Back in 2014, I wrote a guest post for Mint about children’s allowances.

After that I got an email from the guy who founded FamZoo.com, a service that makes allowances easier.

I was intrigued, so I signed up, and we’ve been paying customers ever since.

With four kids, I always used to struggle to keep up with paying allowance, especially since it seemed like I never had the cash around to pay my kids.

Plus, keeping the change on hand to divide up their money into spending, saving, and giving was difficult.

But.

FamZoo.com allowed me to automate this process, which was an enormous life saver for me.

How does FamZoo work?

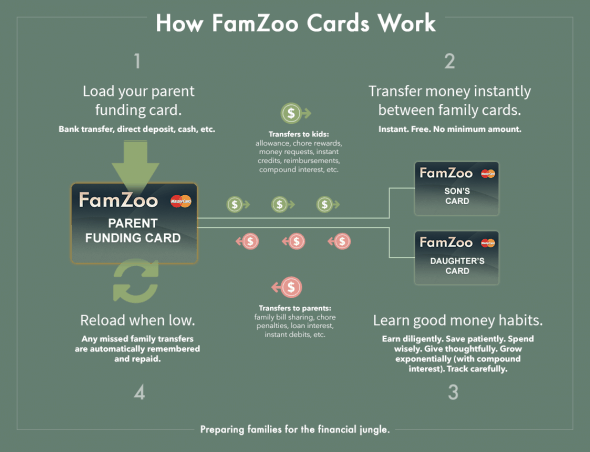

FamZoo operates on pre-paid debit cards. I, as the parent, have a debit card, which I load from my bank account.

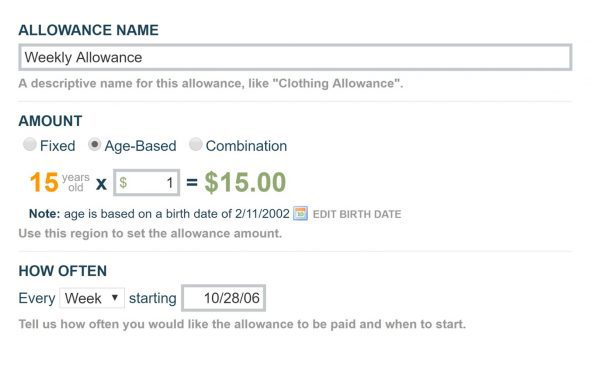

And then from that card, I have it automatically set up to load my kids’ cards each month.

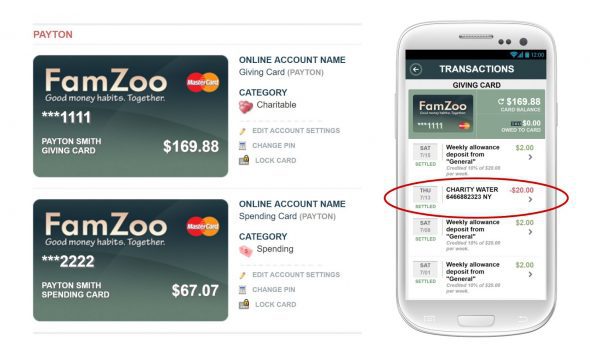

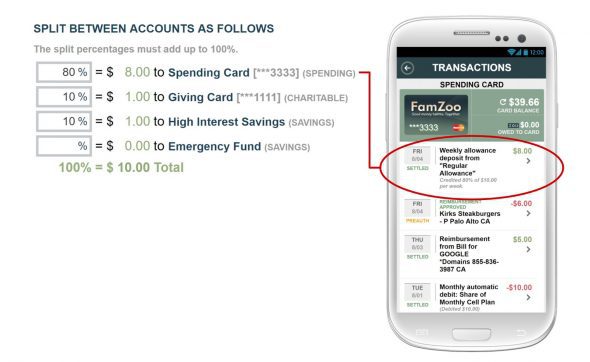

Each kid has a spending, saving, and giving card, and I have their allowance set up to send certain percentages to each card (10% to giving, for instance.)

You can set up the allowance to do auto-transfers, so you never, ever have to remember to pay allowance again.

(Glory be.)

And even if you forget to reload your parent card, no worries…FamZoo keeps track of how much you owe each kid, and it’ll automatically pay them once you load your parent card up again.

Can I do more than allowances with FamZoo?

Yep! You can do manual transfers whenever you want. So, for instance, if Sonia gets paid with a check, I can deposit that into my checking account and then send the money into Sonia’s FamZoo accounts from my parent card.

Or if I pay for one of my kids’ purchases while we’re out (if they’ve forgotten their FamZoo card!), I can just transfer their money to my account.

How do kids access the money on the FamZoo cards?

Spending: My kids just take their FamZoo cards to the store and use them in the credit card machine. The card is a debit card, so you can only spend what’s on the card. This teaches kids to think before they buy, and to keep tabs on how much spending money they have.

Saving: Obviously kids won’t be using this card a whole lot, but if they’re saving for a particular large purchase, they can just use the card to make that purchase once they’ve reached their goal.

Giving: The debit card is easy to use for a variety of charitable options. Most churches allow you to give via card now, and so do most charities.

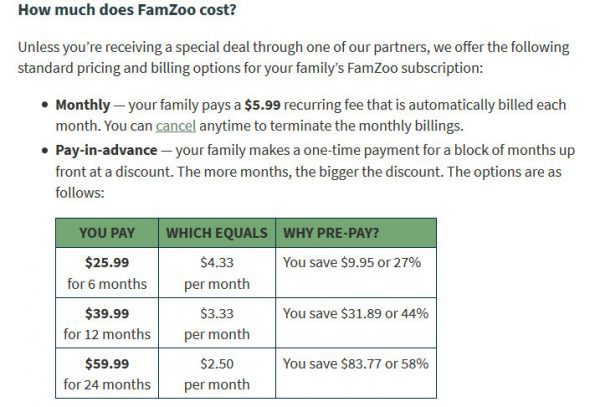

How much does FamZoo cost?

Either $5.99/month OR if you pay in advance, it can be as low as $2.50/month. And the price is per family, not per kid, so it’s an even better deal if you have multiple kids.

For instance, if you have four kids on the plan, it will cost you $0.625/kid per month. Super affordable!

These memberships give you one parent card and three child cards, and if you want more cards, there’s just a one-time fee of $2 apiece.

I wanted spending, saving, and giving cards for each of my kids, so I ordered 9 extra cards when I set up our accounts. That was $18, but it was a one-time fee and it was totally worth it to me.

Note: If your kids are under 13, your name will be on the card until they’re 13, and you’ll sign for transactions they make with it. It will be labeled with their account name, though.

Why would I want to pay for this service?

There are two big reasons, in my opinion.

1. I don’t have to make allowance payments.

Not having to deal with doling out allowance for my kids is completely worth the cost of this service. I was very hit or miss with paying my kids allowance before FamZoo, and now the payments just happen automatically.

It’s one less thing I have to think about, and my kids are happier because they’re getting paid regularly. 😉

This is worth the $2.50 a month alone.

2. FamZoo helps kids practice responsible card use.

FamZoo provides a lovely way to teach even grade schoolers about how to handle a debit card, and to get them into the habit of looking at a card as a way to spend the money that you HAVE, not the money you hope to have in a month.

Here are a bunch of other features/benefits if you still need convincing!

How do I sign up?

Click here to get started with a free trial at FamZoo.com

If you decide FamZoo isn’t for you, you can just cancel your membership.

If you decide you love the ease of automatic allowance payments (YES!), then your automatic payment plan will kick in and you’ll be good to go.

Famzoo is a small, family-owned company, and they make it easy to cancel. So, if you’re on the fence, go ahead and try it. It really is risk-free.

Hopefully I gave you enough info to get you started, but if you have any questions, please let me know in the comments!

P.S. If you have super young kids (preschoolers), I do still think that a cash-based allowance system is a good way to start out because kids that small need a visual connection to the money. But once your kids get a little older, I think FamZoo is super useful service to transition to.

This post contains affiliate links. I pay for my own FamZoo membership just like any other customer. This post is not sponsored and all opinions are my own. If you sign up with FamZoo through a link in this post, I earn a small commission at no extra cost to you.

Amie

Thursday 12th of August 2021

I use Chase and they have a similar account with a debit card. I can transfer money to and from it. It has 3 areas connected to the card saving(can't be touched), atm & purchases. She can only use up to the amount in the acount. Purchases anywhere, atm at just the atm.

NavyWife

Friday 20th of December 2019

Long Comment sorry!

I just signed up for famzoo before reading this article. I enjoyed reading it and thank you very much for it. For me the deciding factors were:

1. Protecting my bank account and the overdrafts. Even if you don't overdraft technically we still get hit with fees and I don't need that.

2. I looked into bank cards as some have mentioned. Until they turn 13 their name can't be on the card period. But with famzoo I can have my name and theirs! This is important in keeping them separate and establishing ownership in their minds.

3. As stated I never have cash in hand and always "owe" my kids. I have a note on my phone keeping track of IOUs and manually deduct from their imaginary accounts. this males it real!

4. Peace of mind! If they lose the card their money is just gone with prompt attention.

5. I considered just doing visa gift cards and reloading them once again to protect my bank account. but they are 4.95 a piece to register/activate everytime one is lost too! and the money is gone within minutes.

6. summary so I feel this is thrifty.... one payment, protecting bank account, teaching kids to manage bank account, peace of mind when lost, no more manual phone managed iou system and me forgetting to add or take away!! FREEDOM!!

LR

Tuesday 6th of November 2018

If we sign up through one of your links that you get a referral fee from do we get the extra free month once we order the subscription. I'm trying to find a referral link that will give me the extra month. Thanks.

Kristen

Wednesday 7th of November 2018

Oh man, I'm sorry, but I'm not entirely sure what the affiliate offer currently is!

Farhana

Friday 12th of January 2018

What is the purpose of giving kids an allowance?

Kristen

Friday 12th of January 2018

Largely, it's to give them some money to help them practice managing it. For instance, most 6 year olds aren't capable of earning money, so parents will give them an allowance to help them learn how to practice saving, spending, and giving.

Bill Dwight

Thursday 11th of January 2018

One thing not mentioned is the parent-paid interest feature where you define a savings rate on the child's card. The interest pmts automatically come from your parent card. I give my kids an outlandish weekly rate (when compared to a traditional bank savings account) because I want to reward them for NOT spending and for carrying healthy balances.

Years later, my kids routinely ask to transfer funds off their spending cards onto their savings cards to put their money to work and reap the rewards of my awesome Bank Of Dad Compound Interest. That's one expense I never mind paying. :-)

We have several behavioral finance features intended to nudge kids into good money habits through incentives, feedback, and repetition. That's the key difference with using FamZoo: our mission is to educate kids/teens. You'll see the other FinLit features if you click on Kristen's "other features" link.

You can definitely implement those kinds of things with a DIY approach using bank products . For example, you could calculate interest each week yourself, credit it to their subaccounts, and send encouraging text messages when the deposits hit. If you're doing that, kudos for sure! As a dad of 5, I just know how crazy things are for parents (FamZoo is short for "my Family is a Zoo"), so we try to lower the bar for money mentoring success by automating it. We keep the price as low as we can to maintain a solvent business. (Much cheaper than, say, piano lessons or science camp!)