3 Ways to Prepare for Unemployment

photo by Mykl Roventine

photo by Mykl Roventine

Worry not...Mr. FG is currently employed, and Lord willing, he'll continue to be.

But, almost two years ago, this was not the case.

I never said anything about it here, but in the spring of 2009, we got word that Mr. FG's company had decided to outsource pretty much their entire IT department to India and a couple of other places (Boo to outsourcing!).

When Mr. FG came home and told me, I worried about it, cried about it, and then a few days later, I was ready to deal with the situation in a more productive manner.

Since a lot of people's jobs are less than secure in this economy, I thought it would be helpful to share the steps we took to prepare for Mr. FG's layoff.

We had the blessing of getting some notice before Mr. FG's job ended, but not everyone does. Given the shaky nature of the economy, though, I highly recommend following some of these steps so that you'll be prepared for a layoff.

1. We cut our spending in order to increase our emergency fund.

We had something of an emergency fund when we heard of the impending layoff, but not enough for us to feel very comfortable. So, we cut corners in every way possible to free up money for our emergency fund.

We were already living pretty frugally, but there still were things to cut. We cut our discretionary spending back to almost nothing, we didn't eat out at all, we ate less expensive meals (I tried to spend between $60 and $80 a week then), we canceled our $15/month cable bill, and we didn't buy new clothes.

2. We looked for side work to increase our emergency fund.

Not only did we cut our expenses, we looked for some ways to temporarily increase our income. I'd only done photography for fun before, but I sent out an advertising email to a local Yahoo! group letting people know that I was available for photo sessions. I took a number of piano-playing jobs for weddings and such. I did quite a bit of childcare that summer too. Mr. FG obviously wasn't able to do as much as of this as I was, given that he was already working a full-time job, but he did some computer repair work on the side to generate some extra money.

If you don't happen to have marketable side job skills (though I bet you've got something if you look hard enough!), take a look through your house to see what you might be able to sell on Ebay, at a yard sale, or on Craig's List.

If you don't have a decent emergency fund, you need to do something to rectify that, so be ruthless (you probably don't need a lot of that stuff, so sell it!) and creative (Can you do yard work? Deliver pizzas on the side? Babysit? Bake or cook for someone who doesn't have time? Think about any and all of the skills you've got and how you could get paid for using them!).

3. We made up a bare-bones budget.

To get an idea of how far our emergency fund would take us, I drew up a bare-bones, only-the-necessities budget. I gave myself $60/week for groceries, planned to cut Mr. FG's hair myself, took all the charitable giving out of the budget (when you have no income, tithing is sort of out of the picture!), took out the monthly budgeted savings (again, you can't contribute to savings accounts when you have no income) and ended up figuring out that we could survive on about $2500/month if we had to.

So, that meant that a $10,000 emergency fund would sustain us for 4 months, even if all of my income sources dried up (which we didn't think was going to happen. I'm self-employed, and I didn't plan on outsourcing my job to India!).

The happy ending.

Happily, all of our hard work paid off, and we ended up being able to get more than a 4-month emergency fund set up before Mr. FG's job ended.

That was a very, very busy summer (thank goodness it was summer because I don't think I'd have been able to handle all that side work during a school year!), and we lived a somewhat financially deprived life then, but it was totally worth it. Knowing we had a cushion and that we'd be all right for a while if unemployment happened brought us a great degree of mental peace.

We also knew that Mr. FG had the promise of some severance pay if he was unable to find a job in time, so our emergency fund would carry us farther than 4 months.

The even happier ending.

At almost the last minute, Mr. FG got a job interview and offer, and we didn't even end up needing our emergency fund. This was fabulous news for us (even though it was the start of Mr. FG's super early schedule) because now we had a nice little emergency fund that could just sit in the bank...yay!

And given the shaky state of the economy, we don't at all regret the work we put into building our emergency fund. As we learned in 2009, a job that seems steady and sure can be quite the opposite, and it is a lovely feeling to have a backup.

So, what did I leave out? Do you have any great tips for preparing for unemployment?

My husband mentioned the other day that he ALWAYS keeps his resume up-to-date. He needs to have it handy anyway for different publications and conferences, but should the need ever arise to send it out, it's already ready to go, only needing to be tweaked to the situation. I spent several weeks last month frantically emailing drafts of my sister's resume back and forth after she got laid off, so I would suggest adding "Update Resume" to the list, as well. And, thankfully, my sister was able to start a new job right away! 🙂

Ugh, resumes. I'm so bad at that. I think the last time I updated mine was 2009. I'm pretty sure my Linkedin still lists me at my job I had before my previous job, too!

Thanks for posting about the need for an emergency fund! When my husband lost his job a few years ago (I was a stay-at-home mom), we really didn't even worry about it much because of our emergency fund. We've always kept 6 months worth of take home pay (plus a little extra to pay for health care out-of-pocket) in cash in our bank account. Of course, building that 6 month stash was a lot of work, but once it's there, you don't have to worry about it again. Once you get a raise, you just save for a month or two until it's built back up.

This 6 month savings gives us security and happiness because we're never at the mercy of an employer or the economy!

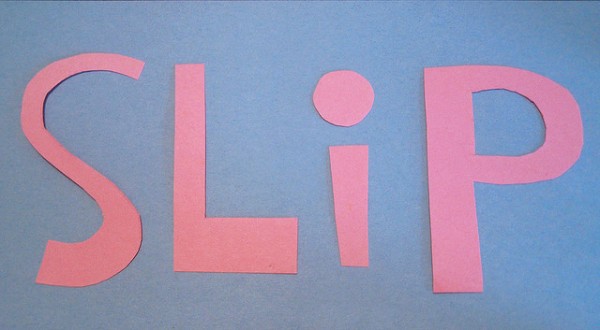

Oh! I forgot! Love your "Pink Slip!"

It's cute, isn't it? I found it on Flickr and decided I had to use it (it's from the Creative Commons, where images are free to use as long as the photographer is credited).

Besides an emergency fund, one of the best things I can think of is some food storage of non perishable items. That said, it's important to only store items that you use on a regular basis so that you can rotate your stock.

More than that, it's important to keep resumes, letters of recommendation, and portfolios up to date. That way if you find yourself needing a new job, you don't have to waste precious time compiling necessary documents.

It never hurts to take a class every now and then in you chosen job field either. It keeps your education up to date and shows potential employers that you are motivated to excel.

Yep...totally agree, especially on that last one. Continuing your education also makes you more valuable to your current employer.

Keeping your resume, LinkedIn profile, portfolio, etc. up to date is very important not only to save time when you need it -- but because you want to work on documents like that from a source of strength and confidence, selling your best self. You don't want to be writing it when you are feeling dejected or insecure or depressed.

I'm going through this now myself. Our company was purchased so everything is up in the air as far as IT. People seem to think it's the first thing you can outsource when in reality most of the time that just leaves you with lower quality service. Regardless, it's sadly a fate that most of us IT people are forced to live with.

No kidding. We'd be very interested to see how the outsourced help desk and IT security service are working now. I'm pretty sure it's gone downhill since they laid off Mr. FG and his co-workers. 😉

I've been to companies where they outsource their helpdesk. At best you talk to someone in a different part of town and they send some Community College dropout with sunglasses on the back of his head to make it worse before "taking it down to the shop to look at." But hey, that kid costs $9 an hour and a qualified IT person would be more than twice that rate! The two phrases I hate to hear from management "outsource it" and "virtualize it."

Is 4 or 6 months really enough anymore? The people that I've known who have been out of a job here recently have been so for more than a year. I suppose it depends on your field and age and education level and part of the country, but as a bookkeeper with 30 years experience, but no college degree, my stepmother has been looking for over two years.

I'd dearly love to have a whole year's worth of expenses in the bank (expenses, not income). But that's $30,000, and we haven't been able to put that much away at this point.

Right now, our extra money is being funneled into a new van account, but of course, if Mr. FG lost his job, we'd just roll that money over into the emergency fund.

As Kristen siad, their emergency fund would have lasted four months with no income. They worked towards having several streams of income: Severence and/or unemployment as well as side income for Mr. FG and photography, piano playing and teaching, blogging, child care services, etc. for Kristen. I think a lot of people today believe that multiple streams of income is smart today and in the future.

I like the idea of multiple income streams. Maybe a few tips on establishing those?

I've got a really steady job (teaching) as does my husband (homeheating) but you never know.

The credit crunch didn't hit us as hard in Canada as it did you in the States but it still freaks me out to see people in McMansions that they only put 1% down on and nothing in the bank for a rainy day.

We're working towards (my surprise mat leave derailed this timeline) being able to live very happily with one income and being able to use the other to pay off our house. We'd be able to do it now but after being so tight last year it's been nice to be a bit more flush the last couple of months. It's time though, to get back on track.

Hopefully, by next year we'll be there and another chunk of our house will be paid off.

You hate to think of the worst but the alternative is to have something terrible happen to your little unit.

This was a very good post. Thank you for telling us about your experience. So many of us tend to panic during difficult times. This shows us that with a level head and some perseverance, we can find ways to stay afloat and get through the tougher times.

This is a very helpful and doable approach to the chance of being laid off. My husband is in the law industry and large lawfirms are dropping like flies all around. My husband is not an attorney, he's in management, so hopefully he would be able to find another job if he was let go. It's still very scary, and I'm trying to save for an 8 mos emergency account, and for our large family and with our large mortgage that would mean we would need nearly $54,000. When you were figuring your mos. needs, did you include health insurance? That would be high on my list of priorities, and probably the most costly expense. It sounds like you did an awesome job in creatively finding ways to save. I'll have to make a list of what I could do to do the same, if the need arose.

Thank you for yet another wonderful post. Well thought out an still timely. You are an inspiration.

For anyone who needs help figuring out how to make themselves financially secure -- DAVE RAMSEY! Get his book. Or for $100 you can take the Financial Peace University course. (You can taken however many times as you wish after paying the fee.)

After 10 years of marriage, job losses/changes, two kids, some debt, it was one of the best things we ever did. We have far less money coming in now than we used to, but Dave Ramsey's class gave us the tools and steps to take to make our future financially secure. Even though we are not in any way making a lot of money (one income family), I feel so much better about our future than I did when both of us were working. I encourage ANY SINGLE or ANY COUPLE to take it. And even if your income isn't a stressor in your life, just going through the act of talking/thinking about it and re-evaluating your goals can be so life-changing.

"(when you have no income, tithing is sort of out of the picture!)"

In one sense, I think you're right... and in another sense, tithing in the tough times can be an opportunity to trust God and show Him you're willing to obey in all life circumstances.

My husband is a "poor seminary student" and I'm his "poor working seminary wife." We've been through many semesters of bare bones budgeting (and even some scary moments of having nothing in our bank account). I credit my husband with this, but when times get tough, he always scrounges up a little money to tithe. Sometimes, we can't do 10 percent... but we give what we can and trust God to supply the rest. There is peace and quietness in knowing that we're not going through financial hardships alone. God won't let us down.

"Therefore I tell you, do not worry about your life, what you will eat or drink; or about your body, what you will wear. Is not life more than food, and the body more than clothes? Look at the birds of the air; they do not sow or reap or store away in barns, and yet your heavenly Father feeds them. " - Matt. 6:25-26

Oh, I'd definitely tithe off of the gross of any income that comes in, no matter how dire our financial straits. We've done that all through our marriage and have never gone without.

I just wouldn't tithe off of our savings (I was trying to explain that if our budget normally includes x amount of dollars for tithing, that doesn't need to be figured into an unemployment budget, which has no income).

It's just like when I was figuring up our barebones budget, I didn't include the $100/month we normally set aside for car repairs. Tithing and saving are things I do when money is coming in, and so they don't need to be done when I'm working with a hypothetical no-income scenario.

I'm sorry for any confusion I caused...I am most definitely, 100% with you on the tithing thing whenever income is, well, coming in. lol

Kristen, if you're anything like me & my husband; I'd assume you probably had tithed off of that money that is now in your savings BEFORE it hit the savings. We tithe off of our gross income and then funds are allocated to each area of our budget, so even the money we have in savings has been tithed from.

Yes indeedy. All the income we earn is tithed off of first thing, and then it gets distributed throughout our budget.

Also ... the way I was taught, tithing doesn't have to be in cash. Goods and services help others as well. YMMV (or maybe I should say, "your religion may vary"?).

When we were first married, we barely had enough money to cover our living expenses, so we decided to tithe our time and services by becoming as involved with our church as we possibly could - lectoring, choir, lay ministry, social justice, charity work, etc. We didn't have the money to responsibly tithe (giving money to the church before paying the rent and buying food is not responsible in my book!), but we did have time, being a young married couple!

This is what we try to do. We really try to make a fair share pledge to our church but we know it's not really much -- we have 3 kids and my husband is working on a startup, and I bring in what I can with doula work and babysitting. So we're happy to be able to work on committees and councils and my husband is on the board of trustees. We are happy to be the first ones there and the last ones to leave.

However, especially now that we are more involved we see the budgetary difficulties of our church and we are motivated to increase our modest pledge.

Good post, my goal is to have 6 steady income streams in case I lose my main job. So far I have two rocking right along, 2 in very start up phase and I'm still seeking 2 more. One stream will just generate $200 a year (small effort, small amount) but that keeps my little one in gymnastics for 19 weeks.

The president hasn't done anything yet on outsourcing. What kind of democracy lets all their companies move to other countries without leaving a balance of their factories in the United States. Nike refused to leave even one factory. Where is the patriotism.? I am for helping other countries but you don't forsake your own people!

Speaking of Nike...I would like to put in a good word for New Balance shoes. I have been told they are the only shoe manufacturer that still manufactures sneakers in the United States. My husband wears them all the time (He is a nurse); he says they are very comfortable.

Diane, I agree - and frequently, I can get them fairly cheap at Sports Authority, with either a coupon or a "spend $X, get $X off next time" which means I can "stock up" on sneakers.

Oh, for Pete's sake, stop blaming the president! One of the abiding tenets of our country is pulling one's self up by one's bootstraps. If you speak to new immigrants, they all recognize America as the land of opportunity. It. Still. Is. Start with yourself: do you always look for the best price? Are you willing to pay more for your (fill in the blank) because it's made in the US? How about this: there are many jobs that are impossible to outsource. Identify one that interests you and get the necessary training. Stop blaming others and start at home.

P.S. I'm a different Diane and I love New Balance shoes because I have skinny feet. All of my tennies are NB except for a pair of Nike running shoes that fold flat for travel. If NB made such a thing, I'd buy theirs.

That's part of the problem - it's cheaper to manufacture overseas. Labor is cheaper, taxes are lower, and environmental controls are not as strict. If you want to support US manufactured goods that are easily shipped (like shoes), be prepared to pay for it!

Tariffs (taxes on imported goods) are supposed to help balance that scale by making imported goods just as expensive as US manufactured items, but our tariff system isn't perfect, and there are a lot of lobbyists who have negotiated specific exceptions.

And specific tariffs, too.

I hope that anyone who complains about outsourcing overseas is very careful to check where things are made (and perhaps not just "made in US of imported materials") and never, ever shops at Walmart.

Thank you so much for this post. Whether or not a job is secure, unanticipated emergencies come up all the time. I've known people to fall into debt over medical expenses that they couldn't cover for lack of an emergency fund so it's so great you are sharing how you built up your own in a relatively short amount of time.

Being self employed in shaking financial times is also scary! My husband owns a dental lab with another person. Employees, business payments, supply bills and overhead have to be paid before our salaries. People do not have unnecessary dental work done, if they are barely surviving. It has been a very unsettling couple of years. I have learned to save, save, SAVE for a rainy day. I have a 3-6 month supply of food (and basic non grocery items; like shampoo, soap, laundry detergent, toilet paper) in my basement storage room and freezers (some months we have lived off it). We do not go into debt if at all possible. We also recycle and reuse vs. buying new. Thank goodness, I was raised by a wonderful mother and grandmothers, who have taught me all their frugal ways.

I'm a fairly recent reader to your blog and I'm really enjoying it. This is one I had to comment on. I'm a sahm and I homeschool. My husband was getting out of the military (non-retired) and while we prepared for 2 full years in advance we had no way to know he'd be without a job for 5 full months. We had our emergency fund fully funded. We discussed ahead of time at what point I might have to seek employment and have him stay home. We cut back as much as we possibly could and we found every possible community and unemployment resource to help make it (including free entertainment in our city so we didn't feel so deprived all the time-you'd be surprised what can be found!). We had an infant and a 4 year old during this time so we used WIC because it was available to us even though food stamps were not. We checked our pride at the door. It was hard but it helped. We researched our best option to maintain at least minimal emergency medical coverage insurance ahead of time and budgeted that in and knew what our options were if we got to a point that we couldn't even afford that. We still had some education debt lingering and we looked into possible deferment just in case (thankfully we didn't need to). We also talked about worst case scenario for if we ran out of money and needed to move in with one of our families. We also talked about keeping our kids feeling safe during this time and how to make sure that we both stayed supportive of each other in a time that can really test a marriage. We made it to the 11th hour and ended up moving to another state for the job he found. We planned. We prayed and we worked really hard. We survived. We learned a lot of infinitely valuable lessons from the experience. We learned what matters, what doesn't and how to survive on about half of what you thought your bottom line was. Mostly we learned that when everything else was falling away, all that mattered was keeping our family in tact and healthy. The rest is replaceable.

This was a great post and thanks for sharing your story. One caveat though: you spelled 'employment' incorrectly in your title. Oops.

Oh, you're so right. Thank you! Stupid typos.

Maybe I need to hire Joshua to proof-read my posts. I need a second pair of eyes!

I am a new subscriber of your blog. I absolutely love your site! You offer so much encouraging and inspirational information. This post on planning for unemployment is incredibly helpful and I wish I had read it two years ago to plan for my year when I didn't have a job. I also wanted to let you know that I linked your blog today in my post about responsible living/housekeeping. Thank you for all your advice!

When my hubby was laid off in 2007 I had recently filled my freezer with beef from a local farm. We had also just gotten an aldis in our area and I guess it was God but the summer before I told my husband I fell and unction. Very Urgent to get these credit card bills paid off and to stock up on groceries. I had a spare room then. I had a huge stockpile of food. While my husband was laid off he did volunteer work at the local food pantry. They always sent him home with stuff even after he explained the them that his wife was well prepared with a really full pantry they insisted he take food home. He was laid off for six months and during that time we never had to buy groceries. Funny thing is currently I don't have a huge stockpile of food and don't feel an urgency to have one either.

When I was going through a rough patch at my previous job, my husband and I sat down and figured out how much our "Great Depression" scenario was. We figured out a way to get it under his stipend, and that made me feel much better about whatever was going to happen.

Whew!

There is nothing like having a back-up plan (emergency fund). We always should set our priorities first. Our family NOT things are first. We do still tithe though even when times are rough because when times are rough you end up giving little anyways... 😉 And you always get a blessing in the end, some that I can say are surprising!

I don't fear losing my job to outsourcing - people would get really frustrated if they called 911 and the ambulance came from India ;). However, I'm working on having an emergency fund so that I have the freedom to leave my job at any time. I love what I do but I don't like the feeling of being "trapped". By having 6 months of expenses set aside, I will have the ability to "carry my resume in my back pocket." I currently have 4 months saved up and I've already noticed that issues at work aren't making me as frustrated or elevating my stress level as quickly.

We always figured that my husband had an extremely secure job. But due to legislatively mandated budget cuts of over 29%, the organization he worked for decided they didn't need an auditor any longer. He has been un-employed for 14 months now, and since he is age 60, it is even more difficult to get a job. I don't know if he ever will. We also had absolutely no notice. He went to work one day, and they told him to go home and not come back.

One of the things we did was to pick up the COBRA health insurance, even though it was expensive. Thank goodness we did, because he has emergency surgery a few months ago, had complications, and ended up spending over a month in the hospital. The hospital bill was $200,000, not including doctor bills. We couldn't have paid that, instead we had an out of pocket cap of $1500, then the insurance covered the rest. You never know what is in the future.

Things we did previously that help us to survive financially include living a debt-free lifestyle, including paying off our home. We have always grown a garden, and I have always preserved the extra produce. I also have a good supply of food in my basement. When he lost his job, we immediately cut our budget. Food budget was cut in half (I mainly buy a few fresh items to supplement our storage, and maybe stock up on basics like flour or sugar when they are loss leaders), household expenses in 1/3 (paper goods, detergents, cat litter, hardware, garden supplies, etc.), gift budget for our kids and grandkids was cut to $25. Our 2 youngest kids were driving cars that we owned, so we ended up giving them the cars, including responsibility for any repairs and insurance, which saved us a lot of money. We had a good mount of savings, which was a good thing. For 3 months while DH was ill, we received no un-employment compensation (they don't pay if you are too ill to work.) And now, DH is doing a few tax returns to bring in some income, but that cuts our un-employment benefit, so we really don't get ahead from it.

I guess I am just saying that if you always live in such a way that you could manage if you lose your income, then you can weather any storm. And we don't know what storms are on the horizon.

great post, FG! if only we all went bare-bones-spending like that a couple of times a year...there would be far fewer money worries.

Funny, DMarie, I usually do a cash diet in February. This year I started on Jan 1 and I'm still on it. Even though I have a 1 year EF, it still feels great to be able to add to it. I'm a little concerned about eating up what's in the pantry now with food prices rising, but I tell myself that things must be consumed before they spoil (even non-perishables) and I can always count on my frugal skills to restock when necessary.

Great advice for those facing a loss of income! I do disagree with your thoughts on tithing during hard times, however.

Three weeks before we got married, my husband was layed off from his job. He is a Learjet pilot and worked for a charter company and made good money with tips and flying celebrities around. It was a scary start to get married while trying to find a job (he even did phone interviews on our honeymoon in Kauai!!). We trusted in the Lord and felt convicted that every single thing we own or have, He has blessed us with. My husband felt led to actually INCREASE our giving (taken from savings). I will admit that I was terrified and felt a little wary about this commitment. However- the Lord honored our giving and soon after we started giving more to our church and missions, my husband got many high paying contract flying jobs. In the year where he did not have an "official" steady job, he brought in double the income he did while he was employed. Every time I would start to doubt (if he didn't get a trip in a month or so) he would get another high paying trip. Since that time the Lord has continually provided for us in unexpected ways so that we could honor our giving commitment- and we were even able to take a one year anniversary trip to Kauai because of the extra money that came in. I NEVER would have believed this could happen, but God's plans are far better than ours. I realize that God places convictions in our hearts in different ways and just because this happened to us, it doesn't mean it would happen to everyone. But I firmly believe that honoring God financially through hard times is a leap of faith that He will honor us for.

No, no, no...I DO believe we should tithe in hard times! I just meant that there'd be no tithe coming forth if we had no income.

God wants us to give him our firstfruits. If we farm and have a crop, then we tithe off of that. If we have no crop, then there's nothing to tithe from.

Hope that clears things up.

Okay, brilliant women, I need some advice for my situation. I am a law enforcement officer for the state of Ohio and have been notified I will be out of a job by 7/1. The last two years have already been horrendous...divorce, death, illness and near financial ruin. I am a single mom with a pair of teenagers in an $800 per month apartment, lots of student debt and about $20,000 in consumer debt I got saddled with in the divorce. I have no savings except retirement savings that I won't be able to access until 3 months after my job loss. I have been searching for a lower cost housing option, but the lesser rent options are in drug infested neighborhoods. I can't buy another house because my credit took a hit during the divorce. Unemployment will be less than half of my salary and I get only a bit of child support because I earn more than my ex. I plan on going back to school to get my Masters and earn my teaching degree. Is there hope for me?

I'm very sorry to read about your circumstances. I'm sure they must appear to be overwhelming right now. I don't know your exact situation, but as I read over your post, I did think of some suggestions that might be of some help.

First of all, determine exactly what you and your two teens will need (not want) to live on after you are laid off. Then try to begin living on that budget now. Like Kristin did, spend no more than you absolutely have to spend. In this way you should be able to put aside something before you lose your job.

Secondly, keep looking for cheaper places to live, or any other way to cut expenses. Do you have relatives who could help you here. Moving in with family for a short period of time could be helpful. Do you have things to sell? Sell them and save the money. Is there something extra you could do now to generate more income? Is overtime available, etc., a part-time job.

Next, are your teens old enough to take part-time jobs? The three of you need to pull together right now. Possibly they could bring in some extra income to help support the three of you and, right now, to save. Even if they just made enough to contribute to some of their own expenses, that would help.

Fourth, ask your ex. (if you are comfortable with your relationship) to help out more with the children, at least on a temporary basis. Or petition the courts since your income appeqrs it is going to be less than your husband's income.

Next, begin now to look for another job. I know the job market is tight, but there are jobs out there; maybe not what you are doing now, but work that will bring in some income.

When you do receive your retirement income, consider carefully before spending it, or even taking it out of your retirement fund. Consider the penalty and taxes if it is in a 401K account. See if you can generate enough income to make it without using your retirement savings.

Finally, consider God. He is a help in trouble, and quite often we humans seek Him and find Him in times of trouble.

I'll keep you in prayer. God bless, and let us all know how you are able to manage along the way.

Thank-you, Diane. You gave me a lot to think about and I will follow up. Thank-you for your prayers. I appreciate them more than you know.

Rita, as I was praying for you this morning, this thought came to my mind. I thought I would pass it on to you. "The Lord is husband to the widow and father to the fatherless." Isaiah 54:6; Psalm 68:5. He ultimately is the One who provides, protects, and directs us. God bless!

Good post, personally tithing is the last thing to go. Sometimes God needs your dedication to show just before he provides. Glad it worked out for you though. Nice it all worked for the good.

I enjoyed reading these comments, very inspirational! I do believe too in tithing and my husband and I have for years. Sometimes I look back about 20 years ago, when we tithed on our two incomes, paid child support for my husband's three children (who are now in their late 20's and early 30's), bought a house (albeit an old 'fixer-upper') and had a car payment...and wonder how we made it?! But God is so good...and I firmly believe He stretches things, makes stuff last longer, etc..when we are faithful to give. One story I have is when President Clinton was first sworn into office on his first term in the early 90's, we had a huge wind storm in our area, and our wooden fence around our house blew down. It already was kind of on its last legs, and we knew before the storm we would need to replace it soon, as we had a dog...anyway, the storm blew the fence down, and our insurance company sent an adjuster out...they paid us enough to put a whole new fence up, as well as replace a few shingles that blew off the roof! We always looked at that storm as a blessing from the Lord! Also, a more recent story...I have a bottle of ROC day moisturizer in a pump bottle..I can't see inside the bottle, but every day I use it and pump a few squirts out for moisturizer, and it always feels just as heavy when I pick up the bottle, and there's always plenty that comes out of the bottle when I pump it...I've had it for probably 6 months at least, and I keep thinking that it should have run out a long time ago, but it is almost like the jar of oil the widow used in the Bible that didn't run out for a long time! It is amazing!

Anyway, just wanted to share those stories...trust in God, He takes good care of His kids!

Kelly

Our bare bones is $2500 a month too. How long did it take you to save up a 4 month emergency fund?

I always had a problem with the advice of having three to twelve months (depending which financial expert you're listening to) of income saved up for an emergency such as unemployment because of the things you have pointed out--basically, that if I was unemployed I wouldn't be spending as much money (little to no charitable giving, no going out to eat, putting savings on hold). I think your strategy makes a lot more sense where you figure out the bare bones budget and use that as your guide rather than how much money you are currently accustomed to bringing in and trying to maintain that same level of living when you have no idea when further income will start to stream in.