As most of you know, this past year I had to submit out-of-network claims to our insurance on my own. And geez, it sure was a process!

But I am delighted to tell you that yesterday, we finally got a pile of checks for the bills we’d submitted.

Hallelujah!

I learned a few things on this fun trip, and I thought I’d write them down in case any of you have to do this in the future.

1. Be really, really careful when you fill out the forms.

At first, Mr. FG and I sent in forms with one box checked incorrectly.

Unfortunately, this was the box that sent payment directly to the provider instead of to us.

You would think that perhaps the provider could just cash the checks and credit our account, but alas, that was not to be.

That kick-started a long process of trying to get those checks cancelled and new ones sent to us and all of that pain could have been avoided if we’d read the submission forms more carefully.

Moral: Don’t be like me. Read the directions carefully!

2. Be ready to be persistent.

It took a fair amount of stick-to-it-ive-ness on my part to get this finally taken care of.

I had to do resubmissions and have multiple phone sessions over the course of a few months to finally get our reimbursement resolved.

Insurance companies, like rebate companies, are quite content to not pay you. You have to be a polite but persistent thorn in their flesh. 😉

3. Ask for a reference number when you call.

Write that down and you’ll be in much better shape for any future calls. Then whatever rep who happens to answer your call can easily get caught up on where your claim is.

Also: write down the date they tell you to expect a result from your call (a statement, a check, etc.) That way you know when it’s time to call back and follow up.

(Hat tip to WilliamB for telling me to do this.)

4. Keep an eye out for errors.

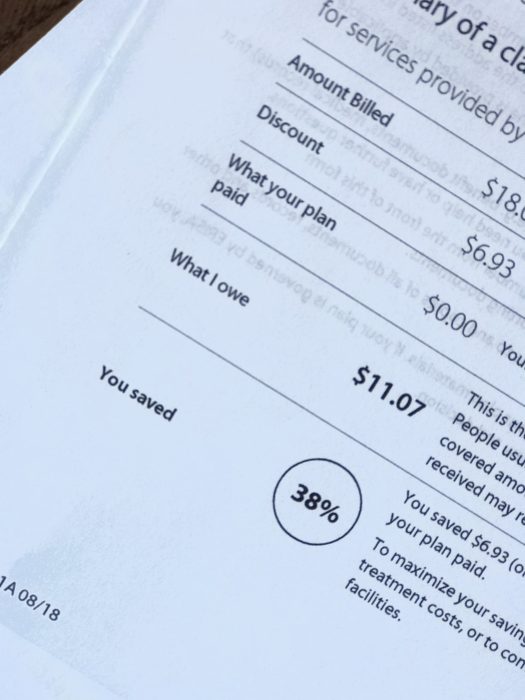

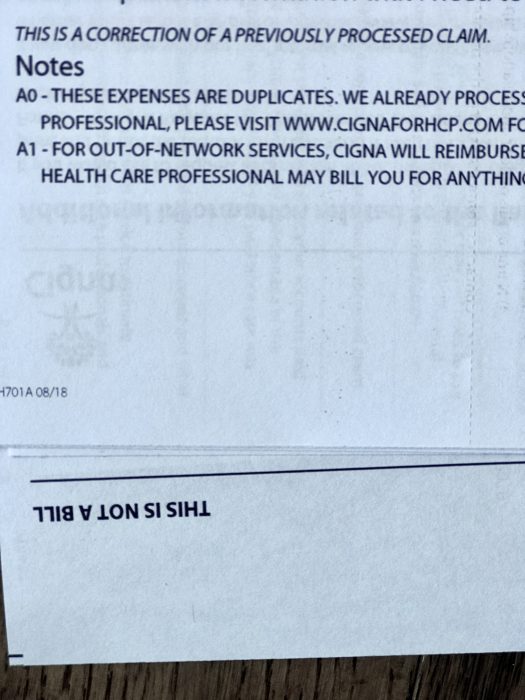

There’s plenty of room for human error here, so check the paperwork and EOBs, and be familiar with your policy so that you know when something hasn’t been done right.

(This holds true for in-network medical bills too! I’ve encountered a lot of errors over the years.)

5. It’s very wise to have a medical savings account.

It can take a pretty long time to get your reimbursement, so you really do not want to be using your mortgage money to pay your out-of-network bill.

6. Stay in-network as often as possible.

This experience has taught me to appreciate the fact that most of the time, the provider’s office takes care of ALL the insurance paperwork for me.

God bless those insurance coordinators! I can’t imagine dealing with health insurance all day long, but I am grateful for people who do it, day in and day out.

______________________

Now that we got paid, I’m going to be over here gleefully shredding documents that I no longer need. EXCELLENT.

Madeline

Wednesday 17th of March 2021

I worked part time in medical billing for years and it is a real nightmare in this country. I can’t tell you how many mistakes insurance companies make.. or , they are NOT mistakes... they are money grabs..I went to seminars where retired insurance reps told us they were told to take 10% of ALL THE CLAIMS THEY RECEIVE In the day and toss them into the round file. (The trash can.) It seems a lot of people never question their unpaid bills or bills they get from their doctors.THAT IS THE NUMBER ONE MISTAKE.

NEVER pay a medical bill till you have someone help you decipher it and make SURE you owe that money.

My son had a surgery and the anesthesia office billed him $800 incorrectly.He would not have known better if I did not help.

A neighbor had claims for an in office procedure denied and was billed personally for over $2000..INCORRECTLY. I helped her resubmit.

I have been “Balance” billed more than once every single year.This is when your doctor agreed to accept an in network fee from insurance, but somehow decides to bill you the difference anyway!

RESUBMIT RESUBMIT RESUBMIT

You will spend too much time of the phone with ignorant clerks during the process of resubmission and it is awful.

We need some Universal health care int his country,ASAP.

No one should have to work this hard to get their medical benefits paid.

Kristen

Wednesday 17th of March 2021

I totally agree. It's smart to approach every medical statement with a healthy level of skepticism.

WilliamB

Tuesday 12th of March 2019

Frugal Tip: mail pharmacy isn't always the cheapest. In the example above, the cheapest option was 90 days from the local pharmacy, not 90 days from mail pharmacy. It wasn't hugs - for 90 days each of three meds, the difference was about $15-20 total - but enough to make a difference if you're price-sensitive.

WilliamB

Tuesday 12th of March 2019

One final (?) note: don't trust. Verify instead.

Yesterday I spent about 90 minutes making sure someone's medications arrived on time. What should happen: - dr sends scrip to mail pharmacy, - mail pharmacy sends meds to patient.

What actually happened: - dr sends incorrect scrip to mail pharmacy; - mail pharmacy delays meds to check that the apparent change is really what dr intended; - mail pharmacy says sent a fax but dr office says never got it; = STANDSTILL, meds not sent - I call mail pharmacy to check that meds are in process, even though I got an email saying they were; am told meds are on hold, etc; - 6-7 calls (two each to mail pharmacy and dr, for example) to determine what happened and how to get what's needed; - call local pharmacies to find one that has all meds in stock since scrips need fulfillment that day; - email dr to get everything in writing; - call local pharmacy to check dr sent scrip; also check that he sent the correct scrip; - go to local pharmacy to get scrip, discover dr changed one from 90 day to 30 days; - call dr to ask why ...

and so on and so forth.

Moral of the story: don't trust. If you're getting surgery, make sure the surgeon knows what organ and which one (not mix up left and right, for example). If meds, write down what you're supposed to get and check the bottle. If tests, verify which test, what it's supposed to learn, and how that will help you. Then make sure the tester sends you the results. In writing, natch.

Cathy in NJ

Thursday 7th of March 2019

I was POA for my Mom and she needed additional in patient rehab time after a fall. Aetna Medicare was denying and the rehab place said regular Medicare would cover this. So I did something different. I called my Mom's former employer, the State of NJ, and said I wanted to switch from the HMO to regular Medicare because they were rationing care. I was given the assistance of the employers liaison to Aetna to help me. The appeal was overturned and my Mom got the care she was entitled to.

Liz Bishop

Wednesday 6th of March 2019

On a side note - if you need a test (including blood work), make sure you are sent to a lab or testing facility that is covered under your insurance. My husband needed some tests related to a urinary tract issue he was having, and the samples were sent to a lab that is not on our insurance. The lab charged $300 that we had to pay out of pocket (he called and was able to get the bill reduced to $250). He didn't realize he had to remind our doctor, and the physician's assistants in our doc's office, EVERY TIME he needs lab work done. (We both realize they see a lot of people day in and day out - he thought it was noted somewhere in his chart). He also had to switch dermatologists, because our health insurance changed ladt year, and his previous dermatologist refused to send any needed lab tests to the lab our insurance covers. He found out that the refusal was related to the first dermatologist's office owning the lab they preferred to use.