Today, we have the pleasure of meeting a reader who has never commented (despite being a very, very longtime reader!). And if you are a cat person, you will smile many times as you read this post; the first cat picture made me giggle out loud, actually. 😉

1. Tell us a little about yourself

My name is Robin, and I am a longtime reader but never commenter. I live in southeastern Wisconsin with my daughter, a high school senior, and 3 cats: Meowy, Tabitha and Pumpkin.

I am in my sandwich generation era; my parents and in-laws have reached the point where they need assistance with house and yardwork. We live in a rural community outside a small town located between 2 major metropolitan areas.

Our Victorian farmhouse was a church parsonage until 1950 and we have a cemetery next door (which is still active).

We have 2 acres; I call it a hobbyist farm. I enjoy gardening and we had a large vegetable garden for several years. I made enough spaghetti sauce for an entire year from our tomatoes.

I had to scale back in the last couple years though and I just grow a few tomato plants now. I love getting plants for free and am lucky that my mother-in-law has a huge garden and has shared many perennials for our yard.

While my daughter was in 4H we had ducks as pets for 8 years. We started with 4 magpie ducks, then got 6 call ducks.

The call ducks multiplied over the years, and we had 26 ducks at the peak. They are frugal pets since they make more ducks for free. Feeding that many ducks isn’t cheap though.

When we let the ducks out to free range in the summer, they quickly figured out how to get into the swimming pool.

I work full-time; I am an architect in a firm of 100 people. I specialize in healthcare design and work on projects in hospitals and clinics.

I am fortunate to have a great boss and a flexible schedule; I can work from home when I want to.

Of course, our cats like to help me work from home.

My frugal driver is now that I am recently widowed. My husband died from pancreatic cancer 14 months ago.

He was diagnosed in February 2021, went through chemotherapy and surgery but the cancer was aggressive and kept spreading despite treatment. We found out in October 2022 that the cancer had spread to his spine, and he was gone 3 months later.

We had been together for 25 years and married for 23 years. To say that the last couple of years have been hard is an understatement.

My husband was adamant that my daughter and I shouldn’t stop living our lives because he was gone so we are grieving but still trying to move forward.

Reading Kristen’s posts about leaving her marriage has been comforting. I feel like the death of a spouse is a similar experience to the end of a marriage.

sunrise over duck house, my husband designed and built the duck house

2. How long have you been reading The Frugal Girl?

Since my daughter was little, so at least 15 years. I don’t remember exactly how I found the blog; I was probably looking for frugal parenting and kids’ activities tips. I read every post and all the comments.

3. How did you get interested in saving money?

My grandparents were very thrifty, and I grew up watching them be careful with their money. They lived a very modest lifestyle and saved a lot of money but also shared their gifts with their church and family.

They were the epitome of thrifty Midwesterners who grew up during the Depression.

4. What’s the “why” behind your money-saving efforts?

My why has changed over time.

I didn’t really try to save money when I was first living on my own as a college student. As a young married couple, my husband and I lived beyond our means for a while, buying things we wanted on credit cards instead of saving up for them, and accumulating a fair amount of debt.

We were only able to pay it off after my husband started a new job with a much higher salary. Once we had paid off that debt, we started saving in earnest to build up an emergency fund (with a goal of 3 months’ salary) and our retirement savings.

I have been laid off twice in my career because the architecture/construction industry follows economic slowdowns. It was only for a couple months each time, but it made us realize how important our emergency fund was.

5. What’s your best frugal win?

My best frugal win was receiving a full academic scholarship for my undergraduate education. My parents paid for my living expenses, so I didn’t need to take out any loans until graduate school.

6. What’s an embarrassing money mistake you’ve made?

I bounced a few checks when I first started college because I didn’t know how to balance the checkbook. My parents got me a bank account but didn’t really explain how paying bills worked.

Online banking certainly makes money management much easier.

7. What’s one thing you splurge on?

Grocery delivery. The grocery store with the best prices in our area is huge and it takes me about 2 hours to get through it. I pay $15 for delivery because the time savings are worth it to me in this season of life.

This is Pumpkin

8. What’s one thing you aren’t remotely tempted to splurge on?

New technology items: I am a late adopter and don’t feel the need to buy new models when they’re released. I am comfortable with my older iPhone and iPad and will use them as long as possible.

I don’t like household appliances connected to Wi-Fi; I want straightforward appliances that will last a long time.

9. If $1000 was dropped into your lap today, what would you do with it?

I would probably put some into my daughter’s 529 account and spend the rest on our upcoming graduation celebration trip later this summer.

10. What’s the easiest/hardest part of being frugal?

Buying items on sale and comparing prices to find the best value comes naturally, my family has always valued a “good deal.”

11. Is there anything unique about frugal living in your area?

Even though our library is small it is great. There is a puzzle exchange that I use often. People bring in jigsaw puzzles that they have completed and then take new ones.

I get new puzzles for free that we do at work in our break area. There is also a houseplant exchange, you can bring in extra houseplants and get new plants for free.

Our library also has lots of free programs for kids, teens, and adults; it’s a fantastic community resource.

12. What frugal tips have you tried and abandoned?

Making things like laundry detergent and yogurt from scratch. With a small family, we just don’t go through those items quickly enough for it to be worth my time.

I would rather spend a little more money to buy them from a store and save time, especially because I get the items delivered. 😉

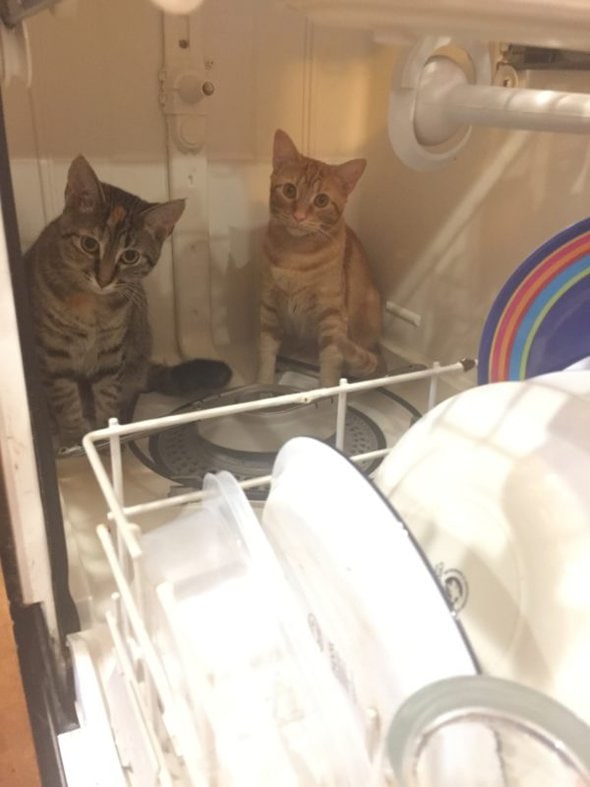

Dishwasher kittens – why spend money on detergent when dishes can be licked clean? 😉

13. What is something you wish more people knew?

Create a plan A, B and C for emergencies because your circumstances can change very quickly.

Before his cancer diagnosis, my husband and I had been through job changes and a couple of serious health issues but still felt we were young and relatively healthy and didn’t discuss emergency plans much.

We were very fortunate that he had great health insurance and benefits through his employer. Two years of cancer treatment cost about $1.5 million and would have caused serious financial difficulty if we didn’t have insurance.

I am financially secure now because he had life insurance through his employer, and I also inherited his retirement accounts.

I met with a financial planner for advice. I can live on my salary alone and have invested the money for future emergencies, my retirement and to pay for my daughter’s college tuition.

She will be attending a private university with expensive tuition. One silver lining is that she will get more financial aid now because she only has one parent’s income on her application. The cost is worth it to me because not only does it offer the degree program and setting that she wants, but it is also where my husband worked and his alma mater.

That connection is important and special to us.

14. How has reading the Frugal Girl changed you?

I think reading the blog for many years has improved my frugal mindset. I have taken ideas and tips from Kristen and the commentariat. Of the many posts, this is one that stuck with me: “It doesn’t have to be perfect to bless other people”.

Social media can make me feel like things have to be perfect or expensive to be worth sharing.

15. Which is your favorite type of post at the Frugal Girl and why?

Meet the Reader 😊 I am fascinated to read about how other people live and what they do.

16. Did you ever receive any financial education in school or from your parents?

Not really, see the embarrassment about bounced checks above.

Growing up, my parents didn’t really talk about money with me and my sister. I remember learning about checkbooks in 5th grade math class but that didn’t stick. We had one unit on finance in 7th grade Home Economics.

My husband listened to talk radio during his commute and would tell me what he learned from the finance shows. We used Dave Ramsey’s snowball method to pay off our credit card debt. We made a pointed effort to talk about money and finances with our daughter.

I have been open with her about our financial situation now because I don’t want her to worry, I want her to understand that we are secure and can afford college and other big expenses.

17. Do you have any tips for frugal travel or vacations?

I always bring snacks and water whenever I go anywhere. I get hangry very quickly and need something to hand. That has probably saved a lot of money over the years. 😉

_________________________

Robin, I just love your cats! They are so cute all hanging out together, and it made me smile to see them sitting on plans and puzzles; my cats also both really love to sit on whatever we are working on.

I am sending you so much love over the loss of your husband. It is really, really tough to lose a loved one so quickly. I can imagine that the adjustment to your daughter going off to college will be a little challenging too…that’s so much adjustment squished into a couple of years.

But I am sure that there will be beautiful things about this new phase for you too, and your heart will be so happy that she is at a college with so much meaning for you.

I’m so glad that my post about my own life upheaval have encouraged you. You are right in saying that there are some similarities! We are both navigating a set of present circumstances that is very different than what we originally imagined.

Thank you so much for de-lurking to participate; it was lovely to meet you!

Readers, the floor is yours!

(I let Robin know her post was gonna go up today, and I said that I hope she will break her 15-year no-commenting streak to come and chat with you all, at least just for today. 😉 )

Joyce

Saturday 4th of May 2024

I’m so sorry for you and your daughter. You sound like a lovely person with a sound mind. I too lost my husband at age 41. It’s been 23 years but sometimes my head still reels from the loss but I’m here to tell you you’re going to be ok. You’ll never be the same but you have the fortitude to move forward. Take care of yourself. Love the kitties!

Allison Walters

Saturday 4th of May 2024

Lol. I love it...the 'commentariat'! Sincere condolences on the loss of your husband. It IS hard and very different to not have your life partner there with you. I am glad that you had finances well in order.

Anita Isaac

Friday 3rd of May 2024

I am so sorry for your loss. Thanks so much for posting. Love your photos. Do you know about Social Security Survivor benefits? My Hubby's orange tabby whom I never met was named Meow. Good luck to you and your family.

Daisy

Friday 3rd of May 2024

Hi, Robin! I'm also in Wisconsin. The Midwest is a great place to be frugal. We can get a lot of value for a little cash.

Heather Mar

Friday 3rd of May 2024

Hi Robin! I love those triple cat photos and loved reading about your property, gardens, and ducks. Thanks for the great post and for being part of the FG community!