Tuesday Tip | Sometimes a deal is not the cheapest option.

I've noticed that especially when people are first learning about frugal living, they tend to be a little overly focused on discounts and deals.

I do love a good deal, of course, and deals have their place in frugal living!

But often the best savings are not to be found in deals and discounts.

Instead, you can often choose a different path and save more.

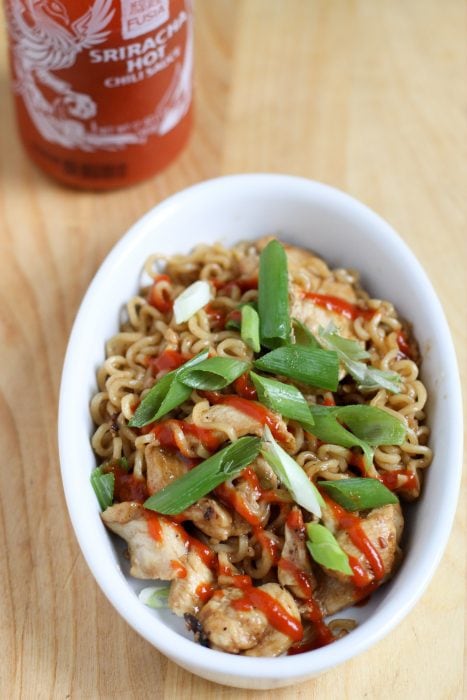

For example, there are few deals that can make eating out cheaper than eating at home. You'll save more by buying ingredients and cooking at home than you will by chasing restaurant deals.

Filtered tap water will be cheaper than discounted bottled water.

A chicken or tuna salad sandwich will usually be cheaper to make than a sandwich made with on-sale lunch meat.

A bar of soap will be less expensive per wash than many other forms of body wash/soap, even with coupons.

Mending a clothing item you already own will usually be cheaper than buying a new one, even with a discount.

Non-disposable items will almost always save you more than discounted disposable items.

Of course, there are exceptions to all of these rules. But they are exceptions, not rules. 😉

The point is just this: that when you are looking at your budget to see where you can save money, make sure you look at all of your options, not just the discount/deal options.

I completely agree with this...for example, a steakhouse restaurant near us often has a buy-one get-one entree deal going on. Most entrees are $18-25, so getting 2 entrees for that price seems like a good deal. However, I can buy enough steak to feed at least 4 people for less than $18, plus some baked potatoes and vegetable or a salad.

Exactly, and I sometimes make one steak and slice into chunks or strips to serve over salads. This way, we all get a few bites of a nice steak but fill up on the salad and potato.

Free shipping isn't always the cheapest, either. Look at your total cost and ignore those who say "I never pay for shipping." A used book from Better Worlds for $1 + $3 shipping is cheaper than the same used book from Amazon for $5 + free shipping.

And of course, the cheapest option is always just to not buy something. 🙂 We used to always shake our heads at my grandmother, who was a relentless shopper and was always buying things just because they were on sale. It doesn't save you money if you buy two sweaters when you didn't even need one, even if they're on sale.

Oh, you are preaching to the choir today! The best way to save money at Target is not by getting their CC or app. The best way to save money at Target is to shop there as infrequently as possible. I do not need that red card, aka free advertising, in my wallet or on my phone, constantly beckoning me to "save" by shopping with them.*

Affinity cards and programs exist not to save you money. They're costly to administer, but companies do it gleefully, because it makes them piles of money, by enticing you to shop there more.

*Not picking on Target, you can insert the name of any affinity program without changing their truth.

I have the redcard, because that’s where I buy all of our diapers and wipes. So it definitely saves us money on those. But I agree about their cartwheel app! I had it for a while and just ended up spending more!

Also our redcard is a debit card, not credit.

Affinity type of promotions are so challenging for me: Apply for our store card and save 25% on today's purchase! While I do want to save money, especially on things that I am buying at the moment, these types of promotions always hurt me in the long run. I am ashamed to admit how many times I have forgotten to pay a new store card and incurred a late fee. I do not open my mail regularly and have overlooked initial invoices.

These days I just say no thanks to store cards. I earn cash back on purchases with my go to VISA card.

Extra cards to remember to pay are a curse! That's why I have the Target debit card version...then I don't have to remember it at all. And Target is not a weak spot for me, so the debit card is not causing me to spend more than I would otherwise. But for anyone whose weak spot is Target...a Target card is probably a bad idea.

Is it bad when you do go out to eat you calculate in your head how many grocerys/meals you can make with the same amount money 🙂 I know it sounds crazy but thats what we started to do. We now rarely go out to eat & have saved thousands of dollars.

I have definitely done that before!

I'd say it's absolutely not a problem to calculate this in your head.

I would say that it is a problem if say it out loud while you're eating out and thus ruin everyone's fun, or rain on someone else's parade by telling them how much they could have saved by not eating out.

Haha, that is so true!

We have been using bar soap for years. I have found that with kids, body wash goes straight down the drain.

Being frugal is often considering the more long-term option. While the up-front cost may be higher (and thus privilege and one's ability to afford that absolutely comes into play), in the long run, buying something once that lasts is always going to be the cheaper option, over buying multiple cheap items that need to be replaced often. It's hard biting that bullet though, when it comes to shelling out the higher cost up front!

Amen! I confess I've had this thought pattern of "But it's a real deal!" in the past, until I finally woke up and realized I was spending money on something I didn't need, no matter how much I "saved." It's easy to do, though. I still have moments when I might have an item in my hand to buy, and suddenly think -- "This is crazy. I can make this at home/do without/already own a good alternative, and I'll be just fine."

One of my husband's favorite memories of his late dad was what his dad would drily say after my mother-in-law would arrive home from a day of random shopping, loaded down with bags. "Well," he would say, "How much money did you 'save' me today?"

Thanks for this important bit of advice. I also think it is about finding the right balance for you and your family. BOGO 50% is tricky for me. If I only planned to buy one shirt, I will spend less money buying the one shirt than two shirts at a discount. But then I will get more use out of two shirts in the long run. I tend to prioritize daily tasks over long term benefits.

Some things we are programmed that we "have to" buy! I have a lovely warm winter jacket that has seen better days. I use it only for walking the dog but when the zip finally gave way I decided I was going to have to buy a new coat. To get one of a similar quality was going to cost me over $100. So I bought a new zipper and put it in. I also sewed up all the tears that my dog had caused over the years. So for $5 and an hour or two I have a jacket that I love that will last for another two or three years. Yay! (I am not a super neat sewer so it is definitely a dog walking jacket!! LOL"

Great point! We're decorating our new office, and I've got some things picked out from a few sites like Wayfair. I've been watching prices and got really excited for the President's Day weekend sale. Some of the "sale" prices were actually higher on the exact same items I had been tracking! We ended up buying a few things that were actually cheaper and finding other options on Craigslist.

I love to re-purpose things instead of buying. For example, I use jars or chipped coffee mugs to hold our toothbrushes/toothpaste, pens/pencils, loose change (which I put in the bank every Thursday!). I use sturdy greeting card boxes to hold tea bags, reusable coffee K-cups, blank grocery lists (which, of course, are made from the backs of old envelopes) and well, cards! I use shoe boxes in my sock and underwear drawers to keep things organized. My biggest money saver is probably coffee. One coffee from Starbucks my way is $6.73. One can of ground coffee that will provide a month's worth of cuppas for my husband and I is $6.99. There's a time and a place for the little luxuries. As I age, common sense just comes in to play more and more often, thank goodness! Love your blog Kristen, I read it every weekday!

Interesting to read all these comments. Target is close to my home and I shop there for items that are cheaper than elsewhere, like coffee, or maybe cleaning supplies. There is little there that tempts me to buy on impulse. I do recognize myself in depictions of grandmothers buying things they don’t need. I was in a lovely museum shop recently and made a couple of unnecessary purchases. I have a large family and have always been a frugal (it is all relative) grocery shopper, but my area of challenge are things for my house that already has enough stuff. Glad to have this psych site!

This post really hit home for me. It’s definitely something to be more mindful of.

I quit spending money on almost everything except groceries. I just stay out of the stores. I really have more than I need. It took me a long time to find contentment, but once I did it was life changing. Now my savings acct can continue to grow.

The one time when getting a deal pays better than the alternative is when you are donating the item to charity. I find "deals" allow me to donate much more than a monetary contribution if the charity accepts in-kind donations.

Yes! I almost got suckered into buying something I didn't need because I was sent a $15 credit to "buy anything on their website" and what I picked out that I thought would be useful would have still cost me $10 in the end with shipping and taxes. I almost clicked the buy button when I thought better of it and found something just as good I already had at home. Great reminder!

I used to be a sale shopper and then I married a very, very thrifty guy. It took only a few times of coming home with great things I bought on sale and having him say, "Well, it's a good thing sh*t was not on sale," for me to realize I was being seduced by greed, not need. He never badgered me, but he did seduce me by showing me how much we could save every month if I stuck to the budget. Now I rarely shop for anything but food, and even then it is often when the loss leaders are what's for dinner. I have enough in the freezer and cupboards to make plenty of meals until I see good deals on food items that make it worthwhile to go into the store. I rarely even buy clothes, since I have more than enough to last me for years---underwear and shoes being the exceptions because they do wear out. I do make an exception for my Friday McDonalds Filet of Fish sandwich; I think I have mentioned before that I was raised by a single father of six and that every Friday he abandoned cooking and took his Catholic self and kids to McDonalds for fish because we did not eat meat on Fridays. That ritual/routine has followed me ever since then, even though the religion did not; I just don't cook on Friday and I stop on the way home and buy a filet of fish for me and the husband. With rare exceptions, that and a salad made at home is our big Friday/it-is-the-end-of-the-week treat. A few years ago our anniversary fell on a Friday, so we splurged and ordered Cokes, too!

Still a fish on Friday girl here as well!

I do love the Filet o' Fish story; it just touches my heart, and yes, McDonalds, or the early local versions, were a huge treat. My far-away grandchildren reject fast food and have to be taken to upscale steakhouses or for sushi or Starbucks $8 apiece drinks! But not from Grandma- lol- making something at home can be fun and exciting- it's all in how it's presented to kids! They like the way I cut up oranges, or eating grapes off the stalk. They did not know people could make pizza at home, so thanks for helping me to master that!

I had the opposite grandmother. She was extremely frugal. Her favorite saying, which I use myself, was her response to advertising ploys:"They must think I have more money than good sense!"

This is such an important tip.

Marketing plays into this in a big way in our culture which leads to many people feeling like they're saving so much money when the reality is they're not.

Sad, but true.

Seriously, whether it's debit of credit, it's still a bright red beacon in your wallet screaming "Target". They want you to think of them first. To go there first. To click on their website first. It is subliminal suggestion, and it works.

I had a coworker that would explain purchases by saying she had a coupon or got an item on sale. Well I got that purse 40% off. How many pocketbooks do you need? She had massive credit card debt and had to get a 2nd job but couldn't figure out why.

I wholeheartedly agree. The old New England thrift in me says quality is best and lasts longer. That is true especially in clothing. A few nice pieces on the higher end of the price scale are well worth it than many inexpensive items.

Thank you for always inspiring.

And shoes. Cheap shoes are never a bargain. If something blingy for a special occasion hurts your toes or gives you blisters, you won't enjoy the event because your feet hurt for the night and a week later.

Agreed! Regularly maintained leather shoes in a classic silhouette can be worn for a very long time. I have only three pairs of work shoes/boots--tall black leather boots, a black leather mary jane block heel, and a brown leather/suede mary jane block heel.

Great article! I find the same thing with groceries. Something in bulk may seem like a great deal but if we don't eat it it isn't. We can't get through a large quantity of spinach in a week. The larger container is cheaper per serving but we end up throwing a lot out. If we buy the smaller container we would likely be ahead financially most weeks. We would feel less guilty about wasting food.