Meet a Reader | Carrie, mom of 7!

I've never met Carrie in person, but we've moved in similar internet circles for quite some time, since we both blog (She blogs at CarrieWillard.com)

So, I was delighted when she volunteered to do a Meet a Reader interview.

Here's Carrie:

1. Tell us a little about yourself

I’m a homeschooling mom of 7 (with 3 graduates!) in a northwest Georgia suburb. I love reading, walking, and spending time outside.

2. How long have you been reading The Frugal Girl?

Since 2008! I’ve been a fan for ages.

3. How did you get interested in saving money?

I'm one of those people who was born frugal (I think I take after my Scottish grandmother). I remember always trying to buy the sale item when my mom took me shopping. At a young age, I was very aware of the connection between spending money and someone’s labor.

Being frugal has also made it possible for me to be a stay-at-home mom for many years, and I'm so grateful.

4. What single action or decision has saved you the most money over your life?

Cloth diapering and breastfeeding my 7 babies saved me thousands of dollars.

5. What's the "why" behind your money-saving efforts?

For much of my adult life, it was sheer necessity. But one of the beautiful things about frugality is that when the stuff hits the fan, and it eventually does in everyone’s life, frugality helps you weather the storm with more ease. The frugal muscles you built in more prosperous times serve you well in lean times when stress makes it harder to learn new things or create new habits.

Also, I've learned a lot from the FiRE community (financially independent, retired early).

Scott Riecken's book Playing With Fire encourages you to create a list of the top 10 things that make you happy on a weekly basis. Interestingly, most of the items that made the list require little or no money. Doing this exercise always makes me think!

6. What's your best frugal win?

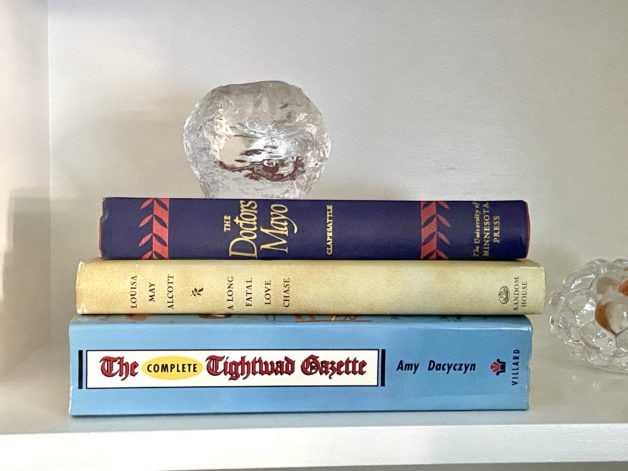

When I was just a teenager I read Amy Dacyczyn’s Tightwad Gazette books. She was my first frugal role model, and I never forgot her story and the principles from the books. I have my own copy of the trilogy now and I re-read it when I need inspiration.

Another powerful frugality habit I adopted is keeping a spending journal.

There is so much power in hand-writing things. It keeps me mindful of my choices. It also helps me make connections between spending that truly makes me happy (books, day trips with the kids, experiences) and spending that doesn’t (running through the drive-thru because I didn’t bring a snack or plan ahead for dinner).

7. What's a dumb money mistake you've made?

Not investing as soon as I began working! I drill into my children's heads that they must take advantage of the benefit of starting early when it comes to earning compound interest.

8. What's one thing you splurge on?

Experiences. I don’t eat out or buy expensive clothing, but I thought nothing of buying Coldplay, Smashing Pumpkins, and Jane’s Addiction tickets! Creating memories with my teenagers is priceless.

9. What's one thing you aren't remotely tempted to splurge on?

New home decor or clothing. Thrift stores have completely ruined me. I simply cannot pay retail for anything!

10. If $1000 was dropped into your lap today, what would you do with it?

I'd log in to my Vanguard account and buy VTSAX! Stocks are on sale at the moment (wink wink).

11. What's the easiest/hardest part of being frugal?

The easiest part is that my particular brain registers spending as painful. I do think some of us are “born this way”, giving us an advantage when it comes to saving money.

The hardest part is scratching my itch to travel. That will have to wait for when I no longer have kids at home, although I have taken several trips free courtesy of credit card flyer miles. I use a credit card to pay for everything, and pay it off weekly when I do my bookkeeping. I never pay interest, but I do enjoy freebies!

12. Is there anything unique about frugal living in your area?

Because of Georgia’s mild weather, we enjoy outdoor (free) entertainment nearly year-round. And yard sale season is from March-October!

13. What frugal tips have you tried and abandoned?

1) Making my own multiple cleaning products

It was ineffective and a waste of time. Now I clean everything in my house with a half teaspoon of original powdered Tide dissolved in a gallon of hot water. Nothing works better, and there are no plastic bottles to dispose of or to clutter up my house.

2) Couponing!

Couponing was a stressful, time-consuming task that took up too much of my bandwidth and made me grumpy. I was so happy to discover ALDI. Their prices are the lowest in my area and I love that shopping there reduces decision fatigue.

_________________

Carrie, I think I was born frugal too! And yep, I think that gives some of us an unfair advantage; it's like our brains are already programmed to always be thinking, "Hmm, how could I do this more cheaply?" I am always, always looking for a money-saving angle. 🙂

And as I said above, I too have the Tightwad Gazette trilogy! I bet a lot of us here do.

Hi Carrie, I agree that being frugal when you don’t have to really helps when you do. I always thought of it as a game. Then in an emergency paying my bills wasn’t the first thing I worried about.

@cc, I like the concept of thinking of frugality as a game:) I find it so fun and rewarding, but I am usually alone on that front. So many people I know say they just can't be bothered or that they have no interest in it. Mind boggling!!!

@cc, I agree with learning to be frugal before it's a necessity. Careful selection also makes it possible in good times to buy better quality, which lasts longer and performs better for the life of the item, AND prevents the need to replace!

@Vicki Skonieczny, not only do I find it fun but when you practice(at anything really)it gets easier. Plus I’ve found that a lot of frugal activities are not a bother because they are done automatically.

@Kristina, or not buy at all. Many times I’ve needed or just wanted something but waited to buy. Then I either found something else that worked or the wait made me rethink the need to acquire the item.

Reader of your blog. Glad to see you over here.

@Linda, what is her blog address?

@CathyW,

CarrieWillard.com

@Linda, thanks!

Glad to meet another reader! Carrie, any tips on how to manage higher education frugally for 7 kids? Not every kid is the same, so I'm sure it's not a one-size fits all solution.

@Kristina, I'm not Carrie, but I have 7 children. We are adopting the same higher education procedures as my in-law's had with their 13 children: if a child wants to go to college, he pays for it himself. If they wish to stay home and commute, room and board is free. If they don't go to college/training, they pay rent until they move out. Our oldest will be going away to college in the fall, and he has already earned more than what financial aid doesn't cover for his first year. I'm so proud of how hard he works.

I know that sounds tough, but we simply can't afford to pay for it.

@Jody S., I read an article about a teacher with a Master's degree now has 300K in student loans, including interest. Don't you think she wishes someone had made her be a little more realistic, or if they did, she would have listened? Your children will be evermore thankful for their situation after graduating with little to no student loans.

@Jennifer, I grew up in a family with four children and my mom didn't work and my dad was a police officer. So I had to pay for college myself and it was soul-destroying. I was sick all the time with stress and with never having enough money for anything, including food. At the time I resented my mother heartily for not working and for having too many children. Of course, I don't regret my siblings, but my terrible issues with college colored my desire to have no more than two kids and to ensure I could pay for their educations myself.

@Jody S.,

Mom of 5 here and this is our plan as well. We also live in GA and with Hope or Zell scholarships, school is affordable for our children I’d they choose to stay home.

@Jan, to piggyback on your scholarship comment--apply for many kinds of scholarships--including the ones with smaller amounts! And encourage your kids to do community service projects while in high school--that makes a big impression on the people who review scholarship applications. Many scholarships have very few applicants. Also, consider joining the National Guard. My son has a college friend who has done this and she gets $10,000/year for her tuition.

I would also add that AP classes and testing aren't always the bargain that you think they will be. If you have a student who knows where they want to go to college, it is worth checking out whether or not the credits will be accepted and count towards their general ed requirements.

Our local community college offers free tuition for 2 years for qualifying high school graduates (they have to have a 3.5 GPA). In our area (west Michigan), this is fairly common for community colleges. All to say .... there are options out there. Take heart!

@Jody S.,

We got four kids through college (the youngest just graduated last month). We told them at a young age that paying for college would be their responsibility; that there was no way we could afford it, especially for four. All worked through high school and saved (our oldest daughter saved enough to cover her room and board for the first year which was more than tuition and fees!), but they also knew they had to earn high grades and keep an ambitious schedule of extra-curricular activities in order to earn scholarships. Before they applied we researched with them the schools that offered the best financial aid, scholarships, etc. (turned out for us to mostly be private schools with large endowments) and all four earned generous scholarships that almost fully funded their educations at top tier private colleges. All four worked two jobs while they attended their college to help cover costs, and three of the four graduated without any debt. Our income wouldn't have covered even one year of those costs for one child, let alone two or three going at the same time.

For us the key was not expecting that things would just fall into place or having an attitude of "let's see what happens," but starting early with our kids and helping them create a plan for saving and figuring out what they needed to do to earn scholarships, etc. (and making back-up plans as well). We worked with them, but they put in all the effort to accomplished their goals. Our financial part of the equation was covering airfare to and from home while they were in school, and covering other fees like their phones and such.

BTW, if they had chosen not to go to college, or a traditional college, that would have been fine too, and we would have worked on a plan for that as well.

@Jody S., I’m in the same boat as you and we just simply cannot afford it either. We started out pre-children with investments and savings and such, and because of “life” happenings, we don’t have that cushion anymore. I was a stay at home mom for 9 years and have been working part time now for 5. For the people that have had no trouble saving and paying for their children’s college education, good for them! But for some of us it just probably won’t be feasible, and to shame us for it isn’t helpful as I’m willing to bet all of us wish we could.

@Rose,

I so feel you on this. I, too, came from a family with 4 kids, though both my mom and dad worked (they were horrible with money, especially my mom, who spent far beyond her means). I had to pay for college while living at home and commuting - nothing wrong with that, and I'm grateful they could offer me room and board for free; unfortunately, my parents lived far away from the university where I went to school. I wasted soooo much time driving back and forth, and public transportation was (still is) very poor in my area. I was constantly stressed, and made no friends because of my living situation (no one - and I mean NO ONE - lived as far away from campus as I did). Since we moved here right after I graduated from high school, I didn't have any friends close to home to hang out with, either.

All this to say - I realize college is about learning, and gaining that degree to hopefully get a good job once you graduate - but it was a very lonely time in my life. I don't want my son to have that same experience, which is why my husband and I started saving a college fund when he was a baby.

@Liz B., I'm sorry. It's painful. I didn't want to live at home and commute--I wanted to go to a "real" school and live in a dorm. And I did. I put myself through an Ivy. But it was unbelievably hard. My mom loves to brag about her smart, successful children while not having lifted a finger to help us get there.

@Melissa, Things like staying at home didn't happen for me because I wanted to ensure my kids' college was paid for. Everyone's allowed to make their own choices about what's best for the family, but please don't imply that hard work and sacrifices aren't involved for many of us paying for our kids' college. And don't shame me for my feelings either.

Wait, I'm confused. I've read back over this comment thread and I'm not picking up where anyone is shaming anyone else. What am I missing? Are we just talking about culture-wide shaming over choices?

@Kristina, There are many many ways to go to college, and it is more and more common t0day that students go part time, take time off between semesters, etc.

As Laura mentioned, private schools might have higher sticker prices, but they also have much more generous financial aid than public schools, so the costs might work out to be similar.

The National Center for Education Statistics has information in their "school search" section about costs and financial aid, as well as student body composition, graduation rates, etc. https://nces.ed.gov/globallocator/

This comment might be specific to people already enrolled: Tuition covers (probably, as an average) between 12 and 18 credits a semester for full-time students. Financial aid, athletic eligibility, being able to use on-campus housing, etc., require a minimum of 12 credits. More than 18 credits is an overload, costing more. Taking 15 each semester for eight semesters finishes a degree in four years. However, taking 18 credits or adding in a summer class or transferring in from a community college, if the classes are in the right place, means finishing early.

Taking more credits during a semester or working part- or full- time is very much individualized. If the student is stressed and not learning, the point of the education might be lost.

@Jody S., Sounds like excellent life training to me, and fair. Also a good incentive to do well in school, to qualify for scholarships and $$ awards. I am a retired college teacher and often saw students spending more energy on paying car loans than on studying; your plan sounds like a good way to help focus on long term priorities.

@Kristina,

My three children went to college as undergraduates using a combination of scholarship money, summer work and parental support. They all have gone on to graduate school and student loans have been necessary at times — although discouraged. I do what I can. Sometimes I’ll send a care package or transfer some extra money into one of the kids accounts. After having a least one child in college every year for 18 years, funds have severely dwindled.

There are so many options available for students besides debt and some have been mentioned here. The daughter of a dear friend is been sent to medical school by the US Navy. Others have worked for company’s with tuition reimbursement programs. Many states including Florida have generous scholarships for students that attend state schools as well as prepayment programs. School guidance counselors can be helpful to students seeking financial aid.

If you happen to have a daughter pursuing undergraduate or graduate studies or if you are a female and would like to return to school yourself, please look at https://www.peointernational.org

@Kris, The women's club I belong to gives out 3 $1,000 scholarships to local graduates of 3 local towns. There is a possibility that the graduating students may attend any of at least 9 or 10 area public or private high schools. This year we received 27 applications. There have been years that we have received fewer apps. Kids don't spend time or effort completing the app properly. Because our "mother" organization is based on volunteering, our application is based on volunteering.

@Kristina, I took some college courses at the local jr. college later in life--but for one reason or another I did not finish. Although a book I had to buy for a first course covered 3 courses, so I made sure I took all 3 courses. I took some evening and some early morning (before I went to my 40 hour job). At one point during an early morning course, the Prof. announced that some students should consider dropping the course at a point so that it would not be on their record. I wondered who was paying for the course that they could waste the money. It was an eye-opening experience.

One of my daughters chose her college based on the 4-year fully paid (minus R&B) scholarship they offered. She was fortunate to receive it and maintained the GPA required to keep it. Both of my children worked through college for her spending money.

@Jennifer, Thank you for the encouragement 🙂

@Jan, I do think it is affordable at community colleges around here. I think that will be the route of our second son.

@Laura, My oldest is going to a private 4-year college (far from home!), but I am fairly certain the next will go to community college. The next son is still 14, but I would not at all be surprised if he ends up at a trade school of some kind because he is both very inclined and very interested in mechanical things.

And our gift for this oldest for graduation was to pay for a little more than half of a year of a cell phone plan for him.

@Kristina, we made the decision out of necessity, but there have been side benefits. Right away, my son has had to make decisions about what is most important because he knows he has limited funds.

@JEG, you may want to consider making the scholarships available to homeschooled students also. There are so many local scholarships around us, but very, very few of them were available to homeschoolers. That was disappointing to me.

@Rose, yeah, that's what I see more of. Parents who don't plan well, so kid goes to college and is expected to pay for it. I've known people who's parents get the loan papers and sign their kid's name on the loans!

@Rose, opposite for me! I’m sorry you feel your soul was destroyed by having to pay for higher education. I felt empowered and independent and proud of myself. Actually, I probably learned more practical adult lessons from managing that than anything else. I have gratitude for it and have thanked my parents many times- AND, my daughters have thanked us for the same thing!

I found myself nodding along with you on so many of your frugal ways and am particularly excited to try your homemade cleaner. I too have tried several homemade cleaner recipes and the idea of just using one to clean my whole house sounds amazing. I noticed one reader said you have a blog. Care to share your blog's name so we can have another source of frugal wisdom?

@Barbara, it's CarrieWillard.com and thanks!

Great job raising seven kids with a frugal mindset. I've always felt it should be part of every child's education. But nothing teaches as well as example.

Hi Carrie,

First things first......your hair is GORGEOUS!!!!!! It just needed saying. I love that you use the same phrase as me: Decision fatigue. Does anyone else remember the days when there was only one Doritos flavor??? Or am I too old??? If someone in the house asked for Doritos, everybody knew what they were talking about:) I crave simplicity in any and all purchasing. I do have a question for you and this is partly, but not entirely because you are feeding a large brood in your household......I was wondering if you have a weekly/monthly meal rotation plan in place? And if you do, I was wondering if you would give a sneak peek into what a typical day of breakfasts, lunches and dinners looks like at your house and how you shop for all your ingredients. Do you make bulk batches of certain meals, eat the same things on repeat, freeze a lot and how often you make a grocery run, etc....I always find it interesting learning about how other people eat and prepare for meals or in some cases do not prepare:) Am I the only one with this weird fascination??? Please tell me I am not. Thanks Carrie. Have a great week.

@Vicki Skonieczny,

LOL - yes, Doritos used to only be what is now "taco flavor" 🙂

And I'm fascinated with how people meal plan and feed their families/households, too. I guess I'm always looking for new ideas on how to do it for my family.

@Liz B., Glad to have a kindred spirit in that fascination:)

@Vicki Skonieczny, Please do not tell my Doritos-loving child that there are more flavors of Doritos. Thank you. 😉

@Karen, HAHAHAHAHAHAHAH!!!!!!!!!!!! Secret is safe with me.....pinky swear:)

@Vicki Skonieczny, thanks so much! Dropping the dye was a huge positive for me! I'll answer your question in a post tomorrow, thanks for asking.

Nice to meet you, Carrie. I must agree with you on couponing. When my husband was in seminary, the seminary had a little grocery store and thrift store of donated items for the students' families. Students' families earned so many points for food by working a few hours a month. My job was to sort through donated coupons to get rid of expired ones. What a job! I probably have a few coupons tucked away somewhere that have no expiration date. I doubt stores would even take them or that the products even exist anymore! (Maybe if I can find them some day they can be sold as ephemera?)

I think we are quite similar-- 7 kids and homeschooling both! But you are a little further ahead; I've only graduated one child so far (yesterday!). Does it get easier to let go?

@Jody S., so far I've only let go of one, and he was going to live with good friends, and I got to see him a couple of times a week. My second oldest lives in a "barndominium" on my property, so he's a few steps away. I'll have to answer this again in a decade!

@Carrie, that sounds delightful. We live in Maryland, but my son's going to school in Minnesota! I'm fairly certain we will say "see ya later" in August and not get to see him in person again until December! I'm so, so thankful for technology today.

It’s wonderful to meet you. I think you are absolutely brilliant to pay your credit card bill weekly. For some reason, it has never occurred to me to do this. I imagine this really helps to keep spending on track. I will be adopting this practice.

Hi Carrie! I don't make cleaning products, either. Vinegar, water, and baking soda are pretty much it for me.

Please share with us a couple of non-obvious frugal tips, if you would. Most FG readers understand the basics and are looking for new ideas.

@WilliamB, I gleaned several nuggets of new info. Carrie is the only person I know who uses cloth diapers, pays off their credit card weekly, keeps a handwritten spending journal, and uses Tide and hot water to clean everything.

I was wondering if WilliamB meant that Carrie might be a good source for some out-of-the-box suggestions, having seven kids and all. Carrie, if you have any like that, feel free to throw 'em our way!

@WilliamB, I created a monthly budget worksheet and at the top in bold letters is the phrase "question everything". That means that I am constantly on the lookout for ways to lower my expenses and I never view anything as a "fixed" expense. Tips differ for the individual depending on the person's location, circumstances, time, etc. But principles are timeless! I share more tips on my blog including some of my trash picking finds. This was just a general "get to know you" post.

Carrie, I almost fell off the couch with your cleaning products solution. Seriously, does this really work on everything in the bathroom?

@Anne, yes it does! And I take no credit, I got the tip from GoCleanCo. They're a cleaning company based in Toronto, and I got my "recipe" from them. Worth a follow on Instagram! For disinfecting you can safely add a splash of bleach. I literally buy NO other cleaning products and this recipe is all I use.

Hi, Carrie, good to meet you!

I own the Tightwad Gazette books as individual books I, II and III, because they didn't have the combined trilogy when I started collecting them. I subscribed to the newsletter and ordered her third book straight from her so it is signed. She has a nice signature, as you would imagine a graphic designer would have. I re-read my copy every so often as well, and it always reminds me to think about what I'm doing.

I make my own simple cleaner but I do mine a little differently - all I use is SalSuds and water (or SalSuds, water and vinegar) except for my floors, which are laminate so I make a slightly different solution for them to keep them from clouding.

I've started hand writing my expenses recently. I always have my little book and a pencil with me. And I really like the idea to pay your credit card weekly. Like Bee, I think I will start that. After all, I can pay anytime online - it's up to me.

I’d like to know more about the cleaning solution. I’m picturing you going around the house cleaning with a bucket of solution. Do you fill spray bottles? Does the solution last or have to be used up that day?

Currently I use Simple Green diluted in spray bottles but I’d love to make something simple that can be stored in each bathroom, ready for use!

@Jenn, i was wondering the same thing!

I have the Tightwad Gazette in 3 separate books. My girl friend introduced me to her back in the late 90's early 2000's. I should re-read them as my husband is retired and no income as of right now. Yikes!

Hi Carrie, so great to learn more about you. And now we have your lovely face to go along with your name. While we share many frugal traits, our lives are quite different (and that's one of the many great things about this blog). Between us, we have 3.5 kids - ha! Thanks for sharing!

@MB in MN, I'd love to hear more about the "half" kid. 😀

@Anne, I should have been more clear (or omitted that part of the comment altogether)! Carrie has 7 kids and I have none.

Hi, Carrie! It's so lovely to meet you. I am a native north Georgia who has lived in Tennessee for going on 11 years. We have only one child, who is grown now, but we cloth diapered him. Disposables were a dime each for the cheapest back then and I just couldn't see throwing that money and waste into the landfill.

I use coupons only when super-convenient and applicable: our local grocery store sends us store coupons for items we routinely buy, and I don't make my own cleaning products. A few drops of Dawn detergent and a splash of bleach in a big bucket of hot water will clean pretty much anything. 🙂

@Ruby

I use Dawn and vinegar or bleach for everything too. My Mom always used powdered tide and hot water. She would make a bucket of it and get a scrub brush and use the bubbles to clean carpets and upholstery. I loved to help her bubble clean.

@Tiana, my husband is allergic to Tide, but I do like the idea of cleaning with just the bubbles. Back when we had carpets, I would spot clean them with a little bit of shaving cream foam.

@Ruby, I used disposables for my first child and felt so bad about all those diapers going into the landfill. I clothed diapered my 2nd child 32 years ago. It was no more problem then disposables.

And remember training pants?

My daughter is getting ready to potty train her first born and had no idea what I was talking about. Apparently they use pull ups now. More disposables, sigh.

@Ruby, I continue to surmise that you and I are from about the same neck of the woods. My father's people were from NW GA, and (as noted earlier) I grew up in the adjacent city in SE TN most famous for its choo-choo.

And, Carrie, are you closer to the city I mean, or to Atlanta?

Finally, yet another Tightwad Gazette fan here. As noted in my own Meet a Reader, I own a complete set of the newsletters, as well as The Complete TG volume. The newsletter set may be among the things I'll have to mention specifically in my will.

@Tiana, love this idea! My cat has asthma so I'll use powdered "free and clear" Tide to clean sofas, etc...great idea!

@A. Marie, we are indeed. I grew up in NW Georgia, about an hour south of your hometown famous for the choo choo song, where we live now. It's a small world.

@Ruby, Dawn is my other favorite product to keep around for frugal cleaning! I love your name btw, it's my middle child's name 🙂

@A. Marie, I'm in Kennesaw 🙂 But I was raised near the airport.

Hi Carrie, nice to meet you!

I, too, keep a spending journal. I think this is an important tool for anyone who wants to manage their spending.

I use an Excel spreadsheet - - - one for grocery expenses and one for everything else. I total my monthly expenses and average weekly, monthly, and yearly. This way I can easily see where my money is going and keep to a targeted budget.

Nice to meet you! I'd like to know more about your Tide cleaning solution also! Sounds very intriguing! BTW, Thrift stores have ruined me to "regular" clothing and home goods stores also. I simply CANNOT pay retail price for clothing anymore. The difference is SO great.

Wow! A March-October yard sale season sounds amazing!!

Loved this post. I only had the Complete Tightwad Gazette. I don't regret giving it to a friend who needed it more than I did. Did not even know there were two other books. Library here I come. You have so much to be proud of. Thanks for posting

Decision fatigue! Love that term! There’s just too many choices of so many things.

@SandyH, I SO agree! My kids often hear me say, "if Aldi doesn't have it, we don't need it" Ha!

Very nice to meet you!! I too love The Tightwad Gazette! And travel…my travel has been curtailed because we have been helping our kids with college for the last eight years. One more year to go and then I can refocus on saving for travel.

I hope you and yours have a great summer!

I hate to be so superficial, but your hair! It is gorgeous!!

Thank you for having the courage to be featured.

@Lindsey, thanks and you're so sweet! It's even more gray now than in the pic here! I wish I had stopped coloring it years ago

I also have a well-worn copy of the Tightwad Gazette. It was my original inspiration for trying frugal living!

I want to know more about cleaning with Tide? Do you mix it up & use it in a spray bottle? Pour it on the floor or bathtub? And does it keep well? Do you have to shake it every time it's used?

The questions are because I've tried many formulas with many pitfalls.

@Jenny Young, I totally get it! I'm answering in more detail tomorrow on my own blog 🙂

Carrie, how do you save on homeschool curriculum costs?

@Kristina, I've written a lot about this on my blog, so come on over for a visit! I love that now there are so many online resources that are free - such as KhanAcademy. The nice thing about having several kids is that curriculum is often a one-time investment for us, books are handed down to the next kid in line.

What a relief to hear that someone else thinks couponing can be a waste of time and energy.

But tell me more about using Tide as a cleaner. I know I'm trying to reduce the toxins in our house, and I always thought vinegar was the way to go??

XOOX

Jodie

http://www.jtouchofstyle.com

PS. We thrift all the time for clothes, and it does ruin us for retail stores!! In fact, we were complaining that our Goodwill prices seemed to have increased!! But we do have dollar days on Thursdays where one color tag means the item is only $1!! Score!!

I only have 2 children and my oldest went to a large Michigan college he was a resident dorm leader so he got free room and board which made a huge difference. We also applied for SO many scholarships even if small as they add up. We helped with basics and he was able to pay his debt off a year after he graduated. My second did not want to go to college and that was ok too. He has a good job too.

@Mar, I'm glad you said this! A lot more people are questioning the obligatory college path these days, or doing some "hackademia" instead. I'm glad of it, because college isn't for everyone, and the trades seem to really need more skilled people.

@Carrie, Two of my four children have college degrees. I consider all of them successful professionally. They would say that the barber-stylist of the group is the most successful. He went to barber school. Works 3 days a week doing high end hair for both men and women. Makes the most money of the 4 but, more importantly, loves his work the most. He discovered his niche at 15 and it’s still his niche at 34. College was a great fit for two of mine. Interesting that the two that didn’t go read the most widely and deeply.

Tide!! One of my best pandiddle discoveries!

Thanks for sharing Carrie! My question is for both you and Kristen and any other homeschooling high schoolers out there. My daughter will start high school this year. We are looking into different options for her to get either an accredited or unaccredited diploma through different programs that help keep track of credits and all. There's a lot of options and it can be overwhelming. What did ya'll do for your high schoolers?

I always have done my record-keeping through a homeschool umbrella group; I turn in the reports every year and they keep a high school record and produce a transcript for me.

I just tried the Tide cleaning solution, and WOW! I used it on the bathroom floor where there was a build-up of hairspray that I could never get off, even with a scrub brush! With this solution, I would say it is at least 89% better! Thank you! I am sure with each cleaning it will be 100% in no time.