On low-fee prepaid cards vs. "free" bank accounts

Though free checking accounts haven't always been around, I've never formally paid for a checking account in my life, and I'm willing to bet that a lot of you haven't either.

I've just kind of accepted that checking accounts should be free and have wondered why people would pay a small monthly fee for some other kind of option (like a prepaid type of card.)

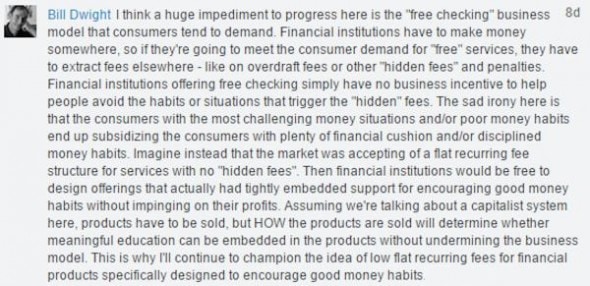

But a few weeks ago, this quote from FamZoo founder Bill Dwight made me rethink this idea.

And then I thought of a long-forgotten incident years and years ago, when Mr. FG and I accidentally overdrew our "free" checking account.

On a Friday afternoon.

I remembered how (conveniently enough!), my bank wouldn't credit any deposits from my savings to my checking over the weekend.

And how (extra conveniently!), they still DID keep taking transactions that trickled in all weekend long, dinging us with $35 fees every time.

By the weekend's end, we'd piled up a good $200 in fees, which at that point in our lives was a small fortune.

Suddenly our free checking account wasn't so free anymore, and obviously, this is one of the ways that the bank makes money while still giving away "free" checking accounts.

Now that we have more of a financial cushion, we'd be able to pay such a fee more easily. But the irony is that we are also far less likely to incur such a fee precisely BECAUSE we have more cushion.

It's like Bill Dwight said: this system means that people with less money end up funding the free accounts for people with more money.

(This is not to misplace blame for my overdrawn account-it was indeed my own fault! But a system that lets you keep spending while not accepting deposits is pretty broken.)

Anyway, this has made me realize the value of a prepaid card system, especially for young people who are just starting out, with little money and not a lot of financial experience.

I'll tell you more about FamZoo in another post (we've been using it with our kiddos), but today, I'm gonna share about Kaiku, which would be a great fit for older teens/young adults.

What's Kaiku? And how much does it cost?

Kaiku is alternative online banking system, which operates on a prepaid Visa card.

Kaiku just charges a $3/month fee for their services, although if you direct deposit $750/month, even that fee is waived.

Also, if you use an out-of-network ATM, then there's a $1.45 charge, but obviously, that can be avoided too, if you use an in-network ATM.

And that's it for fees. You can't overdraw the card or rack up debt or pay interest, which means that this card keeps you from spending money you don't have.

If it's not there, you can't spend it. The end.

Yay!

It's super easy to use-it's a Visa, and mine has been accepted everywhere I've swiped it.

Loading the Kaiku card

You can deposit checks for free using an iPhone or Android device, and you can also deposit money from Paypal or Amazon.

In addition, there's an option to load the card with a transfer from an existing bank account (handy if you're a parent loading a card for one of your kids).

Spending Tracking

Seeing what you're spending on non-essentials is key in keeping those expenses under control, so the Kaiku app has a Funds-ometer feature that tracks spending and compares it to the user's average over the past 60 days in non-essential categories, like eating out, bars and entertainment.

Bill Pay and Friend Pay

With a Kaiku account, you can pay recurring bills (such as electric bills), a classic checking account feature.

And if other friends have Kaiku cards, you can transfer any money you owe straight to their card.

While a traditional checking account/debit card is certainly a better option for a young person than a credit card, I really think that this flat-fee prepaid idea is even better. It's got all of the upsides of a checking account without the downsides, and I think it's such a great idea, especially for teens and college students.

You can check out Kaiku on their website, and read more about the company here.

And if you're ready to get signed up, just click here to get started!

__________________________________

So. I'm curious to hear your thoughts on this. Are you a fan of free checking? And what do you think of the flat-fee prepaid idea?

__________________________________

Disclosure: Kaiku sent me a pre-paid, pre-loaded card to try out so that I could do a review and share Kaiku with all of you. None of the links in this post are affiliate links.

If you shop around there are others that have even less fees especially if you do direct deposit. American Express has one called bluebird, it's $5 to purchase the card and then no fees at all unless you use an out of network ATM.

Yep-this one has no fees with direct deposit, and also no ATM fees unless you're out of network.

I've heard a lot of good things about the Bluebird card. For those who have lost access to traditional banking methods, it and others of its kind are a lifesaver.

I'm fortunate enough that I've never had an issue with any of my bank accounts.

Actually, earlier this year Amex Bluebird was doing a promotion with Walmart's Savings Catcher app that whatever money Walmart refunded to you through the app for sales on purchases you had made, Amex would double the value.

So, I went into my local Walmart's service desk and asked for the Bluebird starter kit. It was completely free for the kit. To activate it, I just had to load it with some money. There was no minimum, so I only added $2 at the time.

I have kept the card since. I still use the Savings Catcher app and everytime I or my husband shops at Walmart, I scan our receipts. I usually get something back. I just keep collecting the money in my Savings Catcher acct and then transfer it to the Bluebird when I feel I have accumulated enough for a shopping trip. Free groceries!

This is an interesting idea. I guess I always thought of free checking accounts as a kind of loss-leader deal from an institution whose financial products are much more diverse than simply checking accounts. From what I understood, the minimum-balance fee-waiving on accounts (checking and savings) has to do with how much money the banking institution can feel secure it has on hand for managing these other financial products: mortgages and loans, investments, etc.

I definitely don't think such hefty fees on checking accounts are equitable, but I also don't think we need a flat-rate monthly fee for consumers to use a bank. It's not like the interest rates we're getting on savings accounts are much better than sticking it under a mattress!

I am a fan of free checking. I just generally don't like to pay for the privilege of using my own money. That said, I have had to jump through some hoops in the past to get a monthly fee waived (making a certain number of transactions, carrying a certain balance, etc.), which is a pain.

The prepaid card is intriguing but the fees would be a non-starter for me. I could see how it would be very beneficial for someone who has trouble managing money and wants to avoid overdraft fees, or perhaps for a teenager or college student trying to learn to live on a budget.

Yep-I think the perfect audience for this is a teen/college student.

The $3 fee is really small, and if it kept you from overdraft fees or credit card interest, then it would be totally worth it!

I mean, Mr. FG and I were very careful with our money, but it just took one small misstep and then we had a big pile of fees...like 6 year's worth of $3 fees. So, if the $3 monthly fee can save you from something like that, it's a wise idea.

Is this a debit or a credit card?

I'm asking because I'm thinking of it as a way to build a credit history. One of the biggest problems for young adults is a lack of credit. I was an authorized user on my mother's credit card from the time I was 20 as a way to build credit (and buy groceries and gas while I was in college) which is how I built my credit, but many of my friends had to have co-signers on their leases and even some bills because they had no credit history. A card like this would be a great way to start building a credit history since there is very few ways it could get you into trouble.

The only trouble I could think of is if you use it to pay a bill, but you don't have enough money so it gets declined and the bill is late or goes unpaid. If that happens one too many times that could get you sent to collections and severely damage your credit. But it's definitely less risky than a regular credit card that gets maxed out every month.

You said that you have been able to use it everywhere, even at Aldi?

Oh, I should have listed that as an exception-I have not tried it at Aldi, but I'm inclined to think it wouldn't be accepted there, because it processes as credit. I'd have to double check that, though.

Our Aldi only accepts Discover credit cards. Anything else has to be swiped as a debit card. (My bank card says debit (Visa) card on it, but you have to swipe it as a credit card so I couldn't use it.) Having never been to Aldi before, I didn't know this.

Our Aldi's here in Indiana, do not accept any credit cards. Only debit cards and cash. I would think since this is a prepaid visa card, it would be swiped as a credit card transaction making it unusable at Aldi.

We're very happy with our bank. It is free checking and *once* several years ago we had a paycheck that we stuck in our glove box instead of depositing in the bank and when our mortgage payment hit our account, our bank immediately called us to notify us of the problem. Any time there has ever been any sort of issue, we get a phone call and the issue is resolved quickly. I like that.

Before we were married my husband was with a bank that had "free checking" with many hidden fees. He had his account set to direct deposit but they held deposits for up to 10 days anyhow, meanwhile other payments were being withdrawn and they wouldn't deposit the direct deposit to cover the expenses...it was definitely the bank working against the customer.

Yes. That sounds so much like what we had! It's infuriating.

I am astounded that you think the general public should *all* be paying a flat fee because those who mess up get stuck with really large charges. The answer is simple, watch your money and you won't be paying those fees. I certainly don't want to pay a monthly fee to make someone else's life easier to mess up.

If you run a red light, you must pay a fee for messing up. If you let your car run out of gas on the freeway you will probably have expenses getting help. If you prepare a spaghetti dinner before you change out of your good office clothes and get tomatoes stains on them, you might have to replace them.

All of this is called a "stupid tax" by Dave Ramsey. And if you run up serious charges at the bank, you will probably pay much closer attention to your balance in the future. But spreading that pain around so it hurts less? Nope.

Oh, I'm not saying that this type of prepaid card is the right choice for everyone or that no one should use free checking. I'm just saying that the prepaid route makes a lot of sense for some people. It's smarter to pay a small recurring fee than occasional large fees, you know?

For people older than teens/college kids/young adults who need savings accounts and car loans and other services that a bank provides, a bank makes a lot of sense.

But I think there are gentler ways of learning to manage money than getting enormous overdraft charges, you know? I think I'd rather have my teen, say, have their prepaid card declined than rack up a huge fee.

Also, I like that some of these prepaid companies are on a mission to help people manage their money well, by offering budgeting tools and spending tracking. Not everyone is great at this and not everyone has been taught money management skills, so I appreciate the companies that are trying to help their customers manage money wisely. Not many banks do that!

I completely disagree with Bill Dwight (based on the quoted paragraph). What he is calling for is not a let the market be free philosphy. Appears to have a smidge of spread the wealth. I could be misreading him though. If people are upset by free checking with the hidden fees, the market will correct itself. Customers would stop using free checking and find other means of having a checking account. Maybe this is what is happening with the rise of prepaid cards.

I too have had overdraft fees, but you better believe I was more careful in the future. Also, I bank at a credit union and all deposits are applied to the account in real time, as well as checks and debit transactions. Love it. Credit unions are awesome.

Yep-we're at a credit union now, but back in the day, we weren't. I'm so glad to be free of that old bank!

I don't know that Dwight is calling for an end to free checking, exactly. What I got from his quote is more of an individual application-that it's better to pay a small, reasonable monthly fee than to risk a bunch of hidden fees, especially if you're young and inexperienced with money.

And I'm definitely not saying that consumer's choices should be taken away. I just am realizing that a free checking account might not be the wisest choice for everyone (whereas previously I would have wondered why in the world anyone WOULDN'T go the free checking route.)

I agree that it's a great tool for young & college students to learn to be financially responsible. But it's not the bank's responsibility, nor is it ever their goal to "encourage" good money habits. Dwight infers that banks just make money from hidden fees and overdrafts. Those are small potatoes to banks. They make 30-75% on YOUR deposited money that they loan out to others. So tell me again why they shouldn't entice depositors with "free" checking accounts?

I agree with others - we shouldn't have to pay for the privilege of using our own money, nor should we have to pay for other's mistakes. Dwight's ideas sound very socialist to me.

For my money, a credit union is the ONLY place to put money. They pay ME for the privilege of putting MY money in their credit union. Granted, the interest I receive is tiny (on both checking and savings), but every penny helps. 🙂 I also never have overdrafts, unless, of course, there is no money in the savings portion of the account. If a check is more than what's in my checking, they take it from the savings - and they charge no fees for the transfer. So my responsibility is to keep enough in savings - just in case.

I love my credit union too!

When I lived in New Zealand several years ago we were very surprised that there were actually no banks that offered free checking accounts. We did get much better service from our bank than I ever have here in the US. The fees were annoying at first, but we got used to them after a while.

That sort of thing (getting hit with overage fees for debit purchases) shouldn't happen anymore. Long, long ago, if you presented a debit card for a transaction and you didn't have sufficient funds, it was just flat declined. Probably somewhere around 2003ish, banks/credit unions quietly started allowing debit transactions when there weren't sufficient funds but charging the consumer $35 a pop. Because it's totally worth $35 to save face and get things now and not have a cashier tell you the transaction was declined... Consumers who found out about this 'feature' could opt out but their account was automatically set to this. After getting burned once, I had them reverse the fee since it was the first time I had overdrawn and at the time and I called them out on the unfairness of automatically switching me to this system.

After a while, the government said that it wasn't fair and now banks are allowed to offer such a thing but consumers have to knowingly opt-in. You can still choose to do that or you can also choose to have a credit card with the same institution and for a lesser fee, overdrafts will go onto the credit card.

They still push it pretty hard whenever I sign up for an account, though. While some of them seem incredulous that I would prefer to have my transaction declined and suffer the embarrassment or possibly not be able to buy what I wanted, mostly they agree that they wouldn't want to pay a $35 fee.

The premise here is all wrong. Banks take my money and loan that money out for interest. In fact, the bank can loan more money than it actually has, I think something like 15 to 1. Meaning, for every dollar I have in my account the bank can loan $15. They make huge amounts of money off of that. This is why you should never pay a fee for giving the bank the privelege of using your money.

I advised by daughter to get a credit card when she was old enough (at age 18). I want her to build a credit history, as she may need one to rent an apartment down the road. She waited until she was 19 to get a card and she charges stuff she would have used her debit card for. Every couple of weeks she.checks the balance and pays the credit card company. She works part time during the school year and full time in the summer.

I think the pre-paid cards you discuss could work for many people and I am glad I learned more about them in your post. Thank you for that service.

These products are good for people who have no money management skills. Unfortunately there a lot of people that do not and these companies certainly enable them with this so called solution.

While it's certainly easy for those of us with good money management skills to look down on people with poor money management skills, I think it's really important to have a humble attitude about this. We all are good at different things, you know? Someone with poor money management skills might be far more skilled than me in another area, and I'd want them to have a gracious attitude toward me about that.

Different financial solutions work well for different folks, and if a prepaid card works out better for someone than a checking account, I think that's great!

I must say, I agree with Stella, I really don't think everyone should pay a monthly fee just in case some people mess up. I have had free accounts my whole life, and have never had any problems with other high fees. In fact, the ING account I have now gives me a 2% rebate on most purchases.

Plus, I'm not sure if it's the same in the U.S., but most banks here waive monthly and annual fees for anyone under 18 or if you are a full time student. Yes, they still have overdraft fees, but it is so easy to monitor your balance these days with online banking and apps.

I've had my account at Wells Fargo since 1989 and I've never paid a fee. The couple times that I was charged an "overdraft" fee, they refunded me because " I'm a great customer". We also have a checking/savings with USAA and they actually REFUND all our ATM fees. We're forced to use other people's ATM's, because USAA doesnt have their own. Never charged any type of fees from them either.

I was recently looking for a way to "train" my kids to budget their money and considered a pre-paid credit card but figured that would basically just cut them off once they used it up and wouldn't really teach them to budget ahead of time. I came up with this system. They volunteer for local organizations and I personally give them minimum wage for their volunteer time which they deposit into their bank account (in lieu of allowance money for behavior, grades or chores, etc). With that money, they are required to pay for their gas, lunches, clothes and entertainment. Which means they have to budget ahead of time for gas/lunches, and if anything is left, they can spend it on clothes/entertainment. We then set up a budget showing how much they would need each week for the essentials (gas/lunch). They track their spending using a checkbook app. When their volunteer work $ gets deposited into their bank account each week, they update their checkbook with the deposit but immediately deduct their gas/lunch money they budgeted for (so they don't spend it). They also put a little of each paycheck into savings so they can build up a cushion. In addition, I retain 10% of all their earnings in a separate savings account and each January, they have to fill out a fake income tax form to get that money back. So far...so good. I really feel like personal finances should be a required class in high school. Luckily, the career academy my kids are going to has a speech teacher that has taken it upon herself to teach a small course in budgeting that includes them figuring out what they might get paid for their desired job...and then budget for insurance, food, gas, electricity, car, etc. to see what kind of housing they could afford. Then she makes them search the internet for housing within their budget...all so they can get an idea of what it takes to live.

I worked for 2 different banks in 2 different states. I have over 11 years experience in the banking field and I am saddened to hear of so many bad experiences. I am also reading many misunderstandings about financial institutions. Please let me explain. Banks and Credit Unions are 2 different types of financial institutions. They are not the same. They are set up differently and must follow different federal laws. Your money is even insured differently. A bank is a for profit company and a Credit union is legally considered member-owned. A bank pays taxes on each $1 earned while a credit unions profits are considered to be shared by its members. That profit sharing is what is used to reduce or eliminate the fees that a bank must charge. That being said Your bank did make some errors. When they opened your account they should have offered you overdraft protection which is free until used, and the charged that is incurred once used is really small compared to overdraft fees from the bank and insufficient funds charged by the business you sent your check etc to. Most banks will waive the fee if this is the first time this has occurred. Banks are not trying to make people pay fees just because. Those fees, especially overdraft fees are set high to try to influence people to avoid them. The mindset of people today has changed. A lot of overdrafts are repeat offenders and not because they do not understand how to keep financial records. A good financial institution will offer help to teach their customer how to keep their records correctly. They want you to be satisfied with them because they want to keep you as a longtime customer. It's easier to keep a customer than to try to get a new customer. Choosing the best financial institution is different for each person. Consider what services you need, what balances you can keep, how wide is their network to avoid fees, what types of charges exist, can you apply payments toward principle on loans etc. Compare against several banks and credit unions, they are not all alike. As to the above question, I would prefer the checking & savings account over the prepaid card. To me, it's too similar to credit cards and I would not be comfortable to have my teens trained on them. Sorry for the long-winded post but, like most things, there is never a simple explanation.

We have always had free checking and savings at any bank we used. It never occurred to me that they were giving me anything. After all they have my money! And I am quite certain that it is not sitting in their vault waiting for me to ask for some of it! They are using it elsewhere. Perhaps it goes somewhere and draws interest or they loan it to someone else at exorbitant interest rates or, more likely now, they take it down to the Casino and bet it. Well not actually the Casino but it might as well be - todays "Banks" call them Hedge Funds, Stock Swap Options, Credit Default Swops, and other Market Manipulations which all add up to the same thing - Betting with my money!!! And they can't lose, if they win, they get to keep what they "Win" (Read steal, from us) and they don't share any of their winnings with us that they get from using our money. If they lose, they just go to the Government and say "We are too big to lose, give us more of the stupid people's money because we are too dumb to work honestly and we are very very greedy and our CEO was 'only' paid $50 million last year and he will leave us if we don't pay him $200 million next year. so give us money" So the government does. And they take the money from us and give to the banks.

One way they take our money is they don't pay interest any more. There was a time when you put your money into the bank and they loaned it out at 10% and paid you 5%. Now they loan it out and bet it and pay you .001% - maybe. Plus they charge you. There was even talk of them charging you to keep your money in their bank!!!

Once upon a time I respected bankers. Now I hate them. They stole $600,000 from us. In my book bankers are way worse than used car salesmen or even politicians. Just saying.

The site mentions that the Kaiku card can be loaded from Amazon. How does that work? I've bought Amazon gift cards at the grocery store in the past (for the fuel points). Are you saying I can load those to Amazon and then transfer that money to Kaiku?

Hmm, I'm not totally sure, as I haven't tried that feature out. I'll let my contact at Kaiku know about this question and then get back to you.

I got my first job (at McDonald's, walking distance from home) three days after my 16th birthday. With my first paycheck in hand, I went to the credit union (I was a military dependant at the time) and opened savings and checking accounts. In the THIRTY (sigh) years since, I've sometimes used a bank but mostly stuck with credit unions. At the moment our household has membership in two credit unions and they offer a tremendous variety of services.

I need to look into this. Like frugal girl I got tired of paying over draft fee's. I had been going and getting moneygram checks to pay all my bills, but it's $3 per check, that can be an additional $15-$25 extra per month on top of the bills.

I am currently using a nextspend card which is a $5.65 fee per month, and $3 every time you load the card. It's a bit cheaper since I can load all the bills that week on the card for one fee. But also I get paid weekly and doing that once a week still adds up.

Do you know anything about NetSpend vs Kaiku?

Sorry for the add on, I just read over the website. Do you know of a fee to deposit a pay role check via a in network ATM?

I just though also how I have been cashing my check at B of A but they charge $5. That's another $15-$20 since I'm paid weekly.

Thanks 🙂

I don't think there's a check depositing fee, but I'd have to double check that.

Is there any way to direct deposit your check? That's free AND gets you out of the $3 monthly fee as well.

Hey there, I found this page doing research on free bank accounts to see if my current bank in upstate NY is being proper or taking advantage of our limited options. I do appreciate both your insights and your frugal living. I need to be more like you. And this is an effort in that direction. I know this is an old post and maybe you don't check here anymore, but I have a question about Zelle and I guess Venmo. I have a Venmo account for the younger people in my life to exchange payments on concert tickets and the like. I resisted for a while, but had to relent. Now my local bank--Rhinebeck--has Zelle which is a Venmo competitor but it's owned by the big banks. It seems like it's free to use, much like Venmo, but where I could use your insight is if you think it's free to use for now until it is fully integrated into my life and then somewhere down the road they create fees (much like the banking dilemma you address at the top with free checking). I guess Venmo could do the same as well, but I can see these platforms are going to become just a part of the financial fabric going forward, and just looking for any insight into how I might set myself up the best to either take the most advantage or cause the least damage.

Well, if it stops being free, you can always switch to something else. 🙂