Five Frugal Things | gift cards x 3

This is gonna be an inadvertently gift-card themed Five Frugal Things. Let's go!

1. I used a gift card from 2018 (!!!)

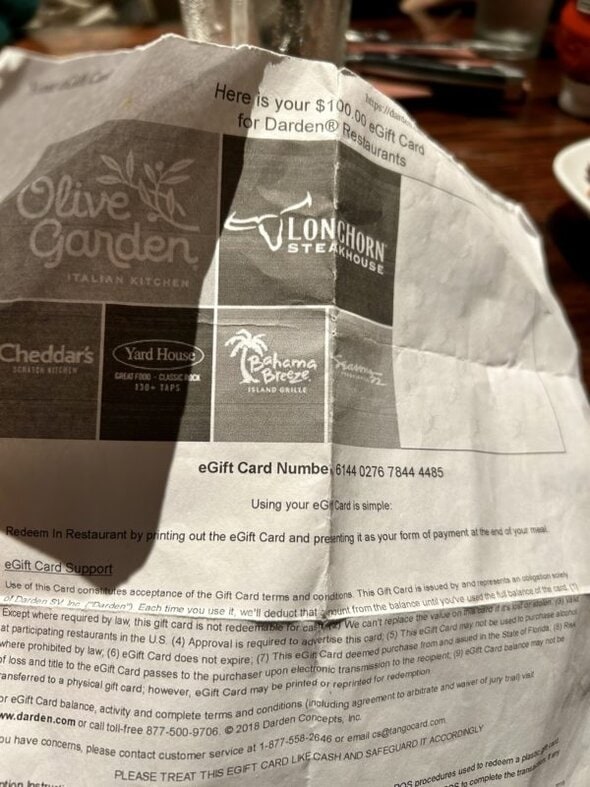

I meant to include this in last week's post, but here it is belatedly: I had a printed-out $100 gift card for Longhorn Steakhouse and it had been in my possession since 2018.

GEEZ.

That feels like a lifetime ago!

When I was looking for nearby places for us to eat after my graduation, I noticed Longhorn was nearby and that's what triggered the memory of the gift card.

Sooo, we used it for our dinner. Yay for essentially free food! And now I don't have to hang onto that piece of paper anymore.

(Honestly, it's kind of surprising the paper made it with me through all the upheaval back in 2022!)

2. I opted for the free transcript option

I'm in the process of applying to school to start my BSN program in the fall, and one of the requirements is a securely-sent transcript from my community college nursing program.

There's a $7 option for an immediate online transcript, but if you can be more patient, there's a free option: having the transcript mailed to the BSN school.

I am not in any big rush because it's only May and I'm not wanting to start school until August. So you know I picked the free option. 😉

3. I redeemed an Equifax settlement gift card

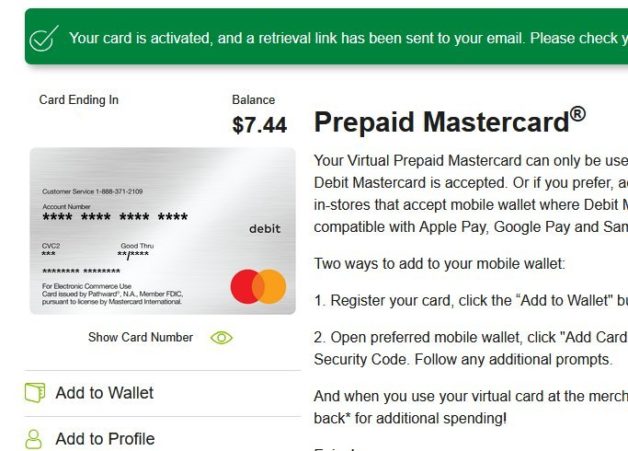

I got an email that I had qualified for a small settlement so I registered and discovered I had a whole $7.44 coming to me.

(As my friend Katy would say, I came into some money. Ha.)

$7.44 is not exactly enough to retire on, but you know me: I am not one to sniff my nose at a few dollars.

Since it's easy to lose track of virtual gift cards, I saved it to my Amazon account, and I will use it next time I need something in the $7 price range.

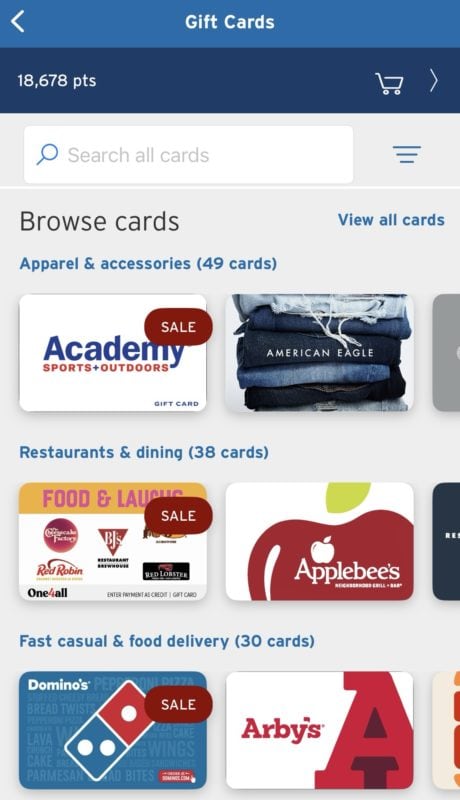

4. I redeemed my Fetch points for a gift card

I was listening to a How To Money episode in which Matt and Joel shared that Citi will be reducing the value of their points by 25% starting in August.

And that reminded me that sitting on point redemption is a risky game; companies can always devalue your points!

I looked into redeeming my Citi points, but none of the cards on sale right now match what I want. I'll keep checking, and if nothing desirable goes on sale before August, I'll just redeem them regardless.

Anyhow, this made me get off my duff to redeem my Fetch points too, since they're prone to being devalued as well.

5. I...

- worked my three shifts last week and spent $0 at the hospital (as my friend Katy always said, "I'm here to earn money, not spend it!"

- potted some spider plant babies in a pot from my Buy Nothing group (and my initial plant was from babies Sonia gave me from her spider plant. Free all around.)

- put a library hold on Jefferson Fisher's book The Next Conversation (because I do have time to read books now. So wild!)

Bizarre that the online transcript has a cost since it will definitely cost less than posting it. ADHD tax!

It is odd, but every now and again an online service does cost more.

Luckily I’m not last minute with it so all is well. I have the luxury of time!

@Victoria, online transcripts usually are sent via a service like Parchment, for whom we have to pay a membership service fee as a university. Mailing it, is cheaper for us.

@Britta,

10 yrs ago when I applied to grad school I don't believe online transcripts were a thing (here at least)...I had to pay $15 (I think) per school to have them mailed.

@Jaime,

Wow that's crazy! My university had online transcripts before the year 2000!

@Kristen, teen has Parchment account & it costs nothing for high school transcripts to be sent to teen. Then teen can submit to college(s).

I have a CITI double cash back credit card and hadn't received that notice. I went digging online quickly and the devaluation is one for certain cards types. Not all thankfully!

Ohhh! I assumed it was for all. Now I’m gonna need to go figure out if mine is one of them.

@Alexis,

That is my main credit card too. I'm glad to hear that, at least for now, the points will not be devalued. I usually redeem the points for a check though I have occasionally redeemed for gift cards that are on sale.

@K D,

This is my only credit card, so I was going to be so sad (and mad!!) if the rewards changed. I use my points as a direct deposit into my bank and then move it over to my Christmas gift savings account/bucket at Ally Bank. Helps me save for Christmas all year!

I've been making the 90-mile drive to a town just about every week again for regular appointments for my eldest. When it was a less-frequent event, I would always get him lunch from Sonic before we started our drive home. Now that we're going so much more, however, I am not enthused about spending $15 for a treat every time. Luckily, the same child is extremely enthusiastic about Oreos. I go to the grocery store while he's occupied, and there I buy the $2.50 package of store-brand Oreos (very close in taste to the name-brand) for him, which I would never buy otherwise. This way he still gets a treat, but it's way cheaper, and there are still Oreos when we get home for the other kids. (If I monitor him and take them away before he eats the whole thing. Because yes, he will eat 30 cookies if I don't watch him. 🙂

@kristin @ going country,

Gotta love the teenage appetite. My teen girl is the one who will eat half a pan of brownies when she's hungry.

I’m trying to imagine eating an entire package of Oreos! The appetite of a teen boy is wild.

@Kristen, Just out of curiosity, he looked up the record for Oreos eaten in one sitting: 520. Ew. I sincerely hope he doesn't take that as a challenge.

Oh my word. Imagine the blood sugar crash we'd experience as adults doing that. Ha.

@Kristen, I probably could but would regret it later!

@kristin @ going country, Remind him that if he attempted that, he would never enjoy Oreos again in the future.

(My Sunday school teacher told us how when he was a child, he stole a bag of brown sugar and hid under the boardwalk and ate it all. To that day, he wouldn't even look at brown sugar).

@kristin @ going country,

Teenagers have a closet in their skeleton...

One of my friends has a teenage son that I had not seen for a month. Honestly, that boy grew more than a foot in that amount of time. I am not kidding! I looked at his Mom and said that was some growth spurt, new jeans, new shoes! He always gives me a hug and I'm sure it was quite a sight. I am 4' 10" and he has to be at least 6'4".

@Sophie in Denmark,

Ha ha, I was thinking the same thing!

@Chrissy,

My teen son is like that! He'll be the same size, height, shoe size, etc., for awhile, and then seemingly over night, he's outgrown everything. He just reached a height taller than me (I'm about 5'5"), and he's not done growing yet. He might never be super tall (he was always a small kid), but it'll be interesting to see how tall he gets.

@Liz B., I remember as a kid declaring to my mother that when I was grown-up I would eat an entire packet of Maryland cookies. I haven't done so yet lol!

@Liz B., my son (now 35) was a preemie and grew very little: at age 7, he weighed only 45 pounds, and only 55 at nearly 11 years old. He was half the size of his male classmates, until the summer after his first year of high school, when he shot up a foot in height and doubled his weight. I was never so glad to replace an entire wardrobe!

We had done that wrist bone measurement test when he was younger and his predicted height was 5'6". He topped out at 5'11".

@kristin @ going country, after my first kiddo was born, I consumed:

1 - 1 lb of Fannie May pixies (turtles)

2 - a dinner of lobster (w/butter), baked potato w/butter and sour cream, asparagus, and pecan pie for dessert (and rolls I'm sure).

I'd never been a breakfast eater until I breast fed the first kiddo. Big pharma should figure out how a nursing mother can consume the same amount of calories as a pro-football lineman AND still lose weight.

I cashed in $25 into a Subway GC from my Ibotta and sent it to a coworker whose child was admitted to the hospital.. this hospital has a 24/7 Subway on the ground floor.. Figured it would give her a place to take a walk to and grab snacks.

Stopped by Panera for my free drink- checked the date of my 3 month plan expiring and put a reminder into my phone to cancel it-TOTALLY got my monies worth!

Froze leftover rice, blackbeans and taco beef for future burrito night.. too many things going on I knew no one was going to be home to eat leftovers!

Used my Fetch point GC on the Sonic app to get a 1.99 sandwich and 1/2 priced drink after work when I was starving! Knowing I can order a quick snack from my car and pick up on my way to run errands( or in this case take mom to the DR) is cheaper than other option when my schedule has gotten away from me and I am unprepared!

@jes, a very kind thing to do for your friend who has a child in the hospital and a great use of points. I think many of us have spent time in the hospital with someone we love. There little things make life easier.

@Bee, *these little things

@Bee, Or "There (in the hospital), little things make life easier." See? You were right all along!

@jes, Ibotta is an awful app and I refuse to use it going forward. They were hard enough to get money back deals on. When I did get money back apparently I didn't use it fast enough (I didn't have enough to cash out) - so they took it for being "inactive". They also take $5 at a time, until nothing is left. It infuriated me! NEVER AGAIN! I only use Fetch and Receipt Hog, both which I get gift cards on at least twice a year 🙂

@JDinNM,

Interesting, different words conveying nearly the same message!

- kind of cleaned the freezer. Ate some stuff, threw some stuff out.

-figured out a way to combine Amex with a store bonus program at my local grocery, which maximizes points

-sent in receipts for business expense reimbursements

-cancelled a gym membership that was not getting used

@Sk in Norway, Wow. Can I relate? I kind of clean my freezer and throw stuff out. Cancelling gym memberships not getting used? Been there (but not to the gym).

I got that same type of settlement from Equifax and went through all the tedious steps to get my $, even downloaded a specific wallet app! Thank you for reminding me it's there. I'm meeting a friend at a coffee shop for tutoring, so it will equal a free drink while I'm getting paid 🙂

I ate out a lot this past week (summer break = catching up with everyone!), but I brought home leftovers every time and have turned them into multiple meals at home. Although restaurant meals are expensive, I (of course) am there for the social interaction, and using the leftovers to the max makes it much more frugal!

After a brief hiatus because I was busy and kinda sick, I'm now going to the pool at my gym almost daily the past few days. Be gone, soreness! Every visit makes my monthly fee even more worth it!

Oooh yes that is a good way to look at a gym membership. I should count my visits this month and calculate the cost per visit!

Thanks for reminding me about my Fetch points...I have been hoping to get them up to a $50 card reward, but maybe I should redeem them sooner. I accumulate Fetch points very, very slowly, since I don't buy a lot of brand names (exceptions including Annie's Mac and Cheese, which gets me quite a few points sometimes).

1. Continuing to carpool with DS#2 to class--sometimes I let him drive, when I don't feel like getting carsick I drive. Ha. That's not a judgement on his driving, I get carsick in regular cars when I'm not driving. Trucks, I'm fine, but cars that are close to the ground, oof. But carpooling makes sense.

2. I had a rare, lovely free day and I took myself for a bike ride up to the library (for free books, ha)--on the way I stopped at a garage sale that, unusually, was happening on a Thursday (the lady running it said they didn't want to be having it on Sunday, as that was her toddler's birthday). I didn't have much cash, just my little box of found change I keep in my backpack, but I found a gorgeous handmade mug for $1 and a badge holder in the shape of a cat and a couple of notebooks, the last a quarter each. Just another reason for me to always take my backpack on bike rides!

3. On the way home I spied a roadkill piece of fabric on the curb--thoroughly beaten into the ground by tires and dirt. I scooped it up and when I got it home and bleached and washed it, it turned out to be a very nice Williams-Sonoma kitchen towel, with no tears or holes. A few stains that didn't come out, but my kitchen is a working kitchen, and if it's clean and works, it stays.

4. When DH and I took a bunch of recycling to the county's free drop off center, I found what I thought was a really oxidized penny on the ground (of course I picked it up!). After soaking it in vinegar, I learned it was in fact a nickel, so I guess you could say I came into some money. 😉

5. Ignoring the vending machines at college (there aren't a lot of them, but they're there!) . Aside from studying, reading library books as always. I did splurge on a Shirley Jackson book to complete my collection, but that's the first book I've bought in since my anatomy coloring book.

1. I signed up for a free 5k parkrun this weekend. It was a lot of fun, despite having to take a few walking breaks!

2. I found a great podcast about exercise which is free to listen to.

3. I made all my meals at home.

4. I baked a cake with ingredients I already had.

5. I air-dried my clothes instead of using the dryer.

Frugal fail: I forgot to renew some library books and now have a fine!

@Sophie in Denmark, I forgot one more - someone left a stand for drying dishes which I took for free.

@Sophie in Denmark, I just read an article ranking the 20 Happiest Cities in the World and it says Copenhagen is #1! Aarhus is #4, Aalborg #15. All in all, Scandinavian countries took 6 out of 20 spots, and 3 of those were for Denmark.

@JDinNM, Denmark is a very happy country! It has excellent public infrastructure, ie, good public healthcare, transport, green spaces and education. My master's and Danish classes are all free - of course, all of this is funded by tax, but it's free to everyone, regardless of if they can afford it or not.

Denmark is not without its issues but there's lots of benefits to living here 🙂

@Sophie in Denmark, I've been to Copenhagen, Stockholm, Amsterdam, Oslo, and just for kicks up to Hell, Norway, just to get my picture taken by the sign so I could say I was in Hell when it was frozen over. And I have a dim recollection of having to walk up a downhill ski slope on my cross country skis (took forever!) because I didn't have enough money for the ski lift. Good times!

Your gift card story reminded me of a frugal thing I did, so I’m going to try to come up with four more to go with it.

1. Cleaned the enormous paper pile that was my desk and found an untouched Starbucks gift card.

2. Called insurance and the hospital about a large medical bill which is now working towards getting paid by insurance rather than me

3. Batch cooked several pounds of chicken to have easy protein for meals.

4. Shopped around for car/renters insurance to find a deal. This saved me about $75/mth.

5. Ate meals at home, brewed my own coffee, packed lunches for work, kept lights off as much as possible

FFT, Things Are Looking Up Edition (revised/updated from various comments at the NCA).

The first two are also "thankfuls" that happened after I wrote last week's Thankful Thursday comment here:

(1) NDN’s other close friend and I got her down to the law office late Thursday morning so that she could sign her final legal paperwork (HCP/living will, DPOA, will, and revocable trust). NDN was a little shaky, but she made it through the entire process. Three hearty huzzahs!!!

(2) And no sooner had I walked in the door from (1) that I got an offer I couldn’t refuse from JASNA BFF: She’s invited me to be her “plus one” at the opening reception for the Morgan Library’s upcoming exhibit in honor of Jane Austen’s 250th birthday (https://www.themorgan.org/exhibitions/lively-mind-jane-austen-250). Woo hoo!!!

(3) I consulted with JASNA BFF about what she's planning to wear to this reception, and found that she intends to go "dressy casual" for the occasion. I can manage that without having to go shopping for something. As Henry David Thoreau reminds us, "Beware of all enterprises requiring new clothes."

(4) However, I did pay a visit on Saturday to the “boutique” Thrifty Shopper store in the university area, and this went very well. I found a like-new pair of no-name but extremely comfy black sneakers (Euro size 41); a NWT sports bra in my (ahem) rather large size; a NWT wooden hors d’oeuvres board with Grad School BFF’s first initial carved on it (will tuck this away for her birthday); and several useful odds and ends. Total $28, which I put on the $100 Thrifty Shopper gift card I bought for $75 back at Christmas.

(5) Finally, I ran my May totals for container returns and found change. The container deposits came to $47.55 (not an all-time record, but definitely in my top 10)–and the found money, thanks to the $20 and $10 bills I found early in the month, came to a whopping $30.48. Cha-ching!

@A. Marie, the Morgan Library is so beautiful! I went there on my trip to NYC last year.

Wow, you are making out like a bandit with the container returns!

@A. Marie,

I did not know the saying “Beware of all enterprises requiring new clothes.” but more or less adopted it several years ago. IF DH does not require new clothes for an event then I generally do not either. It has saved me time, money, and waste.

I am currently sitting at jury duty, but I managed to navigate this new enterprise without buying new clothes.

To be fair, however, the pants I am wearing are ones I bought for court during my divorce, which WAS an enterprise that required new clothes. Ha.

@A. Marie,

I hope you have a lovely time at the Morgan Library exhibition. I watched the 1995 mini-series of Pride and Prejudice again last week while doing things around the house. I do believe that I watch it once a year. BTW, that is a great thrift haul!

@Bee, did you celebrate May 1, now known as Colin Firth Day ("May the Firth be with you")?

@A. Marie,

What a relief to get that paperwork signed! Good for all of you!

@A. Marie,

I wish I had known about this! marking it on my calendar for next year. 🙂

@A. Marie, hubby's friend passed away last week while we were away. His viewing was yesterday. I don't have any dress pants but I have two dresses. I wore my blue one that I got on Thred Up that's blue. It even has shoulder pads! Dressed it down with a jean jacket and up with a strand of fake pearls. Wore my everyday sandals and I was set.

I just got back from a trip so not much frugality to be had.

1. While in the big city I walked rather than cabbing. Nice weather, good exercise, free. Win all around!

2. Brought food with me for the trip home rather than buying it in-transit.

3. The hotel lost a bag of cheese and other nice things (insert very sad face). Since I keep receipts I can send them a list of what they lost. I hope they don't turn giving me a refund into a big fight.

4. I stayed with family rather than in a hotel.

Not Frugal But Very Nice:

I went to three indie bookstores on this trip and, with the advice of booksellers, bought a new book in each one.

We are in the process of planting our garden to reap the benefits at the end of summer. Someone gave us tomato plants, but we didn't know how many when we purchased 12 plants ourselves. We now have 18 plants and will be making a lot of puree for sauce this upcoming fall!

I have a Olive Garden gift card for $15. that has been sitting in my wallet since Dec. 2023. I'm hoping it's still valid. But seeing your experience, hopefully mine will be the same. We have no Olive Gardens near us, so I will spend it at some point. It will probably only cover a slice of cheese cake!

We have been finding food at home to eat rather than going out. And we always make coffee at home. We buy an little more expensive brand, so it is always good. I specifically went to Kroger to get the half caffeine pods that I had an electronic coupon for to save $5.00 on each box.

Husband has been looking into prices of his new medications and our drug plan that will mail you your prescriptions is cheaper than the drug store. So he will be going that route, especially since he doesn't like to go out of his way to the drug store. My drugs are too expensive to get that way, so I use Drug Cost Plus.

Well, your gift card is just a baby in comparison to mine! 😉

@Maureen,

One of the best Christmas dinners I ever had was due to a gift card to Olive Garden (or was it Red Lobster? Not sure.) Anyway, while living in Florida, I was a regular blood donor so I got my card punched. After 6 donations that year, they gave me a gift card to Darden Restaurants, which owns the above-mentioned chains. My nice roommate/BFF and I went there and feasted. I remember it was pleasantly dark and we dined by candlelight. It was either Christmas Eve or the day before; anyway, we had a wonderful meal free (except for the generous tip we were happy to leave).

-DS#2 saw there was a promo, first 50 people in line at a new Jet pizza location received cards for 1 free pizza each week for a year. He lined up early and received cards, yay!

- We're installing Simplisafe at our house and I saw a Chase cc promo spend $250, get $50 back and used that.

- Free exercise, swimming with neighbors every day the ocean is calm. Plus walking the dog at night.

- I checked our American airlines points and saw DH's were expiring in a week, so I paid $5 to transfer 1000 point to his account from mine which extends the expiration date 24 more months for each of us. He has over 80k points I would hate to have seen expire.

- Mom loves outback so I sent her giftcards for her birthday that came with bonus giftcards as a promo, so I sent her those as well.

@Sandy Beach, beware that most Bonus gift cards at this time of year (moms, grads, dads) have short term expiration date printed on gift card>>>>so maybe use first. Unfortunately a few years ago I (& others) learned this the hard way & Bonus gift cards expired before realizing to use. 🙁

@Regina, Thanks!

Not much frugality here- after the semester ends, I go a little crazy shopping and catching up on things.

*I also discovered a lost gift card! Someone gifted me a virtual gift card in March that was a pain to redeem. I forgot about it until last week. This time, the redemption worked, so it'll pay for dinner tonight.

* Husband will use a gift card I bought to get his haircut: when I bought the $50 gift card, we got one haircut free.

*I bought the pool pass for the city's water park for the summer. Big bucks up front, but we will use it almost daily. Much cheaper than paying individually each time.

*Signed family up for library reading program. Teen got a free book for signing up, and well have fun activities to do all summer.

*I bought a pot of car grass for my pets as one has been desperate to go outside. The boy cat kept knocking it over as he nibbled. Teen son measured the pot and 3D-printed a stable base to put it in. It'll take a lot more effort to tip it. No new money spent and gave the teen a design challenge.

Now I just need to stay out of the stores and stop browsing online. My impulse control needs to strengthen up before I can shop again!

Happy Tuesday!

Thanks for the reminder that point values can devalue in a day. I use my IHG card all the time for hotel nights. I try to have dates booked through the year. I'll start researching today.

I have been working 5-6 hours days in the rose garden at the River House. It was in terrible disrepair when we "inherited" it. (The house came with land we transferred for because of water rights. It was either burn the 1912 American foursquare or renovate.) While I am the definition of black thumb, I do have an eye for design. In the past two weeks I have rebuilt a brick border, created a flagstone path and resurrected a sculpture garden along with deheading and weeding dozens of roses. I am bruised and sore but am also getting stronger. I do love the outside. So uber frugal isgetting healthy while savings thousands of dollars by not hiring someone to do the work.

@Mary Ann,

What a beautiful project!

@Mary Ann, I'm great at gardening as far as plants are concerned, but not good on the infrastructure. Too bad we don't live closer to each other; we could help each other out.

I have one of those Equifax settlement $7.44 things also. But you can't use it towards anything that is more expensive and I don't really know how to save it to anything else. I've been waiting to ask my daughter how to do it because I'm sure she knows but fire season has already started in Oregon and she is already working 12-hour days.

@Allison, for those visa type gift cards that won't allow one to apply it toward "anything that has a greater total bill", I've found that swiping it inside at a gas station (pre pay) is an efficient way to use up odd amounts, like $15.37 remaining on the card. The gas pump just stops pumping when the funds reach zero.

@Allison, My grocery store will let me use those low amount gift cards, if I tell them the amount on the card. I guess it’s common for people to use various cards, like SNAP benefits, to cover part of their grocery bill.

@PD, I use those towards my (online/app) insurance payment(s). I just add it as new payment, type in card info & amount to be paid (exact amount on card) & submit payment.

1. I bought 6 packs of ground beef, 2 packs of breakfast sausage, and mango for 50% off at Aldi's, which was a savings of $55.

2. My husband sold a kayak rack on Marketplace. I listed a pair of sneakers on Marketplace.

3. My mom brought us a bunch of food like bread, buns, flatbreads, cream cheese, bagels, broccoli, and olives.

4. I made applesauce from over-ripe apples. I made raisins from over-ripe grapes. I juiced some mushy oranges and clementines, which I made into popsicles for my kids. I made croutons for my husband's lunch salads this week using leftover bread. I made baked French toast for my kid's breakfasts using more leftover bread, bagels, and muffins.

5. I changed the payment method on our home owner's insurance to direct debit from our bank account, which saved $6.

Unfrugal: I wasn't feeling great last week so DH opted to go get a haircut at the local barbershop rather than having me cut it. It's probably been 18 months since he got a haircut outside the house. $32 + tax. DH isn't super frugal, but even he thought that was a bit much for a 10 minute haircut especially since he asked for tapered and blocked, and his hair just got the same size guard all over the back with no taper...then she cut off his sideburns. He looks like an 8 year old with graying hair haha.

Frugal:

1) stocked the freezer with ground beef that was found on a great sale.

2) we found a great flooring option online that is pre-sanded 2 1/4" red oak (what is in the rest of the house), but in an engineered floor. We needed something to go over tile that was put in a den area of this house. I really didn't want to have to pull out the tile. This is a great option. But shipping was going to cost nearly what the floor cost. Found a location just 2 hours from here, so we ordered the floor and will go pick it up at the store. Free other than gas. We will install, stain, and seal it ourselves.

3) We bought a sofa for that same den over Memorial day weekend after looking for months. The deliver was $219 for them to deliver it into the house, but was free to deliver it to the driveway. They'll deliver it to the driveway tomorrow. Sofa was also on a great sale for Memorial Day (more than 25% off).

4) Separated some monkey grass in the yard to fill in a border in a flower bed. Free other than my hardwork.

5) DH likes O'keefes working hands cream. I buy it even though it is NOT frugal. At a thrift store this weekend, they had 6 containers still sealed in the plastic for .50 each. He's stocked for a bit!

1.) Bought a case of Annie's macaroni and cheese. They averaged around $0.66 a box which is pretty good.

2.) Didn't travel much this weekend. The endless rain on weekends in the Northeast sure puts a damper on things.

3.) Bought some Converse new for $20. I won't wear used shoes so I just have some deal alerts set on Slickdeals on Converse and Vans and routinely get brand new pairs for $20. Sizing is limited and colors are whatever they are getting rid of so I don't always luck out. I get some good stuff because I'm patient and in no hurry.

4.) Took advantage of a sunny day and got as much of my clothes line dried as I could. We've also been purging clothes and putting clothes away in storage. Fun side frugal fact: Dollar Tree has Space Bag copycats which are super handy.

5.) Still doing the usuals. Eating homemade lunches. Packing lunch for my picky eater kid. Not buying more stuff. Saving a chunk of my income every paycheck automatically. etc.

I noticed that Fetch has already decreased value in points, not sure by what percent but did notice yesterday some of my regular places it costs more for same gift card.

Well, not surprised since so much of everything seems to be increasing in cost. Why not free gift cards also (sigh).

I'm surprised that your (paper) giftcard was still accepted/good. That's wonderful that you were able to use it. 🙂

Frugal things---

● saved $0.10/gallon on gas ($2.93) & earned $3.00 in rewards & earned additional $0.15/gallon on next fuel purchase. #do not send teen to get gas for lawnmower & use additional rewards on 1 gallon gas 🙂

● used (additional) flags purchased at flea market few years ago to put out for Memorial day weekend (& will do again 4th of July)

● purchased marked down apple pie 65% off ($3.50) for lunchbox containers

● bought new sun dress (tags still on) from Goodwill ($9) to wear to graduation

● I wanted my hair curled for teen graduation (on Sunday) so neighbor did my hair for free (I gave her Bath & Body Works Black Cherry hand soap as tip) because I don't own curling iron or blow dryer in decades

● teen & I drove together to open houses of friends (since kindergarten)

● earned $9 monthly reward for 12+ purchases with debit card

Frugal fail---

● ordered Applebees take out (online buy $40 get free $10 digital giftcard) & have not received free giftcard

● teen broke my vintage deep dish pie pan, but was honest & told me

@Regina,

I also noticed that Fetch gift cards now "cost" more. They have also discontinued some venders. I used to get a Whole Foods gift card which allowed me to purchase gluten-free baking items that were not available elsewhere. Sadly, this option is no longer available.

I'm so impressed you kept that paper gift card for so long! And thanks for the reminder about gift cards laying around. I have $100 GC to Connor's that needs to be used!

FFT:

1) DH cut up limbs from some of the trees that fell during the tornado and I carried them to the street. The 50' to 60' pine trees that lost their tops will require professional tree service to remove but we can at least same a little money by doing part of the removal ourselves.

2) Moved DH's 1968 Mustang from his mom's house to our house instead of paying to store it somewhere.

3) This week's meal plan is based on what is in the frig, freezer and pantry. Only fresh fruit and vegetables needed from the grocery this week.

4) Continue to maximum my Kindle unlimited subscription by reading multiple books a week

5) Brought lunch to work every day last week

Be careful with those gift cards, they expire within a certain period of time. I JUST had one I didn't realize expired in exactly a year. When I went to use it, it was just a couple days AFTER the expiration = and they took the entire balance. There was nothing I could do and I was NOT happy.

When I had one of those virtual credit cards, I would normally stick them in my PayPal to use up - but I had issues with the last one I had like that. It kept wanting to verify it, or something like that, and I had issues every time I went to use it. When you have just a couple dollars, they are tricky to spend since you cannot normally split the payment (sadly!). I have started to see if I can get them a different payment form, to NOT use those kind of virtual credit cards. They seem easy to use, and like the easy option - but they are in fact NOT easy to use. Which is why I think they push them!

I hope this saves someone the aggravation of losing their balance on their card!

@Michaela Urban,

Anytime I have bonus points on my credit card, I don't even fool with the gift card offer. Instead, I just have them apply the amount of $ to my cc bill. It'll knock a few bucks off the bill, and I don't have to worry about expiration dates or anything. These businesses love gift cards bc they know a lot of people will end up not using them, and the business keeps the $.

@Michaela Urban, yes this helps me 🙂 Thank you for the Paypal tip! I have a virtual rebate card that we got when we bought a dishwasher, and I'm trying to figure how to use up the last $11. Hopefully Paypal will work. Thanks!

You may want to get a printed copy sent to you anyways (rather than sent directly to the school).

I am consistently shocked at how often I am asked for a transcript, even after graduating nearly TWENTY YEARS ago.

@Kate, my younger son was allowed 5 transcripts within a certain amount of graduating at no cost from his college. I had him order all 5 separately (like one every week) to be sent to the house. They are still sealed so when he needs a sealed transcript down the road he has it ready to go

I have the Citi double-cash back. Thanks, Alexis for checking on that.

1. Speaking of that, I always redeem my points as statement credit, which I just did a couple of days ago.

2. I had a whole hen that had been hanging out in the freezer and I'd let the weather get hot on me, so I pressure cooked it using the Test Kitchen method of pressure cooking a chicken instead of roasting it and heating up the kitchen. I ate some and pulled the rest off of the bones. I will use the meat this week and the bones are bubbling in my crockpot now, to make chicken stock.

3. I stayed home yesterday since my car is in the shop after bringing up an engine fault Friday afternoon. Hopefully I will get mine back today. It's drivable as far as I understand, but the A/C won't blow cold, I think because the car is reserving power usage on the engine. Hopefully they can locate the cause of the fault and get this fixed. , so at least I didn't spend money on gas to drive back and forth to work. I also stayed home all weekend, saving money there. This is NOT my favorite way to save money, though.

4. I set the house A/C higher during the day after my sister left, as no one is normally home during the day most days of the week, when she isn't there. The dogs have a fan, plenty of water, an air conditioned laundry room and access to the outdoors at all times, so no one is suffering.

5. My DD loaned me her car for today and got a friend to take her to work, which was sweet of her and her friend. Not going to lie, this car issue is bringing back unhappy memories of driving my car with my fingers crossed while waiting on a new engine at the same time I was putting DH into hospice after back to back emergency room and ICU visits.

@JD, I can relate to your #5, although I think your situation was worse (since it involved the car and your driving safety). Four years ago yesterday was the day I took DH to be placed in the nursing home, at the same time I was getting the house AC replaced.

But at least this gave me a good "cover story" for why he was going to the nursing home: I was able to point to our HVAC company's trucks and say, "Look, we're getting the AC replaced [and I added a few other, fictitious, major home repairs], and you're gonna have a little vacation while all this is happening." (Yes, this wasn't exactly honest, and it went against the grain for me. But for other folks who may need to place a loved one with dementia, it makes the process a LOT easier to tell some little white lies than the truth.)

To be honest, it has not been a frugal week at all. I have gone out to eat, bought a new dress, and had my hair cut and colored.

However, I am consistently on frugal auto pilot with many of life's ordinary things and they help to keep my living expenses in line.

* I drank primarily water, brewed my own coffee, and ate 18 out 21 meals at home.

* I cut flowers from my garden.

* I am reading a library book as well as using the Libby App to listen to a book at the gym.

* I have been scanning my receipts to Fetch and occasionally iBotta.

* I earned $10 in rewards points by going to the gym. I listed 3 items on eBay. I continue to declutter. This week's target area is my kitchen.

Wishing all of you peace, good health and prosperity!

@Bee, so eating out 3 out of 21 times is actually not bad. I'm sure it's not a regular thing, so it happens that we occasionally have to do those things. 🙂

First, my frugal fail. DS18 wanted to go to his elementary school picnic (for graduating seniors) & I gathered items to make a pasta salad. But, my morning ran away from me, with needing to prep for an interview, and a hike that went longer than expected. I bought pasta salad at the fancier grocery store, and oh my! It was SO expensive. I was cursing myself as I paid. It was good & went over well, but still. I should have made it the night before! Procrastination tax.

1) Hosted DS18's friends unexpectedly after the picnic. They hung out at the house & stayed for dinner. We had hot dogs in the fridge, for just such an occasion, and I had buns in the freezer. I cut up some watermelon, and put out a bag of chips that DS18 brought home (unopened) from a senior events.

2) DH always buys champagne for when my mom visits, and my parents arrive tomorrow for DS18's graduation. I happened to notice an iBotta offer for $6 off the champagne, so got that uploaded.

3) At the grocery store, the checker asked if I was interested in their current game they have going. I said sure, and she loaded me up with game cards. I won $7.50 & a free package of shredded cheese, so not too bad.

4) Borrowed extra stadium seats for graduation, as sitting in the stadium for that long will crush my back.

5) DS18 is using his brother's cap for graduation (DS19 didn't want to decorate it), which saves a bit of money. I will pass on the graduation gown next week, to save another parent from having to buy it, as well as reducing the environmental impact of needing to continually buy something that should be able to be reused!

6) Bonus: gave away a ton of DS18's clothes on Buy Nothing. Teen clothes can be hard to source, and he now buys most of his stuff at the thrift shop. We had a lot to give away, and a lot of pleased parents.

@Hawaii Planner, Lucky you for graduation cap & gown. Teen had to return gown & keep cap (couldn't decorate until after graduation) & honors cording. We paid $100 & this is how the school operates for graduation.

I loved "The Next Conversation"- I listened to it as an audiobook and he gives such good examples- I wished I had the paper book to highlight and refer back to when you need to have a tough conversation.

Love Jefferson Fisher! How did he get so wise at such a young age?!

1. Downloaded the aisle app and have gotten numerous free items. Was thankful yesterday when I could hand a free to me electrolyte drink to a dizzy low bp pressure friend at the dog park.

2. Signing up for numerous birthday freebies should pay off this month. I'm going to map them strategically.

3. Combined errands yesterday.

4. Reorganized personal care items yesterday and realized I don't have to buy any.

5. Gave moving boxes to a friend

1. Made fajita bowls mostly with ingredients received from Buy Nothing.

2. Cooked a use-it-up concoction of tofu, mushrooms, chickpeas, spinach and basil in peanut oil. Mixed it with farro and ate it as a cold salad. Quite delicious. Ingredients came from Buy Nothing, Aldi and our garden.

3. Gave away a Rummikub game and seed packets on Buy Nothing. All were gifts that we wouldn’t be using.

4.Husband subscribed to Sling TV for Stanley Cup games. He’ll cancel afterward.

5. Learned that applying Goof Off with cotton balls or Q-tips is a preferable way to remove gunked on paint. After putting so much Goof Off on rags that would just get soaked in, I figured there had to be a more economical, less wasteful way. I know this isn’t earth-shattering, but we moved into a house where the previous occupants did not tape off anything before painting walls. Removing paint from trim, baseboards and wood ceilings has been a painful process.

@MB in MN, thank you for the

q-tip tip. Even if I tape everything off, a bit of paint always gets through.

* Getting a free lunch from work today

* Took advantage of an offer where every 100$ spent on a gas station gift card gives me back 10$, so I bought gift cards for a total of 1000$. Yes, 1000$. Saved 100$, that will go towards groceries. I have to pay for gas for the car anyways, so might as well stock up and get that free money!

* Compiling a list of new books I want to request for my public library to buy. They usually do 🙂

* On my Buy Nothing group I got a jar of garlic sauce and ice skates.

* Daughter is dealing with anxiety. I found a used ''very good condition'' workbook to help her, on Amazon, free shipping, saving me 8$.

@Isa, I wish could get that gas offer. 🙂 I would do the same thing & I would pay with my credit card that gives me 3% cash back on gas also. Things like gas & grocery gift card offers that we use everyday makes the most financial sense.

This spring and summer has a lot of work-related and personal travel and I feel completely out of routine, but a few frugal things come to mind:

1. Hemmed a pair of pants for my son so the pant legs would not drag and get ripped on the seams. While I had the sewing machine out I also hemmed another pair of jeans for myself that had the same problem, fixed a rip in my yoga pants and another ripped seam on a shirt. I have some iron-on patches I bought from Joann's going out of business sale, which I will apply to another mend.

2. My husband had a birthday, for which I baked a cake from pantry materials I had on hand already, also using berries from our garden I had frozen.

3. Since the start of summer, have had a few get-togethers with friends where we pool together ingredients for wonderful meals, some as potluck and some where we build a meal together from whatever everyone has in their fridge/pantry.

4. Saved $15 after cashing in on Safeway rewards.

5. Had some bread in the pantry that was about to expire. Put it in the fridge and used it for toast and grilled cheese, extending its life. Also, using up little end bits of cheese is good this way.

Ha ha Kristen!

You're the person gift card people hate -- you actually used your gift card! I remember reading that the percentage of gift cards that are not used is incredibly high. Retailers love them because they sell the cards but don't have to part with the merchandise! So you go girl!

Frugal things --

-- Bought two pork loins on sale and cut them in half to make better dinner-sized portions for the two of us. I sliced one of the halves into 6 boneless pork chops.

-- I bought 4 big cans of Campbell's chunky soups discounted to 98 cents each at Kroger and they are good til late 2026. Perhaps they were not selling well? I can donate them to a food pantry or use for us. Some of these soups can be heated and put over noodles or rice. Add a veggie for a quick, easy meal.

-- It's not often that I make a complete meal using all frozen leftovers. But I was able to make a complete and easy meal of chicken broccoli divan using frozen rotisserie chicken, blanched broccoli and frozen rice. I even added garlic bread made with a frozen half loaf of bread.

-- I've been watching what I eat to lose some weight and recently had a rare desire for a chocolate milkshake. My hubby ran out and got us each a shake. I've since bought the ingredients for a low calorie copycat version of Wendy's Frosty that I had saved on Pinterest. Now I have those things on hand in case the taste for a chocolate shake comes over me again and I can enjoy it guilt-free. ( I made it later and it was Delicious!)

-- I made more homemade bread crumbs from the ends of two loaves of bread and some hamburger buns. I put them in the freezer to use later.

-- I used some old bubble bath to hand wash some things. I never take a bubble bath but somebody gave me bubble bath years ago I had it in the bathroom taking up space. It worked fine just like any detergent or shampoo. Don't know why I didn't think to use this sooner. I'll use it from now on til it's gone.

@Joyce from Arkansas, As was discussed on "The Nonconsumer Advocate" a few weeks ago, soap is soap. Use the bubbles for toilet bowl cleaner.

1. Got an entire case of broccoli from the local food pantry (open to the entire town because if they don’t give away enough food, our town will be cut off from receiving more). AN ENTIRE CASE! We shared with everyone we could think of—several friends are too proud or embarrassed or busy to go to the give-aways.

2. Ordered a book for the library, read it and turned it in. This is a great program called “Zip books”. If a book is unavailable through the county library, older than a year and not out of print, a patron can order it. It comes from Amazon to the patron, who then has a few weeks to read it and turn it in. Super fun way to get and read books without having to pay for or own them!

3. Sewed up a hole in a tee shirt for my husband. Looks terrible but he doesn’t care.

4. Trying intermittent fasting, so I am probably consuming less food. (Just another attempt to beat the pre-diabetes “diagnosis”, which the neurologist insists is responsible for my peripheral neuropathy, my GP says “baloney” to, and my sister now verifies the “baloney” because she also has neuropathy and has never been close to pre-diabetes. Big heavy sigh.)

5. Bought a pair of shorts on sale through LLBean using my “BeanBucks” and with my LLBean Mastercard, shipping is free.

@Central Calif. Artist Jana,

I'm sitting here thinking about trying to store and use an entire case of broccoli. It's a good thing you know people to give it to!

This weekend, my car refused to start. I got stranded in the store parking lot and discovered, to my dismay, that my insurance company's 24/7 roadside assistance doesn't answer the phone at 8:15 p.m. on a Saturday night. Ditto, the Kia service (since my car is under warranty). If you want to hear the entire long, mournful story, go over to Non-Consumer Advocate and read my posts for the last couple of days. After this experience, I will be switching my insurance from Germania Insurance Co. to someone else. And I now believe "Kia" is Korean for "El Cheapo."

Meanwhile, here are my other frugal things:

1. Keeping the AC on 78 degrees to save money. Using fans to circulate the air.

2. Getting several estimates from various roofers. I'm finding that their estimated costs can differ by thousands of dollars.

3. Line-drying my laundry.

4. Repotting several houseplants, and dividing some of the larger ones into two or more plants. Using flower pots and containers I already own.

5. Using clear Xmas tree lights (bought from thrift stores over a year ago) on the (covered) patio for evening ambience. Cheaper than buying decorative patio lights!

I had a bottle of water spill in my purse and soaked all the gift cards in my gift card holder (it was a long day and bad choices were made). Thankfully I didn't lose any, but the paper ones are a little worse for wear. I need to get better at using them!

1. I made some freezer meals for my parents to have on hand while they are staying at my grandparent’s house. My grandparents are both recovering from medical mishaps this spring. I made double batches so that I could restock our freezer at the same time and planned all meals around what was already in the pantry. I cooked everything at my grandparent’s house so that I could chat with my grandma while cooking.

2. Between sports tournaments and visiting family, we put on a lot of miles this weekend so I made sure to check Upside when I needed gas in an unfamiliar area.

3. We had a catered lunch at work last week that had so many leftovers that everyone was encouraged to take some home. I brought home a bag of white rice and bag of pepper beef, which was promptly put in the freezer (we are actually having it for dinner tonight after my son’s game).

4. After my visit to my grandparent’s house, I brought home some legal paperwork that needed to be dropped off at my husband’s office. It saved my dad a trip/postage and got the paperwork into the right hands much quicker.

5. I downloaded two audiobooks from the library to enjoy during all my hours in the car.

1) Went to a local theater for a free screening of Erin Brockovich. I don't think I've watched it since it came out. Still a good movie.

2) Redeemed points for $15 off a purchase of shirts for my husband. Basically, it covered the shipping but still something I guess.

3) Skipped coffee after walking w/ a friend. She wasn't able to go because she needed to start work. Instead of still going myself, I just went home and had coffee there.

4) Used the Too Good Too Go app for some food for lunch today. Is getting take out necessarily frugal? No. But we didn't plan well...and 1/2 price take out is cheaper than full price.

5) Went to a members only screening at another local theater. Every month they do a free screening. This month: Speed! Boy was Keanu young back then.

I had a gift card frugal fail yesterday, but I think I was cheated! My husband gave me a $100 gift card to a nail salon for Christmas 2021. I don't go often, but we are going on vacation in a few days so yesterday I went to the salon for a mani/pedi. When I handed them the gift card, I was told there was no money on it. I said yes, there must be because I've never used it. When I showed the him the receipt he said it was too old. I told him I'm sure there is a law that gift cards have to be honored for 5 years. He sternly told me there is no law, and it's only good for 2 years, and he threw it in the trash. I paid with my debit card and left, but later I googled it...I know google is not always reliable, but it did confirm what I thought - there is a federal law in place that cards must be honored for 5 years, although there are some exceptions. I'm not clear on those exceptions, but I really feel like I was cheated out of $100 yesterday!

@Kathy, Pretty sure Google is wrong as it is individual business decision on timeline. I had $500+ gift cards from various places (before Covid19) & had receipts also but all had $0 on when went to use (after Covid) before end of 2023. I have had (all) giftcard(s) from business & never had problems using 1+ year later until that happened. Plus I noticed that most giftcard now say "Terms & agreement subject to change without notice".

@Regina, I'm going to be more careful in the future!

If I only had this first frugal thing, it would be ok:

*Ridiculously, I developed Afib after dehydrating while running a half marathon. Insert eye roll x 100. After nearly a year of different meds & combinations of meds, we found the right cocktail. The med is $800/mos with insurance, but they gave me a card to make it free for 13 mos. This month it expired & I thought I was just going to have to suck it up, but I was sent an email- updated some data & it renewed for another year. Manifesting that that will continue under it goes generic!!

* Have you guys read Ultra-Processed People? It was mind blowing to me. Not necessarily frugal, but have really concentrated on eating minimally processed food. I don’t eat many, but sandwich bread is one. I bought a loaf of whole wheat sourdough at the Farmer’s Market & dang- it was delicious!!! I figure good health is frugal in the long run

* Used a $10/100 at my grocery

*Planning meals with my son for our beach trip. Cooking together, happy hours with apps, fun desserts are all part of it for us. I’ve bought steaks, burgers, bacon, & sausage while on sale & they’re ready to go in the freezer!! Will buy the fresh seafood there

*Dh had 3 class rings: I wear his college ring stacked with his wedding band on my right hand, my daughter wears his med school ring on a chain, & I sold his high school ring for $400 & we’ll use that for the rest of the needed groceries at the beach. We miss him so much while we’re there, but it’s nice of him to pitch in for groceries : )

You friend "Katy" sounds so wise.

@Katy @ The Non-Consumer Advocate, ;-D !!

Perhaps one day you can meet her. 😉

I am amazed that a restaurant actually honored a 2018 gift card. Around here, this would NEVER happen.

The biggest "save" so far is the time spent (once or twice a month) on reviewing my pantry inventory to see what is expiring in the next 30 to 45 days. This allows me to focus on what needs to be used up when planning what to eat. (I store items by type/category of food, not dates but do place according to dates on shelves. Yes, it is time consuming and I label with the date in/expiring on everything.)

Additionally, I realized that I needed to do what I'm calling an overall "food intake" audit. I've been experiencing some health issues and both the frequency and amount of food (and sometimes type) have changed drastically.

So now I've had to literally plot out the buy dates and cook/eat by dates for the fresh produce I use each week (I still can't figure out how you aren't shopping each week for fresh produce because nothing we buy would last longer than 7 days, if that, at the most without going bad, even if we did not cook it.) as well as any fresh chicken, salmon and turkey (no deli).

It is pretty eye-opening and helped me cut back on what was an already limited amount of produce (spinach, lettuce, tomato, zucchini, rabe, broccoli, avocados).

The other part of the audit was the freezer. I have tried in the past to write down every thing that I put in the freezer (and when) but it was just too much to do. So now, every two weeks, there is a review (I keep leftovers separate from items that were frozen before they expire but could not be eaten and separate from the extra quantities of something that is home cooked.) of what's inside. I then make a list of what I want to eat that week so that I can "eat down the freezer."

This is also vital so that I can, realisitcally, shop sales for frozen food. Sometimes the prices are so enticing that I forget the freezer may be too full to accommodate (it's an apartment size one door with typical amount of freezer space. I so envy those with separate freezers!) and thus not a bargain (although we have spots in our fridge where things put there do freeze, so occasionally that is used to house an item that doesn't fit in the fridge).

Given my appetite (timing, amount, food type) I cannot plan too far ahead because there are days when I just can't eat much at all and some things not at all. So yes, there is still food waste.

But I started logging what I really eat the most, versus what I think I'll want and that also helps.

I really have to do this to help with what I order (for delivery as I can't get out) either every week or other week. Our local supermarkets are so incredibly overpriced. We had one that really had fantastic sales but they no longer deliver and are only available via Instacart and the markup is HUGE and no longer affordable even with sales. Alas, it is only through one or two markets on Instacart where I can even find some products so I have to cut back elsewhere if I want to get them.

I also spend time window shopping Amazon Fresh for various sales. It helps that you only need to spend $35 to get a free delivery (but I also tip) along with a monthly fee for it ($5.99 but I save WAY more than that in a month and it would cost me that much and more to take public transportation or a cab if I could get out.)

In the last few months, they have had some serious price reductions on items I use frequently whether fresh or canned or packaged. We are talking 50% or more in some cases and yes, some have short shelf life dates for fresh chicken, bread, etc. but they also flag this.) The regular prices are almost always much cheaper than our local markets (I live in what is perhaps the second-most expensive major US city in the country: NYC).

The other thing I monitor is my text messages with flash sales from some online places like Vitacost where I've snagged 20 to 25% off some food items. Sometimes there are also savings from manufacturer percent off. I scored 40% off overall a few months ago on a few pantry items. Wahoooo! Again, I must carefully evaluate how frequently I use. (One big problem with online shopping for food items: You can't see the expiration dates to know if you will use by then.)

This does all take time but...I'm semi-retired and I have more time than money at this point plus it really is about food waste and ensuring you have food for "lean" times.

(I worked for decades as an independent contractor and despite contracts that stipulated pay dates, companies would delay sometimes as much as 90 days or longer. This was a learned habit about a pantry, which increased in importance during COVID, when you couldn't even get stuff!)

The other way I have been forced to deal with is that I do not have the physical energy to cook from scratch as I used to. I've had to simplify what I eat as a result and sometimes that is just so repetitive. I have purchased a few pre-cooked meal items (frozen), but only when they are on sale. I save elsewhere to spend on this and some pre-cooked fresh stuff (not many but a few) and again, only on sale.

A couple of years ago I read an article that said: Track everything you spend, especially on food--it will be more than you think. And it was. I was shocked, as many are, to find out what I was spending as a lone diner. Yikes.

The other way I've saved: No restaurant delivery or take out except when I am super sick and the freezer has nothing I want to eat in the moment. Fortunately, this doesn't happen too often (maybe four times a year?) because our local restaurants, even the ethnic ones like Chinese, are now so overpriced (the specials from the remaining chinese restaurant are $20 plus Tax! Yikes) that they've lost their appeal even if I miss the food.

We also lost a lot of restaurants and food stores in the last few years and the trend is continuing.

Savings come in these ways for me and as I track closely, I am seeing the difference both in spending and food waste.

Aside: I really wish that food pantries would not be so limited in what they will take either based on dates (some want 60 days or more!) or nutrition labels. Some here restrict sugar, fat and salt. I don't have a lot of products from pantry heavy in these but...it's about how much you eat of an item if it has a higher % and how often. And sorry, people are starving and a can of Progresso Reduced Sodium soup should be OK to hand out to someone who has nothing. If it is good enough for me to buy and eat, why isn't it OK to give to someone who can't afford it but would enjoy it (The soups are good.) Folks, especially families with children, with low or no income don't have a lot of options for food overall. I would never donate anything that I would not myself eat and never anything that is expired. ) We have gotten way too judgey IMHO about what is or isn't suitable for food pantries.

I just don't do well with gift cards. I do better w those "member" things with places like Dominoes or Jimmy John's. And what I get is usually enough for more than one meal. Or with Casey's current "scratch off" prizes. I have actually won a free Dr. Pepper (my fave), extra points for money off of gas or store products, a cookie.

I'm struggling to think of five frugal things.

I am my own landscaper. This morning, in the rain, I cut some tree saplings from my medicinal herb bed. And I planted some purple salvia next to my water feature, as well as potted the papyrus for in the galvanized wash tub. I found a reseeded baby feverfew in a less desirable spot and moved it to a better one.

The plants I purchased (there are more to pot/plant were on sale at my favorite nursery. The plants are overall more expensive but better quality and provide a better start. Also there is greater variety of annuals and native plants, too

I chose to get gas in town at $2.85 vs the town I work in at $2.89.

I have not put the AC in the window yet, have used cross ventilation with windows open, cooling the house at night, drawing the curtains during the sunny hours. Also have ceiling fans. We have cloud cover, a breeze, and intermittent showers today so it is very pleasant.

1. I found $.18 on the ground and picked it up.

2. I bathed all 3 of our dogs myself; I don't pay anyone to do it for me.

3. I won a $25 gift card to Subway. I used it for one meal for hubby and I and another time towards 5 cookies. Only paid $.34 OOP for the cookies. IMHO Subway has gone downhill with their subs. Luckily, I didn't use my own money towards them.

4. I fixed a rip in our patio table cover with duct tape from the underside. You can't even see my repair. This will save us from replacing at least this year.

5. Deleted daughter's Ipad from our Verizon account, saving us a monthly fee.

I redeemed $45 cash back from my Mastercard, and had it deposited to my higher interest saving account.

I bought two 2 litre cartons of almond milk marked at 50% off…the clerk thought they were expiring May 29th, but the date on the carton was June 29th, so their mistake was my gain…but there were only two on the shelf otherwise I would have bought more!

My bedside reading lamp inexplicably died and the replacement one I was using from elsewhere in the house was just not cutting it, so I found an excellent one on FB Marketplace. The truly frugal part was my boyfriend picked it up and paid cash, and refused my offer to pay him back the $10. I will buy him a beer on the weekend!

I passed by a garage sale where a neighbour was selling lots of quilting and craft fabric in good sized pieces for $5 a bag. I didn’t need any but my sister is repairing a quilt so I messaged her and she went and filled a bag. Gotta love sharing a frugal tip with someone who appreciates it!

Lastly, a received a hydro credit which equals about 6 weeks electricity use.

Love that you used expression get off your duff, Kristen, I hadn’t heard that in a while!

Used art supplies I ALREADY HAVE to make gift bookmarks for my book club (another free event ).. next week.

Doing a whole MONTH of meal planning ,to use up freezer items!!

Staying home this summer, enjoying local river trips,libraries, book club, movies,,etc.Still recuperating from hip surgery.. so no travel expenses for a while!

Used my medicare advantage plan’s vision benefit to get a FREE TO ME pair of new glasses/new prescription.

Joined FREE health club 1 mile away, also with my medicare advantage plan, the Physical therapist says recumbent exercise bike is good for rebuilding hip strength and ROM.

Got my next 2 book club books FREE on cloud library!

1. I meal planned, used up food, and cooked our meals at home. We also stopped buying individually wrapped snacks for now. At some point, I will buy them for convenience. Just not now.

2. We went through a box of shoes before buying anything for kids.

3. We took our gift cards to Barnes and Noble to buy some summer reading. We picked up the summer reading challenge sheets.

4. We went to the library for free entertainment and crafts. We bought some books at the used book sale. I put a book on hold and downloaded an audiobook through the libby app. We enrolled in the summer reading challenge to earn free books. I already read 600 minutes, so I can pick up a free book the next time I go in.

5. The neighbors' maple tree put out an incredible number of seeds this summer. I think they all ended up in our gutters. My husband and oldest got them out while the other kids and I cleaned them up from the ground. We did it ourselves.

6. The carafe for our coffee maker was broken (again). Another was ordered immediately. We picked out that coffee maker because it is easy to order a new carafe.

7. It stopped raining and we have all been biking. I'm still riding the bike that my dad garage picked 25 years ago and fixed up (new tires, but mostly just elbow grease).

@Nikki, Oh, the maple seeds! They have always been a constant in my life, and gutters.

I've seen a few crafts to make with them. One is to spray paint them different pastel colors and put them in a jar as some kind of fairy seeds. Another I just saw was to paint a few of them bronze and, with a few other pieces, shape them into a dragonfly.

They also might be edible, though I haven't tried that. And no craft projects can take care of them all!

I wonder how many of the plastic cards are in landfills. AI is supposed to be used to target consumers even more to jump through hoops to get “deals”.

It has not been frugal since end of March. Best cat ever who already had autoimmune issues that got worse. Between the not I'm not complaining ER visit, specialist vet visit, and exploratory surgery, we're at $5K, plus Rx cost for now. Definitely sucks for the best cat I've ever had in my life. It doesn't matter what the biopsy shows, it is not good. Treatment I can well afford will not cure the problem/cancer. Part of me thinks the best cat ever will pass in his sleep (I hope but if not, I will make the decision yet another time in my life). I know the cat knows he's ill, which is not making it any easier.

Aww, I'm so sorry to hear about your cat. That is so so hard.

@Kristen, it is as he's only 4 years old.

Oh my goodness, what tough luck!!

We just got back from a 5-day trip to see my MIL in Florida (my 25-year-old son, who lives in a different state from us, joined us, which made it extra fun!)--and we did a few frugal things to make the trip more affordable

* Made a plan with my MIL upon arrival for 3 nights of eating out and 2 nights of cooking. We went to Aldi near her as soon as we arrived and stocked up the fridge and ate most of our breakfasts and lunches in her apartment.

* Did lots of free activities--beach twice, pickleball, going to the community pool (which also has a ping pong table), etc.

* Cashed in VISA points to use for most of our meals out--which included 2 extras, a brunch and dinner at the beach with our son. So, points paid for most of our meals, but not all, since my MIL doesn't have a lot of money, so we treated for everything.

* Went to a movie at a local cinema, which cost only $8 per ticket (I don't remember ever paying that little in recent years).

* We used my MIL's car instead of a rental and stayed with her, rather than getting a hotel or Airbnb, like her other son does.

* My husband picked up our son from the airport when he arrived, using my MIL's car, which saved on a $100 Uber ride--plus, we shared an Uber back to the airport with our son, coordinating the timing on flights.