Five Frugal Things | free Old Navy clothes, a rice waffle + more

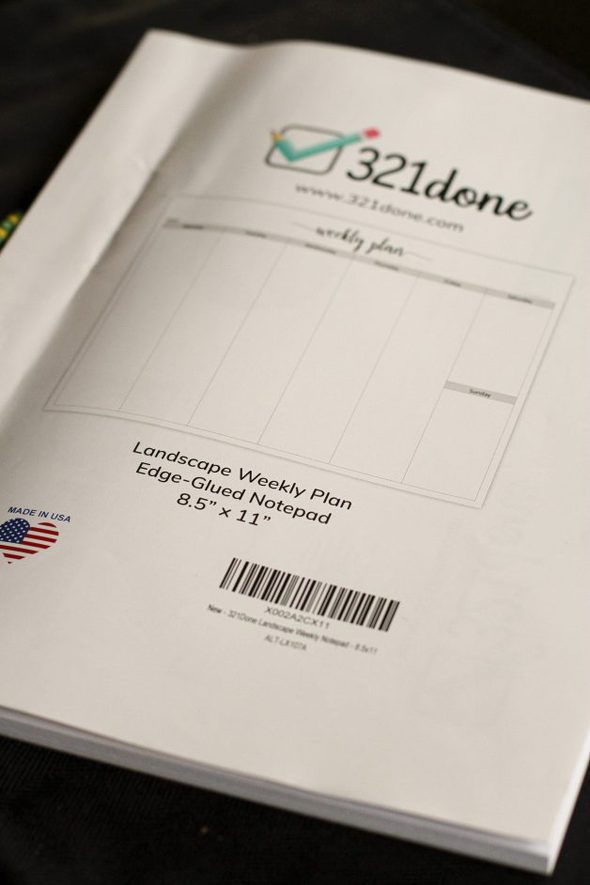

1. I bought an undated planner pad

You all know how I've struggled to find a planner that works with the weird way my brain sees the days of the week/hours of the day.

BlueSky used to make one that was perfect, but they discontinued it.

But I found this made-in-the-USA weekly planner pad on Amazon, and I ordered it.

Since it has no dates, if I skip a week, it's no big deal (skipping a week in a regular planner means that week is wasted).

I paid $14.99 and since it has 50 sheets, it should last me a year, as I'm bound to skip a week or two.

Note: Once I got my planner, I saw that 321Done is a small business, and if you go straight to their website, you can order directly.

Shipping is free with a $25 purchase, so once I use up this pad, I'll order two pads directly from 321Done. That way, they get to keep more of my purchase money than if I buy through Amazon, and I'll still get free shipping.

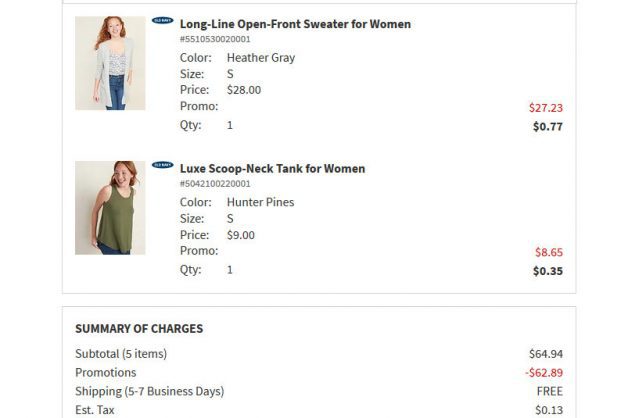

2. I used $50 of Old Navy credit

Remember how I'd taken advantage of their promotion in the last quarter of 2020?

Well, $50 of the $75 hit my account, and I used it to buy a sweater and a few other items.

(I have a long Old Navy sweater, but Lisey borrows it so much, it's basically hers now. So I thought I'd buy another one for myself.)

To maximize my savings, I:

- chose the free, slower shipping you get with a $50 purchase

- added a clearance pair of socks to meet the free shipping minimum (I was $2 away!)

- went through TopCashback and got $3 back on my purchase

My total after my gift card was $2.18, and considering that I got $3 back from TopCashback, this order was a little more than free.

Hopefully everything will fit! My order is obviously not here yet, since I chose the slow shipping.

Good thing I'm patient.

3. I used two rebate cards for groceries

I had an $80 prepaid rebate card from my contact lens purchase and a $50 rebate card from our stove purchase.

I find these cards to be a little annoying...I liked it better when they used to send checks.

But, I used both of these towards my grocery purchases, so they were basically as good as cash.

4. I got an Eddie Bauer tank top for just shipping

They emailed me a $10 coupon, so I looked at their women's clearance online, sorted by price, lowest to highest.

I found a $19.99 tank top, applied the 50% off coupon code, applied my $10 coupon, and paid for just shipping.

The shipping was $9.99, but I figured that's a pretty decent price for an Eddie Bauer tank top.

5. I made a rice waffle with leftover rice

We had some pretty old rice in the fridge, and I saw someone on Instagram use rice + a beaten egg to make a rice waffle.

So, I gave it a try!

The verdict:

- I should have added a little more salt

- My rice was really dry, so it was still a little hard once it was waffled. I should have used fresher rice or rehydrated this rice a bit first

I used one egg for ½ cup of rice, and that seemed to be pretty good proportions.

I'll probably try this again in the future, and I think I'll top it with a fried egg next time.

Your turn! What frugal things have you been up to lately?

P.S. If you want a traditional planner, TopCashback is offering $20 back on any planner from Staples to new TopCashback customers. Click here to see all the details.

Not so Frugal- We signed an agreement/contract to have our shower done.. We don't have the skill set to do this an overhaul job ourselves.. We don't have the time as we are a one full bathroom house with 5 people... so we got a few quotes (and nearly cried) and the last place we called we assumed would be the priciest ( national known company)...prices across the board were lower.. The salesman ended up being an old coworkers husband and he offered a few deals/found a rebate and we signed cause it needs done. Planned to pay with cash so took advantage of the pay in cash 10% off deal.. Put 1/3 down with the CC for the cash back. Will pay that off and use it to PIF at the end for more bonus!

Meal planned and straightened up freezer and pantry and only bought a handful of items at the store to get through the week...Still recovering from surgery and did not have the energy to deal with people at bigger stores... We will survive...

A friend brought a HUGE order of Chinese food for our family to enjoy ( get well fast supper) and so many leftovers!!! We ate them all reheated in lunch or supper!

Cashed in my Ibotta money and some Fetch rewards for a GC - I don't like to keep that stuff hanging too long in case the companies would shut down! (Don't like to lose my hard shopped efforts!)

Found Stimulus money in my checking account and moved it to savings immediately! ( for shower payments)

Hubby is off this week, so there is a list of chores for him to do. Hopefully all will get accomplished with minimum amount of out of pocket.

Looked at my new-to-me car warranty and it turns out, it's still covered. And we've been having a problem with the ignition switch. We took it in yesterday and the guy at the shop kinda looked at us like we had lobsters coming out of our ears. Until the issue happened to him! We'll pick it up today, free of charge, of course.

Been working on eating at home all week. Still working on the pantRy challenge and working thru all the food in the pantry and freezer. Husband is not too happy about that.

Saving all my single dollars over $5.00 or $10.00 and putting them in a jar. We'll see what I get at the end of the month and maybe move this to the end of the year.

Been deleting all the enticing ads on FB and Instagram for the items I want to purchase -- you all know the ads that make you want to impulse buy. Well I figure if I just keep removing them, I won't see them and won't be enticed to buying things I don't really need. It's helping a little!

1- repaired a hole in hubby's jeans and a pullover he likes. I'm no seamstress but they both will get more wearing now. 2- made a pantry and freezer list to use up and went through fave cookbooks and came up w about 20 recipes to use those ingredients and try new recipes. 3- first new recipe was Red Curry Thai Beef from our NYE roast. I didn't have peppers so used carrots, didn't have snow peas so used frozen peas. It's an adaptable recipe and worked out just fine 4- meals planned for next 2 weeks. I rarely follow it exactly but nice to have a starting point. 5- returned 2 gifts for refund that didn't work out and I didn't need

Initially I read this to read that you were still working on your panty challenge. Best laugh of the day so far!

All the talk of shopping in this post reminded me I needed to send back a pair of running shoes I ordered that fit funny. Getting back that money will be frugal (running shoes always hit the bank hard, yikes), although I do have to pay a $6 pick-up charge for UPS to come get them because it was a third-party seller. I don't have the option of going to a UPS store or anything, though. That would be a 300-mile roundtrip. Six dollars is a bargain compared to that. 🙂

One more frugal thing: One of our hens drownded in the horse water. A particular bummer as she was just beginning to lay for the year. Murphy's Law that it wasn't one of the extraneous roosters we were planning on dispatching soon anyway. But there is always a silver lining to every dark cloud! In this case, a couple of gallons of chicken stock, which is absolutely the best part about cooking a home chicken. (The meat on this one not so much, as she was a fairly old hen.)

So sorry to hear about your hen!

And yes, a $6 pickup charge is totally worth it in your case.

We are able to hand a box to our UPS driver or leave it in a location where someone else can hand it to the driver (school, gas station, store). It works as though that driver is a UPS store. Try that and maybe save your six bucks. 🙂

--Thanks to some Googling and YouTube tutorials, I was able to correctly diagnose the cause of our running toilet. The washer inside the fill valve was worn out, and I was able to buy just the washer for $4 instead of a whole new fill valve for $15. I kept the receipt and had assurances from the hardware store that I could still return the washer even after I'd opened it, should we actually need a whole new fill valve. Happily, the washer was all it took!

--I always check the mistinted/returned paint section when at the hardware store. This time I was delighted to find a $3 pint of exterior paint that is the **exact** weird shade of our house. There's some paint marker graffiti tucked in weird places (think rear door jambs, porch nooks and crannies) from before we moved here, and I look forward to finally covering it up this spring.

--A friend needed to pack a piece of artwork for shipping. I was able to provide both the requested advice (I ship delicate items often) and free boxes from my recycled shipping stash. It arrived safely at its destination, so yay all around!

--Another friend graciously gifted me a gorgeous second-hand frame for Christmas (they know my thrifty ways), and it's the perfect size and match for yet another friend's present. Seeing both together on the wall is a delight!

--Stimulus monies are safely tucked away. We're fortunate to not need it immediately but, with an elderly cat, an even older car, and life in general, it's bound to be a source of relief later!

A toilet is a relatively simple device and one that an amateur can easily repair themselves (in most cases.) Congrats on getting over the ick factor and saving a bundle! Plumbers are some of the most expensive people to let inside your house.

Thanks! We rent "our" house actually, but we genuinely adore our landlord and try to save him hassle and money when we're able. If the solution to a given problem is under $50 (most, like the toilet washer, are well below) and a YouTube tutorial away, we're game! This also means that on the rare occasions we call about something needing fixed--like when I noticed the water heater leaking a few years ago--our landlord knows it's serious and is on it right away.

"Waffled it" I love that you made waffle a verb!

1. Proud to say that this is the first Christmas that I haven't used credit cards! It looked different but man does it feel good!

2. Our state was on a semi lock down during the holidays, so we weren't really able to go anywhere or go out to eat. Saved us a ton! But we did get somewhat bored.

3. Just unplugged the outdoor Christmas lights. They turned on automatically and I kept forgetting, so now we are done with that part of our electricity bill.

4. Mended a few of my son's clothes. I have no clue how he manages to wreck his clothes that way he does. Thankfully he doesn't care "yet" about a weird seam in the middle of his shirt!

5. My children were encouraged by their cousin to clean out their clothes and donate what they do not wear. (There are days I don't know who these kids are!)

Congrats on that no-credit-card accomplishment. Yay!!

1. I got a free streaming device from Xfinity which is included with my $25 monthly internet service. It includes free use of Peacock which I have been thoroughly enjoying.

2. Target's Christmas section was 90% off yesterday. I picked up 4 small bottles of cranberry hand sanitizer. They were reduced to 15 cents each, but I had 51 cents in Target Circle earnings which brought my total out-of-pocket cost to just 10 cents for the 4 bottles.

3. I am eating from my pantry and freezer and hoping to buy only fruit and milk this month.

4. My library has shut down again sadly but is still doing curbside pickup. My daughter sent me a link to a site where you can enter an author's name and find similar authors. I requested 4 books this way and will pick them up today.

5. I was able to get a much needed new purse at JC Penney using a sale, 25% off coupon and a gift card. No out-of-pocket expense and $2.79 left on the card.

Can you post the link for the authors? Thanks in advance and thank you daughter.

I use fantasticfiction.com every day. It tells you all books by an author, new books coming out, series titles, books by genre, and suggests other books enjoyed by an author. I keep a running list so that I can request books from the library.

That's the one!

1. Week after Christmas is one where we do minimal cooking and grocery shopping, eating up leftovers from the traditional dinner we make on Christmas Eve. No exception this year. We had leftover meals until Boxing Day, and stretched out Christmas ingredients and leftovers into new meals as long as we could after.

2. As Christmas presents to friends and neighbors, made a nice bouquet of herbs from our garden.

3. Made sure I got a refund for a Christmas present that was malfunctioning.

4. Three out of four of us got home hair cuts (the fourth being me, hah)

5. Did a huge cleanup and decluttering effort on our days off from work around the holidays. Yay. I always count this as frugal as I have a better idea of what resources we have at home or what I can donate/sell before shopping for new things.

I have wasted several of those rebate cards because I just forgot to use them, I finally discovered this hack that I'm sure other people have already thought of: I use the rebate card to buy an amazon gift card, then I just use the credit whenever I buy something on amazon, which is more often than not.

Oh this is a good idea!

Thanks for the tip. I, too, struggle with rebate cards.

It is so easy to forget about them, whereas I would never forget about a check. The Amazon idea is a good one.

Oh!!! Thanks so much for this idea! I just did this now too with a card I had laying around waiting for the right time to be used! This makes me so happy!

Use those generic gift cards to buy gift cards for specific stores such as grocery, target etc (where you were going to use it anyways). those usually don’t expire and buy from a source that offers points or discounts, like our grocery store offers bonus points to be used for gas on gift card purchases or various websites.

That's a good idea!

1.) Almost added a Blu-ray to my wishlist before I noticed the series was on Amazon Prime to stream. I do like to own physical media for some shows but I don't need to own all of them.

2.) Methodically going through all of the snacks, crackers and ingredients we have open before being allowed to open or purchase new ones (e.g. kid wants saltines? Well we have Ritz open so eat those first.) I find often that things get forgotten and then get stale and it's better to just eat them up or find recipes that use them.

3.) FT on behalf of the wife. My wife needed thread for her sewing and I stumbled across a supplier of much larger spools for less than the cost of the smaller ones at Joann so she placed a nice order there.

4.) Did a freezer inventory and calculated that outside of buying milk, eggs and produce we should be able to survive without shopping for the next few weeks. My wife went to the grocery store this weekend and declared that the thing she looks forward to most post-Covid is that someday grocery shopping will hopefully not be so stressful and awful.

5.) My wife found me an old binder that she wasn't using and that will be my new recipe book. Basically this year I'm planning on getting a lot of my recipes in order. I find that a lot of things I make with a recipe require looking it up online (and hoping it's still there.) I'm an analog kind of guy so I am copying them to a Word doc, removing all pictures and superfluous workding and printing them out to put in a binder. So we'll see how this system works out for me.

Battra92, I do this....except I buy plastic sleeve protectors in bulk (I use them for other things as well). That way, my recipes don't get splattered or smudged.

1. Kept myself accountable by entering a few expenses in my EveryDollar budget. Usually the end of the month I lag off on entering receipts. I Also did a few surveys on the receipts in the hopes of winning some cash. One awarded me a free dessert.

2. Began reading The Complete Tightwad Gazette (checked out from the library) which while reading the intro made me get up and turn the dining room light off my daughter had left on, went downstairs and turned the hot water heater to the next setting and while down there grabbed a few grocery items to bring upstairs that needed to get used.

3. Spent time on Sunday finishing December’s budget entries and congratulated myself on reducing and/or not using several of the line items allotted funds for the month. Paid January upcoming bills online and updated my budget.

4. Went to discount tire to have my left front wheel looked at that has been losing air they fixed it for free. Unfortunately they told me all of my tires have dry rot and need to be replaced. Additionally, they said the rims were rusted and were causing the loss of the air in the tires and should be replaced.

5. Stimulus money was in my bank account yesterday- guess how I am going to spend it? New tires and rims, helping the economy that’s me! Will price it out online to find the best deal.

We spent our first stimulus check on braces. Equally as exiting as tires!

1. I'm currently trying to talk my husband out of a new toilet, because he wants better flushing. Ours does still flush! He put one in for my Mom & Dad and I do believe he's jealous of their flush. Let's see who wins this battle. 2. I'm consistently not shopping for unneeded new clothes this season. I have plenty, I just repeat this to myself. I have plenty. 3. I'm trying to get better about food waste. I just threw away a moldy head of cauliflower. I did use some very wilted celery in a soup. I'm getting there. 4. I'm encouraging my Mom to seek a natural remedy for a health problem vs. expensive prescriptions. I'm not getting very far, but I'm trying. They live on a fixed income. 5. I didn't look at Christmas clearance items last night at Wal-Mart, because I know I don't need anything. 75% off was so tempting! I refrained.

Kristen, once you use your new planner a few months and decide it's truly "the one," go ahead and buy a couple more, just in case 321 discontinues that one like Blue Sky did. It's not like they'll go bad. 🙂

My FFT:

1. 2021 is the year of no silly spending. I packed coffee and a thermos jar of oatmeal for my post-cholesterol test breakfast this morning instead of getting breakfast out like I usually do after getting blood drawn. This did turn into something of a comedy of errors as the coffee leaked all over my coat and purse, both of which are washable, but hey, I did not spend!

2. Mended some sweats and a pair of sleep shorts for my son. Am also mending a tattered quilt for a friend. It's a pretty quilt and not worn out, but whoever made is used such tiny seam allowances that the pieces of the blocks came apart fairly quickly. Lots of machine stitching is required.

3. Saved the trimmed-off sections from a too-large foam mattress pad to plump up the cushions in our old Morris chair. This postpones having to have new cushions cut for the chair until the year of no silly spending is over.

4. Did a tiny and inexpensive home improvement project: One of our lower kitchen cabinets is very deep and very dark and we've been complaining about not being able to see stuff in there for going on nine years. For $25, we put two battery-operated, motion-activated light bars in there, with the third bar in the package going into our dark-as-a-tomb coat closet. It's so funny to hear family members open the cabinet or the closet and exclaim, "I can see in here!"

5. Did some organizing and redecorating by moving around things we already had. Things look fresh again and free is good.

That's a very good point; one can stock up on undated planners!

I wish they would send checks instead of gift cards, too, but it is what it is.

1. I received a $10 gift card from my insurance company for something I'm sure I did to earn it, but have forgotten what that was. This can only be used for doctors, medical facilities or medical supplies, but I have a few appointments coming up, so no problem there.

2. I was gifted a food saver for Christmas, and I am using it!

3. A strand of my LED lights didn't work when I was putting up lights outside. I fought the fuse compartment door and teeny-tiny fuses, replacing the old ones with the new ones that came in the box with the lights, and the lights work again (for next year).

4. A member of my family wanted to try Misfits Market. I sent her the code from my account, so she and I will both get a discount on her first and my next box.

5. The floodlights on one side of my house finally burned out. I replaced the two100 watt bulbs with LED floodlights. I bought the two of them for less than one 60 watt-equivalent indoor LED bulb cost when they first hit the market. I have them in almost every fixture in the house now, and it makes a difference in our bill. Also, I got notice that our energy provider (we have no choice on provider) is dropping our per-kilowatt cost by 2.9% this year. That's a first.

1. Last night while I was making dinner I realized that I was out of breadcrumbs. So I pulled out all of the bread ends and miscellaneous bread that I throw in there so it doesn't go to waste and I made breadcrumbs. Plus I had kind of a lot of bread in there (oops) so I also made a french toast bake for my kids to have for breakfast this morning.

2. My Misfits box was pretty disappointing last week, with a lot of my produce showing up bruised or broken. I emailed the company and they gave me a credit worth 25% off my next box.

3. I saved said broken and bruised Misfits produce by making cinnamon apples, then applesauce. I realized that I didn't have an actual plan for my poblano peppers so I cut and froze them, and any pieces that were really not salvageable I put in the compost pile.

4. Slight frugal fail, I tried a new recipe for fried cabbage to use up the rest of the cabbage I had. It seems like we can never eat more than half a cabbage at a time. We did all eat the fried cabbage the first night, but we agreed that it wasn't really our thing and tossed the rest.

5. Another partial win, I bought a lot of clothes for myself for $30. The description excited me, but the pictures were a jumble. I got home and I'll keep maybe half of the items and pass the rest along either via selling on FB or donating to a local clothing closet. In the end though, I'll be keeping a lot more than $30 worth of clothes so it's not a total loss.

Re: working through a cabbage, our favorite recipes are cumin lime coleslaw and blackened cabbage, both from Budget Bytes. The whole website is a fantastic resource.

https://www.budgetbytes.com/cumin-lime-coleslaw/

https://www.budgetbytes.com/blackened-cabbage-chipotle-mayo/

Shredded cabbage is also an excellent addition to stir fry.

https://www.wellplated.com/cabbage-stir-fry/

Or salad greens! I especially like VERY thinly sliced cabbage mixed in with very thinly sliced kale.

1. Convinced my husband that our fourth grader didn't need a super amped up replacement for her laptop that finally died after 7+ years. He takes care of all our tech needs but sometimes he and I see "needs" differently. We bought her a nicely priced, solid machine that she loves.

2. I took apart and cleaned our vacuum cleaner. Based on the amount of gunk that had built up, I feel like I saved us from having to buy a new machine sooner or at the very least, a trip to the repair shop. I'm not so good with maintaining things so I'm kinda proud.

3. I am doing well using up the food that we buy. Made some chili with ingredients I had in my cupboards and freezer and thoroughly enjoyed it.

4. We didn't have work, Christmas and NYE parties to go to this year, which cut back on the number of presents we bought. We did do a New Year's zoom get together with some friends and won a game that had an Amazon gift card as a prize.

5. I've been clearing out clothes from all of our closets but haven't bought unnecessary replacements. Since we don't go out for school or work, we need less clothes and they last longer. If anything, I have a feeling that my kids might outgrow their shoes faster than they out-use them. Now I just need to reinforce to my kids that wearing a sweatshirt for an hour doesn't mean it needs to go into the dirty laundry basket.

Hope your next rice waffle comes out better. What a cool idea.

1. Used reward dollars to get some Mandolarian Child gifts. The Child is a huge favorite. I think Grogu is cute too.

2. Bought earmuffs at Thredup used cash from sales, promotional coupon and Thredup rewards.

3. A blow up Santa died. The fan failed. I cut the fan from the lights, electrical taped the wire ends and placed in into an outdoor lantern I already had. I cut the sand bag weights out of the Santa and used them to stabilize the lantern. Now I have a light up lantern.

4. Redeemed a swagbucks gift card.

5. Continued decluttering. Donated clothes to goodwill to make room for Christmas gifts that came in.

Decluttering is frugal as:

a. It lets me know what I have. I don't waste money buying something I already have.

b. Keeps the density of walkways, stairways in the house low which prevents trip hazards.

c. Prevents believing I 'need' a bigger house or the dreaded storage unit.

these are really creative!

My 5:

1. Promptly returned/exchanged most misfit xmas gifts. I still have 2 stores to hit that were too crowded last week.

2. Still cooking at home.

3. Scheduled follow medical visits. Early care is better for our health/wallet than delaying.

4. Gifted my daughter some slippers I was given and never wore because there wasn’t enough arch support. She is using them so her feet are warmer and we aren’t turning up the heat. Saved me a purchase for new slippers for her.

5. Reimbursed ourselves my daughters rent payments from 529 plan and then re-contributed it back so we get the tax benefit of the contribution and still have enough funds to cover next Fall’s tuition. This is all a shell game just to ease our state income tax hit.

Everyone is so inspirational! My 5 are: I forced myself to not go into any store right after Christmas so did not buy ANY clearance items. 2. Started an accountability notebook to write down all my purchases and/or keep receipts. 3. The humidity our house is super low even with running a humidifier all day so have started making a point of hanging laundry on a laundry rack until almost dry and throwing in the dryer for 5-10 minutes. 4. Trying to only go to store once every 2 weeks and i have always froze milk but couldn't figure out the fresh fruit and veg situation but saw a comment from someone saying to eat all the super perishables first like bananas etc.. and save all the heartier stuff like apples , oranges etc.. for last..

Duhhhhh.! Gonna try it. 5. Talked the hub into opening another seperate savings account named Health Fund for glasses, dental, veterinary care etc and will be putting money in every month. He is opposite of frugal so it was a big win for me! Ps...I also have been trying to eat more cabbage and found a great recipe for craisin, apple, pecan slaw on Pinterest and my hub a tually likes it!

Hard to be frugal this week. I traveled over the holidays; I didn't actually interact with anyone but my home state rightfully doesn't trust that everyone will tell the truth, so I need to quarantine till I get tested. Which means doing online shopping from a regular supermarket, no coupons and no cheap stores.

While I was gone I turned the heat way down, put a few lights on a timer, put out home-made and home-decorated cookies for the delivery people, and a neighbor fed the fish. I successfully kept the sweet peppers edible while I was gone, but putting in a bag with a damp paper towel.

I will try that waffling - I have leftover quinoa and also tomato sauce (home canned by my nephew as a gift) to eat. Or maybe just waffles, as I also have have a jar of pear sauce from the same source.

Over vacation, I continued dealing with my insurance company EOBs and crud. Still the bane of my existence but it is frugal. Among other things, checked that all the covid tests were free of charge.

Continuing to eat out of the freezer.

WilliamB, I had to have a COVID test prior to having surgery - my insurance only covered a portion of it. I paid $100+ after insurance.

That doesn't sound right, unless you don't have a comprehensive plan. Unless those are copays and such? Most insurance companies are waiving those:

The Families First Coronavirus Response Act requires insurance companies to cover all medically-necessary covid tests, and the CARES act requires them to cover antibody tests. Pre-surgery sure seems like it should count.

https://www.npr.org/sections/health-shots/2020/06/19/880543755/insurers-may-only-pay-for-coronavirus-tests-when-theyre-medically-necessary

'The guidance from the Centers for Medicare and Medicaid Services says full coverage is required "when medically appropriate for the individual, as determined by the individual's attending health care provider in accordance with accepted standards of current medical practice." '

https://www.cbsnews.com/news/coronavirus-health-insurance-cover-covid-19-testing-treatment/

"Comprehensive health plans are individual, employer-sponsored or exchange plans that meet the coverage requirements spelled out in the Affordable Care Act. If you're insured by a short-term plan or another plan that isn't ACA-compliant, your insurer may not cover the costs associated with your test."

"Dozens of insurers, including Aetna, Cigna and Humana, have waived co-payments, co-insurance and deductibles for all COVID-19 treatments. That includes hospital stays, according to America's Health Insurance Plans, an industry trade group. In most cases, these waivers apply only to in-network care."

I hope your surgery went well and that you are recovering quickly.

Hmmmm, I may need to follow up with my insurance company! I didn't think it seemed right, either....I couldn't have the surgery without taking the test, therefore it's medically necessary.

Thanks, WilliamB. Fortunately, my surgery went very well, and I'm on the mend.

Happy New Year!

1. Our entertainment for New Year's was banging a pan out the back door and having a bonfire where we burned the old calendar. It's a tradition we started years ago but it was really satisfying this year. And it was free!!

2. Opened new bottles of vitamins that were purchased for free with money allotted by our Medicare Plan B.

3. My husband pulled out the Cricut he bought at Goodwill years ago. He's making snowflakes for me to hang and will also do lettering for a winter sign I want to make. The snowflakes are just cardstock bought in a large 2.00 pack and the vinyl is some he purchased years ago from someone online. I love free decor. Now I just have to go to the garage and pick out a skinny birch branch from our a neighbor's tree for the snowflakes.

4. Eating from the fridge and pantry like everyone else. I have a large amount of meat that I think may last through the winter, hopefully, until stores are safer.

5. I broke down and ordered a marked down download from etsy. I've been looking for a couple years for a particular scripture on a canvas or wood without success. This can just be printed off and I think I have three frames that will work. If not, it's a standard size frame. Having our home look nice is important to me but it doesn't have to cost a fortune. I like supporting women owned business but don't have many opportunities especially during a pandemic.

Stay safe, everyone!

1. My first is also related to my planner but from a different angle. Last year I gushed over Aldi's $8 planners. Columns. Beautiful. Hard cover. It had it all. I was looking forward to this year's planners and when they came out... they changed the layout of the pages!! ROWS. Ugh. But since I would have to dip into my Christmas money to buy a more expensive planner (in a layout I prefer) and I'm saving that money for curtains, I decided to suck it up for this year and go with the $8 Aldi planner. I've added columns to the days this week. Maybe I'll adapt. Maybe next year I'll save up for a different kind of planner. Who knows. But for now, I'm trying to be flexible and make the best of the choice I've made.

2. I made banana chocolate chip granola bars this morning. It used up some bananas with brown, spotty peels and also helps with our lack of snacks problem.

3. My husband needed a get well card, so I went to Hobby Lobby and bought one with my 40% off coupon. I love that those coupons can be used on greeting cards! While we were there, I almost impulse-bought some masks, but took the time to really think it through and decided that I have enough right now. Saying no to unnecessary purchases is definitely a frugal win.

4. I took soup out of the freezer for tonight's dinner. Feels kind of like a free dinner.

5. I'm making some pretty fancy coffee drinks at home. While I'm still using inexpensive coffee and creamer, I asked for a milk frother for Christmas and it makes my drinks so fancy! Adding the frothy milk really makes a big difference and I'm loving the inexpensive luxury of it.

It is so annoying when they change a planner design that you love!

I bought a planner and organizer from Dollar General and I made myself a spreadsheet to track all my expenses for the year. About a month in I usually get lazy about household receipts, but I have made it easy to input as I go, and I'm determined to keep up with it. I know if I examine my expenses I will be able to reduce what I'm spending.

Excellus made a change and now the dentist can bill them directly and I no longer have to pay the entire bill and wait for reimbursement.

I ordered a bunch of work pants at 70% off from a going out of business sale.

I have a few frugal saves....

1. Had some apples I kept cool in our uninsulated garage. I cooked them all down in the crockpot and made homemade applesauce which I then froze in containers to go as sides with meals.

2. We had an unopened bag plus a bag with 1/3 left in it of chicken wings that we won't eat as chicken wings. I put those in crockpot and pulled all chicken meat from them and froze for chicken and biscuits or a casserole. The broth I saved for soup.

3. I returned a few baking items I didn't end up using on holiday baking and got $20.49 credit back.

4. Had lots of leftovers of holiday food that I used in two more dinners and quite a few lunches. Trying to prevent food waste.

5. Returned some broccoli that clerk had rang up as organic broccoli for $4.99/pound. I had bought the regular broccoli at $2.99/pound. I wasn't aware the store had a policy that if something rings up incorrectly you get refunded 100% and get the item for free. I was willing to pay the difference for what i originally intended on purchasing, so I was happy with this as well saving $6.39.

6. Oldest daughter needed her car's oil changed. She bought her car used in May which my husband changed her oil when it needed it. I called the dealership as I remembered she may have cheap oil changes there. She had a free "first" oil change there, so I scheduled her an appointment saving her $ and my husband time.

I used my $10 reward to get a Tall long sleeve shirt for $2 out-of-pocket. I am a rewards member and get free shipping. I used $5 Kohls cash that randomly came to my email (I don't shop at Kohls) to get a hand towel for $1.80 out-of-pocket. I needed both of these items, so was very pleased to get them so cheaply.

I grocery shopped and had a great tidy in the fridge. That feels so good. The only waste was some cranberry sauce. Not bad for the amount of cooking that we've been doing.

I've backed up photos from my phone and deleted over 1000 pictures. It makes me want to accumulate less.

We bought new wire shelves to use as a garage pantry. When we put those up it freed up a small white bookshelf that our daughter had used at college. This went beside other white bookcases in our living room (EXTREMELY needed space!) and meant that we do not have to buy shelves that we were looking at. I also have a beautiful set of counter height bar stools, solid wood, that were a birthday gift in our last house. We have no counter bar here and so we were storing the stools in the garage. I brought 2 in, one is being used as a moveable side table or extra shelf in the living room. One is in the guest bathroom and it provides a needed surface for guest toiletry bags. I LOVE using what I have!

I am working on my compost pile today, and planting some cover crops. I bought cover crop seed at the farm supply for a couple dollars. More than I will need this year. We are in our very short rainy season and I want to take advantage of that! Improving our clay soil in the garden will hopefully make my food crops more productive. This saves a lot of money.

Since New Years Day, the week has just been the usual of checking for coupons before buying (rare, since we usually buy generics), using the library for books and puzzles, using Ibotta and Receipt Hog, doing Swagbucks on the nights we watch TV, sold a bunch of unused yarn that I have collected, and doing a mystery shop. It seems like very little but then I closed out our spreadsheet for 2020. I have mentioned before that my husband and I keep a daily record of every single penny we use and save; it takes about 10 minutes at the end of the day and we have been doing it since 2000 so now it is just routine. Anyway, we have a category called Freebies, where we put down how much we save on coupons, coins found on the ground, earning on shops, savings using the library and so on. In 2020, small things like the ones I did the past week came to $6085.17! That is $117.02 a week that added up over the year to a pretty large amount. It was what spurred me to do a fast food shop this morning while out picking up some medication. Took me 20 minutes and I got a burger for lunch and $12 out of it, which would be a total of $16.50 because of the free burger. That, the library savings, the $40 I earned from selling unused yarn all go into Freebies for 2021. It is very motivating for me to see that a few minutes of effort ends up paying off over the long haul.

I would love to know your other spreadsheet categories.

Love, love, love the idea of that spreadsheet!!

Happy New Year, Kristen & to all of the Frugal Girl readers! Let's hope 2021 is filled with optimism, after the challenges of 2020.

1) We used up so many holiday leftovers. SO many! Everything minus some fancy cheese & meat is now all used up. I used the last of the veggies today in a final salad, but got great use out of all of the ingredients. Woohoo!

2) Trying a monthly menu instead of weekly, to get on top of our planning, save time, balance eating from the freezer/fresh & handle food preferences/ allergies in my family. Fingers crossed this is more effective than our current strategy.

3) My 13 year old tried out Hello Fresh a few times & really liked it. It's perfect for a beginner, but $$ and not great on environmental impact (lots of small packages). We're starting an allowance for the kids in 2021, and one of his chores is to make one meal a week from a recipe. He made a delicious beef stir fry this week, using a regular old online recipe (Budget Bytes). I did help by gathering the ingredients & walking him through the substitutions (I almost always make subs), but the rest he handled himself. This will be a good cost saver, but also continue to develop his culinary skills.

4) Sold a pair of outgrown ski boots, a book & a cake stand this week. Made just over $75, and junk out of the house.

5) Picked the last of the tomatoes & jalapenos. The tomatoes can hopefully ripen on the window, and I'm going to pickle the jalapenos. (The end of the season variety are quite spicy when eaten on their own!)

We also tried Hello Fresh for a short while, and it was helpful in that it kick-started two teenage boys interest in cooking during Covid, but we also found it less than environmentally friendly, and not all that thrifty. As an experiment we did a comparison of what the ingredients (same amounts) would cost from the grocery store. We also found that their meals for four were often not quite enough for four when it included two teenage boys! My boys were able to find several recipe cards from several meal kits posted online, as well as recipes from other sites ( allrecipes and epicurious) and have each taken one night a week to do a meal- they have a budget, and have to have any non pantry items on grocery list several days ahead of time

1. I cancelled my Netflix subscription as I have been watching videos on YouTube which is free and still casts to the TV.

2. I was gifted boxes and bubble wrap from two friends to help me pack ready to move.

3. We have been eating down the freezer and pantry, only doing top up shops for bread, milk and fresh produce.

4. I sold a few items we don’t want to take on Facebook Marketplace. A couch, dresser, dolls house, books and clothes that I don’t have to lug with me.

5. I have been... drinking coffee from home, grouping my errands, organising free activities for the kids over summer and staying home as much as possible.

FFT, Doing What I Can With What I Have Edition:

(1) I have hung tough and converted all Xmas/New Year leftovers into later meals. Even the leftover tomato paste from the Xmas Eve Two Fat Ladies lamb dish was incorporated into a chicken curry, along with what was left in an ancient jar of tamarind sauce. Waste not, want not.

(2) Delighted to see other commenters getting onto the Tightwad Gazette train. IMHO, Amy Dacycyzn is The Mother of Our Frugal Country. (Amy, are you out there somewhere smiling at this?)

(3) I paid a bit extra for an aide shift for DH on New Year's Day so I could get out for some mental health thrifting at one of our local Rescue Mission stores. Trust me, I needed the break--and I got some lovely stuff, including a beautiful old Syracuse China covered dish (for my friend who collects SC) and a very unusual English "Brown Betty" teapot (for my own collection). Frugal only in the larger sense, but frugal nevertheless.

(4) During DH's increasingly long nap times, I am engaging in more of what a commenter on the Spouse/Partner Caregiver Forum on the Alzheimer's Association website has called "covert decluttering." For example, I've cleared away most of his efforts at picture-framing during an earlier stage of his decline (these would break your hearts if you could see them, and now they're no longer breaking mine). And, believe me, he's past the stage where he might notice the gaps.

(5) Finally, I'm boxing up some other stuff that I intend to take to a couple of local antiques dealers. If I were as young, eBay-savvy, and energetic as many of you, I'd try posting these on eBay--but, alas, I'm old and tired. But I do plan to see what (if anything) these guys can do for me.

A. Marie, what a poignant remark about ridding your house of the picture framing equipment. I am so sorry you are going through this.

I had a paper fist fight with eBay years ago, so I only work with them when I must (like for selling my Playbills). However, I have had a lot of great luck with Facebook Marketplace. Just a few weeks ago I sold two different antiques through them for a good sum. I might have gotten a bit more through an antiques dealer, although maybe not when you count the cut they would take. Anyway, I hesitated to use Marketplace after not finding Craigslist of much use, but you might want to try them if the dealer does not work out.

I was thinking the same thing when I read her comment. Much love to you, A.!

Dementia is such a challenging journey. I hope you and your husband find peace. My thoughts are with you.

Thanks for the rice waffle idea! We eat tons of rice here, so that's a good idea for me to keep in mind. Did you eat it plain or top it like a traditional waffle with syrup or something?

1. We just purchased a new to us vehicle, but saved by it being used. It needed a different engine put in, so we had that done. Now we are trying to sell the old engine and our old pick up to make some of the money back.

2. Accepted some free fruit.

3. Ate leftovers.

4. Used old fabric for cleaning rags.

5. Just opened the last bar of soap from a whole box that had been given to us over a year ago.

I topped it with some cheese, since I'd kind of gone the savory route! But you could definitely go a sweeter route by mixing in some sugar/cinnamon when you mix the rice with the egg.

My Mom has an awesome rice pancake recipe if you would ever want it.

Oh, interesting! Does it use cooked rice?

OK, thanks!

1. Watched a bunch of free OT videos on YouTube for strategies for picky eaters. Applied what I learned this week & already my kids are eating better. Praise God for free help:)

2. I said yes to a friend’s offer of free jeans for my youngest & she ended up finding 5 pairs of good jeans, an elegant dress, and a robe while de-cluttering.

3. Tonight’s dinner was a use what we have kind of stir fry & ended up really good. Bacon + hard boiled eggs chopped up + a bunch of freezer veggies + rice+ last bit of pineapple teriyaki sauce. Might actually make it again on purpose someday:)

4. Freezing herbs has saved me time & money for months now—so easy to pull out just what I need. Adds so much flavor too!

5. Strategizing how/when best to use gift cards from Christmas—we were really blessed this year by them.

Isn't it the best when you make "use up what you have" meals and they turn out really good?

I never thought to look for OT videos on YouTube for picky eaters! My son is a very, very picky eater, and always has been (he refused baby food when he was a baby!). Thank you, I will take a look!

Frugal:

1 I deleted all shopping apps from my phone. Amazon. Walgreens. Kohl’s. I am not much of a shopper but Amazon makes things too convenient sometimes.

2. Cooking and eating at home.

3. Really focused on reducing food waste.

4. Powering thru a box of mint tea that I do not love.

5. Driving. Nowhere. Working. From. Home. No gas!

1. Cut up fruit and veggies so they would get eaten, including peeling and prepping a bunch of pomegranates-a pain, but worth it to be able to easily spoon out seeds onto lunch plates.

2. Picked meat off of the turkey carcass and had husband turn it into delicious soup using the pan drippings.

3. Reserved another bowl of shredded turkey for making turkey sandwiches and popped the bones into the freezer for making stock later.

4. Took all the impulse items out of my hungry harvest order so that my order is only fruit and eggs, and pared down my dairy order too. All the things I would have bought we would eat, and none of it was super expensive, but then we wouldn't eat some of the food we already have in the pantry/freezer. So this way we will focus first on eating what we already have, which is like getting food for free! At least that's what I'm telling myself when I look at the food I already own that doesn't excite me anymore because I've been looking at it too long...talking to you, bag of radishes and turnips...you're boring, but free.

5. Opened a box of gift clothing from my mother-in-law and promptly threw away the 130.00 free "coupon" for wine which would have required me to spend 80.00 on wine and probably shipping too that was included in the packaging. I'm through being tricked into spending money to save money.

1. I wanted to steam clean my couches. I asked my Buy Nothing group if someone would let me borrow their upholstery cleaner and someone let me!!

2. I sold the Barbie Dream House I bought on Facebook Marketplace about 1 month ago. I paid $75 for the house, some extra doors/windows to the house, and some extra furniture. I made about $225 on everything. I figured out that I have made a little over $700 in the last 3 months selling a few things.

3. I got my COVID vaccine. It was obviously free, but also frugal because it should hopefully prevent me from getting sick. And getting sick with COVID can be expensive.

4. I filed for the rest of our childcare flexible spending account for the year. The childcare flexible spending account saves us about $1,500 per year in taxes.

5. I roasted, pureed, and froze a pumpkin. We made rice bowls this week to use up 1/2 a head of cabbage, some carrots, some fresh ginger, and a couple of sweet potatoes. I used some buns from the freezer to make egg sandwiches for breakfast for my son.

1) I had 2 free meals at my work place because of a ProD day.

2) I cut my husband's hair.

3) Rather than buy yearly planners, I find and print free, pretty calendar pages from the internet and add them to a binder that I have been using for years.

4) My husband's bike "died" to the point that it will cost a lot to repair. Because we are moving soon, he asked around, and someone is letting him borrow a bike for a few months. Yeah!

5) I'm loosely participating in a no spend month and, and 6 days in, I've only purchased needed groceries!

1. I started reading not only through the posts, but every single one of the comments on this website (I used to only skim comments before). Surrounding myself with frugal and money-conscious content online helps me make better decisions in my daily life. Plus, I'm getting lots of good tips!

2. I was looking for a specific piece of art online and couldn't find anything I liked. I decided I'll try making my own and its in progress! Its a digital painting that I'll have printed. Cost of printing should be negligible and I'll make sure to have it printed in a size that goes into a cheap IKEA (or similar) frame so I don't end up spending a fortune getting it custom framed.

3. Related to (2), I'm not an artsy person so I had to google apps to draw on my iPad (iPad is not frugal, but I bought it and mainly use it for uni). The first website I saw told me an App that cost $ 9.99 was the "best" drawing app. Since I started making a comfortable living, I have gotten very loosey goosey with small purchases that are convenient, but it's gotten really out of hand lately. I slept on it and the next day I found a free app that is great!

4. I have gotten over my cooking slump and have made meals at home. Some were surprisingly good, given that I just threw a bunch of leftovers together! I also put a ban on buying snacks until the ones we have at home are all eaten. We got tons of snacks for Christmas, so we don't even have space for any more snacks in the cabinet.

I had thought of a fifth one but forgot about it by the time I finished this comment. I'll save it for next week!

I continue to cook meals that we eat multiple times. I have been recording all my spending this week to see where the money really goes and it is scary at times. I put bread through the processor to make bread crumbs. Life is putzing along and I am now going to try to stay home as much as possible until next Monday as I don't have any appointments until then. I went out today as my mother broke my little desk that I use for my computer. I bought a replacement but I am not 100% happy with it but it wasn't hugely expensive...and I could not find the same item despite looking online and walking though a lot of stores.

Hmmmm, let's see, I'm sure I have some frugal things to share....

1. My workplace gave everyone a voucher for the Honey Baked Ham store - choice of a quarter ham, a turkey breast, or 2 large sides plus a pie. Since we had a turkey breast in the freezer (bought at reduced price), we chose 2 sides plus a pie, and had a yummy, low stress NY Day dinner. Leftovers have been eaten for lunch.

2. Some of the leftover turkey was used to make a black bean/ancho chili soup hubs and I bought enjoy. Used broth make from the turkey bones.

3. Used my $5 birthday "Kohls cash", and bought some marked down reusable hand warmers that look like kitty faces. Out of pocket cost was about $2.50. Hubs and I like to do winter hikes and outdoor photography excursions, so these will be put to great use.

4. Mended several clothing items, including my bathrobe.

5. Returned several Christmas presents that were the wrong size, etc. One of my sisters had sent gifts in lovely wooden cigar boxes (she and her hubby are cigar aficionados - yes, they are both aware of the health consequences of tobacco, which falls on deaf ears....). Love her repurposing of these boxes, which will be further put to use in our home (to store my scarves, jewelry, etc).

Bonus #6: I joined an online reading challenge, where each month you are challenged to read a book set in a designated part of the world. January is the Artic/Antarctica. They provide book suggestions, or you can do your own thing; I took a suggestion, and chose an audiobook about Shackleton's voyage to Antarctica via my library Libby app. (Audiobooks and e-books are "allowed" in this challenge). Frugal AND fascinating!

Have a great week, everyone!

Would you mind to share where we can learn more about your reading challenge? It sounds fascinating, id love to join!

Let me see what I can come up with - I do love these frugal fives!

1) cut my husband’s hair and my son’s hair. I trim my own ends, not as hard as I thought it would be and something we will continue even after we can go back to salons (well I might go get my multi-texture hair cut professionally, just not as often).

2) we love to cook and are alway trying new recipes, now I’m making our weekly menus with an eye to what we already have in stock and what needs to be used up

3) any leftovers, kitchen scraps go either to our hens or the worm bin

4) cancelled all the little tv add one like CBS access, etc. I signed up for them for sports but they’re not necessary. I did keep Disney+ but that’s it

***** my favorite*****

5) while searching all our storage spots for a specific dish for our NY Eve dinner, I rediscovered our wedding crystal (beautiful Waterford). I wondered why it was sitting in boxes versus being used and so we unpacked our wine glasses and champagne flutes and also found some super cool martini glasses we had packed and forgotten about. While deciding to use those, I wondered why we weren’t using our lovely/fancy glasses that we had stored in the bar. So we brought those up for every day. Every time I open the glass cabinet and see my sparkling glassware, it makes me happy. That I went shopping in my own house makes me even happier. We also give away a lot of our old glassware (not being used) to a friends daughter who is furnishing her first apartment.

I am so going to try that rice waffle. We eat a lot of rice and often have leftovers. Here is our five frugal things for the week:

1. Made grape jam from the bags of green and red grapes I acquired from the tractor trailer tip over. Wasn't sure how it would turn out, but it is yummy!

2. The cocoon sweater I made from yarn my daughter gave me for Christmas was such a success that my youngest daughter wanted me to make her one too. We used a buy one, get one free sale to buy the yarn she picked out for it. She goes back to college next week and I am desperately trying to finish it before she leaves.

3. My daughter's college gave us a $1400 credit on this semester's tuition bill due to covid. Thank you, I'll take it!

4. Froze three bunches of bananas from the tractor trailer spill that were getting rather ripe.

5. Started taking stock of on hand craft supplies that I can use for 2021's Christmas presents. I make most of the gifts I give, so it's vital to start early!