A $150 correction + 4 more frugal things

Things were quiet here yesterday because after I got home from skiing, I promptly got sick with a cold.

Bleh.

Hopefully it'll be a quick one! I'm already feeling much better today.

1. I caught a $150 medical bill error.

I noticed that a $150 appointment bill came back unpaid, and after a few phone calls, I figured out that it's because the provider put the "missed appointment" code on the bill instead of a regular appointment code.

So now we are getting $150 credited back to us.

Keep an eye on your medical billing, people!

2. I used a Panda Express coupon

It's a new location and for the time being, each receipt prints with a survey code.

The survey takes about 5 minutes to complete, and you get a free entree in return.

I used the coupon, and then I filled out the new survey, which means I have another coupon to use next time.

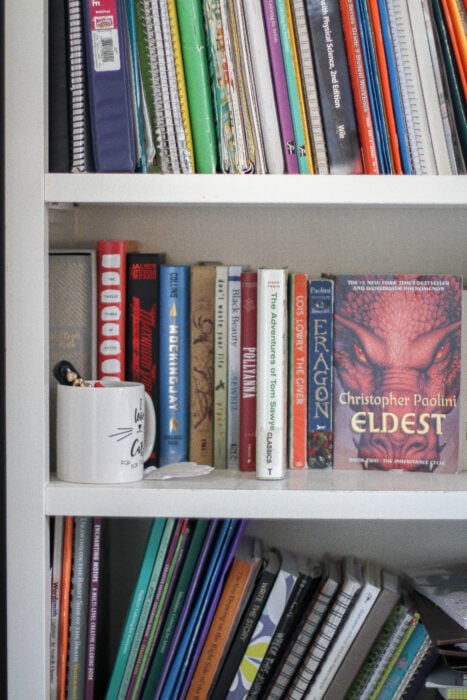

3. We got a free book from the library.

(We don't deserve a lot of credit for this one!)

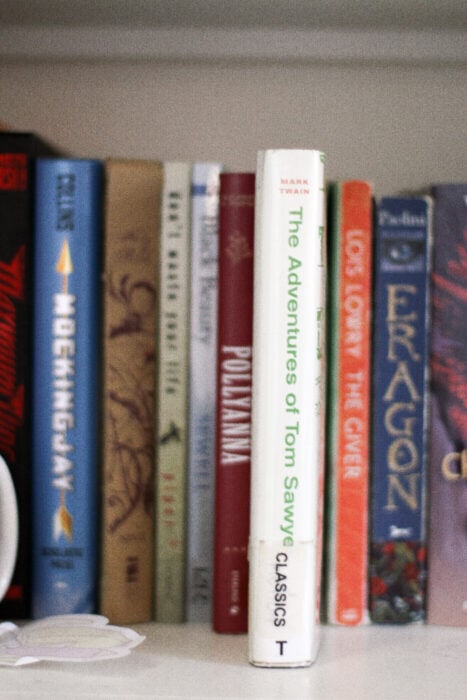

Sonia picked out a Mark Twain book, and when we went to checkout, it wouldn't scan. Apparently it was supposed to be out of circulation, and the librarian said we could have it for free.

Sonia, unlike me, is a person who enjoys owning books, so this is perfect for her.

4. I bought reusable travel toiletry containers.

I got a set of 4 for about $6. This way, we can fill them with whatever lotions/shampoos/conditioners we want when we fly.

Although, after I bought them, I realized that I could have just saved the empty containers from previous travel toiletry purchases and then refilled those.

Oh well.

Regardless, I won't have to waste money on tiny toiletries in the future.

5. I got some marked down Valentine candy.

Chocolate for Zoe and Lisey, conversation hearts for Sonia (she doesn't love chocolate, and a lot of the assorted chocolates contain nuts anyway.)

Kristen, I hope you feel better soon.

1. Rather than eating out this weekend we bought pork carnitas for a special treat at home.

2. We rearranged the living room and now have a bare spot. I've been trying to think of what to put there that we already have. So far I have come up empty. We did stop at an "antique" and consignment store in town to look around. We saw nothing that would work but it did make me resolve to keep fighting the clutter. The amount of stuff that came from peoples collections, ugh! So far no money spent and a further resolve to solve this without buying.

3. I met up with a couple friends for a walk around the lake at a local park. Good conversation while exercising on a nice day.

4. A friend is flying tonight to go visit family. I will drive her to the airport so that she won't have to pay for parking for the several days she will be gone. The airport is 15 minutes from our suburb.

5. I'm organizing tax records then will buy TurboTax and will get taxes submitted.

You probably picked up the cold on the airplane. That’s where I seem to pick up a lot of sinus crud. I’ve started taking a decongestant right before I fly so that I don’t have puffy irritated sinuses susceptible to the dry recycled airplane air. I know they claim it’s filtered but ... plus I use hand sanitizer a lot in the airport and on the plane. During cold and flu season I also carry a mask with me in case I get stuck near someone coughing.

My 5 frugal things

1. Filed my taxes early. Getting decent refund due to an energy credit

2 started a refi on our home that will save about $180 a month

3 ate at home. We received a gift card from the kids but the restaurant is some distance away so we’ll say that for a future treat when we are in town anyway. We are still “eating down” the pantry and freezer and this helps since we are already over on our food budget for the month.

4 our anniversary is close to Valentine’s Day and I was able to find a nice card that could work for both, I just added an anniversary message in the card.

5 no haircut this month and colored my hair at home.

Yep, I figure I must have been exposed to quite a few germs on the two flights and three airports I went through!

The major frugal win from last week was a DIY fix. Our old bathroom faucet started spewing water at full speed. Luckily we were home when this happened and could turn off the water pipe, but we had to live without access to the faucet for a couple of days.

I have earned some gift cards through my work wellness program, and we used one of these to buy a new faucet and sink from Home Depot. My husband was also able to install these himself. While we were at it, we bought matching towel and toiletpaper holders and installed them and fixed up the wall where the old ones had fallen off. This bathroom is just dying for a reno, but looks like we are going about it gradually rather than at full speed. There is an ancient vanity that needs to be replaced, but we were able to update it by changing out the handles to more modern ones.

Feel better, Kristen!

1. My husband is finishing up our taxes which were a bit complicated this year. Thankfully, we don't owe and even have a refund coming.

2. Our Valentine's Day celebration was thrifting with a trip to Qdoba for lunch. We had to search for one as the closest had recently closed but for a buy one, get one free for kissing someone, it was worth it! We finished off with Cheesecake Factory cheesecake that was free with a gift card purchase at Christmas.

3. With life changing as a retiree and a new church which is more casual, I've been editing my closet a bit. I have a nice garage sale pile, I've given some things away and am being pretty ruthless. I did get a pair of Lee capris at Kohls with a 5.00 reward card which made them free and ordered a 79.95 jacket from Christopher and Banks for 8.50. Both will be worn often.

4. Eating down the freezer and pantry still. Tonight is Zuppa Toscana with kale from the garden which is still hanging in there!

5. My independent 98 year old aunt just moved into a care facility she loves. She's insanely thrifty and quite proud but could use a couple of things to wear. I found three pairs of my fuzzy socks which I keep walking out of to take to her. I was hoping to find her a couple buttoned sweatshirt cardigans. My daughter's friend mentioned she had three someone had given her that she wouldn't wear. They're the correct size and style. Because everything was free, I may be able to convince my frugal, independent aunt to accept them!

Hubby and I have had to dial the weekend spending waaay back. This weekend, we scored a free beer at one of our favorite breweries, just for being members of their beer club (so many craft breweries in Central Texas!). For lunch we ate the "seniors plate" at a fish place - $5 each. We had leftover soup for dinner on Saturday, then there was MORE leftover and we took it in our lunches yesterday - so that was three meals from one pot of soup. I cooked some wrinkly apples in my smallest crockpot with a bit of pumpkin spiced butter leftover from the holidays and a little extra brown sugar and split it over a pint of ice cream for two people. DELISH and the best part is, there's no extra ice cream lurking in there. Neither one of us eats lunch out any more and dinners need to be low fat and low salt, so I've had to walk that fine line between frugal and healthy and I am finally getting the hang of it!

1) bought hiking boots with a giftcard so I could go hiking with my husband. Due to our membership at the store, I'll also get 10% back on the purchase. Now I have 4 pairs of shoes that fit.

2) Waited on getting a birthday present for until we found something we knew he would love. Ended up giving him our present 3 days late, but the joy he showed was worth the wait for all of us.

3) wanted a sweet treat so made lava cakes with husband last night instead of going out to buy something. Meaningful time together and cheaper than buying oreos or something else.

4) Made 17/21 meals over the last 3 weeks at home ( in that time frame son had 9 day hospital stay for RSV + 3 other people in family with RSV + ear surgery for a kid) with loads of veggies. The other 5 meals came from friends, which made life so much easier.

5) FAIL: Spent money on drip coffee at hospital every day instead of asking nurse to get some from the nourishment room on the floor (couldn't enter because son RSV is contagious), but saved my cup for the permitted free refills rather than buying a new cup.

Kaitlyn, I hope everyone in your family is healthy again! I think you did an amazing job with getting meals on your table considering you probably spent a ton of time at the hospital with your son. I don't think you should sweat the coffee money cost--inevitably when I have had a loved one in the hospital, I've had to allow a little more wiggle room in my budget (and my diet!) as I didn't have the time or energy to do my usual frugal activities.

Hope your and your family are doing better. Blessings.

Oh my goodness, what a tough week! I think you deserved every bit of coffee.

I hope you feel better. Coming back to a cold is not a happy way to end a fun time.

1. I resisted the urge to take a nap this past rainy Sunday afternoon, and filed my taxes online with Turbotax instead. Free, and we get a modest refund.

2. I found an error on one of my medical bills, too. My employers changed insurance this year, so I make sure to tell my doctors' staffs right away that we have switched, and hand them my new card to scan. Yet, this visit got charged to my former insurance, which of course, declined it. They will re-file and I should be charged only the co-pay, which I have already paid. The bill after the co-pay was $98.

3. I've started paying my tithe through bill-pay at my bank online. The church gets it just as easily, and I don't have to use up a check, which I have to pay for, remember to bring it with me into church (I don't carry my purse into church) or pay for a stamp and envelope to mail it myself.

4. I have added $25 to my Amazon account through earning Swagbucks.

5. I cleaned out and re-started my kombucha brewer. I drink some every day, and brewing it at home is simple and cheap. Buying it at the store may be simple, but it is absolutely not cheap! My brewer is the glazed crockery and spigot part of a water cooler/dispenser that I found at Goodwill for $8.

1. I spent only $18 on groceries this week thanks to a well-stocked (over-stocked?) pantry and freezer. This week I used up some cooked chicken breast, ham, biscuits, meatballs, bacon, sourdough bread, ice cream and muffins that have been in the freezer for awhile. From the pantry, I used up some soup starter. I also made s'mores cookie bars for a valentine's treat for my co-workers using graham crackers and marshmallow crème left over from Christmas baking. All I had to buy for that recipe was the chocolate.

2. I am strongly resisting the urge to buy some unnecessary notebooks and stationery (I love that stuff!) online since I am saving for a lot of very necessary things like a car, and furniture, and home maintenance projects. While I was paying off debt I learned that my bad spending habits on little things added up to big debt. So while I am able to live within my means now, and don't use debt to purchase things, I still have to be on guard against wasting money on mindless spending on "affordable" luxuries. I am obviously not frugal by nature.

3. Accepted an invitation for a weekend getaway at a friend's vacation house next month. We generally entertain ourselves by taking long walks and going for drives, reading, watching movies and playing games, so it will be an inexpensive weekend. We will cook at the house and decide who will provide which meals ahead of time, so I will just need to buy food to take a meal or two for my turn and pay for gas. Its less than an hour away so it will be relatively cheap.

4. Mended a pretty blouse with beadwork on it. I am always wary of beadwork on clothes because no matter how careful I am, the beads always loosen up and fall off. I have reinforced the remaining beads on this one. I only lost a few, I think, and its not noticeable.

5. Used my starbucks rewards before my points start expiring in March. I don't buy Starbucks often enough to always redeem my points on drinks, but now that they have some lower point redemption options I try to pay attention so I don't lose them.

Yuck to the cold. I hope it gets gone very quickly.

Same old stuff for saving money, I guess. With the addition that we were very surprised to get a rather substantial cash gift from my MiL's friend (she doesn't have much family and apparently has enough money saved that it makes financial sense for her to gift it rather than save it? estate planning is foreign to me, so that's my best explanation), which we immediately put towards the loan we took for our house. So that was cut almost in half. Not a very fun use for that much money, but certainly a practical one. And it WILL be fun not to see a large chunk of our monthly payment going to interest, so there's that.

Oh wow, what a great and unexpected gift!

What a blessed gift that will be and you MiL’s friend is a STAR! My goodness what a lovely and thoughtful lady!

I always read your 5 frugal things but never comment....maybe I'll be more intentional if I do.

1 - I snaked my bathroom sink myself - gross! It cost me less than $3 for a set of two snakes. I gave one to my son for their house & cleaned up the one I used for when I need it again.

2 - I used some leftover citrus slices for simmering potpourri. I'd made infused water. After drinking the water instead of tossing the lemon & lime slices I added some dried lavender from my garden to my little simmering pot with a few slices. Heavenly.

3. - I returned a pair of Smartwool socks that I'd worn through on the bottom before the warrenty expiration & received a free pair. The new pair is much nicer than the pair I had to return.

4 - Husband replaced a valve on the dishwasher rather than calling a repairman. He also took it apart & cleaned all the inside parts to help with water pressure.

5 - I made daily home made lattes rather than buy them.

I'm so impressed about snaking the drain! I want to try this soon. I'm not getting the results I want with my vinegar baking soda solution anymore.

Hi Jenny,

I’m not sure what kind of snake you bought but I regularly use a plastic Zipstrip. It’s about 2 feet long with little barbs along the side. Does a great job and they are cheap. You’re right - it’s one of those gross yet strangely satisfying tasks when you pull that wad of nasty out and the water is flowing nicely again.

I love the Zipstrips! I wish they had one for kitchen sinks LOL

I use a Zipstrip, too! Rather than baking soda & vinegar, I do this to our slower drains every week or two: flush with a pot of boiling water, pour 1-2 tablespoons Dawn dish detergent down the drain, then flush with another pot of boiling water an hour later. I read the Dawn trick somewhere, makes sense since it's supposed to cut through grease! Seems to really help.

I can only think of one frugal thing right now.

Yesterday I went to Goodwill's President's Day Sale.

Green tags were marked down to $1.29.

I found a Wamsutta mattress pad in like new condition, originally priced at $19.99.

The problem is it was KING size & I sleep on a FULL size bed.

For that price I can do a little modifying.

I cut the width down by 25" and reattached the elastic band. After I wash it I'll throw away the very old & shredding pad I'm using now.

Hope you feel better soon!

1- Our dryer was making a horrible screeching noise. My husband ordered $30 in parts from Amazon and fixed it himself saving cost of service call.

2- Bought 5 vanilla beans on Amazon. Am going to start soaking them to make Vanilla for frugal Christmas gifts

3- Took clothes to Platos Closet for a bit of extra cash.

4- Bought Soap Nuts at discount store to try...saving cost of many bottles of laundry detergent.

5- Incorporated 2 veggie meals into dinners this week..no meat..cost savings.

Oh boy, it's been an interesting week to say the least.

1.) My dishwasher finally is getting replaced. We've had all sorts of issues where dishes come out just as dirty as before. We've bought new detergent, cleaned it out well and did everything we could to keep the old girl going but it's dead. The good news is she died when a holiday appliance sale was going on with free installation and everything. So that's nice.

2.) I too, like Sonia, enjoy owning books and having them handy but at the same time I'm also more conscious about space than I used to be. I've actually discovered a couple of books via Prime Reading so that's been cool.

3.) Was talking to an electrician I know about my sun porch and wiring up lighting out there to be connected to a switch. Now you have to sort of fumble in the dark with a flashlight to turn on the lights out there. He suggested instead of paying him to wire up everything to just replace it with a plug in switch (think The Clapper but connected to a remote control switch.) That was around $15. The electrician would've been a lot more.

4.) Went to IKEA and actually, more or less, stuck to the list of items we were going to buy. That's more difficult than it sounds. Unfortunately some things were out of stock so we'll have to do without them as it's a 2+ hour drive there.

5.) The usuals: cooking at home mostly, eating leftovers, not spending money on extravagances etc.

1. Picked up 2 beautiful dresses, a tomato, and roasted red peppers from my local Buy Nothing Group. Then listed some shoes and running gear to give away via the Group.

2. Spent $63 on groceries for the week for 2 adults, 1 child, and 1 baby

3. Made my own organic lip balm and put it in a tiny glass jar that came in a free Hello Fresh box

4. Purchased Valentine's Day cards on clearance, for my son for next year, for $1

5. Took my baby for her 15 month physical- preventive care is always frugal!

How do you make your lip balm?

So easy! Bees wax, which we buy at our Public Market for next to nothing from a local bee keeper, and coconut oil. It's a 1:2 ratio of beeswax to coconut oil. Melt beeswax in the microwave and stir in the coconut oil. Let it set. I put it in a tiny glass jar, but you can also reuse empty chapstick containers.

It works really well. I have very sensitive lips and skin, so I have a hard time using store bought lip balm.

1. I've cooked every meal at home this week.

2. Purchased 16 cartons of long-life cashew milk that was almost 1/2 off --- my husband drinks every day

3. Made a list of things like the above that I use regularly and put the lowest sale price I've ever seen it at so I can make my 'bulk' purchases at the 'right' price. e.g. instant coffee, toilet paper, paper towels, dishwasher capsules, washing powder, etc.

4. Made my own spice mix (Baharat Spice) with the spices I had on hand (for a N. African recipe I was making) rather than search this out, probably only find it on Amazon and then pay extra for shipping.

5. Made my own balsamic vinaigrette which (I think) tastes so much better than store bough.

5.

1. Went to our local Zoo this weekend (a lot cheaper than most things to do in town + giraffes!)

2. Bought most produce for the week at Aldi

3. Used up a lot of food from the freezer- veggies and meats!

4. Returned library books on time

5. Bought some clothes on good sales. I live in the north, so we'll need sweaters for another couple of months, but stores are already clearancing all the warm clothes to make room for shorts and tank tops

I, too, almost never comment on these very inspirational posts. Today I'll give it a whirl.

Frugal Valentine's Weekend involved a number of frugalities:

1. Found a bag of my hubby's most favorite candy at the dollar store. A big plus was that it was a small bag, which is what he likes (the guy will take a whole year to eat a regular sized bag of candy)

2. Went out to lunch for under $20

3. Had a romantic dinner at home the next night (Saturday) using my MILs generous Xmas gift of Omaha Steaks box. Sirloin steaks and twice-baked potatoes, complete with candlelight!

Non-Valentine's

4. Saved half of weekly grocery budget by careful meal planning from freezer plus trip to Aldi (we are saving for a new couch :))

5. Scraped out ALL the PB and spaghetti sauce from jars before calling it quits on them. Got an entire PB sandwich for my breakfast and half serving of spaghetti sauce for dinner out of it!

My husband also likes smaller packages of candy because he will take so long to eat it that it goes stale. I have no concept of what it feels like not to want to wolf down an entire bag of chocolates the minute I get them out of the grocery bag, or not to hear the chocolates calling to me even when I hide them in the freezer or in the garage...Chips I can take or leave, but chocolates have some sort of evil control over my willpower.

Linsey, thank you for saying what I was thinking. A whole year? I am unable to make a bag o chocolate candy last a week. Sometimes not 24 hours.

We ate leftover homemade soup from the freezer for last night’s dinner.

I made croutons from bread ends in the freezer.

I found a cheaper price on cat food at a nearby store, so I’ll switch where I buy tins from now on.

I received a dozen free range eggs in trade for a favour I did for a friend.

I divided some perennials in the garden; some I’ll rearrange in the garden, some I will share.

Made 1 litre kefir and 1 litre yogurt.

Oops...that is six!

1.) Bought huge stuffed red panda for $6. (Valentine's 75% off. My daughter has been eyeing it every time we were in the store) Now to hide for Easter.

2.) Last minute flight to help my grandma visit my aunt(she has cancer). We went down and came up on the cheap days. Taking only a personal bag, so no bag check costs and quicker through the line.

3.) Stayed at my aunt and uncle's. No hotel fees. Plus, we only went out twice. We bought food at the grocery and cooked at her house. It's in Florida so we walked around a couple times.

4.) Used Ibotta to save money and cashed out a Wal-Mart gift card to use for groceries. Also scanned Shopkicks while in the store. Will be able to apply to gift cards. I'm already there anyway.

5.) Went to see Sonic the Hedgehog yesterday. I pay for the membership, but it saves me money. I get a free movie ticket each month. Plus, my birthday was this month. I had 2 free tickets and a free large popcorn. Bought 2 drinks which are discounted, because of the membership. (We mostly go to matinees, but the membership gives you a discount on most movies. It's just above a matinee price.)

1. Got a new-to-me pair of Vans that were in nearly perfect shape for $10 instead of the $60 they'd be new

2. Finished the second week in a row of menu planning that ensures no takeout

3. Requested a cookbook from the library to make sure there are enough recipes in it to make it worth a purchase

4. Decorated for our son's bday from the dollar tree and made a homemade cheesecake (his request) $9 worth of decor and maybe $5 for the cheesecake supplies

5. Got one book I wanted to read from the library and borrowed another from a friend instead of buying them!

I had a relatively frugal weekend away, with the dog and a friend.

1. Bought fancy ham and fancy cheeses at Whole Foods (because they have the best fancy meats and cheeses), which was a lot for grocery store food but not much for a meal away from home. Supplemented it with crackers we already had. It made a great picnic dinner while we watched movies we didn't have to pay for, with leftovers for breakfasts.

2. Brought 2 dozen oranges, drinks, chocolate, snacking veggies, and other foods, so we could eat well and nutritiously without spending a fortune.

3. Booked a dog-friendly hotel that was several blocks away from the tourist area, saving about 40%. I was careful not to let the dog mess the place up (for example, bringing a towel so he could get on the furniture without getting it very dirty) so to avoid a excess-mess fee.

4. Found a restaurant that sold $12 lobsters. My friend loves lobster. I had a different dish, which was also excellent. The whole meal was $36 with tax and normal tip. Rather than be ultra frugal, we then spent $15 on additional tips (extra for our excellent server, the guy behind the shellfish counter, the live band) as well.

5. Spent almost nothing else on the trip: $12.50 on a locally-made Christmas ornament (ornaments and magnets are my souvenirs of choice), $5 on locally-made chocolate, and $15 on spice mixes. Gas was cheaper there than at home so of course I filled up. We took my car because it gets better gas mileage.

Other things:

6. While I'm in class for 3 weeks, I'm packing my breakfast, most of my lunches, my snacks, and my drinks.

7. Will be carpooling (sometimes) with another class member who lives near me. Learning that she lived close was happenstance but I jumped at the opportunity.

8. Took public transit to pick someone up at the airport.

Not frugal exactly, and not mine: my roommate won $500!

Kristen- I'm glad you're feeling better.

Kaitlin- Oh, geez, what a terrifying week at the hospital. And like a frugal mom, you were worried about coffee expenses in addition to everything else. Those are the times when having a friend or relative take some worry off your plate by maybe bringing dinner? Our church friends do that and if someone is having surgery or in the hospital, a call goes out for members to make dinner and bring it over.

JD- Gotta love the insurance changes. Our company changed insurance and didn't send out cards. My kid drives to the ER because he was in pain and the ER turned him away....Yup. Turned him away due to insurance!!! Couldn't they treat him and we'll figure out the finances later?! He's a kid and doesn't know anything about insurance and as a parent, would they want their kid to be turned away? Amazing.

Kristin- Congrats on the lovely gift! You used it wisely.

Ok, my fab five:

1) I have a free $5 GC to use at the hardware store. Came in the mail.

2)Went to dinner and found a online coupon. The waitress said it can only be used for takeout but offered a $10 discount instead. It was way better than the coupon.

3)Got discounted valentines candy.

4)Wanted to open up a CD at the bank for my kid. The interest rate was 2% a week before but fell. Bummer. I waited a few weeks and went in anyway and it was at 2.25% so I was glad.

5) We are finally closing on the refi that we started in October. The rates have jumped all over and the underwriters kept asking us to resubmit papers since it took so long...They ended up giving us a better rate and we dropped to a 20 year loan. We're only paying $70 more per month to consolidate 2 loans and drop to a 20 year.

Greetings!

1) Bought up Valentines for my kids the day after the holiday and spent a total of $2.40 for 3 packs of valentine cards for next year's Valentine swap at school.

2)My husband and I did all the painting for a rental property we are getting ready to sell.

3) My husband is doing all the hardwood flooring in the rental property. He basically is watching youtube videos to help out. doesn't hurt that his dad is helping him as well.

4) We are having a little bit of cabinet repair work done. Fortunately my husband's father has a woodwork shop and he's repairing two cabinets for us. Just glad that his dad is a jack of all trades.

5)

Made a jump on taxes early. While that may not be a real frugal thing, it was just nice that we got it out of the way.

We have recently switched from pump liquid hand soap to bar soap. It lasts much longer, is cheaper and is better for the environment by eliminating plastic.

1. I continue to wear some of my favorite old shirts, with a few holes in them..to my art meetup group, where I don’t mind if they get splattered with painters or glitter.

2. Eating down the freezer!!

3. Had houseguests last week, we ate almost all out meals AT HOME (helped me cook down the freezer!) and shared family stories around the fire pit.GOOD TIMES for free.!!

4. Shopping TWICE a week is saving me money.i don’t over buy and get the groceries I need for the next 3-4 meals.Have been shopping at Trader Joe as there are just 2 of us and that has actually been saving me money! I do buy my BULK items (oatmeal,lentils,split peas,flax,etc) at Winco once a month.

5. Entertainment: Enjoying my twice a month card games with good friends, we rotate around to each other’s homes, home brew our own coffee and bring snacks.. always a great day!

1. Continue to pack my lunches and breakfast for work

2. Figured out how much I spend on my homemade laundry detergent each month. $4.71. Pretty sure I couldn't do any better with any other detergent. I do uniforms, farm clothes, etc.

3. Bought my son a pair of jeans. He was low on jeans and we got 10% off for being a member of FFA.

4. Will buckle down and do my 2nd job tonight. It's on the computer and not too strenuous, and the extra $ helps.

5. Really wanted to stop for an iced coffee today on way to work, but drove right by.......

1. Alrspicelsent $700 to car payment this month (plan to pay off my car by August/September of this year).

2. I keep flour/butter/buttermilk/spices on hand so I can make drop biscuits at any time (to cut down on buying loaf bread).

3. Reload $ on a gas card from Speedway vs. shelling out cash for gas every week/2 weeks, etc.

4. Make food at home (I been falling off the wagon a lil bit--Hardees' breakfast biscuits, I'm looking at you). But I'm getting back on track.

5. Didn't make an impulse purchase at a local French bakery (yesss!). Went to Wal-Mart instead, and picked up groceries.

#winning

That first few words on my #1 should be "I already sent", not whatever that mumbo-jumbo is. *facepalm*

1. Sunday evening we needed to get out of the house and have the kids burn some energy, so we drove to a mall that had a play area and they played for free. The only thing we bought there were some Mother's Day cards and a Father's Day card at a store that was going out of business and had deep discounts.

2. For dinner that night, the mall only had full-scale restaurants, so we stopped at a McDonald's on the way home that had a playplace. The kids thought it was amazing.

3. We have a number of children's books right now that I ordered through interlibrary loan. Some of them are ones that I saw at the school's book fair and thought they looked interesting, but I took a picture of the book rather than buy it so I could remember it to check out. We also have a movie and an Adventures in Odyssey CD set from interlibrary loan right now.

4. Remembered to scan my receipt into Ibotta today.

5. Helped my husband install the new tub/shower unit for our bathroom remodel.

Used free movie passes to take my oldest to see Frozen 2 for a fun low cost outing.

Made homemade valentines for my son’s class instead of buying them

Trimmed my own ends instead of going to the salon

Planned ahead and bought some easy freezer meals so that when I worked a lot last week we didn’t order takeout at all.

Bought a lunchbox for my son that I was going to buy anyway on a flash deal 45% off.

My first FF - let me see what I can come up with.

1) we are on ski week break vacation in Tahoe (we ski Sugar Bowl) - we stay at the lodge and eat here. This week we had 2 dinner invitations out at friends who have houses here so we saved on the cost of dinners at the Lodge.

2) I have a freezer full of soups at home so that’s dinner next week (with fresh baked bread)

3) instead of meeting friends at a coffee shop, I’ve been baking and having them to my house for coffee and chat.

4) I’m going to start shopping at Trader Joe’s, not for produce but basics. There’s nothing wrong with their products, I was just lazy and only shopped at one place.

5) instead of overpaying for the tea at the lodge coffee shop, I brought up my own electric kettle, tea bag collection and tea mug. Happy me!

Oh fun! How is the weather this week at Tahoe? And how are the conditions?

Weather was gorgeous and warm - therefore snow was ok. Places were icy in the morning and slushy by the afternoon. Since we aren’t snow snobs we all just enjoyed ourselves.

Sometimes the coldest weather makes for the best skiing! But then you get so cold and miserable, it's hard to enjoy the good conditions.

There's something to be said for a nice mild skiing day.

I hope this weekend gives your family some time for R&R. It's that stuck time of winter when sunnier days soon will help!

5 frugal things:

1) I did a lot of mending of stuffed animals & kid's clothes. Also fixed up a broken foot of a beloved glass doll & she's now thankfully out of the "hospital":)

2) All our science & social studies curriculum this year is from the library or worksheets/maps given to us. It's working great.

3) We did the fundraiser (coffee & cookies) for a group my daughter is in & this saved us $150 in dues. It was an easy item to sell a lot of!

4) Random, but I used to have a lot of potatoes and onions go bad before I would use them. I've been chopping & freezing onions much sooner. I try to cook potatotes within 2-3 days of purchase now. No food waste there anymore!

5) Homemade valentines & we passed them out in person to friends when we would see them

1. We ate some hodgepodge meals from the freezer for dinner. We all picked something we liked and I defrosted them in the fridge the night before.

2. I helped my friend pack to move house and she gave me $50 as a thank you.

3. My parents replaced their television and gifted me their old one. This will work great in the bedroom for lazy Sundays.

4. I started my new job this week. I’ve been unemployed for 6 months so overjoyed to be working again.

5. My parents took the kids out for breakfast today. I got a much needed rest.

#4 - congratulations!!

That is an awesome Panda deal -- and fortune 🙂 And $150 back -- huzzah!

Well, this week beat the last:

1. Meals largely eaten at home or taken to work, courtesy of lovely friends who sent us home from a party with sooo much leftover food -- enough for 2 of us for 3 days. We finally had to throw the last bits out 🙁 because, you know, food poisoning. But it was a great run.

2. Paid credit card on time by phone and tracking all library books to avoid late fees.

3. Took on Home Hospital tutoring for a student who is very ill. While not a great cash cow, it is a bit more eked onto the paycheck. And he and his family are wonderful to be around.

4. Finally found 2 bathing suits for less than the price of one ordered on line that never arrived. Thanks Ross Dress for Less. So using the gym pool several days a week. Trying to stay healthy = money saved somewhere down the line.

5.This is a "Duh!" entry but am juggling the extra long day of tutoring and we're still managing to eat in mostly, thanks to my wonderful husband and the stash of frozen stuff -- pizzas, entrees, etc. Last night we made a complete pantry meal from the last of some frozen turkey meatballs of indeterminate age (very dry and chewy), spaghetti sauce, WW pasta and bag o salad.

Trying not to let the extra work = excuse to eat out.

I bought some silicone refillable travel bottles at Walmart. I put shampoo, conditioner and liquid soap in them for when I go to the gym and when I travel. They are three ounces, so TSA will not force you to dump them. The nice thing about the silicone ones is that they can be left with no air in them, so they won’t leak in the air with air pressure changes. Filling them from the bigger bottles is far cheaper per ounce, and it is the regular brand I use.

Post winter holidays, I have been continuing to go to the gym to get needed exercise during the winter months as maintaining muscle mass And bone density is vital to good health. I have a free membership as the military base doesn’t charge military retirees.

I check my credit card statement each month. I have caught charges that I did not use, seeing a charge for a purchase at a store 1500 miles away, that I don’t recognize is a major flag. I never use a debit card for purchases as you cannot refute them and get refunded, it is like you paid in cash, the bank says it is your money, not theirs.

I avoid buying the candy, even after holidays, it is empty calories, loaded with sugar. I do buy some bulk dark chocolate peanuts or raisins from time to time, but it is a handful for a snack when working in the yard or while hunting, not a bagful in one sitting.

Being I am fully retired, I ski midweek at the local resorts. Lower ticket prices and I get more runs in as there are no long lines. You can find a place to sit down to eat the lunch you packed as well, versus packed like sardines on the weekends.

Heating bills are still significant even with the thermostat set at 62. New fiberglass windows are planned as well as future plans to upgrade to under floor hydronic heat from an on demand hot water heater versus electric baseboards. Projected savings are 35-40% in heating bills. Two years to break even doing it as a DIY/minimal plumber involved project.