Five Frugal Things | Fetch really isn't working for me

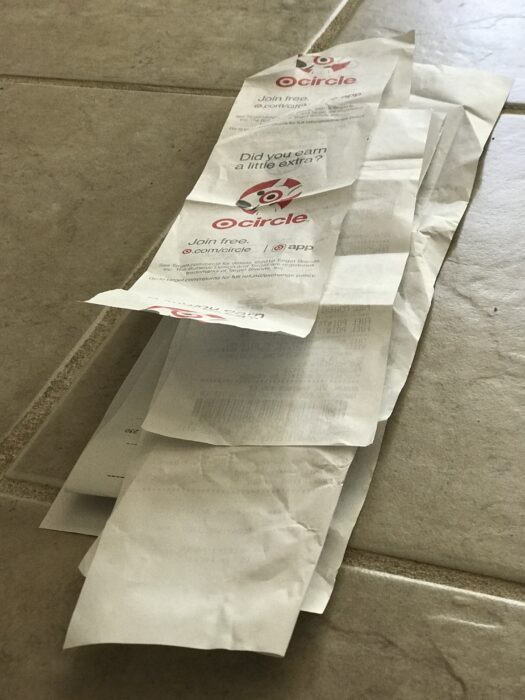

1. I scanned a pile of receipts with Fetch.

I've been using this app for a while now, and I can definitively tell you that it's a much better use of your time if you buy a lot of brand name grocery/personal care items.

Fetch does give you 25 points for a receipt, even if you haven't bought anything from a brand name that participates with Fetch, but 25 point receipts take a LONG time to add up.

Every now and then, I buy a participating product without knowing it, and then the receipt is suddenly worth 400-600 points.

Anyway, if you have receipts with a lot of brand names, Fetch would probably be more worth it for you than it is for me!

_______________________

In case you are new to it, Fetch is a free app that gives your rewards based on what groceries you buy. You can get $3 just for downloading the app and scanning your first receipt. Use code QG8V2.

2. We used a birthday discount at our favorite restaurant.

It's still a splurge compared to our usual $20 date nights, but a free appetizer and dessert does help a little.

3. I tried earning Starbucks stars.

I scanned my grocery receipts from buying two bags of Starbucks coffee at the grocery store, on sale.

But for some reason, the stars are not showing up in my account.

I am still giving myself credit for trying, though!

4. I trimmed my own bangs.

Last time I did this, I accidentally cut some hairs that I didn't mean to, and I will be paying for that mistake for some months.

But this time, I was more careful, so I have no new damage. 😉

And I've trimmed my bangs approximately a million times in my adult life, so hey, one mishap is not a huge deal.

5. I...

filled up my gas tank with a discount card, made sure I had downloaded podcasts to entertain me on several longish drives this past week, cancelled an auto-ship delivery, and shipped out a book I sold on eBay.

1. My husband brought home a $29.99 bread machine from Lidl's and made a loaf of Gluten Free bread. The bread was at least as good as what we have bought and it should be cheaper (and contain only everyday ingredients).

2. I cut up a $1.00 cantaloupe and a $1.19 pineapple. It's a lot of fruit for a little money, if you're willing to do the work.

3. I'm reading paper and electronic books borrowed from the library and we are still watching Acorn TV shows, available for free streaming through the library.

4. We talked about looking at a corner hutch someone was selling on Nextdoor for a good price. We decided we didn't love it and rearranged a few things to make our living room look better.

5. I bought gas at SAM'S Club and picked up a few essentials. I also bought a couple clearance items that may work for an upcoming family birthday.

Ooh, we are getting a Lidl here soon and I am so curious to check it out!

We have both. I like Aldi better.

Fetch sounded like a great deal until I realized 90% of my receipts are only worth 25 points and I'm only in one store a day. I'll keep the app until I can cash out, but delete it after that.

That has been my experience as well. Definitely more useful if you are a name brand shopper!

After reading the comments, I think I will use this as a long-term all and focus on Christmas. A little bit is better than nada.

1. Sadly, a local Kroger is closing. It will be sorely missed in its neighborhood but while combining errands, I ran in for a couple of items only to find many, many markdowns. I loaded up on items I use regularly.

2. On the same trip, we stopped at Big Lots where our bathroom cleaning supplies are 1.00.

3. I thrifted a Land's End Squall for my husband to replace one with frayed cuffs. Oddly, it matches mine, also thrifted!

4. My birthday is next month so my birthday 'freebies' are starting to roll in. Yeah!

5. My garage sale pile is growing as I clean, my freezer is not quite so full as we eat it down and my closets and drawers are getting streamlined as I donate. Spring cleaning is starting early!

Mine is next month also! What kind of birthday freebies should I sign up for?

Red Robin gives a free sandwich but you have to sign up ahead of time. During the year, you'll also receive good coupons and sales from them.

bd's mongolian grill does a free entree if you buy an entree. That also has to be signed up for ahead of time.

There are lots more including free food. Try googling Birthday Freebies and see what pops up.

Happy birthday! Isn't March the best time to have a birthday to celebrate???

Thank you! Happy birthday also! It is a nice start to spring every year 🙂 I share it with my mother also.

I've always felt like those receipt apps wouldn't help me much, either, for the same reason you gave, Kristen, and that's why I haven't tried any.

1. I pruned my own grapevines, but the pruners came apart just before I finished. I scrounged around in our odds and end coffee can and found a nut to hold the screw that holds the blades, rather than toss the pruners.

2. I also fertilized my lemon tree. Fertilizing last year made a world of difference in output, because we have very poor native soil. It's almost blossom time, so time to fertilize again.

3. I managed to keep my grocery bill down this past Friday, to around $65. There are only two of us, but we eat a lot of locally farmed, organic, and/or low carb. I can't fill out my menu with cheap things like beans, pasta, bread or rice -- they are hard on both of us.

4. I mended a pair of my husband's pajama pants, which is what he wears at home.

5. I earned $1.50 through an online research and had it sent to Paypal, where I can send it to my bank. I did the survey on my phone while waiting on laundry to get done.

1. I too am using Fetch, and just reached 5,000 points. The first 2,000 or 3,000 were a welcome bonus. I mainly buy off-brand products and produce, so like you, most of my receipts are only worth 25 points. We’ll see if it’s worth continuing in the long run.

2. We travel internationally as part of our work, so I made a list of easy-to-prepare/frozen cooked foods to eat when we returned home. I didn’t have to think about meals nor rush to the grocery store, plus I used things from the freezer.

3. On the return 12-hour trip, we were able to avoid purchasing any food or drinks by eating and drinking what was offered during the flights and using our annual pass to the United Club during our longest layover. We took advantage of the complementary soup, salad, desserts, tea, coffee and water. In airport prices, we saved at least $40.

4. I used up some hotel toiletries that I have had for quite a while.

5. I am making the effort to use up what is in the house, whether food, toiletries, vitamins/supplements, clothes, etc. My new year “pantry challenge” will continue.

1. Continuing with our big bathroom reno turned to gradual updates, we replaced two bathroom seat rings rather than the complete toilets. This addressed the problem points in both toilets, as the actual porcelain parts are still in good shape. Much cheaper, and used earned gift cards.

2. Wore a dress I bought from Goodwill to my son's orchestra concert. I happened to see a picture of a congressional aide in the newspaper wearing the same dress!

3. At the pharmacy, asked if there any coupons that can be applied to my expensive medicine. It took a little bit of waiting, but saved $50.

4. I don't like to scan receipts, but before grocery/toiletry shopping I make sure to check the Safeway or CVS apps for any digital rewards or coupons for items we need.

5. I needed a new toothbrush, but remembered I had my dental visit coming and waited for it as they always supply new toothbrushes. Also, preventative dental care saves a lot of money.

I trim my own bangs too! I have fringe cut bangs, which I cut between salon appointments. Having bangs that are meant to be a little uneven helps with my inexpert trims. Early on in my trimming experience, I cut of most of the eyelashes on my right eye, though. You’re not alone!

1. In the winter my skin begins to resemble tree bark, unless I use some kind of moisturizer. This week I realized that between us the husband and I had three large pump style dispensers that were not really giving out any cream. I could feel product in there, but the pumps could not reach it---very annoying. So, I found three small jars in my canning cupboard, took the pumps out of each container and nuked each one for 10 seconds. The cream poured out nicely, one container per jar. I put them in the fridge to return them to their natural state of goopy-ness. I salvaged a total of nine ounces of moisturizer, which is a lot of money. I am inordinately pleased by this small savings, which really does not amount to much in the scheme of things but still feels like a victory over poorly designed containers.

2. I really need to start foraging for food in our grocery store parking lot more often. In the past I have found apples, potatoes and a candy bar lying forlornly in a cart or on the ground. This week I found four large onions rolling around in a cart that had been returned to the gathering spot in the parking lot. It was 30 below so they were pretty frozen but I brought them home and as soon as they thawed enough for me to slice them up, I caramelized them and put them in the freezer for future French onion soup.

3. Our grocery store sometimes puts out a cart with incredibly discounted items. You never know what you will find and they only do it sporadically. This week I pawed through a cart and found blocks of Velveeta cheese marked down to one dollar. The husband loves only Velveeta mac and cheese, turning his nose up at homemade and fancier versions. I bought three of them and you'd have thought I brought home the moon when he unloaded the bags and saw the cartons. I made a huge vat and he ate it for lunch and dinner on Saturday and Sunday and has enough left for today. He gives it his highest praise: "This tastes just like my mom's!"

4. Milk usually disappears at our house but this week was an exception. I was about to see a gallon of milk age out so I went into high gear. Used it in the mac and cheese, made rice pudding, and made yogurt. All used up with no waste.

5. A friend tried using buckwheat and didn't like it. I use it all the time so thankfully accepted a nearly full five pound bag for future blini and bread making.

Not a fail, really, but I seldom buy brand new books because I can wait it out until they hit the library. The exceptions are usually only three friends I have who write fiction and I support them by buying their latest novels; luckily they are all slow to write new books! But this week I read the Hilary Mantel's final book in her Tudor era trilogy is coming out so I pre-ordered it and am eagerly awaiting March 6. I tell myself this is why I scavenge frozen onions, to buy books.

I love every bit of this!

I love your lotion save!

Hmm. Let's see.

1. I used some not quite expired, but close to it, milk to make pudding this weekend.

2. I am on a mission to roll my Costco spending into my regular grocery budget (which it should have been already but - you know- Costco is a budget buster.) I cut my weekly budget at the regular grocery store by $20 dollars a week and started a separate set aside account for Costco. So far I have been successful in saving that money. But! Its only been 2 weeks so we'll see how it goes.

3. I used some purple rice a co-worker couldn't use to make Asian rice pilaf this weekend. It's pretty, but probably won't replace the jasmine, basmati, and brown rice I typically use.

4. I started keeping pitchers of iced tea in my fridge again instead of buying bottles of diet coke. I kind of forgot how much I like iced tea.

5. I received some gifts this Christmas that were shipped and wrapped by Amazon. The drawstring bags they use for gift wrapping are really pretty and I am reusing one to wrap a birthday gift this year. They remind me of Kristen's reusable cloth gift wrap bags she wrote about on this blog!

We dump our expired milk down the drain since we have a septic tank and it helps with the cultures of bacteria! That's one thing I don't feel bad about tossing 🙂

I did not know that! Will keep it in mind before going to any extreme lengths next time we have edgy milk; thanks!

1. Saved 46 percent on household items at Walgreens. Nothing exciting but detergent , iced tea, Lysol wipes for school.

2. Tried imperfectly imperfect food delivery. Used a coupon code. Loved the idea of it but did not like the reality of tiny apples and huge carrots !

3. Drinking lots of home brewed hot tea and taking it with me.

4. Went to Art Museum On free Saturday. Saved 14 bucks. But it was CRAZY BUSY.

5. I continue to wear thrifted clothes. Many are years old and I launder my work clothes very carefully.

I felt like this entire weekend was just trying to come up with a way to scrounge up the money to pay our extra large electricity bill. We are on the budget plan and this month is when they "dump" all the money we didn't pay the other months. needless to say the budget plan is not worth it in my mind and we will go back to the normal plan.

1. I am trying the "cash only" system this week. Only a small amount left for the week until payday, so I'm trying to really hold on to it! I'll let you all know how it goes.

2. A few of the moms at my church have a great hand me down cycle going. I get clothes from one mom and then I pass it along to another (who adopted 4 siblings). Everyone is happy!!

3. With the beautiful weather yesterday, we got outside and went to the park. Free fresh air fun for all! It was a sure sign of spring.

4. Frugal win (for my mom) her chemo medication, stated to cost $9000 a month, will be free to her through her insurance and the medication company. Holy geez is that alot.

5. I'm starting to feel cheap with all of the frugal things I've been doing. My mind is jumping to the first cheap thing ALL THE TIME.

I'm so sorry that your mom needs chemo, but I am so glad it's covered!

Hello, like you I scan my recipts and the points seem to creep upward oh so slowly

However

I figure that by christmas time I'll be able to give my teen daughter some nice gift cards for starbucks or ulta

Besides, it takes just a few seconds to scan a recipt before tossing in the waste basket. Might as well get points to redeem at a later date right?

I do like how it tracks your spending by day, week, or month

Five frugal things

1.Eating in and brown bagging it for the whole family, drinks to

2.Have had a few home projects unexpectedly crop up (hello burst pipe seal under the kitchen sink...thank heavens we were at home and were able to act quickly instead of coming home to a flooded house) we were able to do repairs ourselves instead of hiring someone

3. The tires on my car are bald and in dire need of replacement...was about to bite the bullet and get new (800.00 plus...holy moley!! And that's for a mid grade set of tires!!) But we got lucky...a freind of my husband has a set that's almost new that he'll sell to us for 300.00 with some car labor trade...whew!! And thank heavens, we had just paid off my husbands tires and were not looking forward to charging for mine.

4. Track season is beginning soon and daughter needed new sneakers...found a pair of steeply discounted nikes for 25.00 that are usually 60 to 80 bucks(she has high arches and Nike shoes are the most comfortable so that's what we get) they are mens but for 25 dollars that's ok with both of us

5. Paying bills on time and avoiding late fees so that's always a good thing

1. Signed my son up early for the before school program for next school year, saving us a $20 registration fee

2. Made 2 pans of apple crisp for guests using $2 clearance apples and some Cheerios I needed to use up. It came out really good!

3. Found kids sneakers on clearance at Aldi's for $5. I got a pair for each of my kids that they will fit into eventually

4. Sold a cell phone on Facebook Marketplace, listed a cast iron pan for sale on Facebook Marketplace, and gave away a paper towel holder and some clothes on Buy Nothing Group. Giving away items for free is not directly frugal, but it helps me stay organized so I don't buy something I already have.

5. Used our FSA card to pay for the multiple pediatric appointments lately

Thanks for these posts. Through the week it helps me keep track of the small successes I have!

If you send Starbucks an email, they will usually fix any star issues, no questions asked!!

Ooh, good to know. I'll put that on my to do list.

My experience with Fetch is the same as yours. Pretty slow going but over time I’ll see some results. Same with Ibotta. I just don’t by many name brands.

I think one of the things I like most about Five Frugal things is that it lets me focus on my successes and also to learn from all of you!

1. Sorted my seeds for spring to see what I don’t need to buy. Placed my seed and plant order before my coupon expired.

2. Even though we are over on our February food budget, bought some lunch stuff that was on sale so I won’t be tempted to eat out in the next couple of weeks. Trying to push my Walmart pick up order into March which won’t go over well if we run out of coffee!

3 Used all of the celery I bought - highly unusual. Granted, some went in the freezer soup bucket, but none went to waste. Also froze extra buttermilk for future use.

4 Still eating down the freezer and pantry.

5 Hung laundry to dry.

Kristen I agree about fetch I’ve been doing for about a year and Lordy if you don’t buy name brands which I don’t a lot of it takes forever.....I tried deactivating my account but can not figure out how...any suggestions......thank you

#1: A friend kindly took an old saddle of mine to a tack sale. It sold for $100! It had been languishing in my basement for years. I had no idea what to charge for it. I'm thrilled.

#2: I used a $15 off coupon for my dog's expensive food before the coupon expired at the end of February. While there I bought a 50% off chew toy for $4.00 to put away for his birthday next month. 🙂

#3: Have resisted the temptation to go out to dinner. We don't go out often as I usually cook but am trying to save for an upcoming trip to a very expensive city. I'd rather treat ourselves to meals out when we're on our getaway instead.

#4: Rejoined my community's fitness center but only as a membership for myself. I can always add members of my family later should they choose but there's no need to pay extra if I'm the only one using it. It comes out to be less than $3 per month for a single membership so super affordable!

#5: Saving my Aldi shopping for today when I'll be close to the store, but truly, shopping at Aldi in the first place is already frugal.

I don't have anything frugal to add, but when I scanned my Aldi receipt into Fetch, I learned the kettle-cooked chips are Lay's - or count as Lay's with Fetch. I got some weird bonus for buying them. It was a happy surprise.

Oh, that's fascinating. I'm always so curious who makes Aldi's private label products, because I have heard that a lot of them are made by big brand names.

I wanted to jump on here and let you know that if you get on your Starbucks account online, after signing in you can click on Customer Service which will take you to a page where you can click on get in touch with us and it will go to the page that shows the options for how to do so. I click on the email option to send them an email when my star rewards don't get credited properly. I leave a brief explanation and EVERY SINGLE TIME they have responded and credited my account. I love earning my stars and think it is worth the effort. Just wanted to share

1). Went to a specific urgent care where the costs are covered by my husband’s employer, rather than going to the closer urgent care that would have been extremely expensive with our HSA plan.

2). Used up odds and ends in the fridge before our vacation.

3). Took advantage of “free” or included activities at our hotel; crafts, pool, Birds of Prey demonstration.

4). Clustered errands and got gas at Costco.

5). We decided to end our vacation with a trip to the movies, while going to the movies can be expensive we brought our refillable popcorn bucket and used member rewards points to pay for a portion of our tickets.

1.) Was at Target and they had a lot of kids' shoes on clearance. Since all kids shoes are made so poorly we found a couple pairs for around $6 each that our daughter will grow into.

2.) Did some traveling for work and didn't forget to put in for the mileage reimbursement.

3.) Found a ham in my freezer so we cooked that and we'll eat off of it for days. Saves time and money!

4.) My dishwasher was not delivered on time due to an issue on their end. I called support and they are giving me $50 off.

5.) Got some cake flour on sale. I don't buy it very often but I do need it from time to time and I was out. Now if I could only find rye flour ...

I've been disappointed in Fetch, too. Apparently, there's a limit to the number of receipts you can upload in a month. What's the point of that? I probably won't bother with it for much longer.

I agree 🙁

Ha, apparently I have not uploaded enough to hit the limit. I had no idea there was one!

I also didn't know there was limit! We try to shop only once a week, so that is probably why.

I forgot to share my BIGGEST frugal win of all! We don't have "traditional" health insurance. We participate with a christian health sharing organization and have been VERY pleased so far. (I'm happy to share our experience with anyone who may be interested.)

Our youngest son needs non-emergent surgery and so we are in the middle of pre-op visits, blood work, etc. He also needs an MRI, and the surgeon's office was kind enough to set up the appointment for me. (That should have been red flag #1.) After I spent several weeks trying to track down the name of the MRI lab so I could get an idea of cost (the surgeon's office was unresponsive to my many phone calls), I finally spoke to them the day before the MRI was scheduled. The kind lady told me that, since we didn't have "insurance", I would be required to pay $2500 in CASH at the time of the appointment or, if I wanted to make payments, I could pay $4700 over time. I was appalled, angry, you name it. I immediately cancelled the appointment (which kind of stunk because said son had traveled home from college for the weekend to have the MRI done) and told them I would be making some phone calls.

Within 30 minutes, I had called another MRI provider in town and found that their cash price at time of the appointment would be only $525!! So, now our son will have the MRI done over spring break, which pushes back the non-emergent surgery a few weeks, but is totally worth it for the cost savings to us. And, he has had an MRI done at this location before so I know it's a reputable office.

Do your homework, folks! One phone call saved me anywhere from $2000 to $4200!! When all is said and done, we will pay only $500 out of pocket for this surgery, including all the pre-op visits, etc. My husband, who has "traditional insurance" through his employer has a $7000 deductible that would have to be met before they would pay for anything. And we wonder why our insurance costs are so exorbitant????

I have a question if you will divulge me! If someone in your family were to be diagnosed with an expensive medical condition (for us, it's type 1 diabetes in our young daughter), would you stay with the health sharing organization? If you wouldn't/couldn't, would your family be able to acquire health insurance with the pre-existing condition? I'm just super curious about other insurance options since I now deal with insurance daily due to our daughter's disease.

Savannah, since the ACA was passed, insurance companies can't deny coverage or charge more for preexisting conditions UNLESS you're participating in a grandfathered insurance plan (plans in existence w/out any changes since 2010), which only accounts for about 20% of current plans.

https://www.hhs.gov/answers/affordable-care-act/can-i-get-coverage-if-i-have-a-pre-existing-condition/index.html

I obviously can't speak to Jen's experience, but this is particular piece of your question has an across-the-board answer.

Thank you for the information! I am just trying to learn as much as I can. We are a young family and have always had employer-provided health insurance, with no reason to use it other than routine care. Now that we need it every single day, I'm trying to learn as much as possible should the healthcare landscape change in the future!

I don't think this applies to our health sharing plan as it's not considered "insurance". We chose a HSP that does cover pre-existing conditions. They pay 15,000 the first year, 20,000 the second year, and 25,000 the 3rd year. After three years, they are not considered pre-existing and are fully covered. The other two plans we considered did not cover any preexisting conditions at all.

Our HSP coverage is approved under the ACA ("affordable" being a term used VERY loosely!) and so we do not pay any penalty for not having "traditional" insurance.

There is not a federal penalty in 2020 and beyond for not having health insurance. I do not think so for 2019, either. States might have different requirements.

Before you switch to one of the Christian insurance groups, you really should read this article that discusses some of the pitfalls.

https://www.nytimes.com/2020/01/02/health/christian-health-care-insurance.html?searchResultPosition=1

I would like to say, for the record, we do not participate with any of the organizations mentioned in this article. Futhermore, if people had done their homework, they would have recognized the "pitfalls"noted in this article, all of which were spelled out carefully in our plan. We understood the risks we were taking. I researched extensively, which is why we went with the organization we did.

The main reason these types of plans have become so popular is because the ACA has made "traditional"insurance unaffordable for so many in the first place. I know of people who have "traditional insurance"who are being denied coverage and procedures as well and that's if they can even afford the insurance in the first place. It's definitely not an issue specific to health sharing plans. There are pros and cons to both. You have to decide what works for your family.

I'm not trying to change anyone's mind or debate the merits of one over the other. Just sharing our experience, which has been excellent so far. I understand it may not work for everyone.

Finally, regardless of your healthcare situation, it's never a bad idea to call around and see what the difference in costs might be, which was the point of my initial post.

Hi Savannah,

I'm so sorry to hear about your daughter. We have several dear friends who are dealing with T1D with their children, and I know the struggles they have with insulin costs, treatments costs, etc.

Honestly, I haven't considered what we would do in your situation. We would certainly have to do our research. We would be able to get traditional health insurance as it's offered through my husband's employer-but the cost for us (3 of us, including my husband, myself, and our 20 yo son) would be about $1400/month. It also includes a $7000 per person deductible. With the health sharing organization, we pay $300/month for me and our son. My husband's monthly insurance cost is mostly covered through his job. We only pay about $12 additional a month for him but, honestly, the coverage is pretty crappy.

I am in need of some surgery and can't have it because my deductible is $6800 and I can't afford to pay that. I also pay $400 a month for my healthcare coverage (that I basically can't use). And I'm paying $135 a month on 2 ER visits that weren't covered because I hadn't reached my deductible. It is very disheartening.

My option is waiting on the surgery until next year when I can change my plan. My deductible will be a more manageable $1500 but I will be paying close to $800a month for my coverage.

I have worked (and currently work) my whole life and have always had affordable insurance, up until a few years ago. It makes me so angry that I work hard to pay into something that I can't even use besides my well visits.

Kris, I'm so sorry to hear this. I'm glad your surgery isn't emergent and that you can wait, but I'm sorry it will be so costly for you. This is why we explored other options and have been very pleased so far. I hope you are well until the surgery and that everything goes smoothly for you.

Thank you!

I am so sorry to hear that! It's so disheartening. We have a high deductible, but not nearly as high as yours. In my opinion, it's disgusting that your deductible is so high AND you pay that much per month into it! I am SO sorry. Our healthcare system, while it has its benefits, does not support the majority of our population!

Thank you!

I'm an American ex-pat and have been living in England for the last 14 years. My #1 reason for reluctantly coming over here was because I thought healthcare would be substandard to what I was receiving in the US. I am/was so wrong. My copays for each Rx (3 month supply) were never more than $12 and now that I'm 60 are *all* free. I pay nothing to see the doctor. If I call my doctor with a problem (high fever, etc), the doctor (yes, doctor) calls me back that very day or make an appointment to have me come in (that day). I've had surgery, my son has had surgery, my husband has had surgery and we've never paid a penny (pence) extra.

I am shocked to see how much you guys are paying per month for health insurance and having such exorbitantly high deductibles. Things have really changed since I left! With those rates, how can a person maintain a middle class status??

I have no idea, lol.

Hi Kris:

I was in a similar situation -- worked all my life and always had affordable health insurance until the ACA was passed (I now pay $700/month and have a $5K deductible. My husband had a similar result. The ACA has meant we cannot afford to buy a house -- since we now pay $1,000+ per month more for less insurance with a higher deductible than we had before the ACA.)

I needed surgery in 2019 that cost about $14K and I could not afford the $5K deductible. However, when I called ahead to get each and every cost, having my particular insurance company resulted in "discounts", making the entire cost of the surgery below $5K, so that I never even hit my deductible and could afford it. If you haven't already looked into it, you might want to.

It does seem desperately unfair.

I never thought about doing it that way! I have an appt in April and will discuss that with my doctors office. I know he's going to tell me at my checkup, it's time for surgery and I was going to discuss my predicament with him. Thank you for letting me know that may be an option!

1. I spent $25 on a pair of Under Armour shoes for my 6 year old. While I know we can get $5 pairs at WalMart, they're only good for about a month. Most of her recess grounds are asphalt and she plays outside A LOT at home. So this is more of a worthy investment I feel. I did order online using Rakuten plus a Kohl's coupon.

2. Our daughter was diagnosed with type 1 diabetes 4 months ago. Our deductible reset in January and boy, insulin is so expensive. We had a few friends that had gestational diabetes during pregnancy and gave us a bunch of their supplies like syringes, strips, etc. We are thankful for their kindness!

3. I've been de-stashing most of my crafting and sign making items and I have shut down the majority of our side business. I received a 14.4% raise as work this year! And that raise is double what we made in side income.

4. While de-cluttering, I've listed several things on eBay and made some money from that.

5. We are expecting another baby in June and have made the lofty goal to put an extra $10k in our EF. So, the purse strings have been tightened everywhere. Packing lunches, sticking to a strict grocery budget, eating all dinners at home. We are 20% of the way there!

Savannah, I hear you on the cost of insulin and having diabetes. It is a shock (my 18 year old son is now two years into a lifetime) and we definitely had to readjust the budget with his diagnosis. I am very thankful we have insurance, despite the high deductible.

Hi Savannah,

I remembered reading something about SSI and diabetes in young children, hope this link is helpful: https://www.ssa.gov/disability/professionals/bluebook/109.00-Endocrine-Childhood.htm. If your child is under 6 years old there may be a chance that you qualify for monthly payments which may help towards extra medical costs.

Savannah, this may or may not work with your endocrinologist, but ask if they have sample insulin. My husband's private endo, before he started using VA care, would hand him samples several times a year -- each sample was a full-sized bottle. It never hurts to ask, if you haven't done so already. Also, while not all insulins work just the same, you may be able to switch to a different brand of her type that has a (relatively) lower price. Again, ask your doctor if that seems doable, and talk to your pharmacy about that, too.

We've been dealing with this for almost 40 years. Hang in there, and I pray there is a change in diabetes care pricing soon!

Best of luck to your daughter! I was diagnosed with Type 1 as a young teen. 39 years later and i am blessed to say I am still doing really well. No complications! I think the first 10 years are ultra important in how healthy your body stays.

Your doctor or her endocrinologist may be able to get insulin samples for you. Also, mine gave me a new meter when i needed it so dont hesitate to ask.

All the y can do is no!

Sorry i didnt mean to restate JD's comment! That is what i get for not reading them all first

Great advice is worth repeating!

I guess, for me, when it comes to Fetch and other similar apps, I think of them not as an easy way to accumulate a quick dollar but more like adding coins to my coin jar. I pick up pennies and other coins when I’m walking through parking lots. The minimal effort to pick up a penny isn’t going to make me rich but over time it will pay for take out pizza. I see the minimal effort of scanning my receipt as the effort I take to bend over and pick up a penny. Also, I see the abandoned receipt on the ground or in my shopping cart as pennies once scanned! I think it comes down to perspective.

I feel the same way about Fetch. This year I'm saving all my points to cash in on gift cards to give away at Christmas.

I pick up abandoned receipts too. The first $8 I made with Fetch helped buy arch support insoles for my hard-working husband, so it was well-worn the maybe ten minutes total of snapping photos of receipts.

Thank you for this perspective! I rarely buy name brand items so was building Fetch and Ibotta very, very slowly. But if I look at it like picking up coins, it is like that. It took over a year but I cashed out $20 with Fetch and instead of seeing it as accumulated pennies, I was irritated because it took so long. I will be recalibrating my attitude to your attitude!

1. Returned a bunch of dresses I got online that didn't work. Kept one that did.

2. Am making soup from an old friendship soup mix I forgot I had.

3. Only spent $40 at grocery store this week! I had a lot of Kroger coupons and rewards certificates from my Kroger credit card.

4. Packed lunch, water and coffee every day for work.

5. Used a coupon at Roosters for extra frugal date night

1. My daughter wrote thank you notes from her birthday but also made a bracelet to give to each friend. When I got to the post office they said it'd be at least $3.80 to mail each envelope, so we are hand-delivering.

2. I have two bottles of Aveeno lotion and the pump broke off of one. The good one finally got down to the bottom, so I turned it upside down to get the last bit into the other bottle and switched the pump so I now have one full working bottle.

3. I renewed my dog license on time. The fee goes up next week.

4. I'm getting better at portion control. The benefit will hopefully be seen in both how my clothes fit and in my grocery budget. I'm trying to be sure that I'm not eating just because it's there.

5. We have an Aunt Millie's Bakery Outlet just down the road that has food that's at or near its date and there's a small smash and dent section. They have punch cards that get you $5 of free stuff after 12 visits and I remembered yesterday that I had a full punch card. So for just 57 cents I was able to get 2 bags of bagels, 12 hot dog buns, a loaf of bread, and Hawaiian rolls. Since I use cash for grocery money and get it out once a month, that was a great blessing on the last week of the month!

1. Found great 6 pack of new socks at veterans thrift store 3.50 and two glass vases... very nice 1.50 each....filled them with jonquils from yard fir neighbor ladies valentines gift. Had to wash them very well first. 2. 8.00 per class... balance class at community center ...well worth it. Signed up for 4 classes in a row. 3. K C Cafeteria about 10.00 each including good tip...all you can eat...put please get salad and meat first thing instead of filling up on mac and cheese like I did! 4. Chicken livers 1.59 carton at kroger... learn to cook them 5. Shovels full of mulch from neighbors old dead tree that was chipped by professional tree guys...surround my flower beds to help mowing guy understand not to mow my flower beds. 6. Drop off 5 nice warm clean items for homeless at church where we have choir practice each Monday night...joining chorus was best thing I have ever done

These aren't necessarily FRUGAL things (and I've only got 2 of 'em), but here goes:

1. I started zero-based budgeting AGAIN as well as using cash envelopes (both of which I swore off). It actually helps me a TON to do ZBB and cash envelopes; I think the first time around, I stressed too much about where to put extra money.

2. I have $1,000 (actually $1,202) saved in my emergency savings--GO Me! (Thanks Dave Ramsey). Yall do NOT know how many times I've tried and failed to save even $1000--I always ended up spending it on some "emergency" NOT. I'm currently starting another $1000 savings for upcoming taxes/insurance etc. Next, I plan to save up to pay cash to go back to school/get my own apartment (around $7K).

Woohoo on your emergency fund!!

Hi! May I ask what podcasts you have been enjoying? I have sped my way through several that I really enjoyed and am now trying to find something new. Some that I really like are What Should I Read Next? and The Dream (which I think you have mentioned yourself as one you like). Anyways, not to be nosy but I thought maybe you'd have some good recommendations?

Rebecca

The Dream is definitely my current favorite! I like Laura Vanderkam's Before Breakfast. How to Money is another one in my list.

And then I have several blogging podcasts I listen to, such as Theory of Content.

Thanks so much, I shall check them out!

Rebecca

I wouldn't mind hearing your bang-trim method!

I would also! I cut mine on rare occasions, following something I once read. Pull all bangs up and back, such as with a headband, then pull a thin fringe down. Cut it to desired length. Then let another layer down. Cut it. And so on. The idea is that if you make a mistake and go too short, it will be covered in the other layers. I am not sure if that would work with a heavy straight line; my bangs are rather wispy.

Also, I read decades ago that the final rinse when washing hair should be cool water, as it flattens the hair cuticle down, (or opens it up-- whatever!). I have done that almost all my life and my hair is very soft.

Kristen- Happy Birthday! And wishing you many more!

I only earn stars at Starbucks when I use the member card. I have to put cash on it and use it to buy at the store...I don't know of any other ways to get stars...

Here's my fab five:

1) I've earned $10 in swagbucks and will get a Amazon gift card.

2) I love ebay. I got name brand medical necessities for $30 and it retails for $420 out of pocket or $75 with insurance.

3) I got silk items for $4 each. Silk is super expensive and retail was $15 each.

4) I got contact saline solution for $1.50/bottle after a $2 coupon.

5) I got store brand k-cups decaf coffee for 25 cents each at the supermarket on a flash sale.

FFT, Cross Country Big Family Wedding Edition:

1. Flights on Southwest with points, about $22 in fees for two R/T tickets, IIRC. Packed food for travel to and fro. Got 5 days worth of cold-weather clothes, including fancy long dress for me and DH's suit, plus our dress shoes, into two carry-on bags. Didn't save any money, but we didn't have to wait or risk losing our baggage, which gave me a frugal thrill anyway.

2. Hotel=points. There was a mix-up, so some points will be returned to us. Breakfast was included and our room had a fridge, so healthy snacks uneaten on the way out were safely saved for the return trip.

3. The best car deal I found was pre-paid for an intermediate car with Hertz. I'm Gold with them, which makes pick-up/drop-off a breeze and no charge for two drivers. Afterwards, my sister indicated that a larger car would be helpful. Whoops. Of course this was the first time I had ever chosen the pre-paid option, so I couldn't change it. Just prior to landing, I got an email from Hertz, instructing us to go to the "Gold Zone" and choose any car. DH was tempted by the shiny new Camaro for about five seconds, but we selected a mid-size SUV, which came in quite handy and still got decent gas mileage. Got the upgrade for zero extra dollars and no hassle. We used the power of the internet to secure cheap gas prior to turn-in. The fill-up was only $15.

4. I knew I wanted to style my hair with hot rollers for the wedding but didn't want to drag them with me. My East Coast sister (who has short hair) found a set at Goodwill for $8.00. I used them several times on the trip. I intended to find a thrift store to donate them to on the way to the airport, but DH wanted to get to the airport early, so I gave them to the person who checked us in at Hertz. She was thrilled. Win!

5. I already had a lovely dress to wear in my closet. It was velvet, so warmer, and packable, but it was sleeveless, which isn't great in February. I did some google-fu and found a company called "Sleevey Wonders" that makes sheer sleeves that have no shoulder seams, so they look like they are part of the dress. I didn't see the color/style I needed on their website, so I contacted them. The owner herself responded to my inquiry. She custom made exactly what I wanted and didn't charge anything extra. Wowza! They weren't totally cheap, but I got to re-use an existing dress (and shoes), which saved me a ton and kept me from having to go fancy dress shopping. I have lots of sleeveless dresses in my closet, just waiting for summer. I think I'm going to order some more Sleevey Wonders in other colors and get those dresses into year-round circulation.

In our thrifting, we discovered the ReStore locations that are operated by Habitat for Humanity. An outstanding selection of pre-owned and nearly new furniture, and building materials (mostly for interiors), in all sorts of varying states of wear. The stock varies periodically (like all thrifts), so multiple visits are recommended. We found a lovely leather sofa, electric recliner, that we love. It was a floor model that had actually been donated by a local furniture store, so it was very gently used and only required a bit of TLC to get it looking pretty. ReStore also sells a selection of small and large appliances, electrical fixtures, porcelain and marble items (sinks, etc), cabinetry (often entire sets of kitchen cabs). Much better shape than the stuff usually sold in Goodwill.

In our recent move, we discovered, unfortunately, that Goodwill simply takes a lot of the items that you donate...and simply throws them away. Wow. So disappointing. We actually watched the guy at one local store take several of our virtually new small appliances, and threw them all in a dumpster. Tragic! No more Goodwill for us! (At least not for furniture and the like, anyway.)

We found the ReStore locations in Columbia, MD, and Glen Burnie MD, to have the largest assortments. There are others in the metro area, of course, but these were the best for our purposes. We have moved to the metro Atlanta area and there are a number of locations here, which we've begun to explore.

Habitat, of course, is a faith-based ministry, so if you are into that, that is a big plus. Happy hunting!

You now have to follow up and send a photo of the receipt to earn stars from bags of coffee at Starbucks. They'll have sent it to the email connected to your account, so check there, it could be in SPAM. It's annoying, but I have a hunch it's because people were peeling those stickers off and grabbing points they hadn't actually "earned."

You can text “rewards” to 811811 and they will respond asking for your scanned receipts. You can upload as many as you want. They’ll text once they have been accepted and your stars show up in your account then.

1) I scrubbed my shower curtain liner. I really hate this chore. And a new, perfectly clean one would be what, $10? But then I would have to live with myself for putting a perfectly useful piece of plastic in a landfill.

2) We menu-planned, shopped at Aldi, and prepped lunches at home this week. (And every week.)

3) I made two strategic career moves: timing my dissertation defense to the best job market advantage and prepping for an online interview for a post-doctoral fellowship.

4) We made bread in the bread machine this morning. Usually I'm the one who makes it, based on your recipe and guidance, Kristen. But the last couple times my husband filled the bread machine, and things didn't turn out quite right. This morning he watched me, and we realized that over ten years I have subconsciously altered the recipe for what works best in our climate and bread machine. I hadn't even realized! Now we're both on board, which will hopefully result in consistently good bread.

5) We have decided to put our sizable tax refund straight in our "spending saving" account. It is our sinking fund for big purchases--major house repairs, new vehicles, major vacations. We toyed with putting it on the mortgage or splitting it between the kids' 529s, but I think the sinking fund is the right call.

Shower curtains are a pain to clean, and I commend you for not just throwing it out! They can be washed in a not too full load in the washing machine, with bleach and soap and a few towels for friction.

You can buy cloth liners that are easy to wash. I got them at TJ Maxx for $8, and I love them. 🙂

Thanks for the honest Fetch review. I'd been considering trying it, but I also almost entirely shop at Aldi, so I think the juice isn't going to be worth the squeeze for me!

Your Five Frugal Things is one of my favorite parts of your blog. I'm always reading, but I can never think of any frugal things I do. So I am challenging myself to start today... I hope to have several things to post next week!

Have you heard about the app getupside? Its for gas points. It kinda sounds too good to be true.