Hello! If you like cats, you are gonna love today’s Meet a Reader post, because it’s chock full of cats. 😉 Danielle owns six cats, she’s left a cult, she met her husband online, and she said my posts have helped her develop a Best, Better, Good system instead of a Pass/Fail system.

Here’s Danielle!

1. Tell us a little about yourself

I’m 41 years old and live in the mountains of western North Carolina with my husband, Nick. We’ve chosen not to have children, but we have six cats. We’re coming up on our 15th anniversary this year.

Mortimer, one of our cats

We met on e-Harmony; I gave it a try after my aunt met her husband that way, and Nick gave it a try after his mom met his stepdad that way.

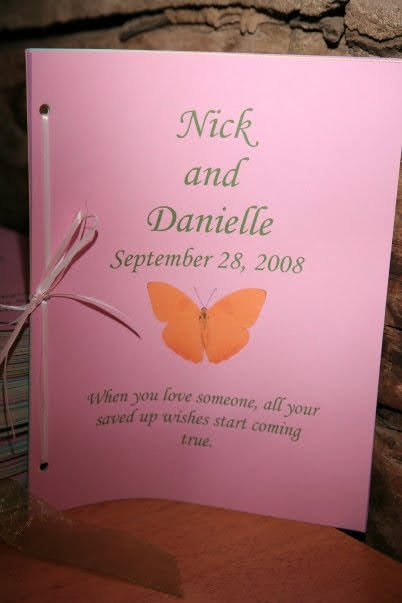

I love cookbooks so much that we did a friends and family cookbook for our wedding favors. We asked everyone for recipes and I compiled them and tied them with ribbons. It was very time-consuming, but well worth it. Everyone loved it and we have recipes from people who have since passed away, so it’s really special now.

My aunt and uncle will celebrate sixteen years this year, and Nick’s mom and stepdad will celebrate seventeen years. And we all had September weddings.

Caroline

I lived in the upstate of South Carolina when we met, but Nick has lived in this area his entire life and didn’t want to move, so I was the one to move. It took me some time to adjust to the move, but I really like it here now.

Nick works in a branch of the emergency services and was a volunteer firefighter for over 20 years. I work for the state as a research assistant in a criminal justice system adjacent field.

Frankie

I love cats, flowers, candles, butterflies, lots of color, and cozy things. My hobbies are cooking, baking, crocheting, photography, reading, and writing. I hope to publish a cookbook and a novel someday.

strawberry-basil pie

I have a blog, Sweet Tea Reads, but I’m not great at posting as regularly as I should. I also volunteer with Chemo Angels and Senior Angels.

We both enjoy board games and love to have people over to dinner and game nights. Like Kristen, we’re both left-handed. I cannot seem to learn how to do anything intricate from a right-handed person.

a cat couch I crocheted for my sister

I’ve learned to crochet from left-handed tutorials on YouTube since I don’t know anyone in person who is left-handed and crochets.

My sister’s cat enjoying the crocheted cat couch.

I grew up in what I now know is a cult. My sister and I both left by the time we were in our early 20s and began to have serious doubts even before then, but my parents are still in it. Obviously, that makes our relationship with our parents very complicated.

The cult believes in spending as much time as possible in actively trying to convert others, so higher education is frowned upon, especially for women, and there’s a prevailing belief that you shouldn’t worry much about getting a good-paying job or saving money for the future because the world is going to end “very soon.”

I was hesitant to mention this because I feel a lot of shame about the beliefs I once held, but the experiences of growing up in that and leaving it have definitely shaped my views on money.

2. How long have you been reading The Frugal Girl?

I started reading regularly in 2016. I was looking for information about meal planning and found it that way.

3. How did you get interested in saving money?

We both have jobs that will never be very high paying, but we love them and feel good about what we do.

I don’t like the idea of having to give up a job I love because I spent too much money. I took a pay cut in 2019 to take my current job, and I’m so glad we were in a position for me to do that. I love what I do now, and I’m much happier than I was before.

We both also had childhoods that really impacted our views on money and stability.

4. What’s the “why” behind your money-saving efforts?

In one sentence, it would be not wanting to end up like my parents.

Nick and I both grew up in financially unstable homes, and there was always an undercurrent of extreme stress and anxiety. We both experienced enough worry about losing our homes, utilities being turned off, and overdrawn checking accounts as children to last a lifetime. Neither one of us want that in our life as adults.

I have very vivid childhood memories of my parents spending like mad on payday (shopping sprees, going out to eat, etc.) but then a week or two later seeing bad checks my parents had written taped up at businesses, scrounging around for change to pay for basic groceries, and getting showers at my grandmother’s house because the power and/or water were turned off at home. I don’t want to live like that.

We also have some friends who’ve made incredibly responsible financial decisions, and seeing the freedom they have has been very inspiring.

One great thing about both of our jobs is that they have a good retirement. It’s not something that will make you rich, but it’s very stable, which is extremely important to both of us.

I love taking pictures of water droplets!

We’ve both worked with people who are 10-20 years ahead of us in age/retirement, and the ones who’ve made frugal choices and enjoy retirement have given us something to aspire to. They’ve proven to us that people in our position can do it.

5. What’s your best frugal win?

Our house.

We weren’t able to buy at the time of the 2008 housing crash, but we bought in 2010 when prices were still relatively low. We also spent half of what the bank said we could afford.

Our house is on the small side at 900 square feet, which is plenty for us and our cats, so we have no plans to move. Our area is expensive, and smaller homes like ours aren’t necessarily the norm, so buying where we did when we did, turned out to be a great move.

Things were really tight the first couple of years after we bought our house, and we had to cut out ALL extra spending to handle a few unexpected repairs, but it was well worth it. Houses similar to ours are currently selling for more than twice what we paid, and I’d hate to be trying to buy right now.

our backyard

Because our house is older, there were a lot of well-established bushes when we moved in. We have some gorgeous azaleas, peonies, and a hydrangea that we didn’t have to buy or plant, which was another nice perk.

A small frugal win that makes me disproportionately happy is our clearance rose bush.

We bought it off the clearance rack for $5.00, more than half-dead, and nursed it back to health. It’s gorgeous now.

I’m so proud of how well it’s doing, and it makes me happy every time I see it.

6. What’s an embarrassing money mistake you’ve made?

I feel like I tend to learn the hard way when it comes to money and make the same mistakes a few (or several) times before I learn. It’s hard to pick one, so I’ll share two. The first is getting sucked into my parents’ financial situation without setting any kind of boundaries. We, along with my sister, depleted our savings and even racked up debt trying to help them.

Meanwhile, their spending and behavior didn’t change, so nothing ever improved, but my sister and I kept getting pulled back into trying to fix their finances. Finally, after almost ten years of it, with therapy and a lot of help from my husband and my sister’s partner, we’ve been able to start saying no.

The second is that I was one of the people fortunate enough to be able to work from home during the COVID pandemic. I always thought I was much more of an introvert than I really am and fully expected to love everything about working from home. I thought I’d cook healthy meals, be incredibly organized, and even lose weight.

I could not have been more wrong!

I didn’t handle the isolation well at all. Working in the emergency services, Nick was still going to work and had a lot of exposure. My sister works in the medical field, so was working 80-hour weeks sometimes, with lots of exposure. I struggle with depression and anxiety anyway, and constantly worrying about the two people I love most in the world (along with a ridiculous amount of doom-scrolling) took a real toll.

Like an idiot, I coped by doing a lot of online shopping and ordering lots of DoorDash and racked up some debt that way. We’re currently working toward paying everything off, but I’m still really annoyed at myself for that.

7. What’s one thing you splurge on?

I’m going to pick two here again.

First, our pets. I don’t mean buying them; we both feel strongly that rescue pets are the way to go, so all of ours are rescues.

We currently have six cats, and up until December of last year, when we had to say goodbye to our last dog, we’ve had at least one dog for our entire relationship. None of our pets had a great start in life, and some came from really terrible situations, so we’ve made it our mission to spoil them and give them the best lives possible.

Four of our six cats are on daily medication, one eats prescription food, and one is on a special diet. We do everything for them medically until they no longer have a good quality of life.

This means we’ve spent a lot of money on veterinary care and medication over the years; sometimes, we’ve financed some of it. I know people tend to have strong opinions on what should or shouldn’t be done for or spent on animals, but Nick and I are on the same page about it and don’t regret our choices.

These ones are littermates and very bonded

Over the years, we’ve dealt with pets having cancer, Cushing’s Disease (both types), asthma, diabetes, pancreatitis, a leg amputation, and surgery to remove an earring, to name a few. Fortunately, we have learned a lot about how to get pet medications as cheaply as possible.

Related to pet care, we also splurge on giving everyone in our vet’s office an individual Christmas present every year. We love our vets, and everyone there is passionate about animals, and they’re so kind to us and our pets. I’ve read that people in that profession tend to have a higher rate of anxiety and trauma than some other professions, so we feel like it’s important to be extra nice to them.

It’s never anything extravagant (some years it’s just a card and a $5.00 Starbucks card for each person, one year, it was tea advent boxes), but we make sure we do something to acknowledge each person in the office every year.

On a frugal note, being nice to everyone in your vet’s office can save you money. We’ve been loaned things like a cat inhaler adapter by various people at our vet’s offices, and I think people are more willing to do something like that for someone who has been nice to them.

Our cat, Howard, in his meerkat phase. He used to pose like this all of the time.

The second thing is Thanksgiving. The cult I grew up in doesn’t celebrate any holidays. Since leaving, I’ve fully embraced celebrating holidays, and Thanksgiving is my absolute favorite.

It’s very important to me to try to spoil everyone a little bit that day.

Our Thanksgiving tradition is to take Thanksgiving dinner to the local hospice house for lunch on Thanksgiving Day. I have the utmost respect and admiration for the people who work in hospice. They do what seems like an impossible job with so much love and kindness.

Then we host a huge Thanksgiving dinner at our house in the evening, and we always have a collection of friends, neighbors, and coworkers. Over the years, we’ve become the place where people know they’ll be welcome if celebrating with their family isn’t an option.

8. What’s one thing you aren’t remotely tempted to splurge on?

Technology upgrades and new cars. I like routine and tend not to like change, so changing something like my car or cell phone is more like torture than temptation.

9. If $1000 was dropped into your lap today, what would you do with it?

Put it toward paying off debt.

10. What’s the easiest/hardest part of being frugal?

For both me and my husband, the big things are the easy things.

We have no desire to move to a bigger/nicer house, buy fancy phones, drive expensive cars, or wear designer clothes. It’s the little things that seem to get us.

We both find it much harder to do things like skip going out to lunch with coworkers or cook at the end of a long week when it’s so easy to order delivery. It’s also an ongoing struggle for me to maintain financial boundaries with my parents.

11. Is there anything unique about frugal living in your area?

Like so many places, housing here has become ridiculously expensive. We were heading that way even before 2020. In 2019, the local news did a story about how people in our fields couldn’t afford to live in one adjacent county and could barely afford to live in ours.

Recently, a few people from Nick’s job have left because they’re entry-level and can’t afford to live here on their salary. Most of my coworkers who aren’t from this area live over an hour away in other counties, and a few live in South Carolina because it’s cheaper. Again, I’m so glad we were able to buy our house when we did.

We do have a lot of free parks and hiking trails in our area.

at a local park

We also have a wonderful library system, which is handy since we both love to read. Most of the counties in North Carolina are on the same system and share books, so it’s rare not to be able to get a book we want from the library. My favorite library branch is on my way to/from work, so it’s also very convenient.

We also feel like we won the lottery when it comes to neighbors. It’s a close-knit neighborhood, and most of us have each other’s phone numbers. We regularly share and loan things back and forth, including muffin pans, tools, dog crates, and crock pots, to name a few. Everyone is also very generous with food. I love to bake, so we tend to share cupcakes, etc.

There’s a local Middle Eastern restaurant that does cooking classes, which I love. These stuffed potatoes are one of the things we learned to make there. They’re so good!

Two of our neighbors have chickens and generously share eggs, and the people who garden share their produce and flowers. We were given so many eggs in the spring that I made a huge batch of egg za’atar to share.

It’s perfectly normal to text the group asking to borrow a tool or saying you have something you’re giving away to see if anyone can use it. We also exchange pet sitting, which is a huge money saver. I can’t imagine how much it would cost us to hire a pet sitter when we go out of town, so we’re very grateful to have neighbors who do it.

Our neighbors love our pets, so we know they’re getting great care and lots of attention. Some of our neighbors come to our Thanksgiving and invite us to their huge Easter event, so we sort of trade holidays, too.

Our neighbors definitely contribute to us having no desire to move to a bigger house.

12. Which is your favorite type of post at the Frugal Girl and why?

Once again, I have two. I love all of the posts about Kristen’s finds from her Buy Nothing Groups and all of the furniture rehabbing. I enjoy living vicariously through those.

I’ve worked in and around the criminal justice and court systems for almost twenty years, so I’ve seen a lot of the worst of human nature. As a result, I’m not very trusting of strangers, so I’ve never been comfortable with things like Buy Nothing Groups, Facebook Marketplace, etc. I’m not knocking them.

I know lots and lots of great people use them happily and safely, but it’s not something either one of us is comfortable with. It’s fun to read about Kristen’s finds and it helps restore a little of my faith in humanity.

My other favorite posts are the What I Spent, What We Ate posts. I’ve gotten some great ideas and recipes from those. The chicken brinerade is one of our favorites now.

brineraded chicken with zoodles and alfredo sauce

I’ve also learned just how awesome sandwiches can be.

avocado toast, which I believe counts as a sandwich!

But my favorite thing about them is how real these posts are. So many frugal blogs out there make me feel like I’m failing and seem to have a message of “Don’t even bother if you’re not growing your own food and making everything from scratch.”

But the WIS WWA posts never make me feel like I’m failing. I love that sometimes dinner is pizza or canned soup if it has been a bad day.

It’s nice to see that even someone who is really good at being frugal gets takeout for dinner sometimes.

13. Did you ever receive any financial education in school or from your parents?

My parents have been a crash course in what not to do.

I was homeschooled, and I got no financial education there. But a few years ago, I was able to learn some about investing and stocks, which I’ve always been a little afraid of, from my aunt and uncle. They’ve made smart choices, so I appreciated it when they took the time to share some of what they know.

Mostly, though, it has been trial and error, with a lot of error.

14. What frugal tips have you tried and abandoned?

Couponing.

It just wasn’t worth the time for me, and with only two people, you don’t need to stockpile things, which couponing seems to lead to. We ended up throwing away a lot more expired food when I was couponing.

I don’t usually make broth/stock anymore. Between work and pets, I feel like I have to use my free time carefully, and the trade-off isn’t worth it for me. I’ve also learned to modify freezer cooking a little bit. Cooking and freezing meal components seems to work a lot better for us than freezing something like entire casseroles.

What is something you wish more people knew?

That shelter pets/rescue animals aren’t damaged or broken, that there are breed-specific rescues if a purebred is that important to you, and how rewarding it is to love and be loved by a special needs animal.

Our last dog, Duke, came to us with heartworms and a bum leg.

Duke

Over the years, so many people told us that they thought it was so amazing that we took on caring for a three-legged dog. We didn’t think of him as different or handicapped; he was just Duke to us, and he lived a full and happy life. The missing leg did not slow him down at all.

He had so much love to give and made so many people happy, and it’s heartbreaking to think about all of the other animals like Duke who never make it out of the shelter because people are worried about how hard caring for them might be.

We’ve been asked how we’ve dealt with caring for so many pets with medical issues. There’s definitely a learning process, and it can be stressful at times, but the idea that you have to basically be a saint to take on a special needs pet just isn’t true. I promise we’re not saints.

Obviously, it’s important to do your homework and make sure you’re financially, physically, and emotionally able to care for a special needs pet, but don’t just automatically write them off. Some conditions aren’t as expensive to manage, and some rescues will help with the medical care if you adopt a senior or special needs pet.

How has reading the Frugal Girl changed you?

It has helped me to become a more positive person.

I tend to worry and be anxious a lot of the time. If I’m told there’s a 90% chance something will go well and a 10% chance it will go badly, my natural inclination is to fixate on the 10% that can go wrong and obsess over how bad it might be. Kristen’s Thankful Thursday posts and general positivity do a lot to help me reframe and try to look for the positive.

It has also helped me learn to look for the middle ground and find value in small things.

I definitely tend to be an all-or-nothing person, but reading The Frugal Girl has helped me learn to look for middle ground. If my meal plan doesn’t work out for some reason, I now realize there’s a lot of ground between whatever I had planned and going out to eat, like a frozen dinner, sandwiches, cereal, etc. It might not be as ideal as the plan, but it’s probably better than going out to eat.

Kristen’s approach has helped me develop what I think of as a Best, Better, Good system.

Some of her posts have talked about how cooking from scratch is likely to be the most frugal option (what I classify as Best), buying some pre-made things to mostly cook at home is still more frugal than eating out (what I classify as Better) and that if you’re going to eat out, there are ways to do it more frugally (what I classify as Good).

It’s a lot better than the Pass/Fail that I default to on my own. I feel the same way about the posts that have discussed saving money for an expense and how even if you don’t meet your savings goal, you’ll be better off than if you hadn’t tried at all.

I’m so much more likely to continue on with something when I feel like I’m succeeding, or at least getting closer to succeeding, than if I feel like a failure.

In one sentence, reading The Frugal Girl has taught me that it’s better to try and not quite make it than to just give up.

(Note from Kristen: Aww, this made me smile. I love, love, love that this is your big takeaway.)

What single action or decision has saved you the most money over your life?

Learning to be true to myself and my beliefs.

I hope I’m articulating this well and not in a way that sounds hokey or weird, but having grown up in a cult, it took me a long time to figure out what I truly believe and what’s important to me. I didn’t leave until I was in my early 20s, and there was a long process of learning what I truly believe and what’s important to me.

Fortunately, my sister left around the same time, and there’s a sort of loophole that our parents use to stay in some contact with us, but I lost all of my lifelong “friends” when I left.

When people found out I was marrying my husband, I received some extremely hateful phone calls and letters. Obviously, I ignored all of that and moved on with my life. And I’ve mostly accepted that there’s a strong likelihood that one day my parents will cut off all contact with me. I’ve gone through a lot of therapy to get to this point.

Once you deal with something like that, ignoring financial advice that just isn’t right for you becomes relatively easy in the grand scheme of things.

For example, a lot of people might think it’s terrible that my husband and I maintain separate bank accounts and each pay certain bills. Some people might say that’s a bad reflection on our marriage. We know it’s because our brains are wired so differently that it makes more sense. He’s a numbers person and a procrastinator, so he automates all of the bills he’s responsible for and can tell you his bank balance to the penny at any given time.

I, on the other hand, ignore the advice to automate everything. If I don’t take some action, my brain just doesn’t compute that the money is spent. Logging in and paying a bill online is enough to make my brain go, “Okay, that money is gone now.”

I also have to manually enter everything into a budgeting app and look at how much is there; otherwise, I have no idea when I’m getting close to maxing out in any given category. That goes against what a lot of people say is best, but we have no problem doing what works for us.

Also, when you’ve completely changed your life like that, you know you’re capable of big change, so changing your spending/saving habits isn’t as scary as it might be.

__________________

Danielle, thank you so much for your very thorough interview! And I appreciated all the cat pictures you sent; so cute.

I’m so sorry to hear that you grew up in a cult; that is so tough to recover from as an adult. My friend Carrie (the one that visited me recently) had a similar experience, so you might enjoy her blog and social media accounts.

I think it was so brave of you and your sister to leave; I know there is a high price to pay when you leave a group that does shunning.

But I am also so happy to see that you have built a new community around yourself with your neighbors. And I think your neighborhood group sounds a little like your very own Buy Nothing group. 🙂

Lastly, it made me really happy to hear that the realness of the WIS, WWA posts helps you out. That’s the whole reason I post them in retrospect; a menu plan post can be aspirational, but a WIS, WWA post has to be real.

Lee

Friday 1st of September 2023

I loved this one. I also thought I was an extreme introvert until I retired. Now I realize it was just that my work more than met my social needs.

Kristen

Saturday 2nd of September 2023

That's how I feel too. I'm an ambivert, but I can feel more like either an introvert or an extrovert depending on what's more prolific in my life at the moment: alone time or people time!

Michelle H

Friday 1st of September 2023

Danielle - thanks for sharing! I didn't grow up in a cult, but have similar experiences in a lot of other things you talked about (my parents are also the poster children for what not to do financially, but my dad looooooves to give me bad advice).

My husband and I kept separate accounts for the first several years of marriage because I grew up poor and had to know to the penny how much money was available at all times, while he rarely balanced his checkbook because he knew ballpark how much he had (and didn't write down ATM withdrawals!). Ironically he had never overdrawn his account while I had done it several times - go figure.

Anyway - childhood trauma affects us in unexpected ways as adults, and I also struggle with certain quirks related to money that my patient husband has learned to just roll with, because even if it's not logical to him, he knows its something I need in order to feel secure.

Sending hugs!

Vicki Frederick

Wednesday 30th of August 2023

Danielle, thanks so much for an inspiring story. I’m sad about the losses you experienced when you left the cult, but so glad you were able to leave, and especially grateful that you have your sister and your husband. I love your “best, better, good” view - because of course we don’t have to be perfect to do a good job at something. I admire your courage, and am really glad you have made such a nice life. All the best to you.

Caro

Sunday 27th of August 2023

Love this post. I have long held that perfectionism is the thief of joy, which is kind of similar to ''best, better, good'' vs '' pass/ fail.'' Quite often, something being 70% what you wanted it to be is completely good enough. Fretting over not *quite* perfection is a route to being dissatisfied, and for what? To have the inner strength and courage to leave a community - probably a very close one - to break free and live your own, chosen life is incredible. Everything you have written about how you live, what you do around holidays and for animals IS the description of a person living a good, kind and generous life, making things better in different ways for many people and animals.

Big inspiration!

Anita Isaac

Saturday 26th of August 2023

your post is so fab. was on vacation so i am late. but the pictures of your cats, everything really are so wonderful. am sorry your childhood was so precarious. but i am so glad you have a happy life now. when my dad passed i had to cut stepmom out of my life. she was only halfway nice to me when he was alive. it was so hard for me. but i had to do it. i did not find out she passed until 3 months afterwards. she left everything to charity when my dad's will had left everything to me after she passed. but the universe has been very kind to me.