Taxes. A shrimp recipe. FIRE. And updates on Sixth Continent.

This post contains affiliate links.

I did my taxes and I am relieved.

It turns out that I earned less money than I thought I did and oddly, that's a relief to me,

That's because I'm ending up owing a lot less money than I thought I would. Woohoo!

I used Turbo Tax, OF COURSE, and as usual, it was a simple process. I've been using TurboTax since 1997, and I am a very, very satisfied customer.

(I have to pay for the TurboTax self-employed option, but I helped Lisey file her return with TurboTax Free, since she has a very simple return. Easy to use, $0, highly recommend!)

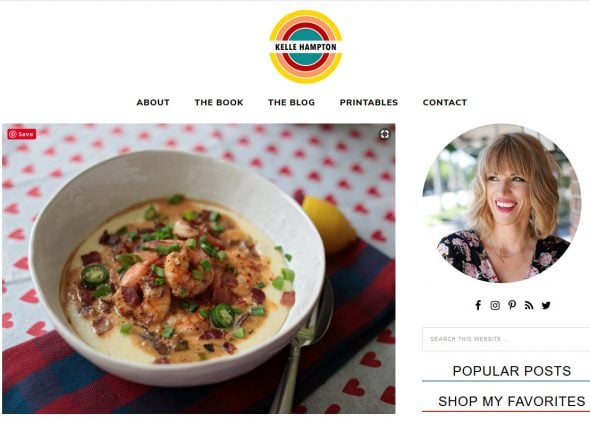

I really want to make this recipe.

I sometimes order a similar dish at a local restaurant, and I am definitely putting this blackened shrimp recipe on my menu next week!

I'll let you know how it comes out, of course.

I'll let you know how it comes out, of course.

Don't feel bad if you can't retire early.

If it seems like everyone around you is becoming financially independent and retiring early (FIRE) while you are most definitely not, this will be an encouraging read.

(In case it's not been obvious: Mr. FG and I are not even close to being able to retire early! Frugality has saved us from falling into debt, but it has not been enough to make our retirement accounts fat and happy.

And like the author of this article, in the past we had far too low of an income to make early retirement a remote possibility. Also, four kids. Ha.)

What I think of Sixth Continent

I first tried this company in November, and so I've now had the opportunity to have several purchase experiences from their site.

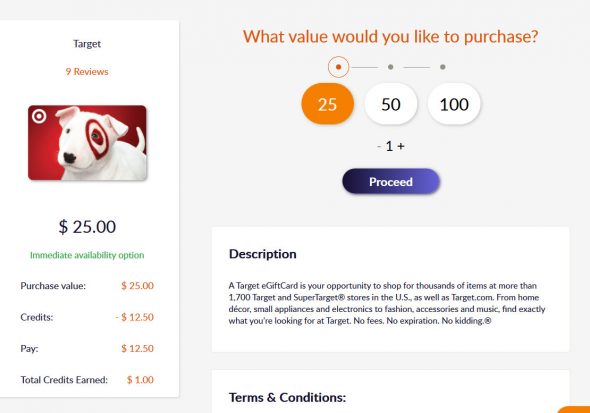

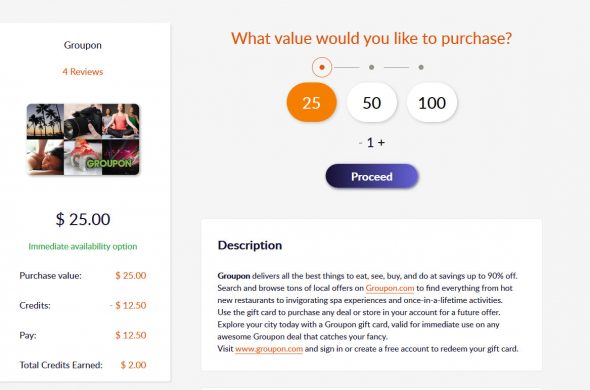

In case you missed it, Sixth Continent is a website that helps you save money on gift cards from places such as Amazon, American Eagle, Starbucks, and more.

You earn points and credits just for signing up (almost a $10 discount right away!), and you also earn from just logging in every day.

Also, Sixth Continent shares a portion of its profits with its customers every day. I have $48 of credit in my account right now, mainly just from the little deposits Sixth Continent gives me.

Plus, as you purchase gift cards from Sixth Continent, you earn credits which you can use toward future gift cards purchases.

You can only redeem credits for 50% of the gift card price, so no gift card is ever completely free. But still, it's way better than paying full price!

There are tons of redemption options (Delta, Starbucks, Old Navy, DSW, to name a few), and you can even buy a discounted Groupon.

(You currently get 8% back in credit on Groupon purchases.)

I ran into one snafu with one of my purchases, but their customer service people were able to help me get the problem figured out.

And I've gotten all of my gift cards and redeemed them all, so I can confidently tell you this is not some shady operation. 😉

(They started in Italy in 2014, so they've been around for a while.)

If you sign up through this link, you will get enough credits/points to get your first $25 gift card for $15.90.

_____________________

Aaaaaand that brings me to the end of the random things I wanted to share with you!

By the definition of most of the fire blogs I read, you are FIRE... you just have a lot of side hustles and a spouse who works... I guess that only counts if you’re the husband in the family though, if you’re the wife it isn’t called FIRE, but childcare or self employment or freelancing. (Cue chorus of people complaining about the retirement police. So much drama.)

Haha, well, by that definition I've been FIRE since I was 13. Except for about one year when I worked full time at Nordstrom, I've always had part-time side gig sorts of jobs.

Ha. We do everything the FIRE couple does, but we're sure as shootin' not saving much for retirement. My husband got really into reading the Mr. Money Moustache blog for awhile and had pretty much the same takeaway as the author of that article: Namely, there are some valuable ideas and perspectives there, but it's not for him. He says often that he might end up working until he's 70, but he doesn't care because he's not trading away his time now for time later. Now when our children are young and want (and need) to spend time with us, and we are (relatively) young and have so many things we want to try and do.

Anyway. The one size fits all approach doesn't work any better with finance than it does with clothing.

I saw that recipe on Kelle's blog, too, and thought it looked delicious. She seems to only post a recipe when it is truly phenomenal so I bet it's great. I made a recipe in the past from one of her friends that tasted amazing and was simple. It was the spicy curried whitefish recipe.

I’m not sure I get the “retire when you’re 30” movement. What do you do with the next 50 years of your life? How about finding work you really like and doing it for 30, 40, or even 50 years? I’m not saying we should be workaholics, but there is a lot of dignity (and even fun!) in doing good work.

Amen to that!

I read a nimber of the blogs for a while, out of curiosity for the trend. It seemed like a bunch of them were in well-paid IT jobs that were cubicle work and/ stressful and/or not something they liked doing at all.

We made too many life decisions in our 20s (3 kids, I stayed home with them, bought a house and paid it off, etc.) to have enough saved by now, at 42, to retire. We would be restless, anyway. We did start our own business to get my husband out of the drama of working with his family.

I LOVE shrimp and grits, ever since we had it in Savannah, quite a while ago. I found a restaurants's recipe years ago and started making it at home, and we love it. I had to stop since I had to eliminate all grains from my diet, but I find I can handle a little grits now and then. Thanks for reminding me about them! I'm going to check this one out, because I love blackened seafood, too.

And thanks for the link to that article! I admire the people who can have financial independence while young, but I am too old to do anything while young anymore, and we've lived on far too little salary for far too many years to be able to save big chunks of income. Plus, as Kristen points out, kids. The kids were worth it to us and we never will regret having them. I can't imagine my life without them or without the grandkids we have now, so I count them as a big part of my "wealth."

I must have missed the Sixth Continent thing somehow. I'll check into that!

Hmmm, I read that article when it was published and was not overly impressed. They didn't even define FIRE correctly. And retiring by exactly thirty isn't the point, or the goal. Sheesh.

I was never a high wage earner, always lived in a HCOLA, and didn't marry until late in life. I also had cancer when I was in my very early twenties, so I never put off living my best life, I just did it frugally. I knew with all my heart I did not want to work until traditional retirement age, so I continued to save and invest over the years. Guess what? Even though I didn't retire until I was in my fifties, retiring early has been an utterly fantastic experience and completely worth the effort.

I'm a huge MMM fan, particularly the MMM Forum. Yes, I am a big, fat Walrus (wink). Sure a lot of his schtick is hyperbole, and yup, he swears, but in my younger days, there was no one teaching folks how to escspe the rat race early. Well, there were Joe Dominguez and Vicki Robin of YMOYL fame, but I didn't want to live with a bunch of housemates in a rented house in Berkeley, wear Birkenstocks (sorry) and eat beans to stay "retired". Even my dear Amy D. didn't have the goal of retiring early. Before MMM, The Frugal Girl, The Non Consumer Advocate, and the original versions of The Simple Dollar and Get Rich Slowly helped me save money, stay frugal and avoid lifestyle inflation. MMM helped me calculate a strategy for exiting the daily grind of the working world. I will be forever grateful.

I participate on the MMM Forum to encourage others, especially single women, so they can achieve their FIRE dreams more efficiently than I did. Being Financially Independent and Retired Early is AWESOME! I now have both time and means to support causes I care about. Did I mention it was completely eorth the effort? YES!

It is never too late to start working toward financial independence. You will be better off, whether you retire early or not.

That's pretty unfair to YMOYL. There's nothing in there that says you have to live with housemates in Berkeley or wear Birkenstocks or even eat beans. It's a really great book about finding your own "enough" and being kind to the planet. The key concept is FI and not being stuck in a job you hate because you have no other options. https://nicoleandmaggie.wordpress.com/2010/07/18/pre-tenure-angst/

I really need to read this book because I know it's a classic!

Nicoleandmaggie, thanks for giving me an opportunity to think about this further. I read YMOYL when it was first published in 1992, and everything else I could about Joe D, because after experiencing cancer at a young age, I knew retiring early was my heart's desire. As much attention as YMOYL received, I knew that living in a shared rental, eating beans and living on the interest from government bonds wasn't going to be my path. I laud my younger self for this audacious realization and for having the confidence to learn from YMOYL, but forge a different path.

The ubiquitous Birkenstocks, especially in Berkeley, which is not far from where I live, are a telling example. If you have a certain kind of feet, they are amazingly comfortable. If you have long, skinny, bony feet, they are torture. I knew what worked for Joe wasn't going to work for me.

Joe retired in 1969 with a nest egg of about $70K. He lived on $6k per year in bond interest, the ONLY kind of "investments" he advocated. $6k per year in 1997 (when he died, at age 58) equals $9.5k today. Good luck finding anything to rent in Berkeley for that entire amount now.

As a cancer survivor, his numbers simply did not convince me it would work, especially if my cancer recurred.

Finally, I couldn't agree more with your final sentence. You nailed it. I just knew mine would have to be a different path from Joe's. I like to say there are lots of paths to FIRE.

P.S. I am so, so glad the Vicki Robin updated the book and is getting her fair share of the attention for their seminal work. The first book, and of course all the interviews I read, were much more focused on Joe. It seems times have changed, and for the better.

I am 59 and have saved more than enough to retire, but I have no desire to! I like my job (research scientist) and enjoy working. I do like the idea that if I somehow lost my federal funding ,which supports 100% of my salary, I could stop working and be fine financially (federal funding is how most academic scientific research is funded - I get no salary at all from my institution!). Key thing seems to find a job that you like so that you don't want to retire early!

Having read quite a bit about FIRE, I think there's a chunk of deceptive advertising about it. Many FIREd people still work, mostly in the gig economy or as consultants. I wonder what they do for health insurance, and I find that many of their plans are fragile in that a big financial hit - such as major medical - would derail their RE. If a FIREd person is actually still working in their field then maybe they can get a full-time job but if they're really retired, then that's going to be quite hard.

I consider FIRE doable for some and a great source of new ideas for many, but not the be-all and end-all for most of us.

I feel like the FIRE movement has some good ideas, but can easily become THE purpose in your life. And I think that's dangerous.

We certainly don't make high enough of an income to retire early, but my husband enjoys his job and we both think it's more important for me to stay home with the kids and homeschool than earn another income.

Just my two cents.

I'm glad your taxes are done and you're happy with the results. We have no idea how ours will turn out!

I read all about FIRE and with college expenses and years of job loss and no savings, we are not ready to retire now, if ever. It disappoints me to say that, but it is what it is. I have to accept that and move on. As long as the bills get paid and we can maintain some health (DH had 4 brain surgeries and I'm a 40 year child diabetic), then I can't hope for otherwise. As we age, we do get complications but we have to plow through them. At least until the kids can take care of us..hehe

I looked at Sixth Continent. Looks like a purchase has to be made every month to keep any points you've earned. I'd have to think on that...I like to go for stretches of no-spending as I've gotten quite frugal.

I am a 37 year child diabetic. Insurance has always been my main motivator. I am lucky that I can work part time and carry the health insurance. My hospital job has always been more stable than my husband's engineering jobs so it made more sense for me to carry it anyway. I actually made the conscious decision to work in healthcare and in a hospital when I was diagnosed as a very young teen. I figured that a hospital job would give me access to good healthcare. 30 years later and it has proven correct.

You are lucky. I am a hospital worker (PT/OT assistant) part-time and unless an employee is permanent full-time we get no insurance, no paid vacation, no statutory days pay, no sick days, etc. We do get a "benefits in loeu" bonus of couple dollars an hour added to our pay, but it sure doesn't amount to the real thing!

And we have a pension plan.

Some of the FIRE people are evangelical and/or birkenstocks, but someone like Cait Flanders or Tanja from our next life are looking more at work optional. I read a few frugal type blogs, like this one, and there are things you can take from each. One of the main problems for people, in my opinion, is looking at someone like MMM, saying "they're not like me" and immediately discounting everything they do just because you can't do all of it.

Yeah, and I appreciated that the article pointed out that there ARE helpful things to learn from the FIRE movement. Like, that you maybe don't need a brand new car every five years. 😉

Average car in the US is 12 years old. I'm surprised it's that old but very pleased.

Thanks for recommending the FIRE article. While I do not generally follow the movement, I do appreciate certain aspects. My takeaway is that everyone can do better with their finances, particularly in our consumer driven society. We need more fiscal responsibility, generally speaking.

Most americans are working for health insurance. It does not matter how financially well off u are. 1 catastrophic event in your life will wipe out what you saved.

Unfortunately, you are right. My daughter had some allergy issues and had a few ambulance rides and we have very good insurance. I was amazed at how the costs mounted up. It was really scary. We pretty well cleaned out or savings, just pay ing our portion.

Is sixthcontint.com always so slow? I signed up and the page will load but any of my info is just spinning circles. Or did we overload it with everyone trying it

I switched over to Tax Slayer from Turbo Tax this year. Their prices are MUCH better and they have good reviews. Changing over was much easier than I expected and the rate I had to pay was very low.

Well done Kristen on getting your taxes done - you inspire me to get ready for mine.

In terms of life goals I guess it all comes down to what you are living for but as for me and my household we will serve the Lord