

- I didn't pay too get my nails done.

- We didn't buy new books, we instead used the library extensively.

- We had potlucks when we gathered with our circle of friends. We did these almost weekly, rotating homes as we went along. Friends for our children to play with, while the adults talked, so we adults lived for them I think!

- We didn't pay for expensive birthday party outings, we homemade them. I had the Pennywhistle Party Planner, and it was fantastic. Just some of the homemade birthday themes it contained, that we did- 1) Gold miners birthday, where among other things I hid small change at a local sandy play area, and had guests 'mine for gold,' 2) A Piggie birthday, where among other things each guest was covered in a cutout trashbag when they arrived, in preparation for the messy things to come, like eating without utensils (we held this party in our garage, ha!), and a Cooking Chefs birthday, where guests made their own pizzas. So much fun.

In retirement, we still practice passive frugality. We primarily self entertain by hiking, biking, kayaking, and walking, either together or with our respective his and her friends. We continue to use the library, we work to take advantage of the many free outdoor activities in our area, we cook from home during the week, we continue to avoid paying for parking around our beach community simply by being willing to walk a few blocks instead.

We spend for sure at this phase of our lives, but the frugality we continue to apply to certain areas results in our having more income to direct for things we value, vs things we don't.

@Tamara R, your birthday parties sound like lots of fun! And your retirement frugality observations made me think that that could be an interesting post on its own.

Kristen, if you ever wanted to do one of your question posts on this, I'd be interested to hear from the Commentariat about frugal post-retirement lessons, tips, surprises, challenges, etc...

I always make my coffee at home, especially in the morning when I'm drinking it black anyhow. I don't need to pay $3 and upwards for a cup of coffee when I can make it at home. Our power was out for 11 days from the aftermath of Helene. One morning, I dropped my daughter off at school, went to Starbucks and got a simple drink THAT WAS STILL ALMOST SEVEN DOLLARS!!! and went and sat in the library parking lot and used their wifi (also out at our house - and not available at that time at Starbucks).

I grew up the oldest of 9, and my dad did most of the grocery shopping. He would routinely weigh anything that was sold pre-bagged (potatoes) or by unit, not weight (watermelons).

I used to make myself baked potato meals--my DH and the boys stared at me when I suggested it, but I like them. I should do those again.

Regarding stamps, I had a Frugal Fail the other day---I stopped at the post office to get a few (I do send snail mail cards to friends), and I used the self-serve kiosk. I opted for 20 stamps, so I wouldn't have to come back for a long while! While they were printing, my oldest happened to come in--he drives in once a week to check his PO box--and I must have gotten distracted and not realized the kiosk prints the stamps out 10 at a time. I only picked up one sheet and thought it was 20! Realized my mistake when I got home and looked at the receipt. Boo! So for me, stamps sent to home would have saved money! LOL.

But passive frugality--we don't go out to the movies, I think that saves a lot. We make our entertainment at home.

I am often really, really tempted to stop and get a tea or something. I don't know why---my mom's spendthrift ways (she and my dad went out for breakfast/coffee every.single.morning! And they had a coffee maker at home! Why?) must be somewhat genetic. But I resist! I remind myself I have a whole host of lovely, bought-on-sale (mostly) teas at home.

I don't get my nails done and rarely go for a haircut.

I don't buy makeup.

I have lately stopped buying books and rely on the library system, so there's that.

@Karen A., I don't go to the movies often, maybe four times a year, but when I do, we make a fun event out of it and anticipate the movie for a good while. Boxing Day this year we are so looking forward to seeing the new Nosferatu by my son's favorite director, Robert Eggers.

I also don't spend money on cosmetics or fancy things (she says vaguely) but I do sometimes forget to make my coffee in a flask or am low on time. Part of this is me needing to be more organised but on a general note, time is a big factor. Is it discussed in the book? I see lots of advice about going around different stores for deals and making things, and it always seems to assume that the reader has lots of time to do so. I work fulltime and don't really want to spend my weekend going around store to store.

@Sophie in Denmark, Amy explicitly says her family's frugality is so she could stay at home with the family. IIRC she doesn't have as much for people with less time.

@WilliamB, thanks! I find this factor is often left out of frugality discussions - you can save money but you spend time, and a lot of it is deciding which is worth it.

For me frugality is a balance. I want to feel confident about managing money and not spending on things I'll later just donate, but on the flip side, I don't want to save money simply for saving money. I want to go and see films in the cinema, I want to go out with friends and I want to travel and see new places. Money in this sense is a tool for those things.

I also try and spend money on something which is good quality and/or made sustainably (second hand is good for this which is also a frugal win). I want to buy things which will last (within reason) and not end up in a landfill! I also try and find products made in good working conditions. It can be a headache, which is a whole other discussion, but I do the best I can.

@WilliamB, this was exactly the conclusion I came to when I first read the Tightwad Gazette - that a lot of those tips were extremely time-consuming and not worth it for somebody like me with a job(s) that I loved and no desire to give it all up to stay at home. No disrespect intended to those who like Amy made a different choice, just that for my family, different choices were better suited.

For me, frugality includes not trying to follow strategies with a smaller payoff per hour invested than I can make teaching violin lessons, for example. I have to be frugal with my time. But contentment is a useful strategy for anyone, employed outside the home or not, who can honestly say that their basic needs are met. We still live in our first house, built in 1952, which we bought 30 years ago. It will in all likelihood be our last house. When we decided to have a third child, that automatically meant that the older two would share a room, which they did for a dozen years before the eldest went off to college. And that room was not (still isn’t) large. We don’t drive fancy new cars, we don’t spend money on clothes or status symbols. My hair has been graying naturally for 20 years now. Etc etc.

@Meg in SoTX, when I shut down the baby factory, eldest kiddo asked why. Said you'd have to share a room if another sibling. Good enough reason in kiddo's mind to keep it at two. And it would have been a quite large room truth be told. Both kiddos have seen the room my sibling and I shared for a number of years. It was 1/4 size of the room kiddos would have had to share.

Is THAT how you tore that hole in YOUR jeans? On a barbed-wire wannabe Christmas wreath?

Hahahaha, no they came from the store that way. 😉

However, I refuse to buy the jeans all my young classmates are wearing...they have huge chunks of material missing from the knees, and they're loose and baggy. My young friends are going to FREEZE in the winter.

@Kristen, Spoken (written) like a Mom! "Bundle up! You're going to catch a cold! Where are your mittens, young lady?!" You'll be SO popular...

Hahaha, yes. Well, I have several classmates who consider me their school mom, so I have already settled nicely into the role. 😉

@JDinNM, One of my Mom's favorite cartoons was a mother saying to her child, "Mother is cold. Put on a sweater."

It's almost impossible for me not to say something, even to my renters. "Now I this is annoying but I'm a mom so I can't not say it. We have bad riptides this weekend so please, please stay away and keep an eye on your kids." I guess the Mom is strong in this one.

sigh. Great typing. "Now I know this is annoying....please stay aware..." etc.

@Rose,

Some people might find that annoying, but I would appreciate it. Rip tides are no joke. I've never been caught in one, thankfully, but I pay close attention to any warnings when at the beach on vacation.

@Liz B., I have, but luckily I knew what to do and I didn't panic and also I'm a strong swimmer. I may suck on land but I'm OK in water! I can easily see why people drown, though.

@Heidi Louise, that was my mom, too. Plus insisting we wear socks and zip up our jackets.

@JDinNM, don't laugh about being a mom at work. I make very, very good money as doing mom duty is at least 50% of my job.

@WilliamB, don't forget, "Always wear unripped, clean underwear because you might have to go to the hospital." As a kid, I kind of lived in terror over that one. Never happened, though.

Well, to me, not buying upgraded water bottles is a passive frugality.

I remember the stamp envelopes, somewhat. I think I only used one once, way back in the day. I use stamps much less than I did in the past, but I do still use them.

When I was in high school, we had a sorority that all girls, as long as they weren't failing

or getting discipline referrals, could join. As a fund raiser, at least while I was in high school, we were allowed to borrow the school cafeteria and the commodity butter to bake large potatoes and load them with butter. Volunteer underclass girls carried baskets of the hot, foil-wrapped potatoes, plastic forks, extra butter, packets of sour cream and salt & pepper shakers to sell the potatoes at the last home football game, when it was usually quite chilly. The potatoes sold like, uh, hotcakes. Anyway, we raised money for projects and the folks in the stands loved them. I think we sold them for a dollar each, which was mostly profit for us. This was the 70's, after all.

Let's see, passive frugality....

I set my retirement savings to come out of my paycheck, and this job matches it, so I certainly take advantage of that. Like Kristen, I don't think about it, it just happens.

I don't upgrade things until I just have to. Appliances, cars, electronics, phones, wardrobe - I like to use them as long as I can.

I don't color my hair, either. I'm not morally superior to anyone who does, I just don't consider it worth the money to ME. It obviously is to some other people, and that's perfectly fine.

I don't go to the movies - I go less than once every five years or more.

I don't do "retail therapy." I don't shop when I'm bored, either.

I don't know if I can count this, since I don't like coffee, but I don't go to coffee shops for drinks. I don't go to ice cream parlors to get ice cream (I don't care that much for commercial ice cream anyway), don't order pizzas to be delivered or go pick them up, don't purchase cakes for events (I make them), and don't stop at a bar for a drink. I don't drink much, but if I do, it will be at home - my home or that of friend or family.

I would imagine most of us here can say all or most of the same things.

@JD, our lives are quite parallel, except I do like coffee. The last movie I saw at a theater was Little Women. They waste 1/2 hour of commercials for zombie movies, are Way Too Loud, and I'm not a fan of my feet sticking to the floor, but it is quite thrilling to see things on such a huge screen.

@Central Calif. Artist Jana,

Theaters are Way Too Loud to me, too. I don't get it. I don't have sensitive hearing, in fact I have a bit of hearing loss in one ear. If it's too loud for me, just how loud is it to the others? And why?

@Central Calif. Artist Jana, here's a funny thing: I like seeing the ads for upcoming movies. I almost never go it to movies anymore and I miss that part.

Around the holidays the post office will usually put envelopes in the mailbox and you can check the box of what you want, put in a check and they'll deliver them to your mailbox the day after you pick them up. Although I tend to just get them at my usual grocery store because they sell stamps as well as mail packages, etc, and I am at the store way more often than I need stamps!

I do still send cards for bdays here and there, but mainly use stamps for holiday cards, but I feel like I am in the minority of people who still do these!

@Jen, I absolutely love to get cards, letters and invitations in the mail. I also love to send them. It means so much to others.

@Bee,

Me, too. Unfortunately, I send a lot more than I receive. But I still enjoy it.

You might say we were brought up passively frugal. Just one example: as a teenager, in my last grow spurts, I can recall only having two pairs of jeans. One on the body, one in the laundry and back in the closet. And in those days only undies/socks and sports clothes were changed after one use - daily clothes were worn an entire week. We did not own a drier, in the 70s nobody did. It was entirely acceptable and there were many more classmates where this was the case. We did not smell - only the winter coats of the teenage boys smelt - it is often disregarded how hormonal changes affect boys.

Growing older I appreciate growing up in a sober lifestyle a lot, as I see it as a way to prevent consumerism. Having said that, I have always loved pretty things and we did have pretty things growing up, just not a lot of them. I am pretty sure the need for beauty is inherent in humans. Not for the sake of ego/ prestige necessarily - I can imagine people in ancient times doing woodwork or creating baskets or weaving, and trying to beautify useful objects. And feel convinced that a really compelling tale or beautiful song will have thrilled audiences then as they do us, now.

@JNL, Some people need more beauty than others. For me, a beautiful environment is very important. My mother, too: we were pretty working class, but Mom worked hard to make our home attractive. She was artistic and my father could have been a great artist--he went to a special high school for artists in Manhattan--but his temperament was, uh, not quite right. If Mom wanted something, she figured out a way to make it herself, via sewing, woodworking, or whatever. And Dad would paint pictures--right now I am looking at the lid to the toybox Mom built for me when I was four and my father beautifully painted with my first and middle names. I tried to do the same for my kids--we still have the (rather nice, I think) painting i did for my son when he was three months old of the cow jumping over the moon.

@JNL, YES YES YES to the human requirement for beauty! It is one really fabulous thing that we cannot overdose on. And we can bring order and beauty to our surroundings in so many small ways that don't require spending money. This might be a fun post for Kristen to write about. . . it sure would be a fun one to read!

@JNL, William Morris said it best: 'Have nothing in your house that you do not know to be useful, or believe to be beautiful.'

@Sophie in Denmark,

You might want to visit Worpswede, Germany. There are several interesting houses there, and one of them has been fitted out in so much detail, the door handles, the furniture, the lamps, the fabrics- I was drooling like our cat smelling tuna.

@JNL, Oh I know that place. Artists' colony, the idea of Gesamkunstwerke, where everything in a space is considered art. Klimt took this idea to the extreme, providing linen smocks for weekend guests so they matched the interior decor. I made a copy of his own linen artist's smock for my daughter, actually.

@JNL, thanks, I'll add it to the list! It sounds great!

I enjoyed this post (as many of the other Commentariat members who subscribed to the Gazette have, I imagine) as a walk down memory lane. I confess, however, that as another member of the Lifelong Klutz Klub, I never attempted either the tin-can angels or the barbed-wire wreath.

And as I've said for years, I also enjoy many forms of passive frugality, and I don't feel that it gets the kudos it deserves.

Finally, a word from an elder stateswoman about stamps: I still pay some bills and conduct some correspondence via U.S. mail, so postage is still a necessary household item for me. Some of my own "elders and betters" (a 93-year-old JASNA friend now in assisted living, and the 100-year-old mother of my next-door neighbor's other close friend) rely on stamps even more. And for those of us still using stamps, NDN's CF has tipped me off to the fact that several online vendors now sell older U.S. Forever stamps at considerable discounts. Just Google "discounted U.S. postage stamps" and take your pick of sites!

My mother believed that paying her Amex bill via a check and envelope meant that her information couldn't be stolen online. I tried to explain to her that that was entirely untrue, that's not how hackers work, and that sending a check was just more trouble than it was worth, but she was stubborn and wouldn't admit she didn't know a thing. I said, "OK, if you want to believe Amex writes down your billing info in a quill pen on a foolscap ledger, go for it. In reality they scan right into a computer like everyone else."

Sometimes people have a similar line of thinking; that if they just don't use their bank's app, their information will be protected. But you not using the app has zero effect on the fact that your bank already has their whole system online!

@A. Marie, that is a fabulous tip! Forever stamps simplified postage considerably. Remember trying to find just one 1¢ or 2¢ stamp to make up for the latest price increase? I do try to buy stamps at my local post office because it helps them, and their service is stellar in my town.

Young folks in general: I am gradually moving toward paying more bills online. But I continue to pay some bills by mail for other reasons. For example, if I were to pay my city and county property taxes online, I'd actually get hit with an extra fee (don't ask me why!). Please don't automatically assume that I don't know how the postmodern, computerized world works.

Oh yeah, I paid my water bill by check for a long time for this very reason. The stamp was cheaper than the pay-online fee!

@A. Marie, I also pay my water bill & property taxes by check. Our auto registration charges a fee to mail your check (why?!!), so I sashay to the courthouse to pay those by check. I just mailed a check to a subcontractor today. I love to mail postcards, & Xmas cards, & thank you notes. Checkbooks & stamps are still used by this 50 something yr old!

@A. Marie,

Is there a specific site that they recommend for discounted stamps? I know some sites are scams.

@A. Marie,

Here, here! My local tax bills also charge a fee for paying online. I write a check and take it by or mail it in. Since I live half a mile from the satellite county tax/DMV office, and they have a secure drop box at their front door, I usually drop my property tax payment and driver's license renewal fee in there on my way to work. One of the rare advantages of living in a small town, I guess.

Yes, it's a lot easier to pay bills online, but I refuse to pay the stupid "convenience" fee to do so.

@A. Marie, "Please don’t automatically assume that I don’t know how the postmodern, computerized world works."

That's not what I meant--more like the 93 year old and 100 year old.

@A. Marie, Businesses are all starting to charge a 3.5% "convenience fee" for credit card payments, so I am not only paying by mail but by check. Exactly whose "convenience" are they charging for? Their own, apparently.

@Rose, I need to thank you for giving me a good laugh! I am picturing a family member who works for Capital One sitting down every day with his quill pin and foolscap.

@Meg in SoTX, Kinda gives a Bob Cratchit vibe!

@JDinNM, it's for the customer's convenience. Credit card companies take a 3.5% or so out of every payment made to a business by cc. The businesses have been eating those costs for years and I guess it has gotten to be too much for some businesses. I, too, have gone back to paying by check in some cases even though I consider it a major nuisance, but that 3.5% fee adds up, so it's understandable that it would hurt the bottom line of a small business.

@Bobi, the agreement between merchants and banks used to forbid the merchants from passing on that fee. Obvs that changed some time ago.

@A. Marie, I will pay via ACH - especially for the one provider who not only charges $3 for a paper bill but $10 for a service (that only as of late has been reliable - only due to me calling every two weeks to schedule a service call!). You can keep on-line bill pay and RTP (real time payments). RTP is a huge security risk IMHO (and I'm not the only one thinking this). I do pay via e-check for government services as I will not pay a service charge. Heck, I avoid fees as much as I can. Most non-government fees are just profit, pure and simple. I never use my credit (or debit) card at a small business either. If the purchase price is large enough, I may ask for a cash discount. But we're talking a hundreds of dollars purchase. I don't haggle for small amounts.

@Selena, et al,

I pay a lot of bills by phone the day I get the bill.

Saves time, keeps me from having to write a check and it does not put my cc number online.

I think it may be a bit safer, esp. since I'm one of those old dinosaurs who still have a landline phone.

@Central Calif. Artist Jana, my mother in law died in 1990 with a large stamp collection that had been her husband's. Neither my husband, nor his siblings could be bothered to do anything with it, but everybody talked about how valuable it was. Of course it was not valuable at all.

I took it upon myself to schlepp it around to stamp dealers, where it was pretty unwanted. I got a few hundred dollars from one guy who took some of the stamp sheets just to use for postage in his store. I sent all the individual "collectable" stamps to my friends teenage son, who collected stamps.

The best thing though was just using up the various denomination sheet stamps for my own letters for roughly the next two years. By the very end I was using a lot of small denominations to get up to the current postal rate. I just loved it, though.

@A. Marie, I pay most of my bills on line but things like property taxes, water bill and donations to the local PBA get checks and dropped off at town hall. This way no stamps are used. My town is 2 square miles and it's a horrible walk from my house on top of a hill down into town so I get in the car and start with just letting the momentum of the hill move my car.

@WilliamB, my husband is now very careful about paying by credit card in restaurants that we rarely go to. I also pay some credit cards on line cause they will charge me $2.99 for a paper bill. Whaaat? Stupid.

We are not in credit card debt we just rotate the cards to get the best cash back. We use an American Express to get 6% back on groceries for example.

@JDinNM, many small businesses are suffering from the credit card fees so they are now passing them along to the customers. I try to pay cash.

We often have baked potatoes for a main dish. Esp during Lent.

We like sour cream or cottage cheese. Chives and cheddar cheese for toppings.

I own one very nice water bottle. It is almost four years old. My kitchen cabinet space is minimal.

OK, I ran the potato dollar amounts in the West Egg Inflation Calculator. What cost $3.39 in 1990 would cost $8.03 in 2023. For 1992, the year the book was first published (in December, per Amazon), their $3.39 would be $7.48 for 2023. If the year was 1995, the cost would be $3.39 back then and $6.91 last year. (The latest stats available; they can't calculate until the year is over with.) So, adjusted for inflation, the store-bought baked potato still cost a bit less in her time.

If you want to run the numbers to compare other years, just look up West Egg Inflation Calculator and it will walk you through the steps.

Some of my mini-frugal habits include: drying clothes and linens on clothes racks whenever possible (some get 15 min in the dryer to de-wrinkle); never going to the local mall (I prefer thrift stores and Walmart); buying used (estate sales, garage sales, thrift stores) unless there is a super cheap bargain on a new quality item; re-using what I already have in different ways (a bathroom space saver minus its legs is now a wall cabinet; Xmas tree lights are on the covered patio; a valance in my former living room is now in the bathroom and the lace curtains for the LR now are on the window of my front door; an old microwave oven cart from when microwaves were huge is now a bedroom nightstand, etc.); brown-bagging my lunches; never going into Starbucks or other coffee shops (I make my coffee at home); cutting up limbs and brush to put out at the curb and thus avoid landfill fees. (Even if it takes a couple of months to get rid of it all.) I've cut up area rugs and used them as a hallway carpet and gotten starts of plants to transplant in my yard. When I paint the house, I've used recycled paint sold at Habitat Re-store and Glidden paint sold at Walmart. I re-use the artificial Pier 1 "Peppermint Pier" Xmas tree my family bought back in 1970 when I first got my driver's license, along with vintage ornaments passed down in the family. I reuse gift sacks and bows and you won't see me in a Black Friday crowd unless I'm cashiering that day.

Oh, and I almost forgot (apologies if you've heard this from me before): I rarely go to movies or entertainment venues and I use updated "rabbit ears" (indoor antennas) for my TV sets, both of which were bought used. So my entertainment costs are zero.

One of the TVs is so old that it has a thing for video cassette tapes. A friend gave me her collection of old movies since she upgraded to DVD and streaming. I have free entertainment there, as well.

I dyed my hair once. It was really nice but I didn't like how it looked when growing out. So now I'm back to natural gray. (I have a thrifted sign in my bathroom reminding me that "Silver is the new blonde." LOL!)

Besides not dyeing my hair, I also don't get my nails done.

@Fru-gal Lisa, my neighbor cut up her old couch into pieces to fit it in the trash can over several weeks. I thought that was so funny and resourceful.

@Central Calif. Artist Jana,

A lot of thrift stores won't take upholstered furniture or mattresses anymore, so you either pay the landfill fee or resort to something resourceful.

Investment in mutual and index funds was becoming more common place in the very early 90s when Amy D. was writing, but these types of investments were still novel. Many people who had money to invest still used brokerage services and many funds also had investment minimums. The savings account or the Certificate of Deposit was still the primary savings vehicle of the middle class. Although IRAs and other retirement vehicle were available, many companies still offered pensions. Things have changed a great deal over time. However, I think saving money at the grocery store may leave us with more money TO invest in the long run.

I think there is a lot of overlap between active and passive frugality. Passive frugality is not easily acknowledged or seen by others. For example, not stopping for fast food when out running errands. However, there is often a more active component to this like packing a snack to take along.

I don’t think that I ever made stuffed baked potatoes for dinner when my children were growing up. However, DH loves potatoes, so often he will bake one to go along with his dinner. I think it is his way of getting is weekly allowance of butter, sour cream and cheese.

I feel like looking at the Tightwad Gazette is a bit of a history lesson. So much has changed in our world in 30 years, but so much has stayed the same.

Sharing plant cuttings with friends is a frugal activity. Plants have gotten so expensive at nurseries. I went to a plant sharing workshop last week, and it was so fun and I'm hoping the cuttings I came home with survive. Most of my yard is things people have given me.

Washing your own car is frugal and good exercise too!

@Carolyn, I went to a plant sharing propagation workshop last week. Do you live in North Florida?

@Bee, No, Bee, I live in Louisiana.

@Bee, Maybe now is (in the South) the right season of the year for plant propagation, so the workshops coincided.

This sort of links to another frugal move: Consulting with experts and learning from them. That might take activity, like attending your plant exchanges, but repeating what was learned is passive. Sort of. And certainly having a broader circle of people with your own interests is frugal!

@Heidi Louise, a lot of gardening is done in the South in the spring and fall. Summers have been too hot as of late to do much. Having friends who enjoy the same thrifty activities is definitely a plus.

@Carolyn, I was wondered if our paths crossed and we didn’t know.

@Bee, Wouldn't it be nice to cross paths though?!

1. I notice that much of the FG Commentariat doesn't spend much on personal grooming. Good tip there.

2. Investing was GREATLY harder when Amy was writing.

2A. It was impossible for an individual to invest directly in the stock market unless they had a personal (and I do mean an actual person) to call to make the trades for them.

2B. It was a lot more expensive: fees were by the 1/4%, so they were both sticky and a lot higher than they were now. The change to very low and very fluid fees is due to a combination of technology and legal action stopping brokerages from colluding about fees.

2C. Another reason personal investing was harder is that many of the vehicles we take for granted didn't exist, were new, or were scarce and hard to find out about. Money market funds were all but inaccessible to most folk. 401(k)s were established in 1978 (and were an unintended byproduct of a different policy). IRAs established in 1974 but weren't practical till a different tax code change in 1981. People still thought that individuals picking stocks would outwit the market as a whole.

2D. When Amy started writing, information was poor, untimely, and hard for individuals to access. That, too, will affect one's ability to effectively invest in the market.

3. My fave way to serve potatoes as a meal is twice-baking them. Bake them; scoop out the insides; crisp up the skins; mash the insides with cottage cheese, grated cheese, and flavorings to taste; restuff the skins and heat/broil till warm through and crispy.

@WilliamB, "It was impossible for an individual to invest directly in the stock market unless they had a personal (and I do mean an actual person) to call to make the trades for them."

Not true. I did it online via Fidelity and Schwab even then.

We're in the second book, which would have been published around 1992/1993. Was there online access to Fidelity and Schwab then? I'd find that surprising!

A quick google is telling me 1995 was the earliest year those services were available, and I have to imagine they were pretty rudimentary and uncommon at that point.

Ohhhh, that makes a lot of sense then. Thank goodness investing is easy these days; otherwise I'd probably avoid it as well!

@WilliamB,

Thank you! I remembered that no one I knew invested when I was a teen and young adult, I'd never heard of, or only heard of vaguely, the terms IRA and 401K, and remembered brokers as people one had to have a lot of money in order to use their services, but I had zero information to back me up on any of it.

@WilliamB, Actually, Fidelity started selling mutual funds in 1946 and Vanguard in 1975. Vanguard (which is owned by its funds' shareholders) created and offered the first low cost index funds).

@Rose, Also DRIPs were popular in the '90s. We bought stock directly from major companies and still have it. Of course, we mailed them checks to start the accounts. 😉

@WilliamB, Regarding information being poor, untimely, or hard to access:

Anyone else remember travel agents? Buying a ticket was not necessarily easy or convenient. Nor was getting travel/tourist information in general. In the stuff we found cleaning out my Dad's house was some information about visiting Switzerland that my parents had written to the Swiss Travel Board (or similar) in New York City to get.

I recall when toll free numbers were a new thing, and a new way to deal with customer issues. (I also recall the newness of zip codes and UPCs, not to mention computers in general).

@Kristen, I worked for a very prominent tech company then and had to teach higher ups how to use the internet, so yes. I believe it was via CompuServe (hahaha) then. Then for a while I just faxed documents and then the Web appeared. But you didn't have to call up a broker--I've never phoned one in my life.

@Bobi, If we ever have a "most idiotic financial mistake" column I think I would come out tops. I am ruthless when it comes to paper mail. If I know it's a bill I've already gotten online, I tear the thing up without opening it. It's the only way I can make sense of it.

Well, I used to regularly get paper mail from Fidelity. Since this was the era before paperless billing, I just figured they were either trade confirmations or monthly statements, so I ripped them up without looking.

A couple years later I realized they were dividend checks.

***SIGH***

Rose, she started publishing in 1990. The World Wide Web wasn't pushed to the public until 1991, and the internet was rudimentary to say the least. Charles Schwab web trading became available in 1996, around the time Amy stopped writing. Fidelity's webpage isn't as detailed but lists establishing the world's first mutual fund homepage in 1995.

@Heidi Louise, I do! My mother and I were once issued actual paper tickets for a flight that - get this - never existed! It wasn't that the Monday flight from Lima to Iquitos didn't run that week, it was that there was -never- a Monday flight.

To this day we have no idea how the agent was able to issue that ticket. The other dozen flights on that trip were fine.

@JDinNM, crud. I wrote mutual funds but I meant MONEY MARKET funds. Sorry everyone!!!

Yes, y'all, they existed. But they were relatively rare in Amy's time.

@Rose, not in the 70s or 80s you didn't. And internet in rural areas, even dial-up, was not that common in the early 90s. It wasn't until the turn of the century that online became more the norm. I've worked in IT since 1978 - online/mobile took awhile to become close to being mainstream. And infrastructure for internet is still so-so for a lot of the country.

@Kristen, My parents' investments were Certificates of Deposits at the Savings and Loan. The stock market was for very learned, wealthy people, not the working class. Or so they thought.

@WilliamB, in about 1986 my father decided that he and I would go to California to Big Sur to scatter my mother's ashes. He went to a travel agent who gave him a crazy quote for airfare. I said "heck no" and booked out flight with People's Express. Much cheaper. Anyone remember that airline?

@auntiali, oops, our flight.

also re baked potatoes: the British have a chain called Spudulike which never fails to make me laugh.

Some of the things she says are just weird and compulsive stingy behavior. Virtue overdone becomes a vice.

@Farhana, Yes. I remember when she said a recession was a good thing because it taught people to save. Tell that to the people losing their jobs and homes. Making a bunch of angels from frozen juice cans isn't going to save them.

@Farhana, I think maybe you had to be a subscriber to the newsletter and maybe read some of her early interviews to really understand her point of view. She admitted in her inaugural newsletter that she did things other people thought were odd. She told her personal story and shared her insights but often resisted the idea that she was an expert. She also had a great sense of humor and I think many things today's readers are taking literally were intended as humor.

Also Amy started the newsletter to be able to work from home and she had very defined goals. After her newsletter became such a success and she decided to stop publishing, she continued to provide readers yearly updates via letters. She spent much of her early retirement years volunteering nearly full-time at the local thrift store and elsewhere. I won't argue that some of her suggestions did come off as weird or strange but I would argue that she was never stingy and your last line absolutely does not describe her. Btw, if you look under her name on the book's cover, you'll note that she referred to herself as The Frugal Zealout, which was definitely tongue in cheek!

I almost thought the barbed wire wreath was a joke, but she did say she found the idea in a Country Living magazine!

@Bobi, I have the same book Kristen does and I've read the whole thing. I do get humor. But I also remember "I am probably one of the few people who think that a recession is a good thing," said Amy Dacyczyn (pronounced decision) the founder of The Tightwad Gazette, a monthly newsletter for the thrifty that is published in Leeds, Me." from the New York Times in 1992. To me, that's just smug and tiresome, not humorous etc.

@Rose, Thank you. I'm aware of how she pronounces her name and also saw her when she was on one of her book tours. She was neither smug nor tiresome but perhaps you just had to be there.

I think Rose was quoting from a newspaper article about Amy, and the article was explaining how to pronounce her name!

@Bobi, Amy D saved my life. I had my son and while in the hospital I watched Phil Donahue and Amy D was a guest. She rocked my world! Her one example that almost made my head explode was that once you wear a dress (for example) and wear it again then it is used. Why would it be any different from buying clothes at a yard sale?

My materialistic sister thought I lost my mind with my frugality.

My passive frugalities: I don't color my hair (I do get perms routinely because my hair is fine and flat otherwise) and I have very few grey hairs even at 72 y/o, don't wear makeup, don't get my nails done. That said, I use quality shampoo and conditioner and body wash. I use washable (I call them "drizzle") pads because of occasional "leaks."

I rarely drink soda and when I do, it's Dr. Pepper or my favorite thirst quencher is a Sonic cherry-limeade, but mostly iced tea or hot tea after one large chai latte. and my reward to myself for mowing is a root beer float-made at home.

I do buy quality thus longer lasting shoes and purses. I buy most of my clothes on eBay, because certain designers fit me better and are in styles I like. I found one brand and style of jeans that fits and have various "ages" of them, from faded/worn for everyday and yard work wear to darker dressier pairs to wear with nicer tops, including a pair of black ones. Same for summer shorts and modest tank tops. Those are the passive frugalities off the top of my head.

Something we love for dinner is loaded tots. For dh, it's cheese, chili and sour cream. I skip the cheese since I can't taste it. A bag of tots is $3 and I have recently discovered Jack Link's chili, which is $4 a can. We can get 4 meals total out of this, so even if you add a little for the cheese and sour cream, it's a little more than $2 a meal. Very tasty and very filling.

Living frugally is so automatic to me that it is hard to think of it as "tightwaddery". These lifestyle choices probably make it look as if I have the most boring repetitious life in the world, but I love my life!

•Buying high quality (used if available) means not having to replace things. (a fun treasure-hunt approach in many cases)

•Keeping what you already own if it still functions instead of "upgrading".

•Choosing to take a walk or make coffee at home with a friend instead of meeting at a restaurant or coffee shop. (Better conversations in quieter settings)

•Not using shopping as a recreational activity. (More time for everything else)

•Washing (or not!) your car instead of going through a carwash.

•Using the library.(Ordering books through the website or using Libby)

•Not going to movies or subscribing to movie things (netflix? I know nothing!)

•Propagating your own plants if possible (basil is my easy one).

•Making yogurt.(Less expensive, less waste)

•Making bread. (No weird unpronounceable ingredients)

@Central Calif. Artist Jana,

I almost never bother washing my car. But I recently took my kids through a car wash after they saw one on a movie and they about lost their ever loving minds. We don’t get out much. It was so much fun! They do a whole light show while the car goes through- crank up your favorite tunes and roll on through. Now it was $10 and did not do a particularly good job at getting the car clean- definitely not a frugal endeavor. I’m just saying if you’ve got any young easily impressed kids on your hands, this is a solid treat.

When our kids were young, DH was in graduate school so money was tight. We'd make twice baked potatoes and while the children weren't looking, I'd add soft tofu to the mix to add protein.

Our kids are coming for dinner this weekend and we are doing a baked potato bar and chili. I'm shocked at what 5 good size baking potatoes cost anymore.

Probably the most passive is that we drive our vehicles forever...until they start needing real repairs. My husband drives a 2014 and I drive a 2015. He maintains them well at home (oil changes/brakes/tire rotations). We will probably replace his in the next year. We need a small truck...new house doesn't have garbage pick up and we will be hauling a lot of stuff while remodeling for a year or two...and he has wanted a truck for a while haha. But the money saved from older cars/insurance is big. Also, about every two years I tend to call around and check insurance rates. This usually saves me a few hundred dollars each year for a couple years.

I don't spend any money on services for haircuts/color/nails. I do color my own hair at just a few dollars a month. I cut DH's hair (and my younger son's). I cut my cat's nails and groom him also.

In the summer months I will keep heavy curtains closed in rooms we aren't in to keep the sunshine out. We keep the air upstairs higher (and heat lower) because we aren't up there much. One room up there we keep closed off completely. New house we will use all the space as it is about 1/3 smaller than our current home.

We eat at home except maybe 2 meals a month when DH and I go out. Each of us go to lunch once a month or so with a friend. We do not doordash or delivery or any of that. I'm just shocked when I hear my older son say what he spends on that type of stuff.

We have a sirius radio subscription for DH because he drives weekly for work and loves it. I call every year and have the price reset to under $100/year. We have a prime subscription and Hulu (which I get every year on Black Friday for usually less than $2/month...this year was $1.06/month). Those are our only subsciptions.

Everything else is probably a day-to-day frugality (like I bought 8 lbs of butter today because it was on sale for $2.49...better than the $4 it usually is).

@Marlena,

Where can i find the Black Friday deal on prime? Do you know if I can cancel & then re-subscribe if I'm a current customer of prime at the better rate?

@Gina, the black friday deal is on Hulu, not on prime.

@Marlena, good tip to call around every year or two for better insurance rates on cars. We are stuck with Allstate because they insure our house, and NO ONE can find insurance for homes in our town so we don't dare quit Allstate for cars lest it trigger a cancellation on our home. (There is something available called "California Fair", and it is unfairly expensive and only covers for wildfires. An old friend in insurance said that California's overregulations are the reason that so many insurance companies have dumped our state.)

I basically do the same as most frugalista's - always pack my lunch/snacks for work, bring my own coffee, never leave the house without my trusty water bottle (which is NOT new and fancy; I do have a "Healthy Human" brand, purchased on black Friday sale quite a few years ago, because they last a long time, and i live in Florida - i can leave it in my car full if ice/water when i walk into work, and even on the hottest days, it still has ice and ice cold water in it 8 hours later for my ride home!).

I have a very basic work wardrobe (office setting); which was thrifted!

Unplug any "vampire" appliances at my home.

Utilize the Library and the Little Free Library's by me for reading material.

Leftover meat sauce from spaghetti is very good on baked potato! Top with some cheese and you have a meal!

Thanks for sharing this! I often try to come up with 5 frugal things each week, but most of what I do is passive frugality. I rarely buy fancy coffees or go out to eat. I rarely buy new clothes. I rarely wear makeup. I haven't dyed my hair in years. I don't buy the kids many clothes. Et cetera.

I also use potatoes as our carb in meals. In fact, I have some potatoes "baking" in the slow cooker right now that will become the base of our meal with some leftover apple bbq pork from yesterday.

I often feel that I'm frugal not because of what I do (I hate couponing, I hate signing up for all the rewards programs, etc.), but because of what I don't do.

I forgot to say before that I love making baked potatoes. In the UK we call them jacket potatoes which I think is a great name!

One thing I try to do that's passive is not automatically replacing something that gets used up or broken. The biggest thing we've ever done this with is cars, once a couple years into our marriage when my husband was in an accident and his car was wrecked and now since our very old minivan didn't pass inspection and had to go to the junkyard. We live just outside our town and the road is not safe to walk, so it is a bit of a bother, but we're just going to see how long we can last with just one car. Some of our friends are supportive and some simply cannot wrap their heads around the idea that we don't just jump into buying another car.

@Kate, I "passively" hung on to my beloved station wagon (a dealer's demo I bought for cash at a tremendously reduced price) for about 26 years when I reluctantly donated it to my PBS station. (Someone actually bought it at auction for a whopping $600!) But it was my only car so I did have to replace it ... with an 8 year old Toyota RAV4 I also bought for cash. I'm just not what anyone would call a "car person", I guess. But I'm also not a "car loan" person. Or a "Let's see how much I can pay for car insurance" person.

@JDinNM, we held on to the van for 22 years, but it was parked outside in Pennsylvania weather for most of those years, so the bottom essentially rusted out. By the end the AC didn't work, the back had to be opened with the key in the lock, the headliner rested on your head as you drove, and there was quite a bit of primer covering patches that had been made to get it to pass inspection over the past five years or so. Our young adult children were quite sad to see her go so I had a friend cut circles out of her that I'm going to make into silly little Christmas ornaments for them. 🙂

@Kate, Awww! Gone, but not forgotten. May she rest in peace (or piece, I guess!), good and faithful servant. (I still miss my station wagon. Sniff!)

In addition to the "not doing things" sort of passive frugality, I also think about passive frugality as those things that I have to do once, like when I switched to a super cheap phone carrier, and now every month I save a ton. Like passive income off of digital products - do the work once, and reap rewards later.

Love your blog! I wonder if Amy D. would be interviewed for your blog?

If she wanted to, I'd love to! But I don't think she really does much publicly these days. Her frugality and her entrepreneurship have probably afford her a well-deserved quiet retirement!

My favorite baked potato is topped with butter, sour cream, and tuna.

I wonder where AMY is today!? If she would comeo out for an interview with you to share with us??? (Like you have time for that, lol…???)

I’d love to hear her take on how to stay frugal as you getolder, how it has paid off for her and family and any current tips based on current times.

just a thought!

Passive frugality: Wearing sweaters before turning up the heat?

Staying home,having no drive days?

Using same pots pans clothing and etc. that we have used for yers, till they wear out??

Throwing SALES circulars in the trash without reading them: If I do not look at the Kohl’s ad I can’t decide I “need” something that is 30% off.

I think Amy keeps a pretty low profile these days!

I'd say driving a car that uses regular gas would count as passive frugality.

As is continuing to drive my van, which is 12 years old now. Except...that's a lot of car for one person. I plan to get a smaller car once I graduate from nursing school!