Meet a Reader | Ginger from Cincinnati

Today we're meeting a reader who is super new; she's only been reading for about six months. I love it when people hop right in and do a Meet a Reader like this. 🙂

Here's Ginger!

1. Tell us a little about yourself

I’m Ginger, I’m a 38-year-old pharmacist. I live in the greater Cincinnati area with my husband and our two children (3 years and 3 months).

I like playing boardgames with friends (when I can find the energy to set something up) and cross stitch.

2. How long have you been reading The Frugal Girl?

Maybe 6 months? On the Before Breakfast podcast, Laura Vanderkam mentioned she interviewed you for her other podcast, so I listened to that interview and started reading after that, and am enjoying every word!

3. What's the "why" behind your money-saving efforts?

When I first became an adult I was in college and had lots of extra money from my student loan checks.

Did I save it so I could pay off the loans when they came due? Of course not!

I bought a Wii! And Rock Band! And ate out every day!

So that was dumb in the long run, but luckily hasn’t ruined my life as I know student loan debt can for so many.

When I graduated college I moved to the Navajo Reservation for a pharmacy residency (not required for pharmacy like it is for doctors, but it affords extra education and can widen your job prospects- but the trade-off is a smaller paycheck for a year or two while you complete training) and I lucked out on the “frugal” scale, as my rent in my hospital-provided house was less than $500 a month, and I could walk to work!

So, money wasn’t much of a pressing issue for me in my early-ish adult life, just because I lucked into a super low cost of living situation. I ended up staying at the same hospital I did residency training in for almost 10 years, so I had full salary with that same low cost of living.

I was able to travel a lot with friends, while also making larger payments on my student loans.

However, like so many have, I fell in love and got hitched.

I applied for a credit card to help pay for the wedding and honeymoon (free flyer miles for the plane trip! Great deal right???). For various reasons, for most of our marriage, we have been a one-income household, and yet my spending habits didn’t change.

Debt went up. And up. And then Christmases came and it went REALLY up.

I wasn’t paying attention and then when I did the picture was scary. So, money saving is a necessity.

4. What's your best frugal win?

Probably that low rent from when I was on the rez.

5. What's an embarrassing money mistake you've made?

I’ve got two and they are BOTH doozies!

When I stayed on at the hospital on the Navajo rez, I became eligible for loan repayment help. I think it was about 20K over two years if you committed to stay at the hospital for those 2 years. Remember from above I stayed there for nearly 10?

I only applied for and received one payout. Every time applications were due, I would think “Two years is a long time. I don’t know if I’ll be here in two years. I don’t think I’ll apply” until finally I realized I was fooling myself by thinking I wouldn’t be there in 2 years!

So I received one payout, and by that time I had actually paid off all of the debt that was in my name for school. (don’t think I got awesome scholarships or came from a wealthy family! My parents took a lot of money out with parent plus loans, so I didn’t have as much on my plate as they had on theirs).

My second money mistake was from trying to be kind. My husband’s family has not always had a lot of money. So I wanted to try and help set up his youngest sister (the only kid left at home by the time we got married) for success.

So we bought her a car. Out of the emergency fund. The idea was she would pay us monthly, no interest, and so have a good start at adulthood.

However, I set the monthly payment so low we would never get our full amount back. I’m still happy we helped where we could, but using the emergency fund was stupid, and since then it’s just gotten lower and lower to where it doesn’t exist anymore.

6. What's one thing you splurge on?

Fast food and board games.

The fast food is more of a compulsion than a splurge. And board games because I love playing them.

However, since I moved from the rez I don’t have a regular game group so most of them sit on the shelf collecting dust.

7. What's one thing you aren't remotely tempted to splurge on?

Make-up and clothes. I aggressively don’t care how I look, and I’m frankly a bit scared of make-up.

8. If $1000 was dropped into your lap today, what would you do with it?

Come up with a weekend trip to take the family on.

9. What's the easiest/hardest part of being frugal?

For me, almost all of it is hard. Like I said above, my compulsion is fast food, which eats away at your money insidiously. I almost always go for convenience over price.

The hardest part though, is the basic of knowing where the money is going. How much do I spend on fast food? No idea. How much does my husband spend on groceries? No idea. How much do we spend on utilities, and how have they changed? Again... no idea.

10. Which is your favorite type of post at the Frugal Girl and why?

I like the 5 Frugal Things posts because I make it a challenge to come up with five of my own to comment with. I also enjoy the WIS WWA because it gives me a sense of what a “normal” amount to spend on food is.

11. Did you ever receive any financial education in school or from your parents?

Never anything formal or official from either source.

However, my dad always used his credit card to pay for everything, but was fastidious with paying it off every month. I don’t think that man paid one cent of interest for anything other than the house.

We lived in the first house my parents ever owned. Mom cooked most meals. I grew up thinking Olive Garden was the peak of sophistication.

Something I’ve learned recently is my dad also had several life insurance policies he kept up with his whole life. Unfortunately, I’ve learned this because he recently passed away. While we are settling his estate my siblings and I have discovered how truly frugal he was. Even after he’s gone, he is still caring for us.

All of the debt I discussed earlier? Is gone. And I have an emergency fund again. All because of his financial care.

We were never a wealthy family, but I grew up wealthy in terms of the love, care and planning I had from my parents. I just hope I can get my act together enough to be able to help my children after I’m gone as well as my parents did me.

___________

Ginger, I love this story about your dad, and I think it is so beautiful that his love and care for you extends past his lifetime. So sweet. Now you have a fresh financial start, and all you have to do now is maintain it.

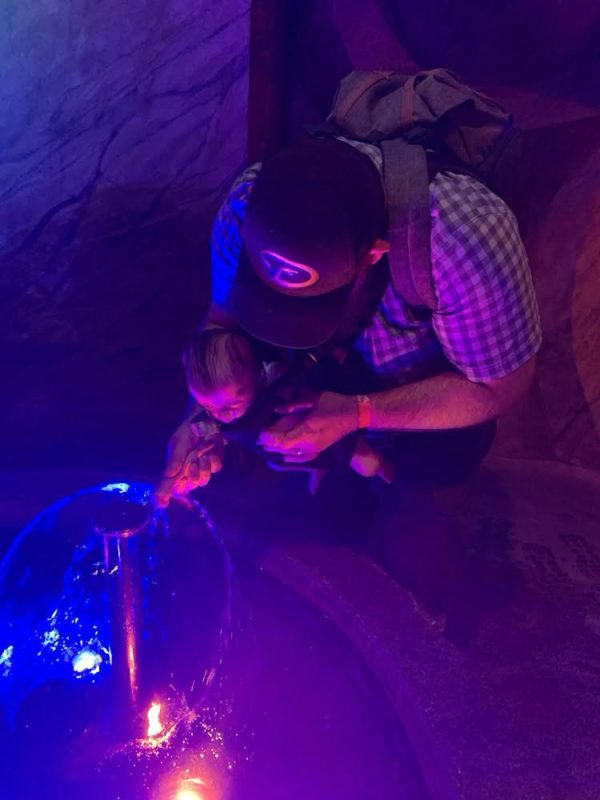

I think your wedding bouquet is beautiful, and of course, your children are adorable. 🙂

What made you want to become a pharmacist? And do you miss living on the reservation?

Lastly, you mentioned you traveled a lot in your reservation years, so I was wondering what your favorite trip was.

Such beautiful words about your dad. Love it.

Ginger,

Thank you for sharing. I love all the pictures of your family and your adventures.

The longer you stick with this "group" the easier frugality will become. Give yourself grace as this is new to you and you have a baby. You will get there step by step and remember that frugality is different for everyone.

I think this was brave of Ginger, as someone who isn’t as frugally organised as some of your readers. Well done!

Ginger, have you considered speaking to a professional about your experiences with fast food? The way you write about it made me wonder if there were underlying issues (because I have experience of it).

On the emotional side again, if you’re worried that you might slip back into debt after the inheritance, would checking in with your dad’s memory about how you’re doing with money several times a year help you stay on track? I put this as a loving thing and hopefully not creepy or upsetting.

I have some twisted financial approaches, from my family’s actions when I was growing up. Reading this blog helps to refocus.

@Victoria, I’ve done a prescription food system in the past, and some medicine too. Both helped and now I’m not pregnant I’m going to ask my PCP about getting back on the same medicine. I’m toying with surgical options too, but not seriously as of yet

What a wonderful man your dad must have been!

It must have been interesting to live and work on the Navajo Reservation. You must have learned about the Navajo People - their beliefs, their arts and their culture.

I’d be interested in knowing more about this.

I found frugality after the birth of my second child 35 years ago. I think the best place to start is by tracking your spending. After all these years, I’m on autopilot. However, when things seem off I still take out my statements and evaluate them. Know what I did with my money is the first step in correcting it.

It was a pleasure to meet you and hang in there frugality gets easier with time. I imagine it is especially hard right now as you are probably sleep deprived. Having a 3 year old and a 3 month old is challenging!

@Bee, as I was looking at the post I realized that I didn’t send in a single photo from the Rez! Which is ridiculous because it is the most beautiful place in the country. I didn’t learn as much as I should have, but baby related: they think having the baby shower before the baby is born is bad luck. And my absolute FAVORITE thing is the first laugh. Whoever makes the baby laugh for the first time has to throw them a party! I knew a pediatrician whose life goal was to get to throw one of those parties.

Tracking spending is where I trip up. We have an account with Rocket Money but never look at it.

I’ve tried to create a money review sheet for money discussions with my husband, (I used a super old post here as a basis for it) but it hasn’t gotten off the ground. I still think it’s a great idea though so am still hoping to make it work.

@Ginger, Jewish people also think baby gifts before the baby is born is bad luck.

@Ginger, I would want to throw lots of parties.

I have one question that I meant to ask. There are two beautiful bonsai trees in one of your photos. Is this one of your hobbies? I have never tried to grow a bonsai although I have grown many other flowers, plants, and trees.

@Bee, They are, sadly (but luckily for them!) not mine. that picture is from a board game night the conservatory in Cincinnati threw in conjunction with their butterfly exhibit. the glass ceiling with the astronaut is also from the same place.

Hi Ginger! I'm so sorry about your dad, but that was a great ending to your post. I smiled at your line about not having energy to set up game nights. I had my children somewhat later in life too (my first when I was 30, my fourth when I was almost 39), and it is an endurance challenge dealing with little kids when approaching 40. 🙂

@kristin @ going country, so, so true! I also have a bit of depression and social anxiety mixed in, but trying to arrange something is so hard!

Hi Ginger! I love your honesty and ruefulness. Frugality doesn't come easily to many of us. The struggle is real!

I bought my sister a car once. I worried about her a lot around 2000 or so; I left a big tech company with a boatload of money and so I offered to buy her either a new car or a cheap condo in her town. She chose a new Accord. She drove it for about seven years until it was hit by someone else and totaled. She took the insurance money and used it for her honeymoon, having recently met someone. Facepalm. Well, it all worked out OK for her; she and her husband have a nice little house and a 15 year old daughter. As for the condos, they went for $60K each at the time (mostly being around 450 feet); now they run about $500K each. Again facepalm. That's life.

@Rose, we don’t have future vision so no fair beating yourself up on the past decisions! That’s part of the reason I’ve never gotten into investing. It’s all guesswork and I get paralyzed thinking about what if I make the wrong decision…

@Ginger, pick something really broad like market index funds and get going! It's easy, really. The point of the funds is you're not the one picking securities. I'd just startt throwing $x per paycheck into a financial services corp (I've used Fidelity for a long time but there are others of course), pick an index fund, and then check your account every 2-3 months and don't pay any more attention. Your money will grow with no effort on your part. A year from now, you will be thankful you did.

If you want or need any more financial help, I'm not exactly the Sage of Wall Street but I've been doing it for a long time, so hit me up if you like. The main thing is to get started and keep going. You're young so you have plenty of time for the miracle of compound interest to work.

Ginger, I am the same way as you about investing; I am not faintly interested in it, so I do like Rose does and just stick with simple stuff, like a Roth IRA.

There is no need to get deep in the weeds with trading and individual stock buying; in fact, that's not at all likely to be more successful than just investing in an index fund.

Ginger thank you for posting and like another reader I think you are brave to put out there all your mistakes.

But I really wanted to thank you for your last story. My father also took care of my siblings and me with money saved that we inherited after he and my mother died.

They always lived very simply. And I always felt a little guilty that they saved and saved for us and did not spend on themselves. But when you said even after he is gone he is still caring for us it hit a cord in me.

So again thank for that.

@karen, glad I could help! I actually told Kristen she could take that part out if she felt it was too much for the blog!

This also reminds me of one of my favorite memories of my mom. She was on the phone with her mom, and she hangs up the phone and just says out loud “she treats me like a child. I am 65 years old!” I just have to laugh because, parents will always want to take care of us no matter the age. (And I have had to remind myself of that while dealing with both my parents on occasion as well)!

Love this post!

I too have continued to reap the benefits of the umbrella of my parents' love and sacrifices many years after my dad died, and in the years since my mum died. I think we both know that we would take all of those financial wins and insurances and inheritances of whatever sort and hand them over to any passerby for just 15 more minutes with our folks. This is what will keep you accountable and on the right track though. For me, I think about whether my parents would have vaguely approved or disapproved of whatever bigger ticket item we're planning to buy / build / whatever. I see myself as having the responsibility be sensible, live a happy life, but also to ensure that the priorities they taught me are passed on, and that my kids have at least some of the advantages I had.

But... no to convenience food! LOL. I am only partly joking. That is a money pit and also not great for your health, so make it a treat only!

@Caro, if I had the will power to say no to convenience foods I would! But like I said it’s nearly a compulsion. I’m planning on talking to my dr for some medicine (which has helped in the past) next time I see her

Hello Ginger, thank you for telling us about your interesting and beautiful life! This blog has been the most help to me in learning how to think about frugality and try new things. I admire your kindness to your sister-in-law even though you have regrets. I too received an inheritance from my parents after they passed away. It's a bittersweet gift but it allowed my husband and me to move out of a declining neighborhood and buy a really great house. Sometimes I walk around the house and whisper "thank you."

@Book Club Elaine,

It is important to acknowledge the gifts we were given! Also I looked at your meet the reader post to decide what kind of pictures to send in lol.

As an avid reader, I looooooooove your wedding bouquet!

I do, too!!! And the story about your Dad - poignant and sweet. A parent's love never ends. About that bouquet . . . Did you design it yourself? It's absolutely delightful!

@Mary ~ Reflections Around the Campfire, design is a very over stated term… I decided I wanted book flowers years before I was married because a friend had them. The leather and metal flowers I bought at the Renaissance fair, and my sister in law actually put them together. I was just lucky it looked so nice!

Thank you for sharing your story. Convenience is a huge factor when you have two young kids and a full time job, and it sounds like you are the one working and your husband stays home (perhaps I am mistaken there). I am a firm believer in tracking your spending as a first step to gaining control of your money. You have to know where it is going before you can start making any changes. Also, small changes are usually easier to swallow and more sustainable in the long run. Be realistic- if you eat out twice a week right now, cutting to zero is going to feel stressful and like you're being deprived.

It sounds like you have a lot of great things going right now, keep it up and keep going in the right direction! This community is wonderful for ideas and support!

@JP, thank you! And correct I’m the working out of the house spouse!

Ginger, I have a suspicion that you are fun and quirky--just a guess, from your LOTR-themed wedding, and the picture of what appears to be the roof of a greenhouse with a storm trooper on it. Love it! 🙂

I am sorry about the loss of your father, and I can relate to the self-sacrificing care of a parent. My siblings and I were astounded to realize how well my dad provided for his family (which we didn't discover until he was significantly impaired with dementia). My experience with parenting has been that as you watch your children grow, your desire to set them up for success continues to increase. I say that as encouragement for you--I'm sure that you will hit your stride and be able to find a good balance between saving and spending. Your dad would be proud of the person you are becoming.

I'm wondering what board games you enjoy. Thanks for participating today!

I am also wondering what board games you enjoy. Our favorite for a group of varied ages (kids to adults) is Telestrations. My favorite is Azul and recently we've been enjoying Skyjo which is a card game that is easy to teach quickly, but still involves some strategy.

@Kris,

Same here about the greenhouse - how cool is that to have a Storm Trooper in residence? 🙂 I wondered if that pic was from the Krohn Conservatory (fellow Cincinnati area member here!)

@Liz B., I am also in Cincinnati and thought that as well.

@Kim from Iowa, we love Telestrations! Always good for a laugh. Taco Cat Goat Cheese Pizza is another great game, and if you like to be a little rambunctious, Poetry For Neanderthals is a good one. As you can tell, I prefer games that make me laugh rather than games that make me think. 😉

@Kris, the Cincinnatian replies have it correct, both the picture of the game with the bonsai trees and the spaceman picture are from Krohn Conservatory!

We almost always play Splendor Duel right now. When we get together with friends we've been playing through the Harry Potter Hogwarts Battle game. I really enjoy Hanabi when I can get a large enough group together.

for the Cincinnatians... do you ever go to the madtree brewing company game night that's put on by Yottaquest?

@Ginger, I've been to Madtree many times but I did not know they had a game night.

Thank you, Ginger, for your interesting and honest interview. I'm sorry about your father's passing, but I'm glad that he gave you the means for making a fresh start. It may make frugality easier as you go along to think of it as a way of honoring your dad's memory and his values.

And I too know the bittersweet comfort of knowing that a deceased loved one is "still caring for" me. In the case of my DH, it was everything he did to make our house snug, tight, and energy-efficient. He only ever verbalized this once: When we were having a 50-year roof put on in the early 2010s, I overheard him telling a friend, "This is one thing I don't want Marie to have to worry about." But I think that this was behind a lot of what he did--and one reason I'm not leaving this house till I have to is that I still feel his love all around.

@A. Marie, that is incredibly sweet! what a great practical legacy to leave behind to shelter (literally) your family!

Hi Ginger, thank you for posting:) I love your bouquet and all of your pictures!! I love to hear stories from others that align with how I acted during my college years. I did exactly what you did. And I paid on my loans for soooo long and finally qualified for the temporary student loan forgiveness. By that time I had paid of at least 75% of my loans. I figured it out once and if I had done a lot of what Kristen talks about, and used my earnings from my full time job my loans would have been much more manageable. I know this now, so I can help my two boys with college in the future. That way they won't have the same financial burden like I did for so many years.

Hello, Ginger! Thank you for writing. I have a great admiration for pharmacists, especially during and post-pandemic. (As for many health care professionals), we need more of you!

For the fast food, can you figure out what it is you really like? The taste or the convenience or the perceived speed? Maybe line up the equivalent of what food you buy, (burger, fries, drink), with food at home, (sandwich, chips, drink), and see if you can save money that way. Give yourself permission to use paper plates and pre-packaged and portioned items for a while for a transition to eating at home if that is a goal for you.

@Heidi Louise, I love this suggestion for the fast food!

I am also thankful for your work as a pharmacist as someone who has newly experienced the benefit of modern medicine with 2 recent health ailments. Medicine is amazing!!

Your sentiment about your dad is sweet. I’m one of those naturally frugal folk who has a hard time spending money. I think the main reason is I associate money with security and so I often don’t want to spend even if I can most definitely afford something. I’m often in my own life trying to balance current pleasure with future security but I don’t think a whole lot beyond life/disability insurance in regards to my kids. We are trying to raise them in a wealthy family in terms of love and attention and emotional support (which it sounds like you had, that is a great gift too and perhaps undervalued in todays world). If that’s the type of environment they get to be raised in then I believe you are giving your kids an extraordinary gift. (I also believe in child independence and boredom so to me this doesn’t mean I’m entertaining them and all the time or we’re attached at the hip, it means I’m present and available for them when we are together when they need me).

When I was in the stage of a long commute (along with my ex as we worked in the same office), then picking up my baby and toddler , what helped avoid the siren call of Boston Market was having plenty of frozen meals (like Costco lasagna or bags of Trader Joe's stuff) on hand. To make it faster, I would throw whatever tonight's dinner was gonna be into the fridge to at least have it partially defrosted by 6PM ish when we got home.

Feeling a tad wistful about parents since once again I feel like the only functional adult in my family of origin as well as my own family. I tried so hard--getting a financial planner to meet with them, and so on--and every time, the elderlawyer or planner was politely turned down by my parents. Never planned for anything--after my father died, my mother moved in with my sister, I told my sister she wouldn't be able to handle it, I was pooh-poohed because of course, you're just not easygoing enough and you fight too much, Rose, you know how you are. That didn't last and then Mom's plan was to move to assisted living at $10,000 a month, and then spend all the money she had. When she ran out of money she told me she planned to turn her face to the wall and die. SIIIGH. IDK--my mom died two months ago and I'm not coping well.

@Rose, hugs to you.

@Rose,

Losing a parent - but I think especially your mom - is tough. Remember, there is no timetable for grief.....take as much time as you need.

Ginger Thanks for sharing w/ us.

Your post came up very timely as I am currently looking for a board game for my sister-in-law. She loves games and has a ton.

Are there any you would recommend for adults?

@Jaime, do you know some of the kind of games she has? It’s easier to give suggestions when you know the kinds of games she likes to play and ones she already has.

@Jaime, I second Emily's question. I LOVE recommending board games but there are so many... Hanabi (tile/card laying cooperative game, everyone at the table can see your hand except you, so you have to use the limited info the others are allowed to tell you to figure out what to play) is one of my favorites but I've never played it with only 2 people, but if she has a larger gaming circle it may be a good one. Also it's well known but not too well known so it's less likely she already has it.

Hi, Ginger, and thank you for commenting. I know it's not easy to admit it when one isn't frugal, so I also admire you for being open. Kudos for coming here to join in with the rest of us; we are still learning also.

You have a fresh start now, thanks to your wonderful father. Living within your means and saving up for your own kids would be a beautiful way to honor his memory and legacy. I agree with some others here - track your spending. It's no fun, but you have to know what you spend before you know where to cut back. And may I suggest something such as Dave Ramsey, the Tightwad Gazette, Your Money or Your Life and/or You Need a Budget, which is an online budget, to get you started?

You are at an ultra-busy stage of life, but frankly, it's going to stay busy for a lot of years, so you might as well start now, right?

Your kids are adorable, by the way.

Ginger,

You are not alone in not tracking what you spend. Many of us went through that for long periods in our lives until we were forced to sit down and do a real tally of what we spent versus what we thought we spent.

I get how scary it can be to put exact numbers on our expenses, especially in a one-income family situation. But here's the good news: You gain incentive and motivation when you look at the numbers and it will prompt your creativity.

Don't waste time feeling bad about what you haven't done in terms of controlling spending. If you are here and learning, you are on a new path and you can take baby steps to help you start tracking (all it takes really is one of those cheap Staples notebooks and some pencils, you don't need Quicken although it can be helpful) what you spend.

I went through a very tough time in my life while freelancing. But once I came to terms with the reality of my expenses (the lowest) versus income, it got me moving to get better paying work and to treat my spending more seriously.

I know several folks who have gone through periods in their life with a lot of fast food. There were both legit and questionable reasons/rationale. One of them told me that healthwise she had to change. So when she cut back and then stopped (except maybe once a year on her birthday, her special treat), she felt better physically as well as financially.

Shopping and cooking can take a lot of time and energy, something that may be in short supply as pharmacists have a pretty demanding workload from what we're hearing. And taking care of two young ones...that's a lot.

As you learn more about alternatives to fast food (and there are healthy dupes you can actually make at home especially if you get an air fryer) and commit to cooking in bulk, say, and then freezing, it will be easier to cut food costs and still have foods you want to eat.

You may need to get creative to find several hours a week to prep/cook/freeze.

But anyone who can play board games and love it? You've got the little grey cells to help you create simple menus for the family. Take your time. Change doesn't happen in a day and again, don't beat yourself up for what you haven't yet done in terms of coming to grips with expenses. Having one income is tough in today's world, no matter what that income is.

If you can find time to read back columns from The Frugal Girl, you will find lots and lots of really useful advice as Kristen is a mother of four who home schooled her kids and didn't have a lot of time either.

Saving money can actually be fun. It's like the attitude where you love getting freebies even more than buying new, knowing what you saved. Or in never ever paying anything but the best (not always lowest) price based on what you're buying.

Take a deep breath and maybe start by tracking just one area where you suspect you spend the most (say food?). And if you have credit cards, take a look at what you are spending and what you are paying each month in terms of interest/fees.

Thank you for sharing. Your honesty is how others realize: "Hey, we're not alone. Been there, done that." Because seriously that is the case. We've all been there, done that at one or another point in our lives.

Good luck.

Hey Ginger! I guess my question for you is a bit of a plug - have you heard of the facebook group, "Women's Personal Finance"? It is a wonderful resource full of non-judgemental humans (judgemental jerks get booted pretty quickly, the modmin team is really protective of the group culture) that can help with everything from the basics of budgeting, to super complicated investing topics.

Welcome, Ginger! I think in lists.

1. Your wedding is the most original I've ever heard of.

2. Your bouquet is the most original I've ever seen.

3. You are the first person I've ever heard say she "aggressively" doesn't care about her looks.

4. Your honesty is refreshing.

5. Tracking spending is about as appealing as tracking calories. I've heard that both are highly effective but I find both to be too much truth. I am simply frugal and sometimes downright cheap, which has worked for us. We did take the Dave Ramsey Financial Peace class and had to track spending then; it was helpful information, but afterward we continued on our Just Don't Spend approach to life without keeping track.

6. If I wasn't so opposed to spending money, if I wasn't indoctrinated from early childhood about good food choices, and if there was fast food in my town, I might be compulsive about it due to convenience.

7. Your story is compellingly unique—thank you for sharing. I hope you will find the Commentariat here welcoming, supportive, kind, encouraging, and fun, because it is!

So nice to meet you, Ginger! You will find many cheerleaders and like minded frugal friends here to gently help when you need advice.

I love your theme wedding bouquet. Quirky is my love language.

Bless your dad for his foresight. I know this well thought out planning myself. It my quest to build generational wealth with my dad's hard work and thoughtful financial blueprint of the future.

Hi Ginger! I love your willingness to share with us after half a year of reading. I hope that you find an abundance of encouragement and ideas here, as I have over the years. I feel like I've learned a TON from Kristen and this community!

Your wedding bouquet is incredible! My eyes bulged and my jaw dropped when I saw it and read the caption. I am also 38 years old and remember watching LOTR on repeat my senior year of high school and right after. I still have all 3 extended editions on DVD. Last summer I listened to the audiobooks, narrated by Andy Serkis. It was so, so good!

My husband and I played lots of board games before we had little ones and then it got harder for a while. We have games like 7 Wonders, Dominion, Catan, Bohnanza, Alhambra, and the card version of Ticket to Ride. I know other readers have asked for your recommendations, so I'll read back through to see what ones you recommend! Now that my oldest kid is 10, it's been fun to start playing board games with her (you know... something other than Candy Land!)

Like others, my heart was warmed by the story of your dad. I wish you all the best as you navigate this life change.

Thanks for sharing with us! I'm glad you're here!

Hi Ginger, so nice to read about your life. Your wedding bouquet was gorgeous and so original!

I loved your words about your dad. Such a wonderful ending to your post.

Hi Ginger! I hope this helps. I used to go through fast food 5-7 times a week. Sometimes multiple time a day. I work a high stress seasonal job and told myself this helped. I also have a family history of high cholestrol and my numbers stopped moving and I am on a high douse. So I decided to stop fast fooding. I give myself a limit of once a month. I carry granola bars with me and at first I would eat one if I had the desire to go through a drive thur. I now (7 years later) don't even have to do that. I know there is food at home and I can wait. I realized after starting my habit was compulsive. I would cruize through even if I had had lunch already. IT just made me feel good. I had an order at evering FF place. I also don't use my once a month nearly as much as I used to.

I love your story about your dad. You can also set your children up for success.

@Amy cheapohmom, Good for you-- Changing eating habits such as you did is hard!

I don't particularly like to cook. My husband does. He and I have very different eating preferences, and we let our son grow up with a third group of preferences. Fast food can occasionally fill in these gaps.

I logically know that if I do pick up McDonald's, I can have Coke from home, (less than fifty cents, in a recyclable can), or a McDonald's fountain drink, (in a plastic cup that will never decompose for probably closer to two dollars than one). But as is the model for such places, McDonald's has some of the best drinks: they set their machines to extra-chill the liquid and add more syrup, with ice of just the right crunchable size, with appealing colors in their packaging. These can be difficult to resist!

You have written one of the loveliest tributes I have ever read about your father. What a man!

I am a cheerleader for recording every penny you spend. That was how I discovered that I spent over $3000 a year on books and magazines; before that, I had some vague idea that I spent a lot but after the first year of keeping track I was gob smacked. For over 30 years now, the last thing I do every day is make sure I have a list of every penny we spent that day. Sometimes I don't get it recorded into our database until the next morning first thing. Honestly, it changed our spending entirely and it is the sole reason we could retire from regular jobs very early and just do gigs we want to do.

Finally, I was a McDonalds addict, eating it twice a day sometimes. Then I realized that the food was all tied up with the fact that my single parent father used to take all 6 of us kids to McDonalds every Friday for a fish meal (we were raised Catholic and at that time no meat on Friday was a big deal). He got us to exclaim on those Fridays that "we should buy stock in McDonalds!" before any of us know what stocks were. (Looking back, people must have thought we were nuts, especially given that my father had a loud Russian accented voice.) When we reached adulthood, each of us received some McDonalds stock. Once I figured out that I felt closer to my father when I went to McDonalds, I reduced it to only Fridays for a filet 'o fish. Maybe you have no emotional connection to fast food, but I offer us my example just in case. When we travel outside of Alaska we do buy fast foods that we have never heard of, but that is a different issue.

Ginger, thank you so much for sharing your story!

One suggestion might be to not go cold Turkey with the fast food.

However many times you get it per week, start by cutting that number in half.

At the same time maybe grocery shop for sone foods that “fill that itch” but are both less expensive and better for you that the fast food (like turkey burgers at home with frozen French fries, good quality frozen pizza, etc.

Please ask for suggestions and guidance from the commenters. This is a pretty awesome group of people who have much shared life experiences regarding the things you want to work on.

Hi Ginger! I am a fellow Cincinnatian, and I wanted to pass along a couple of local suggestions that you might not know about. Since you mentioned cross stitch, Scrap it Up in Pleasant Ridge is a non-profit that takes craft donations/school art stuff and sells it very cheaply. *Disclaimer* I volunteer there, and I know that we have many cross stitch kits/patterns/floss. Also, as you clearly like to read, St. Vincent de Paul outlet sells books by the pound, I think around 50 cents a pound. (also has clothes, shoes, etc. all by the pound) Great place to get stuff very cheaply!

Just remember that you have very young children! Everything seems more difficult during this time period, but will get easier.

Ginger,

Cute kids 🙂 Along with all of the great suggestions others have made, you could look into your local library for board game loans. Libraries have so many things other than just books (bakeware, tools, games, audio/visual things, FREE PASSES TO MUSEUMS/GARDENS/HISTORIC SITES/ETC, sewing machine, hot spots, dvd player, karaoke machine--the list goes on & on!). The items are often listed as equipment, but if you search the item in the catalog and then filter for equipment (or whatever is assigned), it'll weed out all of the books, etc. And, of course, remember story time for kids! 🙂

Good luck in your frugality! Start small and build.

I love how you used the word "aggressively" when describing not caring about how you look. I'm the same way and it's a very freeing attitude as a woman.

Thank you for sharing about your life!

Hi Ginger - I really loved your post. I think the ones from those not naturally frugal have been amongst my favorite. If you have trouble tracking finances, I might suggest using cash only for certain categories. Like set a max amount you want to spend on this category and once you run out of cash for this you will know by default how much the spending was and to make the choice if you want to add more into this bucket.

1) About a year ago, my mother was complaining about how difficult a task is for her. Overly eager to solve her problems, I offered to get her a subscription that would do the task for her. They were still charging me for it. I called my mom about it and she eventually admitted that she had never even used it. I ended up having to email the company to cancel it because she had no idea how to log in. In the future, I resolve to just listen to my mom complain (which is what she actually wants) rather than propose and enact solutions in which she has no interest

2) I am going through our entire past year of spending in order to update our budget

3) I made sure to eat breakfast before meeting with a friend for coffee. I really value making time for friends, but I don’t really value paying for soggy overpriced breakfast sandwiches at coffee shops

4) I encouraged my husband to come home for lunch rather than going out- he works very close to home, so this is not a long haul home or anything

5) I marinated chicken breasts this morning and am now cooking them to go on Greek salad for dinner. This will provide plenty of leftovers for my husband’s packed lunches as well