Six things I learned from submitting medical claims myself

As most of you know, this past year I had to submit out-of-network claims to our insurance on my own. And geez, it sure was a process!

But I am delighted to tell you that yesterday, we finally got a pile of checks for the bills we'd submitted.

Hallelujah!

I learned a few things on this fun trip, and I thought I'd write them down in case any of you have to do this in the future.

1. Be really, really careful when you fill out the forms.

At first, Mr. FG and I sent in forms with one box checked incorrectly.

Unfortunately, this was the box that sent payment directly to the provider instead of to us.

You would think that perhaps the provider could just cash the checks and credit our account, but alas, that was not to be.

That kick-started a long process of trying to get those checks cancelled and new ones sent to us and all of that pain could have been avoided if we'd read the submission forms more carefully.

Moral: Don't be like me. Read the directions carefully!

2. Be ready to be persistent.

It took a fair amount of stick-to-it-ive-ness on my part to get this finally taken care of.

I had to do resubmissions and have multiple phone sessions over the course of a few months to finally get our reimbursement resolved.

Insurance companies, like rebate companies, are quite content to not pay you. You have to be a polite but persistent thorn in their flesh. 😉

3. Ask for a reference number when you call.

Write that down and you'll be in much better shape for any future calls. Then whatever rep who happens to answer your call can easily get caught up on where your claim is.

Also: write down the date they tell you to expect a result from your call (a statement, a check, etc.) That way you know when it's time to call back and follow up.

(Hat tip to WilliamB for telling me to do this.)

4. Keep an eye out for errors.

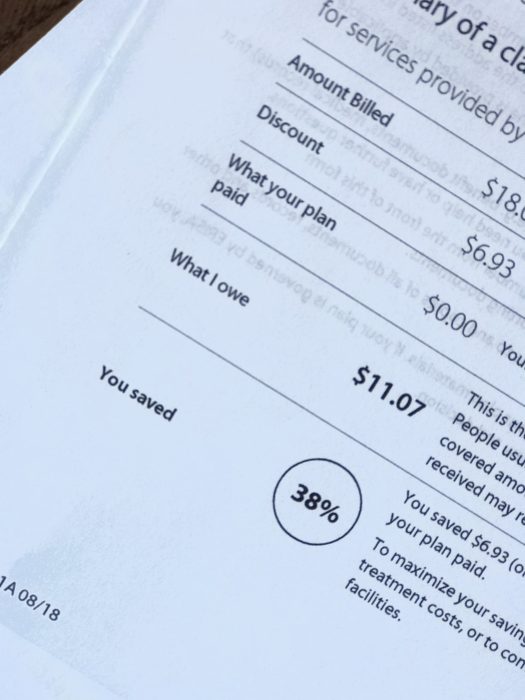

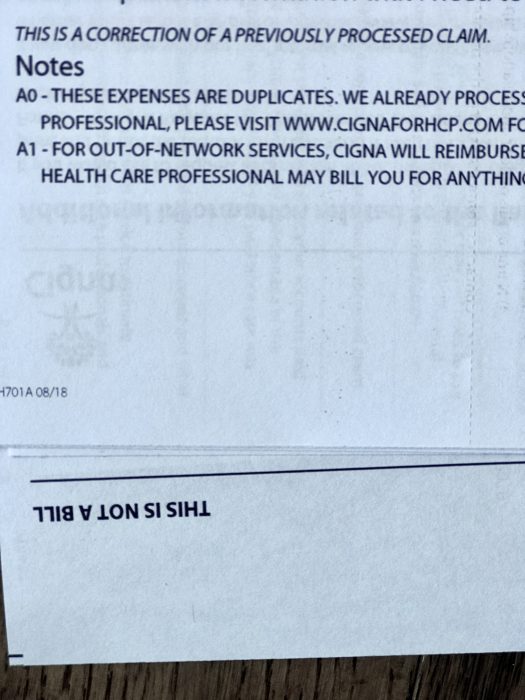

There's plenty of room for human error here, so check the paperwork and EOBs, and be familiar with your policy so that you know when something hasn't been done right.

(This holds true for in-network medical bills too! I've encountered a lot of errors over the years.)

5. It's very wise to have a medical savings account.

It can take a pretty long time to get your reimbursement, so you really do not want to be using your mortgage money to pay your out-of-network bill.

6. Stay in-network as often as possible.

This experience has taught me to appreciate the fact that most of the time, the provider's office takes care of ALL the insurance paperwork for me.

God bless those insurance coordinators! I can't imagine dealing with health insurance all day long, but I am grateful for people who do it, day in and day out.

______________________

Now that we got paid, I'm going to be over here gleefully shredding documents that I no longer need. EXCELLENT.

All great tips! I would add that in lieu of a reference number (or possibly in addition to it) always get the name of the person you speak with. The smaller the organization you are dealing with (not necessarily speaking insurance here) the better off you are to know who you spoke with initially.

Name of person you spoke to and date and time!

Get both! Be sensitive to the fact that not all customer service reps want to - or are allowed to - give out their real names. Some orgs assign employees an "employee number" instead. Name, employee number, whatever; just as long as the identified uniquely identifies the person with whom you spoke.

We haven't had to deal with this exactly but, because we are members of a health-sharing organization and don't have traditional insurance, I do ALL our medical paperwork, submission of bills, etc. It can be daunting, for sure, but the cost savings has been MORE than worth it for our family. I second the HSA suggestion. It has made a HUGE difference for us since we have to pay out of pocket for almost everything and wait to be reimbursed. I know it's not an option for everyone, but if you have the option, take it!

Glad you got everything worked out and got those checks!

Hooray for the FG family! I know you must be as thrilled to be done with this as you are to actually get the money.

I've spent about 8 months working on two claims that were in network. I got my first refund check yesterday, and I'm told that the second one is supposed to be coming soon. Until it shows, I'll keep calling. (See #2 in the post)

My situation, in a nutshell, was that my insurance company kept saying I hadn't paid all of my deductible at each claim filed, when I clearly had, as even their own website showed. They said that my one MRI was actually two procedures (because they did "both my pelvis and my abdomen" -- oh, come on!) so my $300 co-pay for an MRI (regardless of deductible paid) should actually be two $300 co-pays and they were "giving me a break" by only making me pay $370. The second issue was that the office which read my MRI charged me over $400 and insurance said I owed almost $300 of it as a co-pay. My co-pays are supposed to be 20%. I got six, yes, six different answers as to why I was being told I owed so much. I finally put in a written request for a review, explaining all the details, and got an EOB back that showed they were paying the providers more money than they had previously, which means, I am owed a refund by both offices, which I then had to pursue. You are right, there is no urgency to pay back any money to the customer who was hounded until she paid it, even though she was trying to get it straightened out the whole time.

So, my tip is don't give up! If you keep getting the answer no, keep trying. You may still end up with no, but give it all you have, first. They count on you giving up and paying it yourself. A big amen to getting names, case numbers, and keeping notes with dates.

I would also echo the “know your benefits” sentiment. When I got pregnant, I called my provider and got a detailed summary of what they would and would not cover so I knew ahead of time what to expect. Now, granted, I had a high risk pregnancy so some of the billing got complicated, but almost every single bill and EOB I got for the whole process was wrong. They even said my sons chest X-ray was mine. As side from the fact that he’s male and I’m female, the age and size difference was pretty impressive seeing as he was 4 months old

Because I knew what was covered, I could fight an educated battle and won - saving THOUSANDS of dollars. Obviously, most medical issues are not quite as known in advance but a call to your insurance provider before (or even right after) a procedure or medical visit can help you navigate your bills to ensure you are paying correctly. I don’t mind paying what I owe, but I sure don’t want to overpay.

I’m more educated about my plan now and typically know what’s right and wrong but for well over a year, I called the insurance company to review each and every claim. Sometimes, more than once. Time consuming? Annoying? Ridiculous? Yes to all....but, again, saved us THOUSANDS.

I would also suggest if you have a family member who get easily confused, getting this information through a three way call with their insurance company could be invaluable to all parties sanity!

I also use a health sharing plan and I have had to walk through several large medical issues in the past 6 months with my kids. I have learned to check everything and always ask for a discount and/or explanation of the bills. I prepaid at one walk in clinic, but then later received a bill from corporate. I called and was told, "Oops, disregard that bill, it should be zero." I feel most people would have paid it without questions.

I also learned that large bills are always negotiable. Once I get to a point I can pay off a hospital balance, I call and ask if I can have a discount if I can pay the entire balance that day on the phone. They almost always give me an additional discount of 20% or more. I didn't realize there was that much wiggle room. And it never hurts to ask for a discount. I've only been told no by one provider. I guess insurance negotiates a lower price for you, but often people are still left with large balances so always ask!

Susan, I don't know what health sharing plan you use, but the discounts has been one of the biggest surprises for me. I had NO idea! Last year, our son needed an MRI. I told them I would be paying cash at the time of service and asked for the discount. I paid $525 that day. A few weeks later, there was an issue and I called the billing dept to ask about it. The woman told me that if we had run the MRI through traditional health insurance, they would have charged the insurance company $2400!! And I still would have had a sizable copay--maybe more than I paid out of pocket! It blows my mind--and we wonder why insurance is soo expensive!

We started with the health sharing because my husband's employer wanted to charge $1500/month for four of us for marginally decent health insurance. I did a TON of researchWe pay $300 through the health sharing and we have not had any issues with it. Every time I pay out of pocket for something, I remind myself that I'm not spending an additional $1200 month for "insurance" I may never use. It's not for everyone, but we have been very grateful and happy with it.

Yes, it is so much cheaper than traditional insurance in monthly payments and copays! It just takes more work on my part, but very worth it. The walk in clinic charges me $120 but they bill insurance over $400. Crazy the mark up! And I can see any doctor without a referral or network which is so nice too! We use Samaritan Minstries.

Document..document..document. If you know you are going into a doctor/hospital/lab for something outside of your routine checkups and illnesses, start a log in a notebook or on a memo in your phone. Dates, who you saw, and why. Then you'll be in much better shape when the bills come. Then keep documenting. When, where, and how much money you've sent off. If you have to call for an error, when (date and time) you called, who you spoke with, and the reference number. I note what phone number I called so I don't have to go look it up when i make follow up calls. Make a note of EXACTLY what they tell you. I try to grab a file folder and a few sheets of notebook paper and clip it all together for bigger issues.

My son has had a complicated medical history. Twice, bills got sent to collections because I thought they were being resubmitted to insurance so I didn't pay them (which is what I thought the billing department told me to do. Turns out we were talking about 2 different bills). Collection people are not friendly!! I would have avoided a lot of that stress if I started documenting earlier what was going on with the bills.

Great post! Resolving health insurance claims sometimes seems like my part time job, and we are healthy. I feel for the folks without the time or knowledge to work this stuff out. I would add that consumers should also review the bills and claims carefully that the wonderful folks at doctors' offices submitted. I have found errors there too that took just as much of my time to work out (for example, after our last birth the doctor's office and the hospital both sent me a $1500 bill for delivery--when I called they said, oops you only have to pay one!).

Wow, what a process!

I wish I had something to add, but all I can say is that I'm so glad to be Canadian and don't have to deal with (most) medical bills.

Glad you got through this and can help others because of it!

Like Kristyna, reading this makes me so thankful I live in a country with a national health service.

Glad you got it sorted.

Our previous employer had an excellent, knowledgeable person in charge of Human Resources. She was able to help me understand what was wrong in at least one health insurance situation, even though I still had to sort it out. When we had a life insurance billing hold-up, she called the company and asked them to move on it, which they did within two days. So if you have assistance from a credible professional, use it! Even if the person can't make any calls on your behalf, having a confidential neutral person to talk through what happened may help.

Provide your insurers in advance with contacts they may talk to. When my father-in-law had his stroke I had to call the insurance company from his bedside so he could tell them it was OK to talk to me. Not fun having all those paper spread out on the foot of his bed.

I once read a study that found that 100% (ONE HUNDRED PERCENT!!!!) of the medical bills reviewed had errors! So it's important to always check.

Most people don't know that there's a document called an "Evidence of Coverage" (EOC) which is the actual contract between you and your insurer, and you've never seen it unless you have specifically (and in writing) requested it. I suggest requesting a copy every year. That booklet is the bible. If the EOC says it's covered, it's covered. If the EOC says it's excluded, it's excluded. And if the EOC doesn't say whether it's covered or excluded you have a good chance on appeal of getting it covered. So get the EOC and check the EOC before you have a procedure or test or get medical equipment and you will understand if your insurance should be paying for it or not. (Sometimes it's hard to understand, so you can always ask for clarification).

When you disagree with a coverage decision, it's always worth an appeal of denial. Use the EOC to support your argument, e.g. "The EOC states on page 9, paragraph two that all medically necessary diagnostic X-rays are covered. This X-ray was ordered by my doctor to rule out X and therefore was medically necessary and should not have been denied."

I once helped a friend whose father committed suicide but didn't die right away. The insurance company denied the $80K hospital bill because they claimed they excluded "self-inflicted injury". But the EOC did not say that self-inflicted injuries were excluded anywhere in the document (remember, it's a contract!). When we pointed that out, the insurance company said "well, we're going to add that in"--but since it was NOT in the EOC covering her dad, the insurance company ended up having to pay the entire claim.

Get a paper copy of the EOC, even if you have to print out the monster yourself. There's nothing to stop an underhanded company from changing the online version. Well, it's illegal but regulatory enforcement is weak. Having a copy prevents any such shenanigans.

That's awful. Suicide and self harm are caused by mental and physical illness. It's not just a hobby that went wrong!

One more: Don't pay a bill until you see the EOB. One of my providers has a habit of sending a bill for the whole amount, and then another bill for the amount I owe after insurance kicks in.

Following up on what Jan wrote: some providers will try to bill you for the amount that insurance won't pay to them, even if you aren't responsible. Don't pay without checking first. For example, the lab my doctor uses, does this. After a series of calls to both the doctor and the insurance company, I learned that the remainder isn't my responsibility.

After 15 surgeries in two years, I have a million insurance horror stories. My favorite one is when one hospital put me in an ambulance to send me to a hospital in a city about 200 miles away because I needed a complicated emergency surgery they were not equipped to do. They were afraid I would not survive the trip so they ordered an ambulance. The insurance company said my husband could have driven me and they refused to cover a $3000 bill (this was the second time they refused to cover an ambulance bill, again one ordered by one hospital to transport me to another). The doctor at the original hospital was so furious he sent a letter to the insurance company and also to the state insurance regulator, to no avail. It still took several years, not months but years, to get them to cover the bill. And my husband and I were carrying out this fight while I was literally fighting for my life, and had depleted our savings to cover things the insurance did not so we could not afford to pay $3,000. One of the best gifts I have ever received is a friend who heard the story from my husband and immediately took over following up on this particular bill, keeping the necessary detailed records and making the phone calls until it was paid---she didn't quit even though it was over a year of effort on her part. It makes me tear up even now to think of the effort she put in and how much worry and money it saved us.

THAT is a good friend!

That friend deserves a lifetime of homemade cookies and muffins!

What a lovely thing to do for you guys!

On a side note - if you need a test (including blood work), make sure you are sent to a lab or testing facility that is covered under your insurance. My husband needed some tests related to a urinary tract issue he was having, and the samples were sent to a lab that is not on our insurance. The lab charged $300 that we had to pay out of pocket (he called and was able to get the bill reduced to $250). He didn't realize he had to remind our doctor, and the physician's assistants in our doc's office, EVERY TIME he needs lab work done. (We both realize they see a lot of people day in and day out - he thought it was noted somewhere in his chart).

He also had to switch dermatologists, because our health insurance changed ladt year, and his previous dermatologist refused to send any needed lab tests to the lab our insurance covers. He found out that the refusal was related to the first dermatologist's office owning the lab they preferred to use.

I was POA for my Mom and she needed additional in patient rehab time after a fall. Aetna Medicare was denying and the rehab place said regular Medicare would cover this. So I did something different. I called my Mom's former employer, the State of NJ, and said I wanted to switch from the HMO to regular Medicare because they were rationing care. I was given the assistance of the employers liaison to Aetna to help me. The appeal was overturned and my Mom got the care she was entitled to.

One final (?) note: don't trust. Verify instead.

Yesterday I spent about 90 minutes making sure someone's medications arrived on time. What should happen:

- dr sends scrip to mail pharmacy,

- mail pharmacy sends meds to patient.

What actually happened:

- dr sends incorrect scrip to mail pharmacy;

- mail pharmacy delays meds to check that the apparent change is really what dr intended;

- mail pharmacy says sent a fax but dr office says never got it; = STANDSTILL, meds not sent

- I call mail pharmacy to check that meds are in process, even though I got an email saying they were; am told meds are on hold, etc;

- 6-7 calls (two each to mail pharmacy and dr, for example) to determine what happened and how to get what's needed;

- call local pharmacies to find one that has all meds in stock since scrips need fulfillment that day;

- email dr to get everything in writing;

- call local pharmacy to check dr sent scrip; also check that he sent the correct scrip;

- go to local pharmacy to get scrip, discover dr changed one from 90 day to 30 days;

- call dr to ask why ...

and so on and so forth.

Moral of the story: don't trust. If you're getting surgery, make sure the surgeon knows what organ and which one (not mix up left and right, for example). If meds, write down what you're supposed to get and check the bottle. If tests, verify which test, what it's supposed to learn, and how that will help you. Then make sure the tester sends you the results. In writing, natch.

Frugal Tip: mail pharmacy isn't always the cheapest. In the example above, the cheapest option was 90 days from the local pharmacy, not 90 days from mail pharmacy. It wasn't hugs - for 90 days each of three meds, the difference was about $15-20 total - but enough to make a difference if you're price-sensitive.

I worked part time in medical billing for years and it is a real nightmare in this country. I can’t tell you how many mistakes insurance companies make.. or , they are NOT mistakes... they are money grabs..I went to seminars where retired insurance reps told us they were told to take 10% of ALL THE CLAIMS THEY RECEIVE In the day and toss them into the round file. (The trash can.) It seems a lot of people never question their unpaid bills or bills they get from their doctors.THAT IS THE NUMBER ONE MISTAKE.

NEVER pay a medical bill till you have someone help you decipher it and make SURE you owe that money.

My son had a surgery and the anesthesia office billed him $800 incorrectly.He would not have known better if I did not help.

A neighbor had claims for an in office procedure denied and was billed personally for over $2000..INCORRECTLY. I helped her resubmit.

I have been “Balance” billed more than once every single year.This is when your doctor agreed to accept an in network fee from insurance, but somehow decides to bill you the difference anyway!

RESUBMIT RESUBMIT RESUBMIT

You will spend too much time of the phone with ignorant clerks during the process of resubmission and it is awful.

We need some Universal health care int his country,ASAP.

No one should have to work this hard to get their medical benefits paid.

I totally agree. It's smart to approach every medical statement with a healthy level of skepticism.